- India

- /

- Consumer Finance

- /

- NSEI:CHOLAHLDNG

Benign Growth For Cholamandalam Financial Holdings Limited (NSE:CHOLAHLDNG) Underpins Its Share Price

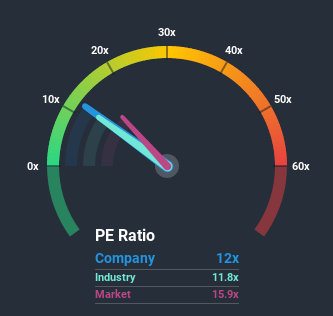

With a price-to-earnings (or "P/E") ratio of 12x Cholamandalam Financial Holdings Limited (NSE:CHOLAHLDNG) may be sending bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 16x and even P/E's higher than 40x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Cholamandalam Financial Holdings over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Cholamandalam Financial Holdings

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Cholamandalam Financial Holdings' is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 1.4%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.8% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Cholamandalam Financial Holdings is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Cholamandalam Financial Holdings' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Cholamandalam Financial Holdings maintains its low P/E on the weakness of its recentthree-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Cholamandalam Financial Holdings has 3 warning signs (and 2 which make us uncomfortable) we think you should know about.

Of course, you might also be able to find a better stock than Cholamandalam Financial Holdings. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

When trading Cholamandalam Financial Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:CHOLAHLDNG

Cholamandalam Financial Holdings

An investment company, provides financial services in India.

Acceptable track record and slightly overvalued.

Market Insights

Community Narratives