As the Australian market grapples with rising inflation, which now sits at 3.2%, investors are closely watching the Reserve Bank's next moves amid concerns of potential bearish sentiment. In this environment, dividend stocks can offer a measure of stability and income, making them an appealing consideration for those looking to navigate these uncertain economic waters.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 6.69% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.76% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.90% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.10% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 6.18% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.77% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.28% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.64% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.88% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.83% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Cedar Woods Properties (ASX:CWP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cedar Woods Properties Limited is an Australian company that develops and invests in properties, with a market cap of A$712.56 million.

Operations: Cedar Woods Properties Limited generates revenue of A$465.94 million from its property development and investment activities in Australia.

Dividend Yield: 3.4%

Cedar Woods Properties offers a mixed dividend profile. While trading at 10.3% below its estimated fair value and showing strong earnings growth of 12.1% annually over the past five years, its dividend yield of 3.38% is lower than the top quartile in Australia. Dividends are covered by earnings and cash flows with payout ratios of 49.7% and 71%, respectively, yet have been unreliable historically due to volatility and lack of consistent growth over the past decade.

- Click to explore a detailed breakdown of our findings in Cedar Woods Properties' dividend report.

- Upon reviewing our latest valuation report, Cedar Woods Properties' share price might be too pessimistic.

Joyce (ASX:JYC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Joyce Corporation Ltd, with a market cap of A$153.76 million, operates in Australia as a retailer of kitchen and wardrobe products.

Operations: Joyce Corporation Ltd generates revenue through its Retail Bedding - Franchise Operation (A$6.10 million), Retail Bedding Stores - Company-owned (A$21.11 million), and Retail Kitchen and Wardrobe Showrooms (A$120.39 million).

Dividend Yield: 5.3%

Joyce Corporation Ltd. presents a complex dividend profile. Despite trading at 71% below estimated fair value, its dividends are not top-tier, with a yield of 5.29%, lower than the Australian market's top 25%. The payout ratio is sustainable at 88.5% for earnings and 33.4% for cash flows, yet dividends have been volatile over the past decade. Recent announcements include a regular dividend of A$0.115 and a special dividend of A$0.055 per share for June-end 2025 earnings, reflecting decreased net income to A$7.35 million from A$8.86 million previously.

- Dive into the specifics of Joyce here with our thorough dividend report.

- The valuation report we've compiled suggests that Joyce's current price could be quite moderate.

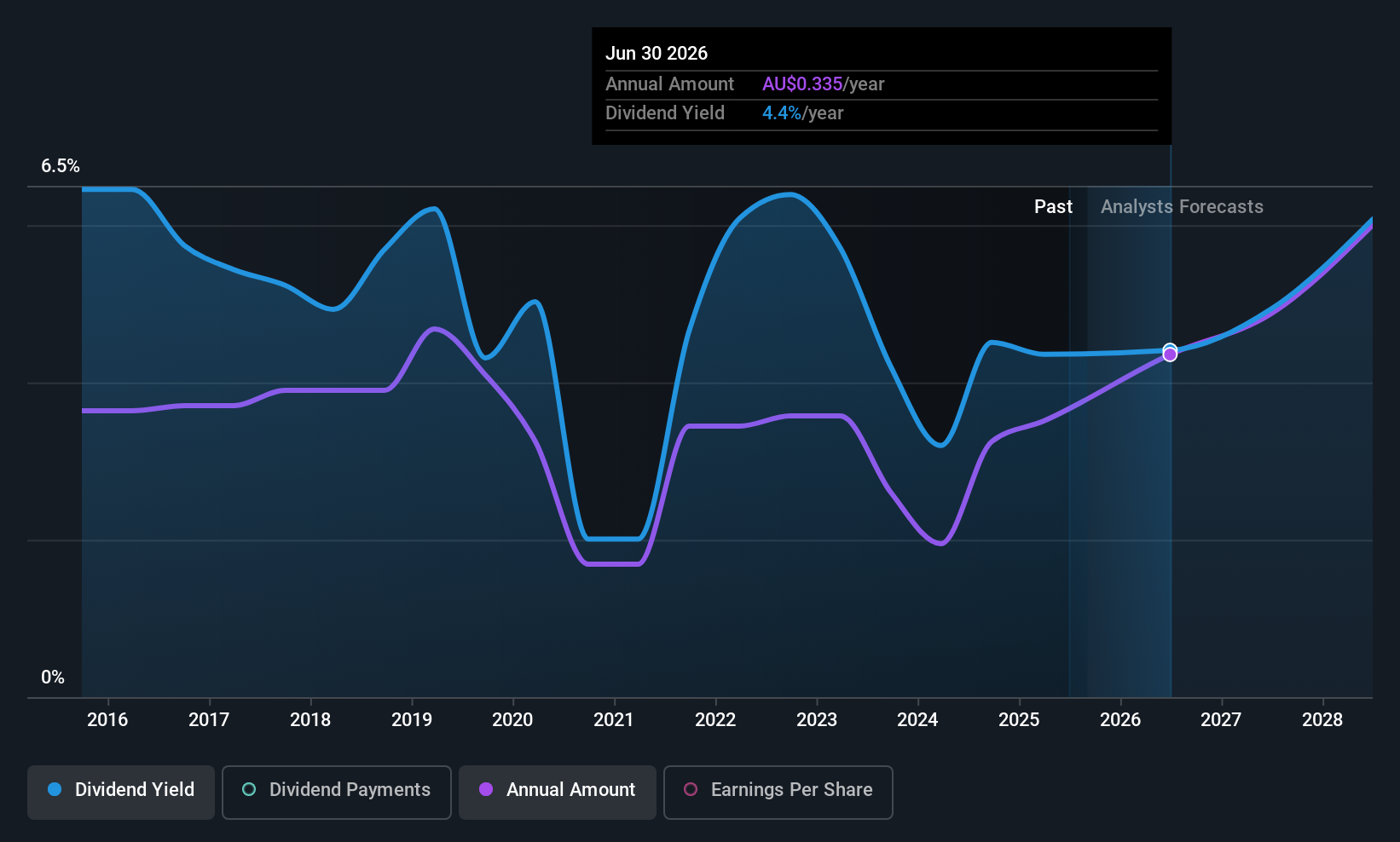

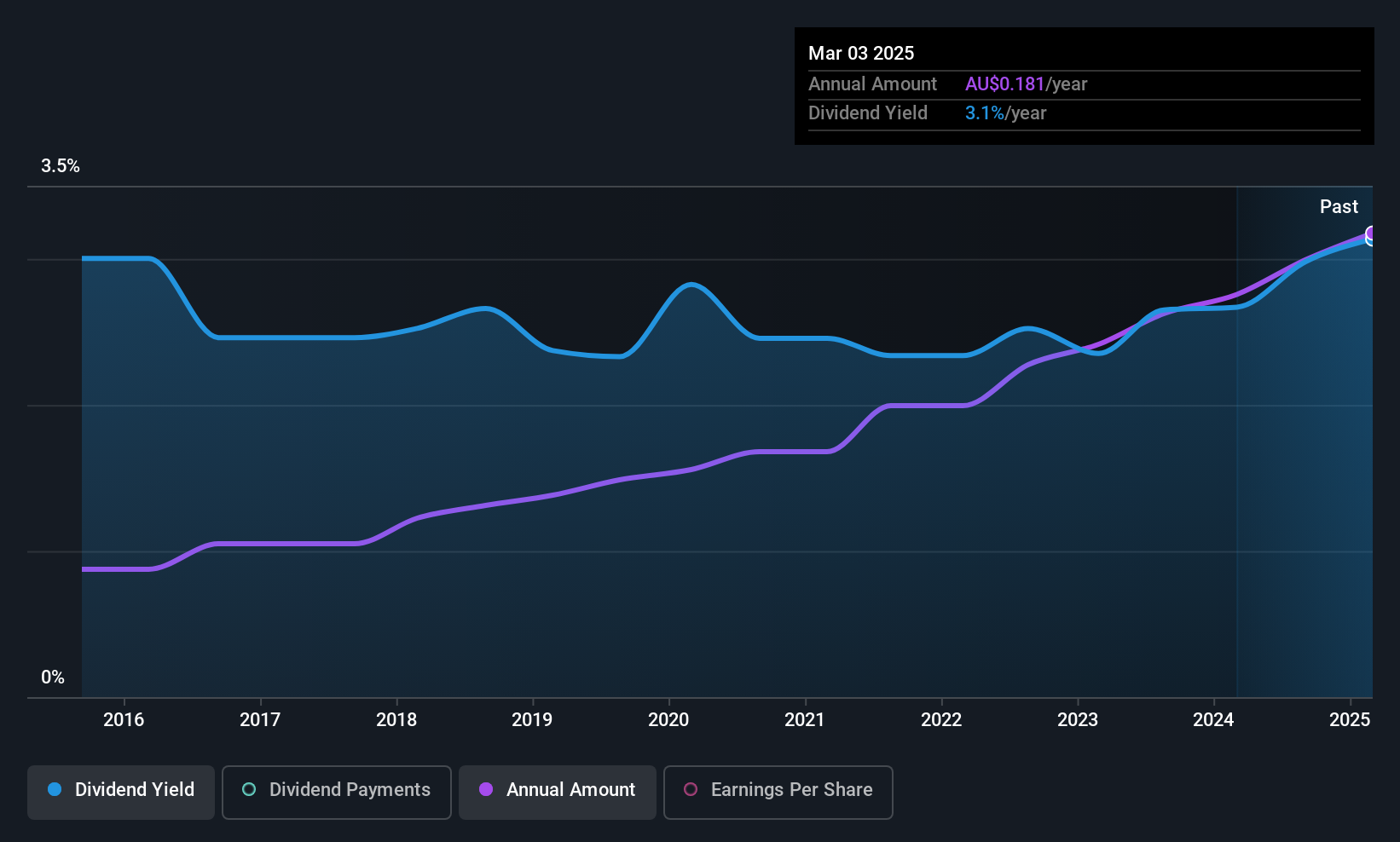

Steadfast Group (ASX:SDF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Steadfast Group Limited operates as a provider of general insurance brokerage services across Australasia, Asia, and Europe with a market cap of A$6.94 billion.

Operations: Steadfast Group Limited generates revenue primarily from its Insurance Intermediary segment, which accounts for A$1.68 billion, alongside its Premium Funding segment contributing A$123.50 million.

Dividend Yield: 3.1%

Steadfast Group's dividend reliability is underscored by a stable 10-year payout history and recent increase to A$0.117 per share, despite a yield of 3.1% being below the top quartile in Australia. Earnings growth of 46.9% supports its sustainable payout ratio of 64.2%, with dividends well-covered by cash flows at a 43.9% ratio. Recent board changes include Vicki Allen succeeding Frank O'Halloran as Chair, ensuring strategic continuity amidst significant insider selling activity recently observed.

- Unlock comprehensive insights into our analysis of Steadfast Group stock in this dividend report.

- Our valuation report unveils the possibility Steadfast Group's shares may be trading at a discount.

Turning Ideas Into Actions

- Discover the full array of 28 Top ASX Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SDF

Steadfast Group

Provides general insurance brokerage services Australasia, Asia, and Europe.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives