ASX Value Stocks That May Be Trading Below Estimated Worth In July 2025

Reviewed by Simply Wall St

As the Australian market navigates the complexities of international trade tensions and sector-specific developments, investors are keenly observing how these factors influence overall market performance. In this environment, identifying stocks that may be trading below their estimated worth can provide opportunities for those looking to capitalize on potential value investments.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ridley (ASX:RIC) | A$2.90 | A$5.78 | 49.8% |

| PointsBet Holdings (ASX:PBH) | A$1.185 | A$2.10 | 43.4% |

| Pantoro Gold (ASX:PNR) | A$3.06 | A$5.50 | 44.3% |

| Integral Diagnostics (ASX:IDX) | A$2.53 | A$4.57 | 44.7% |

| Infomedia (ASX:IFM) | A$1.26 | A$2.07 | 39.2% |

| Fenix Resources (ASX:FEX) | A$0.28 | A$0.51 | 44.6% |

| Domino's Pizza Enterprises (ASX:DMP) | A$18.02 | A$29.57 | 39.1% |

| Collins Foods (ASX:CKF) | A$8.79 | A$15.62 | 43.7% |

| Charter Hall Group (ASX:CHC) | A$19.36 | A$35.43 | 45.4% |

| Advanced Braking Technology (ASX:ABV) | A$0.083 | A$0.16 | 49.5% |

Here we highlight a subset of our preferred stocks from the screener.

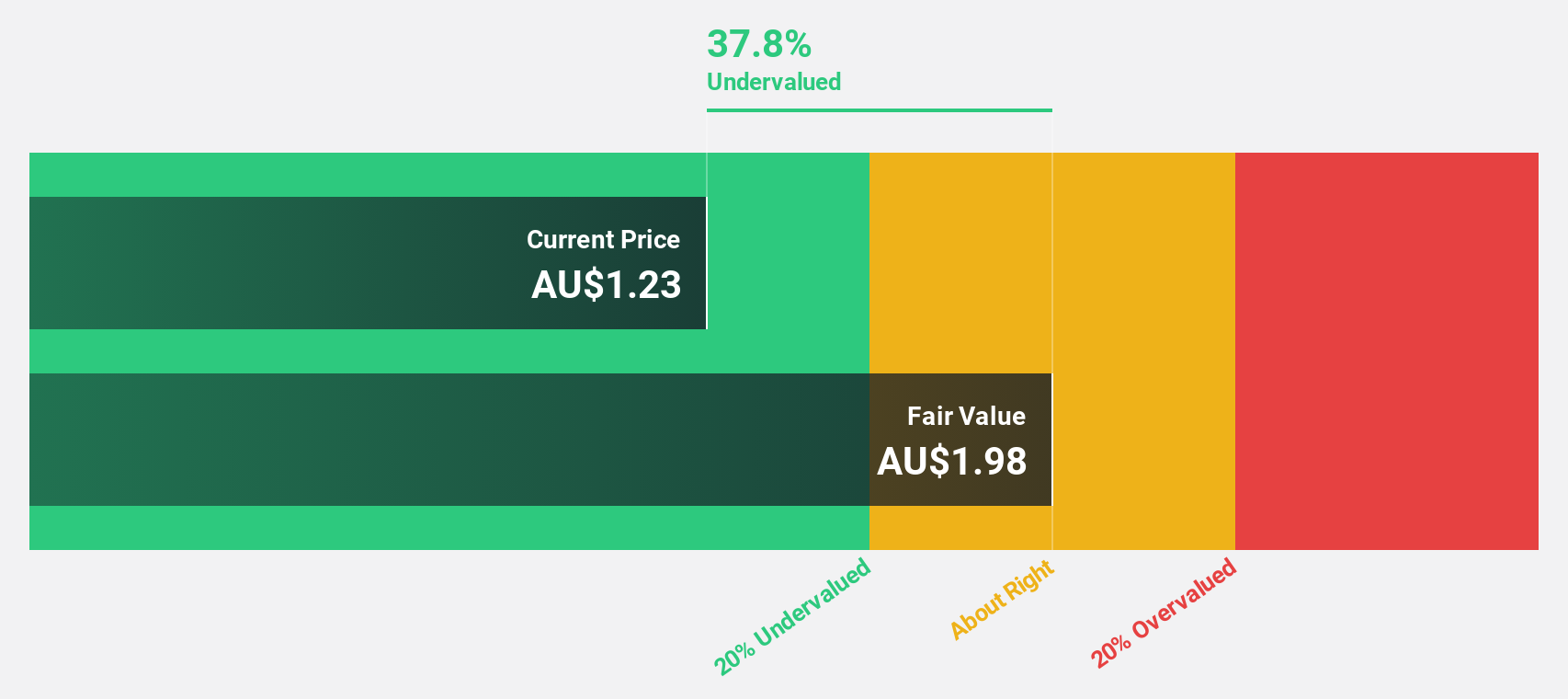

Infomedia (ASX:IFM)

Overview: Infomedia Ltd is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide, with a market cap of A$475.51 million.

Operations: The company's revenue primarily comes from its Publishing - Periodicals segment, which generated A$142.41 million.

Estimated Discount To Fair Value: 39.2%

Infomedia is trading at A$1.26, significantly below its estimated fair value of A$2.07, indicating it may be undervalued based on cash flows. However, its 3.33% dividend yield isn't well covered by earnings due to large one-off items impacting results. While revenue growth is modest at 6.9% annually, earnings are expected to grow nearly 20% per year, surpassing the Australian market average of 10.9%. Analysts anticipate a potential stock price increase of over 40%.

- Upon reviewing our latest growth report, Infomedia's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Infomedia's balance sheet health report.

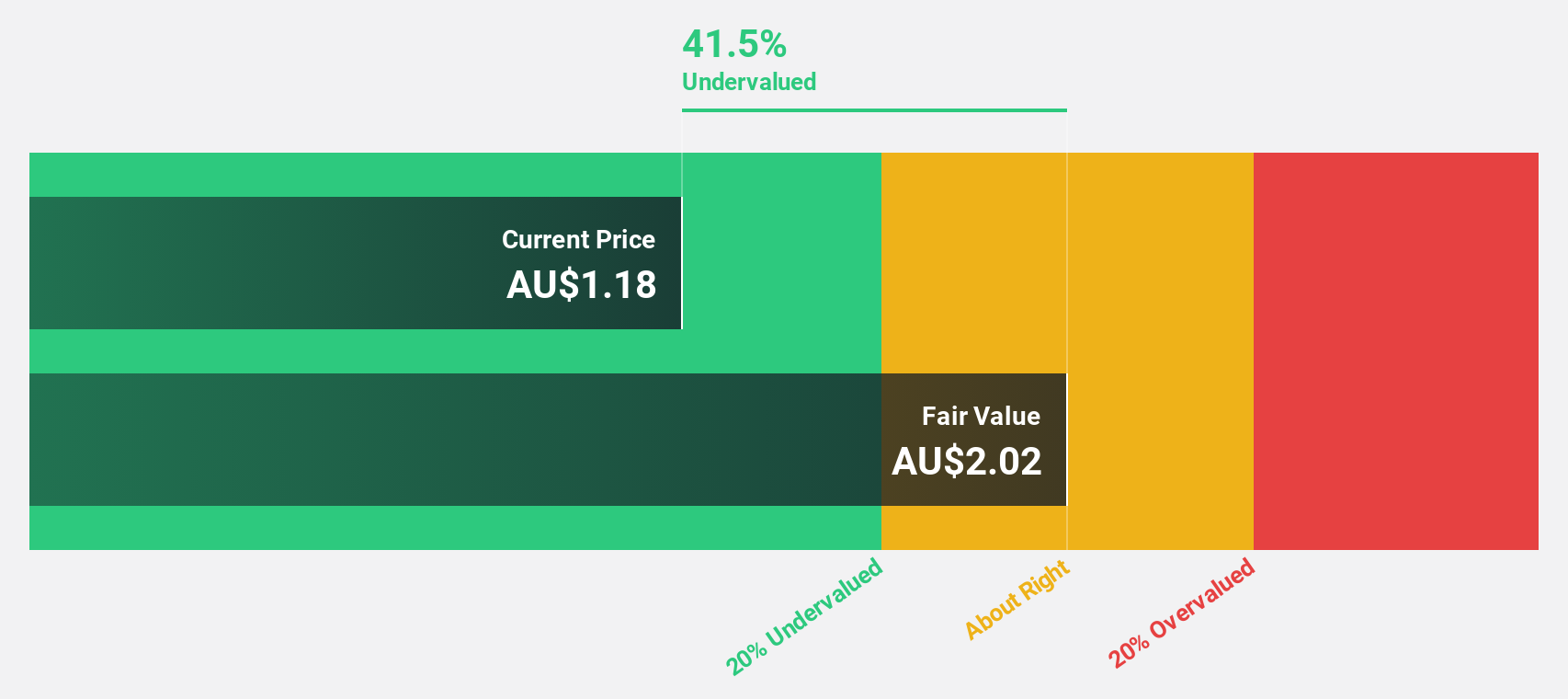

PointsBet Holdings (ASX:PBH)

Overview: PointsBet Holdings Limited operates a cloud-based technology platform offering sports, racing, and iGaming betting products and services in Australia, with a market cap of A$399.15 million.

Operations: The company generates revenue through its Canadian Trading segment, contributing A$36.24 million, and its Australian Trading segment, which brings in A$216.01 million.

Estimated Discount To Fair Value: 43.4%

PointsBet Holdings is trading at A$1.19, well below its estimated fair value of A$2.10, suggesting it might be undervalued based on cash flows. The company is forecast to become profitable within three years with earnings expected to grow significantly, outpacing the average market growth. Despite slower revenue growth at 10.5% annually compared to a higher benchmark, PointsBet's return on equity is projected to be very high in three years' time at 59.7%.

- According our earnings growth report, there's an indication that PointsBet Holdings might be ready to expand.

- Dive into the specifics of PointsBet Holdings here with our thorough financial health report.

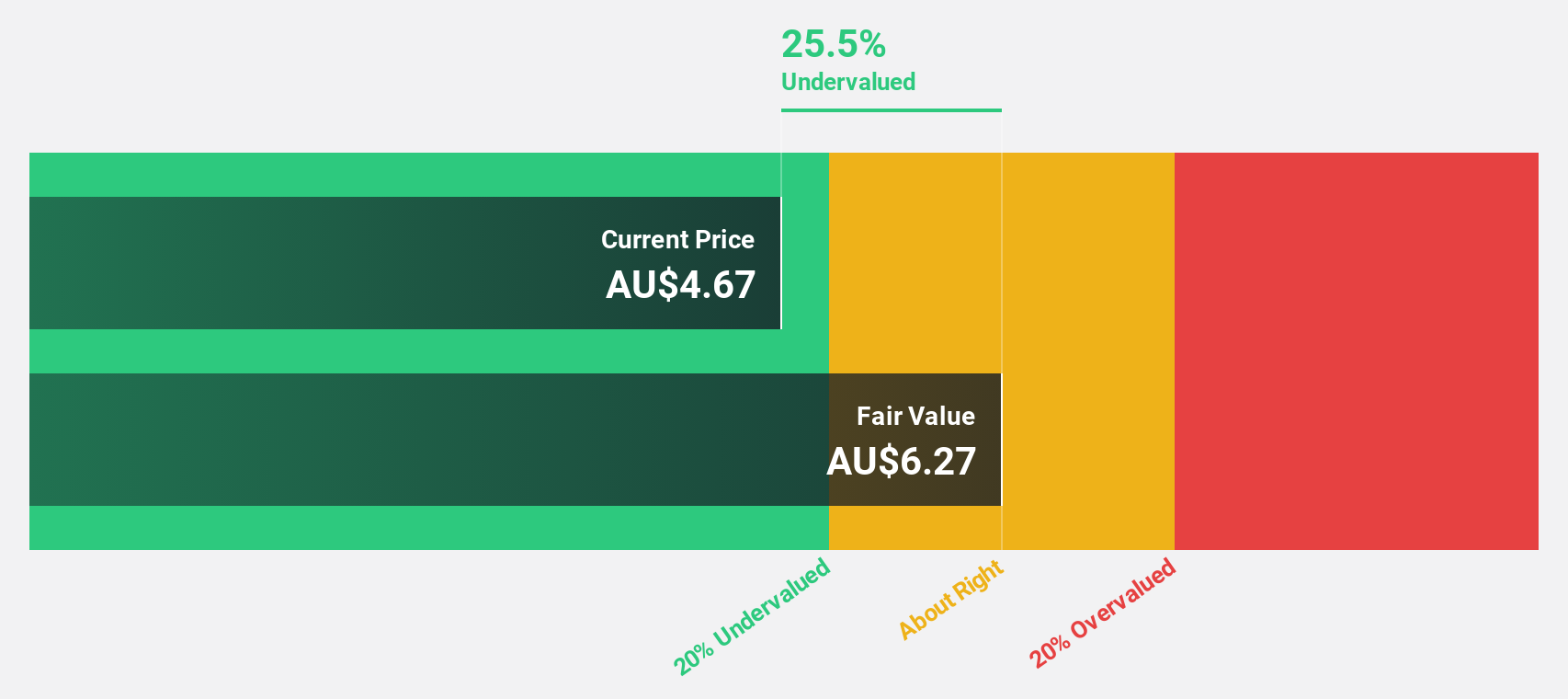

Web Travel Group (ASX:WEB)

Overview: Web Travel Group Limited offers online travel booking services across Australia, the United Arab Emirates, the United Kingdom, and internationally with a market cap of A$1.62 billion.

Operations: The company generates revenue primarily through its Business to Business Travel (B2B) segment, which accounts for A$328.40 million.

Estimated Discount To Fair Value: 29.6%

Web Travel Group is trading at A$4.49, below its fair value estimate of A$6.37, indicating undervaluation based on cash flows. Earnings are projected to grow significantly at 31.92% annually, surpassing the Australian market average growth rate. However, profit margins have decreased to 3.4% from last year's 24.6%, and insider selling has been significant recently. Recent board changes include the addition of experienced directors Melanie Wilson and Paul Scurrah, potentially strengthening governance.

- Our comprehensive growth report raises the possibility that Web Travel Group is poised for substantial financial growth.

- Take a closer look at Web Travel Group's balance sheet health here in our report.

Where To Now?

- Delve into our full catalog of 37 Undervalued ASX Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IFM

Infomedia

A technology company, develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives