- Australia

- /

- Metals and Mining

- /

- ASX:FEX

ASX Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The Australian market recently experienced a shift as profit-taking in Commonwealth Bank impacted the broader indices, while materials stocks like BHP saw a resurgence. Amidst these fluctuations, penny stocks remain an intriguing area for investors seeking potential growth opportunities at lower price points. Though often overlooked, these smaller or newer companies can offer significant upside when they possess strong financials and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.37 | A$106.04M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.23 | A$105.2M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$118.24M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.82 | A$434.79M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.80 | A$475.94M | ✅ 4 ⚠️ 1 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$363.6M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.71 | A$838.04M | ✅ 5 ⚠️ 3 View Analysis > |

| Accent Group (ASX:AX1) | A$1.41 | A$847.67M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.75 | A$177.94M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.80 | A$144.98M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 474 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Argosy Minerals (ASX:AGY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Argosy Minerals Limited, along with its subsidiaries, focuses on the exploration and development of lithium properties in Argentina and the United States, with a market cap of A$49.50 million.

Operations: Argosy Minerals Limited does not report any specific revenue segments.

Market Cap: A$49.5M

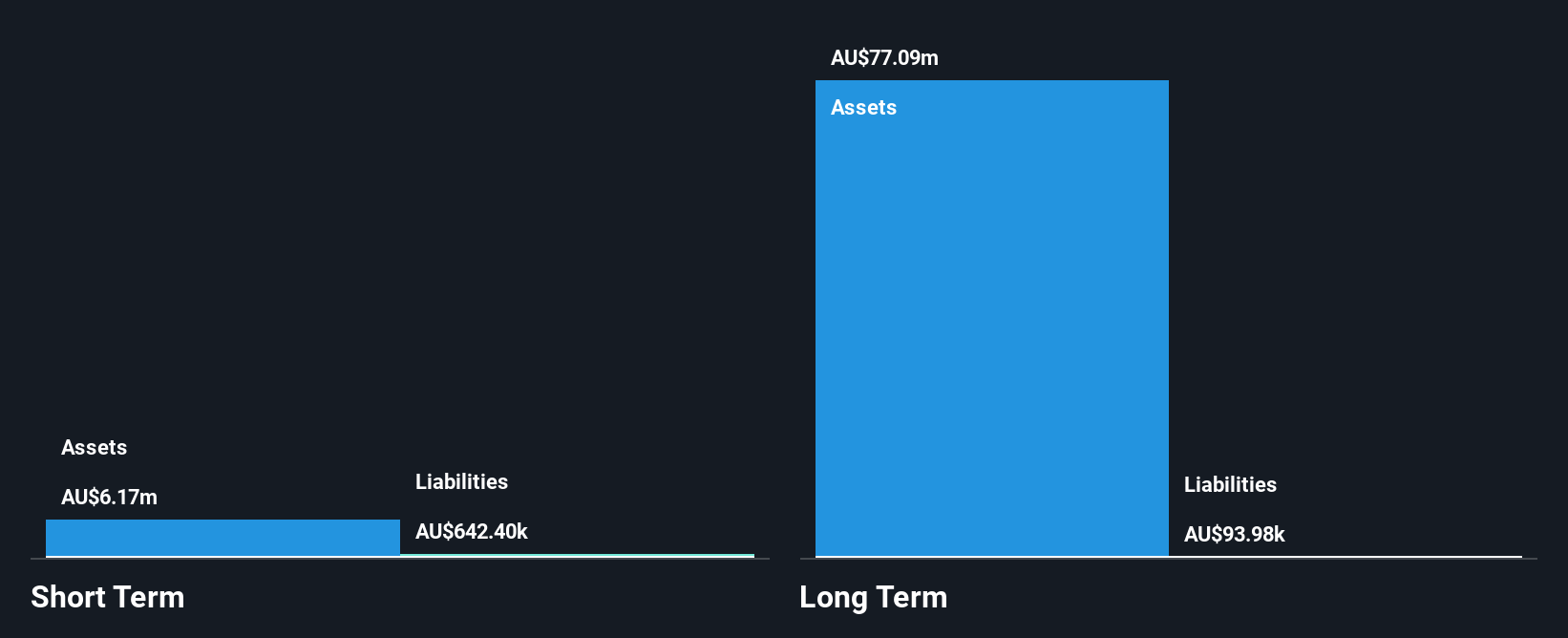

Argosy Minerals Limited, with a market cap of A$49.50 million, is pre-revenue and focuses on lithium exploration in Argentina and the US. Despite being debt-free and having short-term assets (A$6.2M) exceeding liabilities, it remains unprofitable with losses increasing annually by 70.9% over five years. The company has a sufficient cash runway for more than a year based on current free cash flow but faces high share price volatility recently rising from 18% to 26%. Its experienced board averages 3.3 years tenure, though management experience data is insufficient for assessment.

- Click to explore a detailed breakdown of our findings in Argosy Minerals' financial health report.

- Learn about Argosy Minerals' historical performance here.

Austin Engineering (ASX:ANG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Austin Engineering Limited, with a market cap of A$220.29 million, manufactures, repairs, overhauls, and supplies mining attachment products and related services for the industrial and resources sectors.

Operations: The company generates revenue from its operations across three main geographical regions: Asia-Pacific (A$169.08 million), North America (A$117.15 million), and South America (A$53.59 million).

Market Cap: A$220.29M

Austin Engineering, with a market cap of A$220.29 million, has shown robust financial health and growth potential. The company's earnings have grown 21.9% over the past year, surpassing industry averages, while maintaining stable weekly volatility at 9%. Its net debt to equity ratio is satisfactory at 7.5%, and interest payments are well covered by EBIT (16.8x). Recent guidance updates project revenue to reach approximately A$370 million for FY25, reflecting an 18% increase from FY24. However, despite high-quality earnings and experienced leadership, its dividend track record remains unstable amidst ongoing corporate changes.

- Click here to discover the nuances of Austin Engineering with our detailed analytical financial health report.

- Gain insights into Austin Engineering's outlook and expected performance with our report on the company's earnings estimates.

Fenix Resources (ASX:FEX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fenix Resources Limited is involved in the exploration, development, and mining of mineral tenements in Western Australia, with a market cap of A$211.23 million.

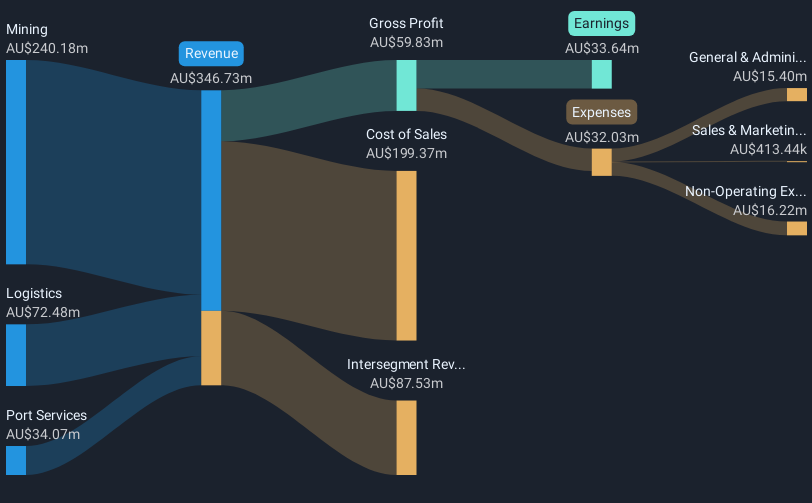

Operations: Fenix Resources generates revenue from three main segments: Mining (A$244.98 million), Logistics (A$84.02 million), and Port Services (A$40.44 million).

Market Cap: A$211.23M

Fenix Resources, with a market cap of A$211.23 million, has demonstrated financial resilience despite recent challenges. The company’s short-term assets (A$111.9M) comfortably cover both its short-term (A$69.5M) and long-term liabilities (A$56.6M), indicating strong liquidity management. While the earnings growth was negative last year, forecasts suggest a promising annual increase of 53.41%. Fenix's debt is well-covered by operating cash flow, though its profit margins have declined from 16.9% to 5.1%. The management team is relatively new with an average tenure of one year, which may impact strategic continuity.

- Jump into the full analysis health report here for a deeper understanding of Fenix Resources.

- Understand Fenix Resources' earnings outlook by examining our growth report.

Key Takeaways

- Click here to access our complete index of 474 ASX Penny Stocks.

- Seeking Other Investments? We've found 16 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FEX

Fenix Resources

Engages in the exploration, development, and mining of mineral tenements in Western Australia.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives