- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Boeing (NYSE:BA) Delivers 280 Commercial Aircraft and 62 Defense Units Year-to-Date 2025

Reviewed by Simply Wall St

Boeing (NYSE:BA) recently reported a significant price move of 57% over the last quarter, coinciding with key developments such as the announcement of delivering 150 commercial airplanes and 36 defense units in the second quarter of 2025. The company's growth was further bolstered by major orders, including Qatar Airways' record order for up to 210 widebody jets. The strengthening of Boeing's executive leadership, with new appointments in critical roles, could have enhanced investor confidence. Despite market uncertainties around trade policies, these company-specific achievements reinforced Boeing's market performance, standing out amid a broadly flat stock market.

You should learn about the 3 risks we've spotted with Boeing (including 1 which is concerning).

The recent 57% price movement in Boeing shares during the last quarter, due to significant aircraft deliveries and strategic leadership changes, supports the longer-term narrative of production stabilization and strategic contract acquirements. These developments present a positive outlook for revenue growth as they strengthen Boeing's operations, potentially mitigating the pressures from tariffs, certification challenges, and supply chain issues. Over a three-year period, Boeing's total shareholder return reached 59.60%, showcasing a steady recovery despite current industry challenges.

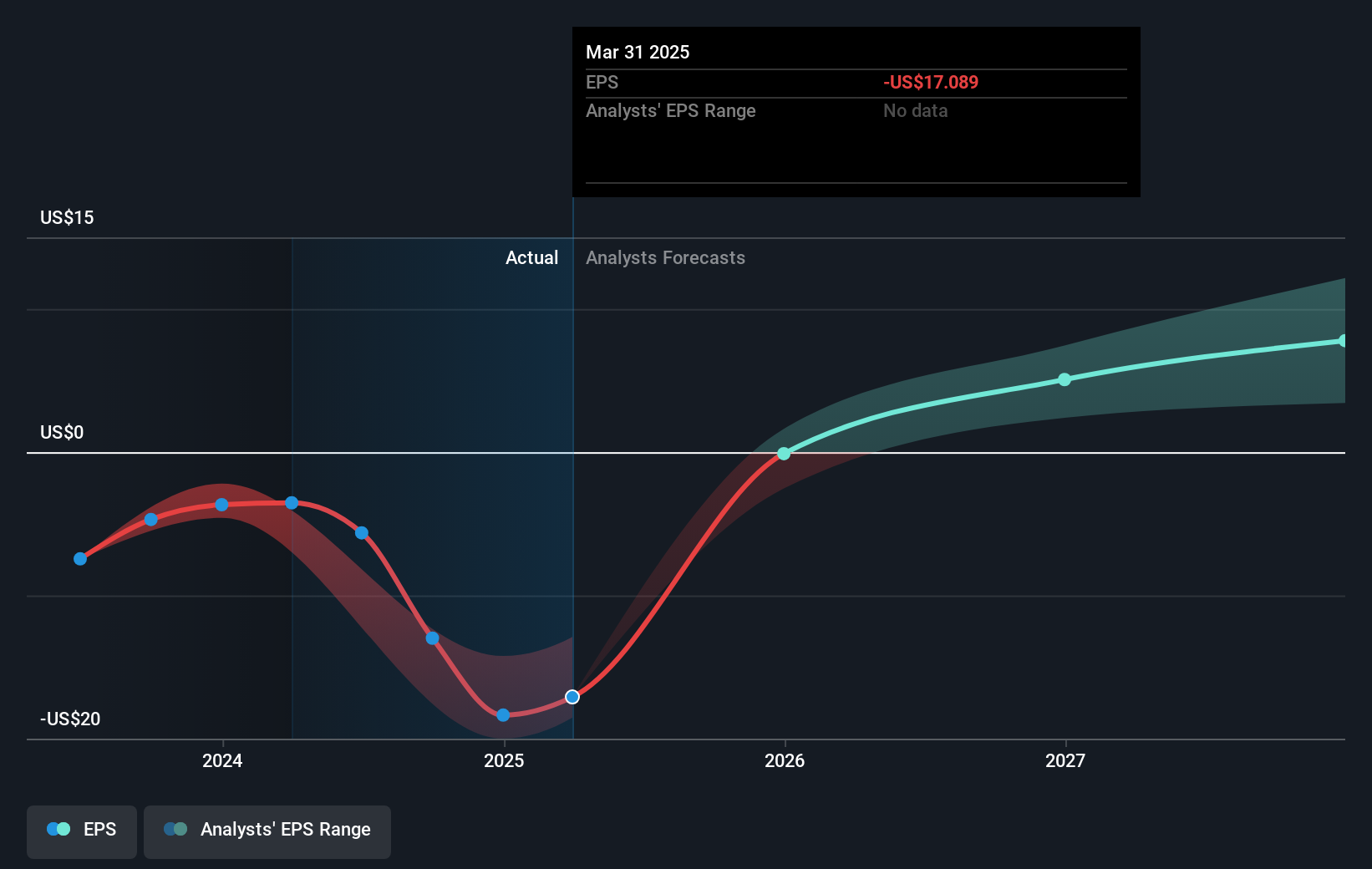

Relative to the US Aerospace & Defense industry, Boeing's annual performance underperformed, with the industry posting a 41% increase over the past year compared to Boeing's own results. Still, the company's recent activities might bolster its competitive position and improve future comparisons. The substantial orders and expected cash inflow from business divestitures are likely to impact revenue projections positively, aligning with analyst forecasts to potentially elevate earnings from US$11.65 billion losses to a more stable forecast.

Boeing's current share price of US$209.79 sits close to the analyst price target of US$224.13, suggesting a modest 6.4% increase potential. This proximity indicates that while there is an expected upward movement, the market might already be factoring in some of the positive outcomes from the recent announcements. Investors need to weigh these expectations against underlying risks such as trade uncertainties and production hurdles, contributing to the cautious outlook reflected in analyst valuations.

Take a closer look at Boeing's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives