- Australia

- /

- Specialty Stores

- /

- ASX:BBN

ASX Penny Stocks To Consider In June 2025

Reviewed by Simply Wall St

The Australian market is experiencing some turbulence, with futures indicating a slight decline for the ASX 200, largely influenced by ongoing international trade uncertainties. Despite these fluctuations, investors continue to seek opportunities in various sectors, including the often-overlooked realm of penny stocks. Although the term 'penny stocks' might seem outdated, these smaller or newer companies can offer unique opportunities for growth and value when supported by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.71 | A$225.19M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.85 | A$149.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.90 | A$1.14B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.565 | A$73.83M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.55 | A$393.16M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.42M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.50 | A$166.08M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.33 | A$783.26M | ✅ 4 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$2.99 | A$699.78M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$3.29 | A$272.21M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,000 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Aroa Biosurgery (ASX:ARX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aroa Biosurgery Limited develops, manufactures, and sells medical devices for wound and soft tissue repair using extracellular matrix technology in the United States and internationally, with a market cap of A$175.90 million.

Operations: Revenue Segments: No specific revenue segments have been reported for Aroa Biosurgery Limited.

Market Cap: A$175.9M

Aroa Biosurgery has demonstrated notable progress, with sales reaching NZ$84.7 million for the year ending March 31, 2025, reflecting an increase from the previous year. Despite a net loss of NZ$3.81 million, this marks an improvement from prior losses. The company is debt-free and maintains a strong cash position with short-term assets surpassing liabilities significantly, ensuring a stable financial runway for over three years. Recent clinical evidence highlights the efficacy of its Endoform Natural product in treating venous leg ulcers more effectively than competitors, potentially enhancing patient outcomes and reducing costs in wound care management.

- Click to explore a detailed breakdown of our findings in Aroa Biosurgery's financial health report.

- Examine Aroa Biosurgery's earnings growth report to understand how analysts expect it to perform.

Baby Bunting Group (ASX:BBN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Baby Bunting Group Limited operates as a retailer of maternity and baby goods in Australia and New Zealand, with a market cap of A$233.41 million.

Operations: The company generates A$496.90 million in revenue from its specialty retail segment.

Market Cap: A$233.41M

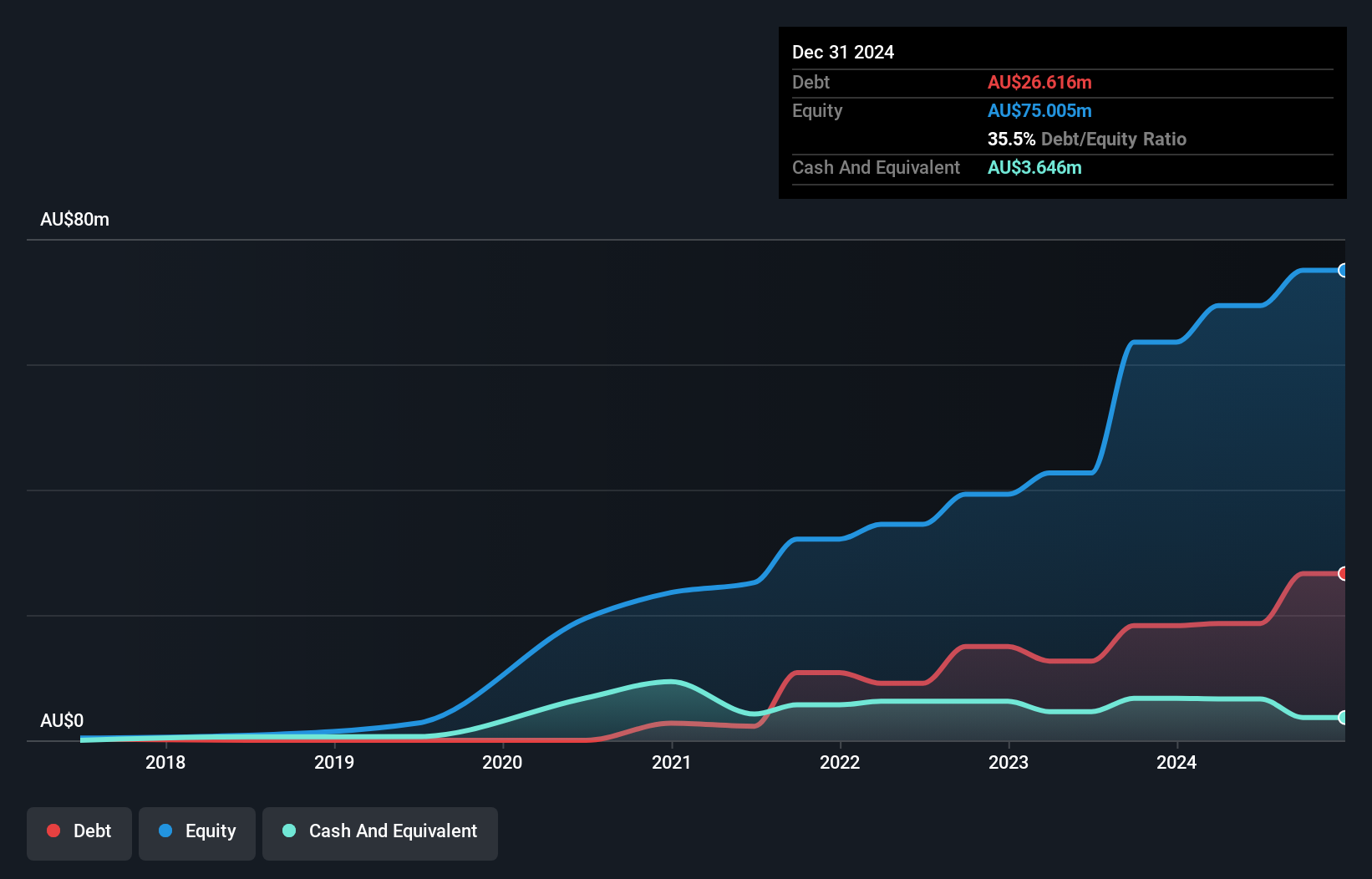

Baby Bunting Group's financial position is mixed, with a market cap of A$233.41 million and revenue of A$496.90 million from its specialty retail segment. The company faces challenges, such as negative earnings growth over the past year and declining profit margins, currently at 1.2%. Despite these issues, Baby Bunting maintains a satisfactory net debt to equity ratio of 8.6%, with debt well covered by operating cash flow at 177.9%. However, short-term assets do not cover long-term liabilities (A$132 million), and interest coverage by EBIT is low at 2.2x, indicating potential financial strain ahead.

- Jump into the full analysis health report here for a deeper understanding of Baby Bunting Group.

- Explore Baby Bunting Group's analyst forecasts in our growth report.

COSOL (ASX:COS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: COSOL Limited, along with its subsidiaries, offers information technology services across the Asia Pacific, North America, Europe, the Middle East, Africa, and globally with a market cap of A$142.86 million.

Operations: The company generates revenue primarily from its Asia Pacific operations, contributing A$98.75 million, and North American activities, adding A$12.26 million.

Market Cap: A$142.86M

COSOL Limited, with a market cap of A$142.86 million, demonstrates mixed financial health. Trading at a value price-to-earnings ratio of 16x and offering high-quality earnings, it presents potential value compared to peers. However, its short-term assets (A$32.3M) do not cover long-term liabilities (A$40.7M), and net profit margins have declined from 9.5% to 8.1%. The company's debt is well covered by operating cash flow at 25%, but the dividend yield of 3.04% isn't supported by free cash flows. Recent inclusion in the S&P/ASX All Ordinaries Index highlights its growing recognition in the market.

- Get an in-depth perspective on COSOL's performance by reading our balance sheet health report here.

- Gain insights into COSOL's future direction by reviewing our growth report.

Make It Happen

- Reveal the 1,000 hidden gems among our ASX Penny Stocks screener with a single click here.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Baby Bunting Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BBN

Baby Bunting Group

Engages in the retail of maternity and baby goods in Australia and New Zealand.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion