ASX Value Stock Picks Including Lynas Rare Earths For Estimated Growth

Reviewed by Simply Wall St

As the ASX200 flirts with record highs, investor sentiment in Australia is cautiously optimistic, buoyed by potential trade deals and corporate activities like mergers and acquisitions. In such a climate, identifying undervalued stocks becomes crucial for investors looking to capitalize on market opportunities; companies with strong fundamentals and growth potential can offer promising prospects even amidst fluctuating sector performances.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Superloop (ASX:SLC) | A$2.85 | A$4.92 | 42.1% |

| Ridley (ASX:RIC) | A$2.86 | A$5.64 | 49.3% |

| Praemium (ASX:PPS) | A$0.685 | A$1.16 | 40.8% |

| Polymetals Resources (ASX:POL) | A$0.825 | A$1.54 | 46.3% |

| PointsBet Holdings (ASX:PBH) | A$1.195 | A$2.05 | 41.8% |

| Nuix (ASX:NXL) | A$2.35 | A$4.04 | 41.8% |

| Nanosonics (ASX:NAN) | A$4.35 | A$6.92 | 37.1% |

| Fenix Resources (ASX:FEX) | A$0.285 | A$0.47 | 38.9% |

| Charter Hall Group (ASX:CHC) | A$19.35 | A$33.88 | 42.9% |

| Capricorn Metals (ASX:CMM) | A$9.12 | A$14.62 | 37.6% |

Underneath we present a selection of stocks filtered out by our screen.

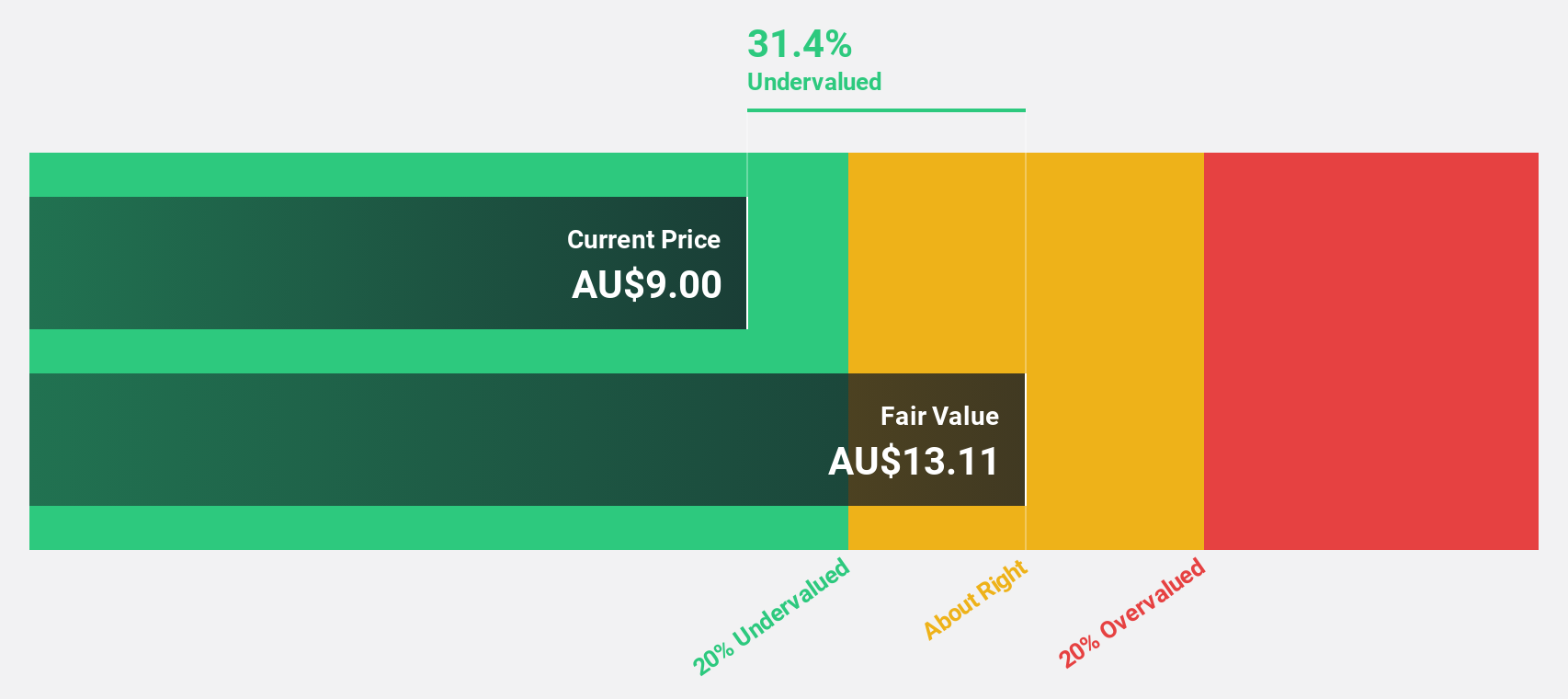

Lynas Rare Earths (ASX:LYC)

Overview: Lynas Rare Earths Limited operates in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia with a market capitalization of A$8.04 billion.

Operations: The company generates revenue primarily from its rare earth operations, amounting to A$482.82 million.

Estimated Discount To Fair Value: 36.5%

Lynas Rare Earths is trading at A$8.6, significantly below its estimated fair value of A$13.55, suggesting it may be undervalued based on discounted cash flow analysis. Despite a decline in profit margins from 33.2% to 10.5%, the company is expected to experience substantial earnings growth of over 61% annually, with revenue projected to grow at 38% per year, outpacing the broader Australian market's growth expectations.

- Our growth report here indicates Lynas Rare Earths may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Lynas Rare Earths stock in this financial health report.

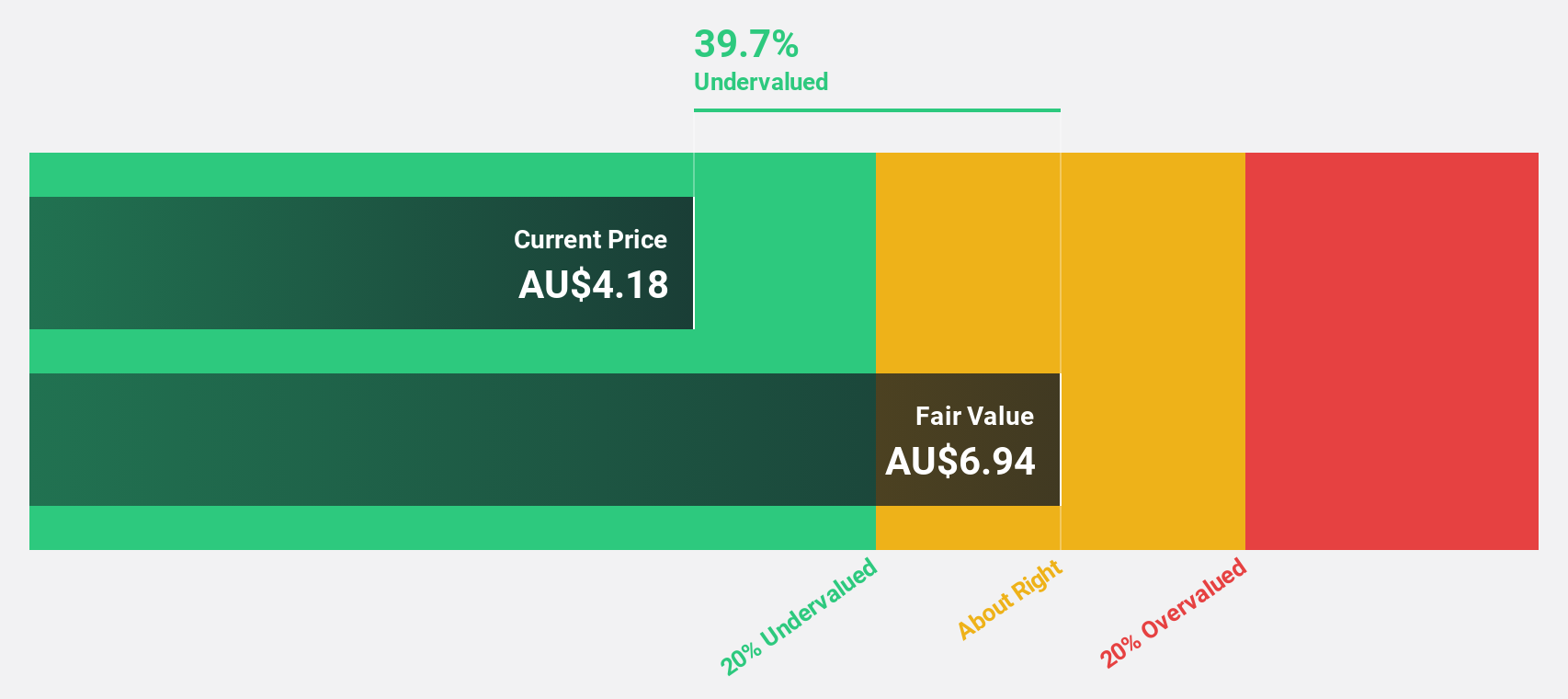

Nanosonics (ASX:NAN)

Overview: Nanosonics Limited is a global infection prevention company with a market cap of A$1.32 billion.

Operations: The company's revenue is primarily derived from its Healthcare Equipment segment, totaling A$183.97 million.

Estimated Discount To Fair Value: 37.1%

Nanosonics, trading at A$4.35, is valued below its estimated fair value of A$6.92, highlighting potential undervaluation based on discounted cash flow analysis. Earnings have grown 14.3% annually over the past five years and are forecast to increase significantly by 24.3% per year, outpacing the Australian market's growth rate of 11.6%. However, its future return on equity is projected to be relatively low at 13.9% in three years' time.

- The growth report we've compiled suggests that Nanosonics' future prospects could be on the up.

- Get an in-depth perspective on Nanosonics' balance sheet by reading our health report here.

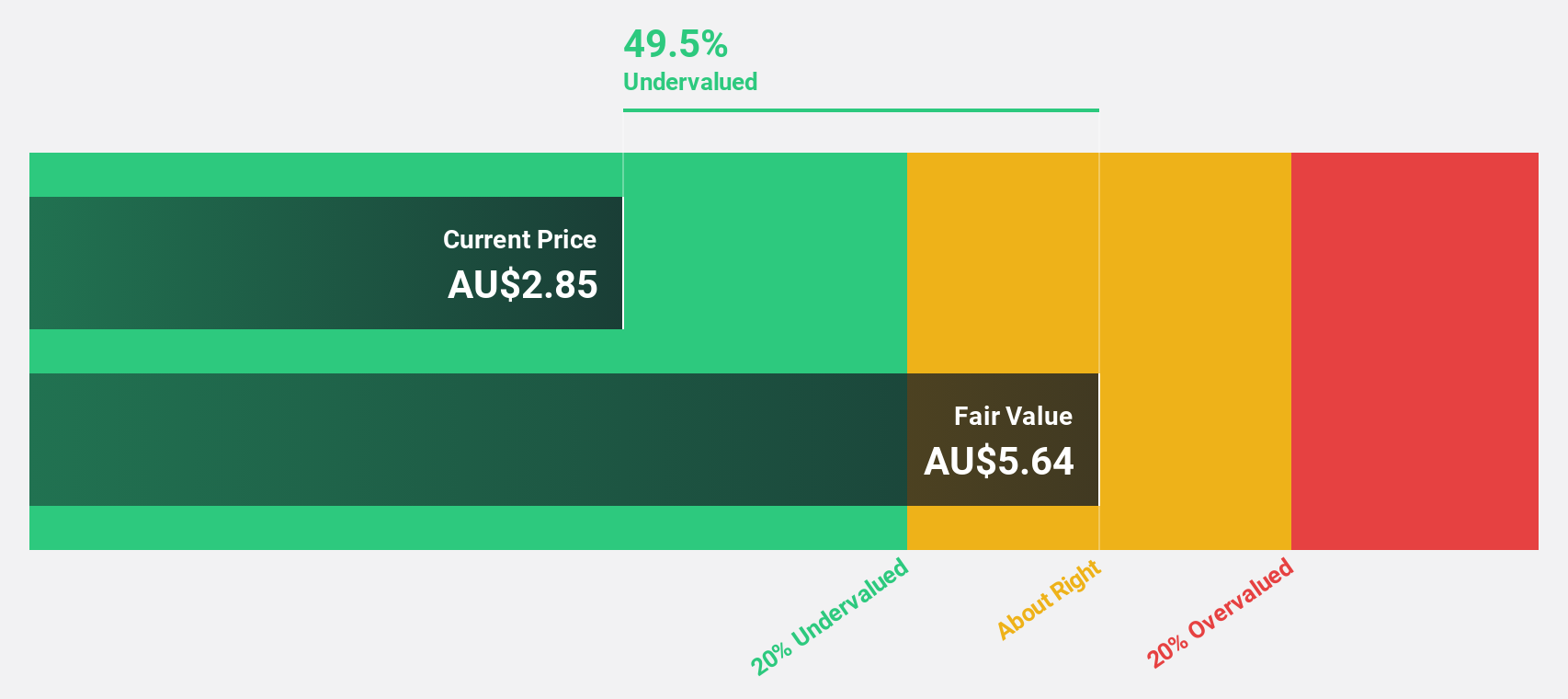

Ridley (ASX:RIC)

Overview: Ridley Corporation Limited, with a market cap of A$1.05 billion, provides animal nutrition solutions in Australia through its subsidiaries.

Operations: The company's revenue is derived from two main segments: Bulk Stockfeeds, contributing A$894.26 million, and Packaged/Ingredients, accounting for A$389.70 million.

Estimated Discount To Fair Value: 49.3%

Ridley, trading at A$2.86, is priced below its estimated fair value of A$5.64, indicating potential undervaluation based on discounted cash flow analysis. Recent equity and fixed-income offerings might impact shareholder value in the short term. While revenue is expected to grow robustly at 20.7% annually, earnings growth of 16.6% per year surpasses the Australian market average but remains moderate compared to significant benchmarks. The company's dividend history is unstable, and return on equity forecasts are modest at 14.4%.

- Our expertly prepared growth report on Ridley implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Ridley's balance sheet health report.

Next Steps

- Navigate through the entire inventory of 32 Undervalued ASX Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RIC

Ridley

Engages in the provision of animal nutrition solutions in Australia.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives