- Australia

- /

- Metals and Mining

- /

- ASX:GMD

ASX Insights 3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

The Australian market has recently been shaped by fluctuating commodity prices and sector-specific movements, with utilities outperforming while real estate lagged following the RBA's pause. In this environment, identifying undervalued stocks can be crucial for investors seeking opportunities; these are often characterized by strong fundamentals that may not yet be reflected in their current market price.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ridley (ASX:RIC) | A$2.89 | A$5.78 | 50% |

| PointsBet Holdings (ASX:PBH) | A$1.185 | A$2.10 | 43.6% |

| Nuix (ASX:NXL) | A$2.05 | A$3.32 | 38.3% |

| Lindsay Australia (ASX:LAU) | A$0.71 | A$1.15 | 38.5% |

| Integral Diagnostics (ASX:IDX) | A$2.57 | A$4.57 | 43.8% |

| Infomedia (ASX:IFM) | A$1.215 | A$2.07 | 41.3% |

| Fenix Resources (ASX:FEX) | A$0.2825 | A$0.50 | 44% |

| Collins Foods (ASX:CKF) | A$9.12 | A$15.84 | 42.4% |

| Charter Hall Group (ASX:CHC) | A$19.12 | A$35.43 | 46% |

| Advanced Braking Technology (ASX:ABV) | A$0.084 | A$0.16 | 48.9% |

Here we highlight a subset of our preferred stocks from the screener.

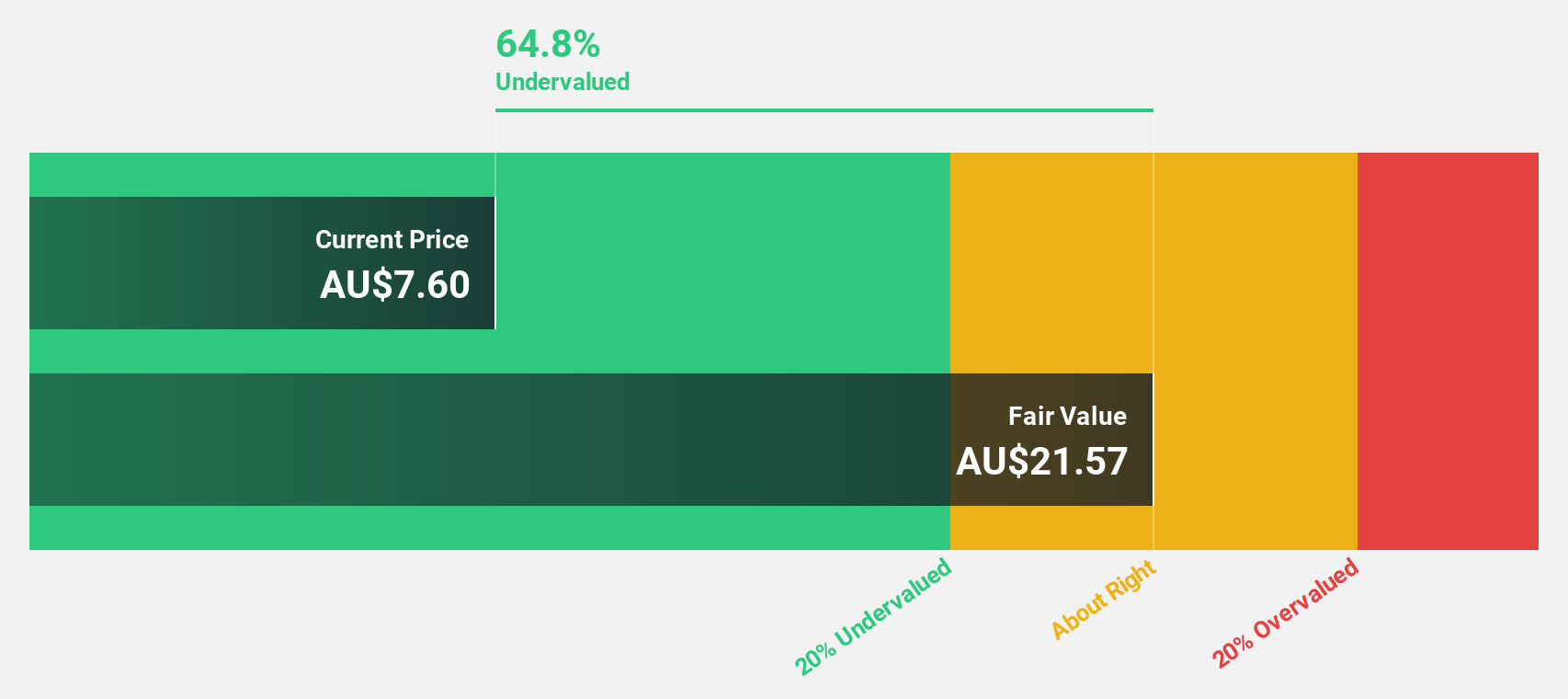

Domino's Pizza Enterprises (ASX:DMP)

Overview: Domino's Pizza Enterprises Limited operates retail food outlets and has a market capitalization of A$1.77 billion.

Operations: Revenue for Domino's Pizza Enterprises comes from its restaurant operations, totaling A$2.30 billion.

Estimated Discount To Fair Value: 37.5%

Domino's Pizza Enterprises appears undervalued, trading at A$18.78 against a fair value estimate of A$30.03, suggesting potential for appreciation based on cash flow analysis. Despite challenges with low profit margins and high debt levels, earnings are forecast to grow significantly at 32.9% annually over the next three years, outpacing the broader Australian market. Recent leadership changes aim to bolster performance and strategic execution amidst ongoing global restructuring efforts.

- In light of our recent growth report, it seems possible that Domino's Pizza Enterprises' financial performance will exceed current levels.

- Dive into the specifics of Domino's Pizza Enterprises here with our thorough financial health report.

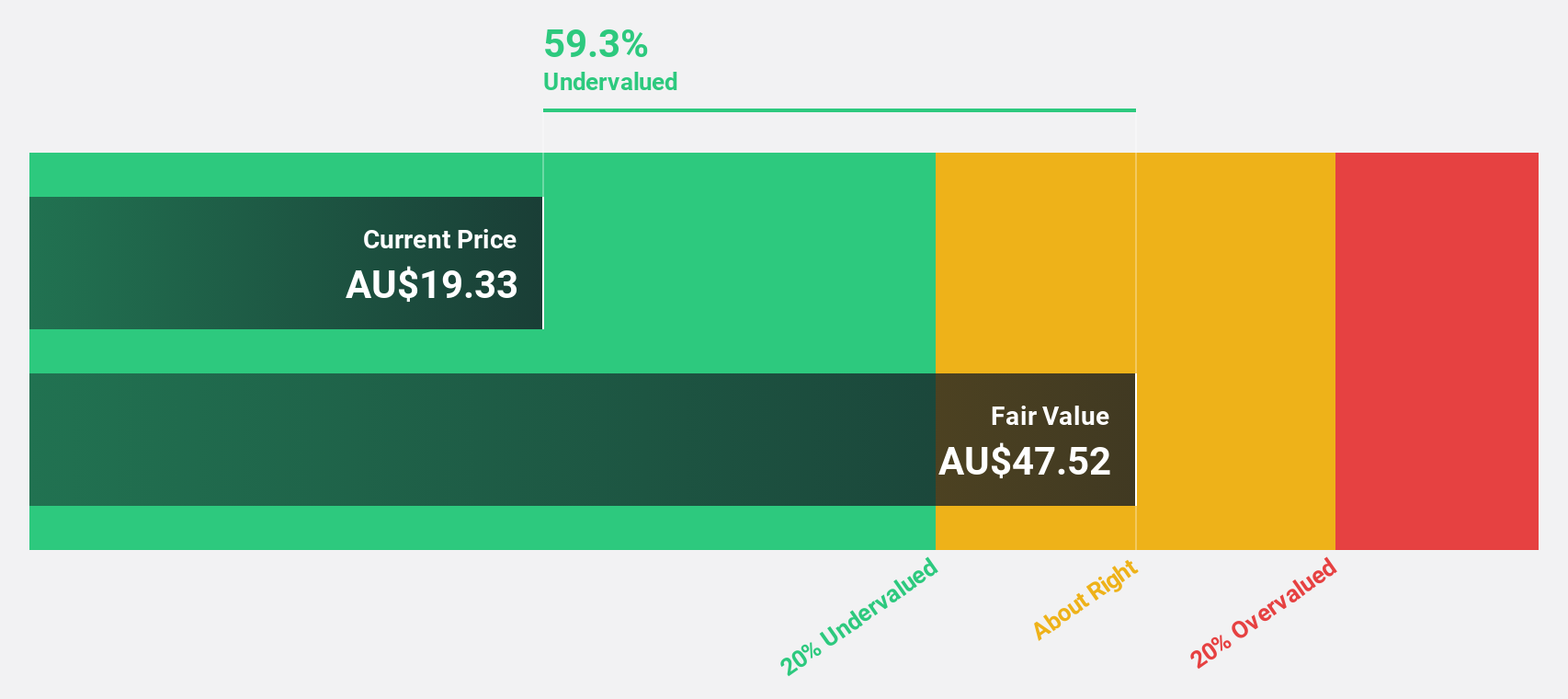

Genesis Minerals (ASX:GMD)

Overview: Genesis Minerals Limited focuses on the exploration, production, and development of gold deposits in Western Australia, with a market cap of A$4.57 billion.

Operations: The company generates revenue of A$561.40 million from its activities in mineral production, exploration, and development.

Estimated Discount To Fair Value: 37.9%

Genesis Minerals is trading at A$4.04, significantly below its estimated fair value of A$6.51, highlighting potential undervaluation based on cash flows. The company's earnings and revenue are forecast to grow at 26.7% and 21% per year, respectively, outpacing the Australian market growth rates. Genesis recently appointed Jane Macey as a Non-Executive Director, bringing extensive industry experience that could support strategic growth initiatives amidst this promising financial outlook.

- The analysis detailed in our Genesis Minerals growth report hints at robust future financial performance.

- Click here to discover the nuances of Genesis Minerals with our detailed financial health report.

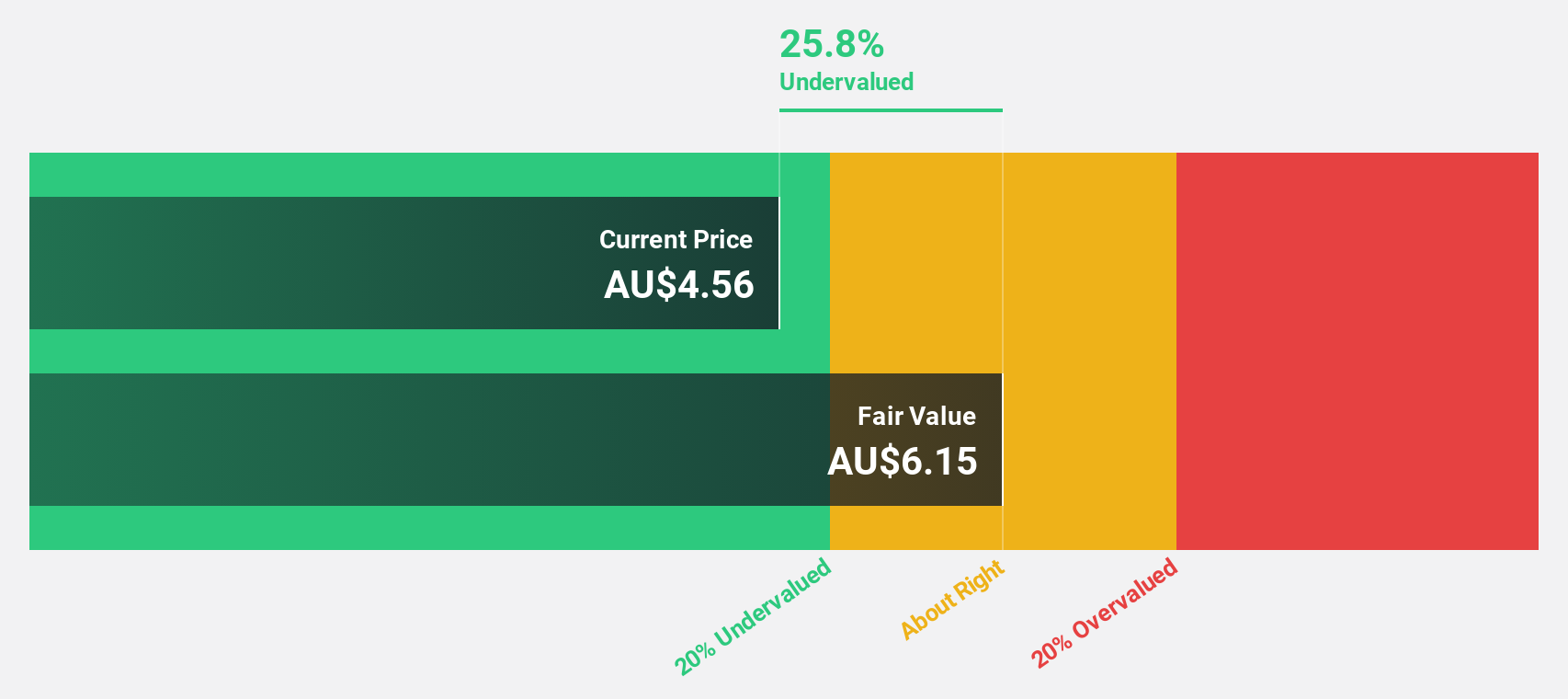

Regis Healthcare (ASX:REG)

Overview: Regis Healthcare Limited provides residential aged care services in Australia and has a market cap of A$2.25 billion.

Operations: The company's revenue is primarily derived from its residential aged care services, amounting to A$1.10 billion.

Estimated Discount To Fair Value: 28.6%

Regis Healthcare, trading at A$7.46, is significantly undervalued with a fair value estimate of A$10.45. The company's earnings are projected to grow 24.9% annually, surpassing the Australian market's growth rate of 10.9%. Despite slower revenue growth at 8.1% per year compared to its earnings, Regis became profitable this year and exhibits strong potential for future financial performance based on cash flow analysis and return on equity forecasts.

- The growth report we've compiled suggests that Regis Healthcare's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Regis Healthcare.

Seize The Opportunity

- Unlock our comprehensive list of 36 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GMD

Genesis Minerals

Engages in the exploration, production, and development of gold deposits in Western Australia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives