- United States

- /

- Banks

- /

- NasdaqGS:CTBI

Best Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the U.S. stock market reaches new heights amid optimism over trade talks and potential interest rate cuts, investors are keenly observing how these developments might influence their portfolios. In such a dynamic environment, dividend stocks can offer stability and income, making them an attractive option for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Rayonier (RYN) | 12.40% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.45% | ★★★★★★ |

| Heritage Commerce (HTBK) | 4.91% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.94% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.00% | ★★★★★★ |

| Ennis (EBF) | 5.90% | ★★★★★★ |

| Employers Holdings (EIG) | 3.08% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.64% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.75% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.46% | ★★★★★☆ |

Click here to see the full list of 138 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

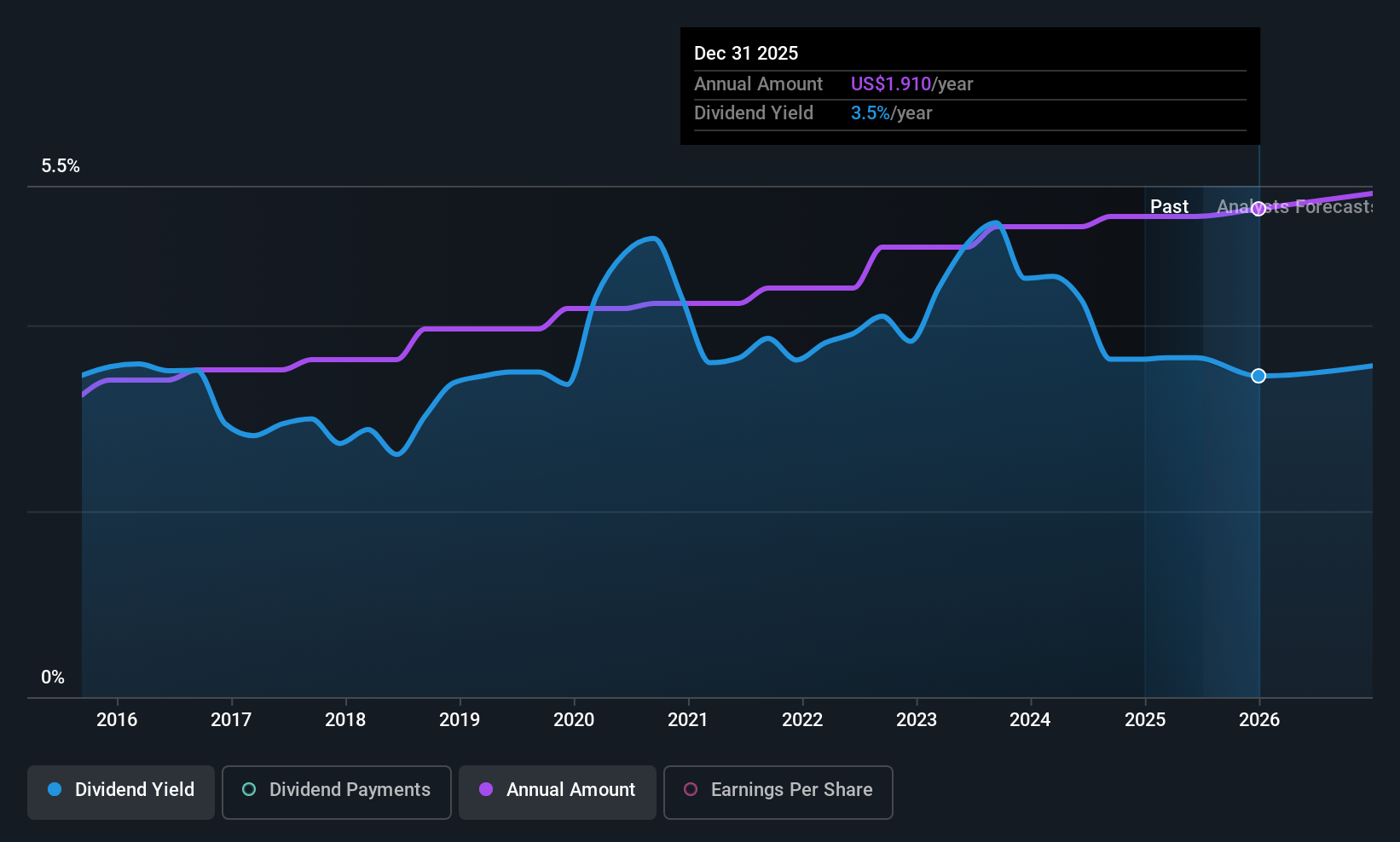

Community Trust Bancorp (CTBI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Community Trust Bancorp, Inc. operates as the bank holding company for Community Trust Bank, Inc., with a market cap of approximately $956.78 million.

Operations: Community Trust Bancorp, Inc. generates its revenue primarily through its subsidiary, Community Trust Bank, Inc.

Dividend Yield: 4%

Community Trust Bancorp's dividend payments are well covered by earnings with a payout ratio of 37.4%, and this is expected to remain stable at 35.6% in three years. Despite a dividend yield of 4.01% being below the top quartile in the US, dividends have been reliable and stable over the past decade. Recent earnings growth, with net income rising to US$23.91 million for Q3 2025, supports continued dividend sustainability amidst increased net charge-offs reported at US$2.75 million.

- Click here and access our complete dividend analysis report to understand the dynamics of Community Trust Bancorp.

- Our valuation report unveils the possibility Community Trust Bancorp's shares may be trading at a discount.

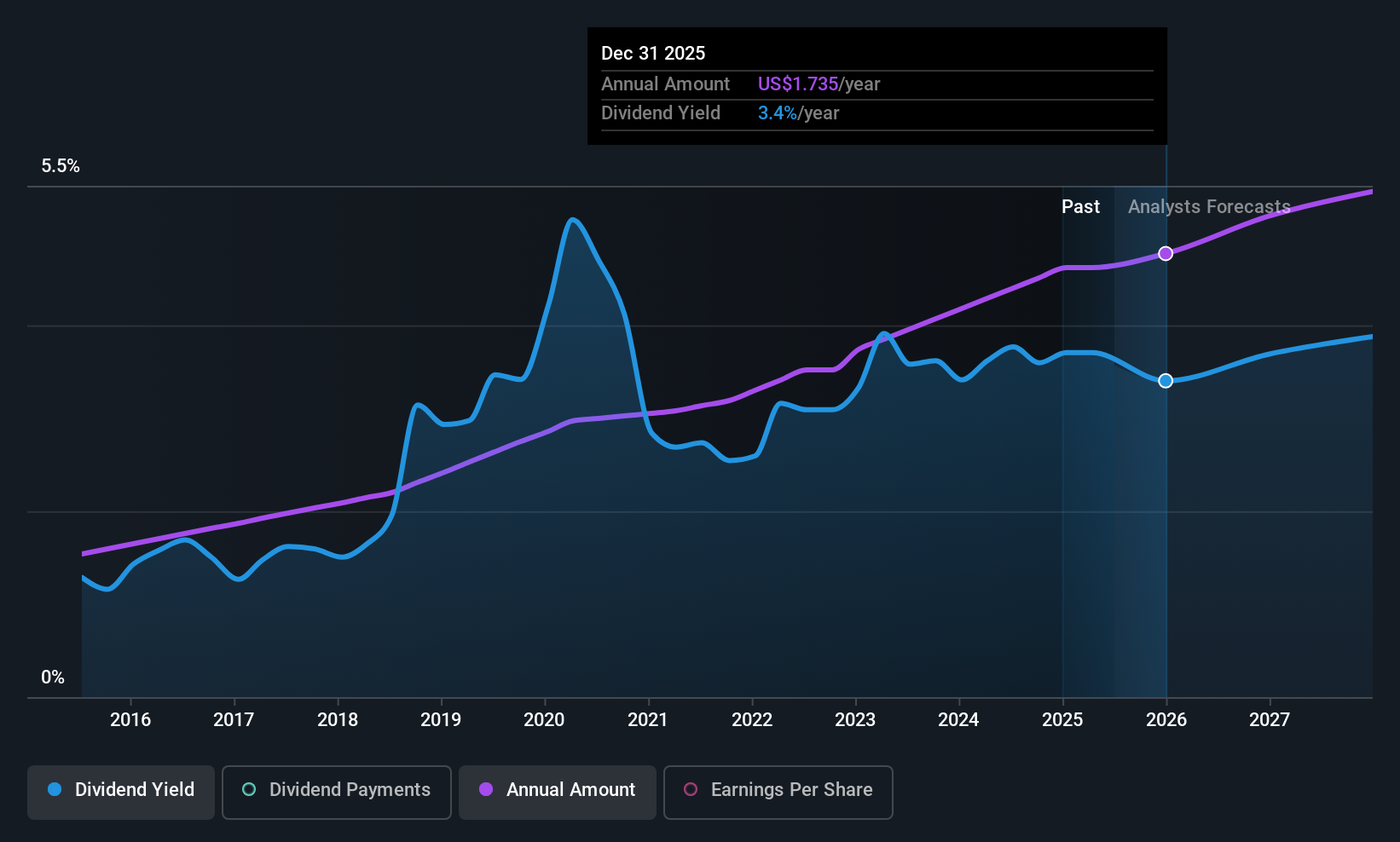

Bank OZK (OZK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank OZK is a full-service Arkansas state-chartered bank offering retail and commercial banking services across the United States, with a market cap of $5.15 billion.

Operations: Bank OZK generates revenue primarily through its Community Banking segment, which accounts for $1.54 billion.

Dividend Yield: 3.8%

Bank OZK's dividends have grown steadily over the past decade, supported by a low payout ratio of 27.3%, ensuring coverage by earnings. Despite a yield of 3.85% being lower than the top quartile in the US, dividends remain reliable and stable. Recent Q3 earnings showed net income at US$184.58 million, up from US$181.19 million year-over-year, enhancing dividend sustainability as analysts expect continued coverage with a projected payout ratio of 30% in three years.

- Click to explore a detailed breakdown of our findings in Bank OZK's dividend report.

- Upon reviewing our latest valuation report, Bank OZK's share price might be too pessimistic.

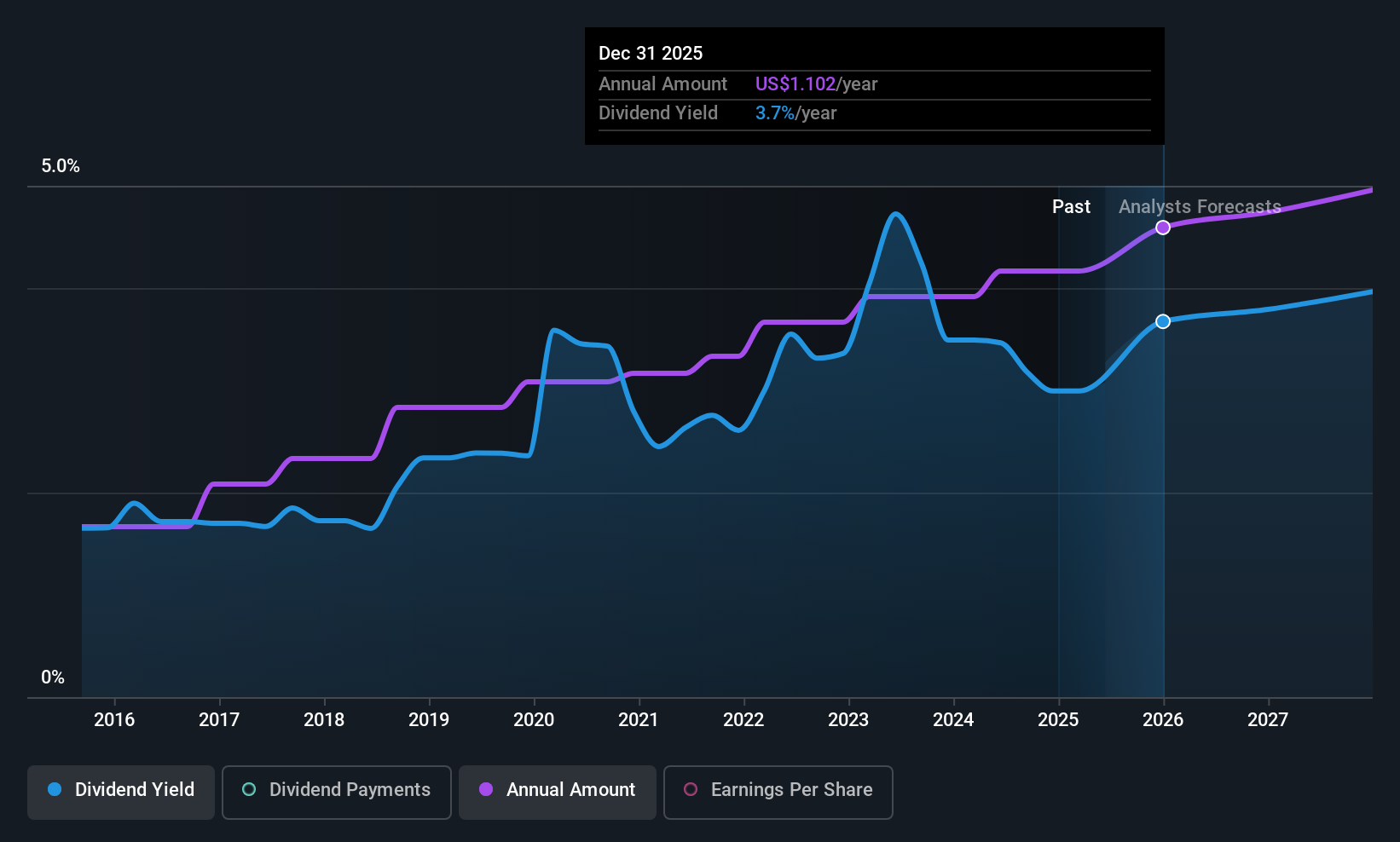

Cadence Bank (CADE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cadence Bank offers commercial banking and financial services in the United States, with a market cap of approximately $6.80 billion.

Operations: Cadence Bank's revenue is primarily derived from its commercial banking and financial services operations within the United States.

Dividend Yield: 3%

Cadence Bank's dividends have been stable and reliable over the past decade, with a current payout ratio of 38.2% ensuring coverage by earnings. While its yield of 3.01% is below the top quartile in the US, it remains attractive due to consistent payments. The recent acquisition agreement with Huntington National Bank for US$7.6 billion could impact future dividend policies, but Cadence continues to declare quarterly dividends amidst strategic changes and steady earnings performance.

- Click here to discover the nuances of Cadence Bank with our detailed analytical dividend report.

- Our expertly prepared valuation report Cadence Bank implies its share price may be lower than expected.

Summing It All Up

- Click through to start exploring the rest of the 135 Top US Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTBI

Community Trust Bancorp

Operates as the bank holding company for Community Trust Bank, Inc.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives