- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Boeing (NYSE:BA) Reports 186 Deliveries In Q2 2025 Across Commercial And Defense Sectors

Reviewed by Simply Wall St

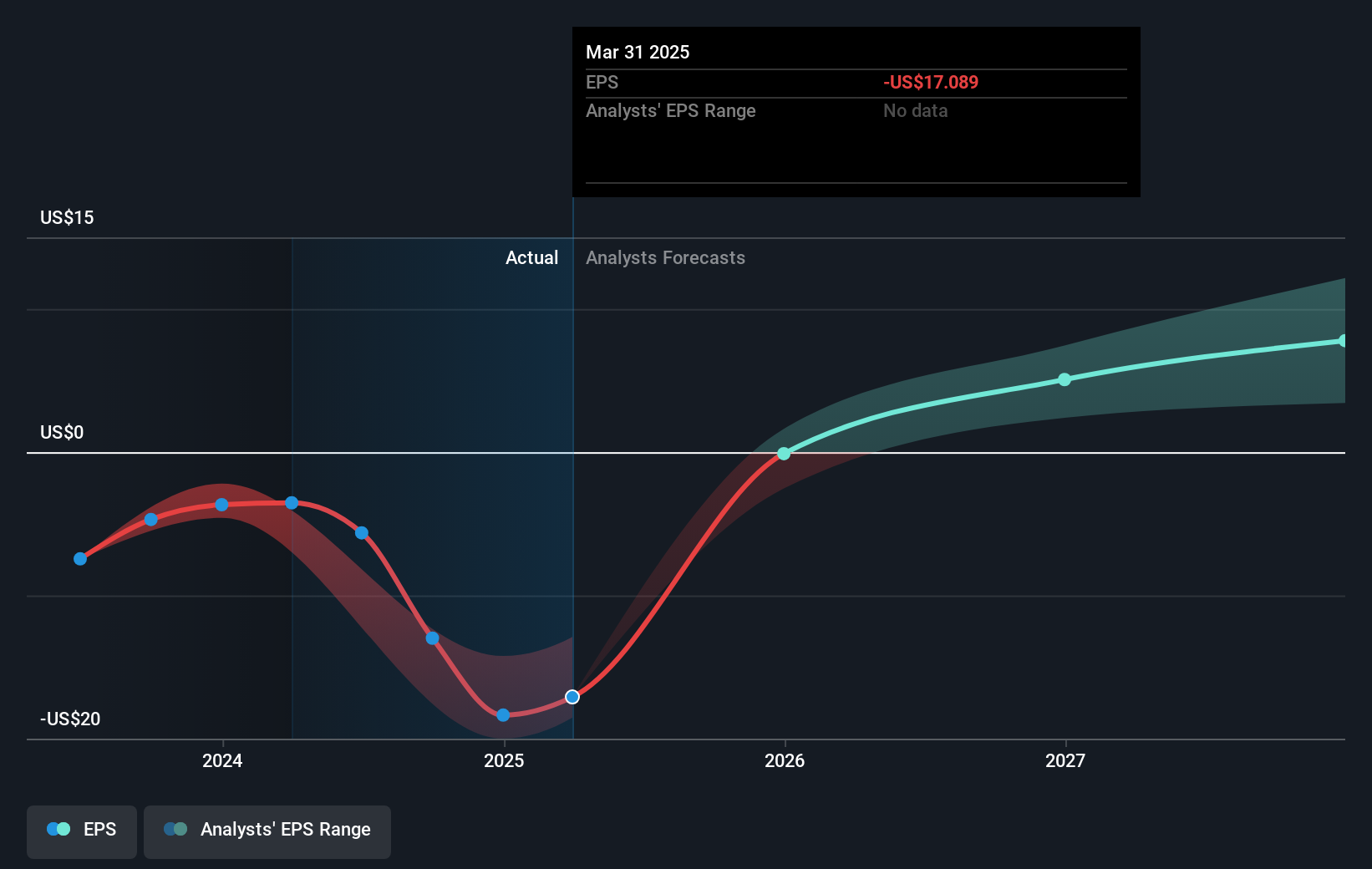

Boeing (NYSE:BA) announced impressive delivery figures for its commercial and defense sectors for the second quarter of 2025, showcasing robust operational capabilities. This achievement, coupled with a notable rise in quarterly revenue to $19,496 million, reflects significant business momentum. Despite a reported net loss of $37 million, a stark improvement from last year's figures, investor sentiment has remained buoyant. Executive changes, including Stephen Parker's appointment as CEO of the Defense, Space & Security unit, likely strengthened confidence. While broader market gains were tempered by tariff concerns, Boeing's specific advancements potentially bolstered its 36% share price increase.

Boeing's impressive delivery figures and revenue increase highlight its operational strength, which could positively impact revenue forecasts by maintaining momentum in the production of its 737 and 787 programs. The executive changes, particularly in key roles like the Defense, Space & Security unit, may enhance strategic execution, potentially leading to improved earnings projections. Over a three-year span, Boeing's shares achieved a total return of 48.50%. This longer-term performance reflects significant investor confidence despite recent challenges. When compared to the past year's market dynamics, Boeing's price increase of 36% indicates a strong recovery against the backdrop of the industry, which returned 40.5%, and the U.S. market, which returned 12.6%.

The anticipated stabilization of production and expected contract wins in the defense sector bolster revenue and earnings outlooks. However, ongoing tariff-related pressures continue to pose risks, possibly affecting Boeing's ability to fully capitalize on recent business advancements. The recent price jump places Boeing's share price close to the consensus analyst price target of US$224.12, indicating that the market may have already priced in some of these positive developments. With a current price of US$209.79, there's a potential for a 6.4% increase to align with analyst expectations, assuming upcoming forecasts materialize as anticipated.

Upon reviewing our latest valuation report, Boeing's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives