- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Boeing (NYSE:BA) Advances Global Connectivity With SES Satellite Deliveries

Reviewed by Simply Wall St

Boeing (NYSE:BA) recently delivered the 9th and 10th O3b mPOWER satellites, with innovative software-defined payload technology for SES, enhancing global connectivity capabilities. This development aligned with a broader 40% rise in Boeing's share price over the last quarter, during which the company also secured significant aircraft orders from Qatar Airways and China Airlines. The market's overall strength, as seen in the rallying S&P 500 and Nasdaq, likely supported Boeing's gains, although the company's strategic advancements in aerospace technology and its efforts in military applications, such as the Wideband Global SATCOM satellites, also added weight to its strong performance.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

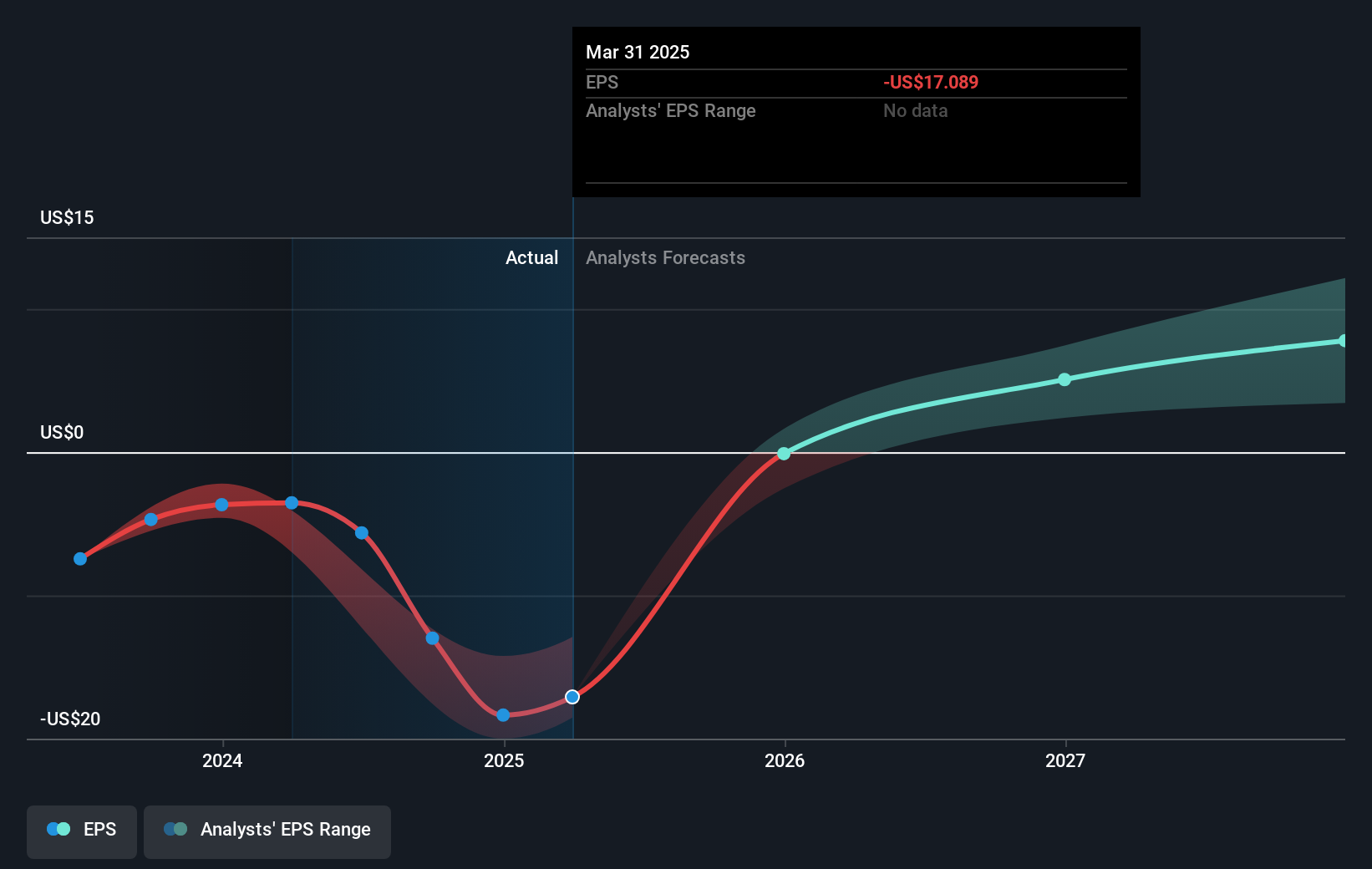

Recent developments in Boeing's satellite technology and contract acquisitions suggest potential future impacts on the company's revenue and earnings forecasts. With a focus on stabilizing its 737 and 787 production, Boeing appears set to enhance its operations, possibly reflecting positively on earnings estimates. The recent rise in its share price could indicate investor optimism about these strategic advancements, although Boeing's share price is currently US$200.26, slightly undervalued compared to the consensus price target of US$224.12.

Over a three-year period, Boeing's total shareholder return, including dividends, was 55.55%. Despite this longer-term gain, Boeing's recent one-year performance lags behind the U.S. Aerospace & Defense industry's 38.5% return, even as the S&P 500 and Nasdaq have shown strength. This suggests Boeing's challenges in navigating industry pressures despite strategic improvements and new contract wins.

Assess Boeing's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives