- United States

- /

- Banks

- /

- NYSE:BAC

Bank of America (NYSE:BAC) Appoints Gabby Hodgson as New Colorado President

Reviewed by Simply Wall St

Bank of America (NYSE:BAC) has witnessed a price move of 8% over the past month, influenced by several key developments. The appointment of Gabby Hodgson as president for the Colorado market signifies a strategic leadership realignment. Additionally, the company’s recent redemption of CHF 0.2525% senior notes and enhanced cash back rewards offerings may have bolstered investor sentiment by showcasing active financial management and customer engagement efforts. These initiatives came amid generally favorable market conditions, as indices like the S&P 500 and Nasdaq Composite reflected modest gains, aligning with broader economic recovery and positive trade discussions.

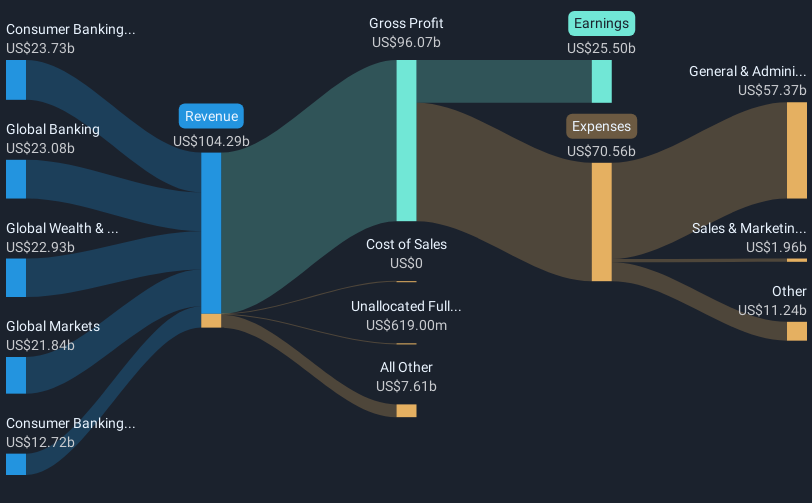

The recent developments at Bank of America, including leadership changes and enhancements in financial management, could positively influence its long-term strategic positioning. The emphasis on digital engagement and credit diversification could strengthen customer retention and revenue potential, aligning with the company's investment goals to bolster future earnings despite the challenges of economic volatility and policy uncertainties. This productive approach could support the expectation that earnings might reach US$31 billion by 2028, even though revenue growth may face headwinds from external economic factors.

Bank of America's shares have showcased significant resilience, marking an 87.53% total return over the last five years, including dividends. However, the company's shares underperformed the US Banks industry, which returned 21.8% over the past year, struggling to match broader industry momentum.

The recent appointment of a new market president and the redemption of senior notes might boost investor confidence and positively impact future revenue and earnings forecasts. These actions display a commitment to active financial management, potentially leading to improved net interest income and customer engagement. Despite a recent share price move of 8%, the current price of US$40.84 remains below the analysts' consensus price target of US$48.57, indicating a potential upside. While the target suggests a 15.9% increase from the current level, investors should assess these opportunities against their expectations and understanding of the company's strategic direction.

Understand Bank of America's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives