Asian Value Stocks: Wee Hur Holdings And 2 More Companies That May Be Trading Below Estimated Worth

Reviewed by Simply Wall St

As global markets navigate through a period of muted responses to new tariffs and mixed economic signals, the Asian market presents unique opportunities for investors seeking value. In this environment, identifying stocks that may be trading below their estimated worth can offer potential advantages, as these undervalued equities might benefit from future market corrections or shifts in economic policy.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.02 | CN¥74.99 | 49.3% |

| Taiyo Yuden (TSE:6976) | ¥2560.00 | ¥5097.13 | 49.8% |

| Puyang Refractories Group (SZSE:002225) | CN¥6.34 | CN¥12.66 | 49.9% |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥23.29 | CN¥46.22 | 49.6% |

| Medy-Tox (KOSDAQ:A086900) | ₩161200.00 | ₩322233.66 | 50% |

| Grand Korea Leisure (KOSE:A114090) | ₩17010.00 | ₩33803.83 | 49.7% |

| cottaLTD (TSE:3359) | ¥428.00 | ¥852.86 | 49.8% |

| BYD (SEHK:1211) | HK$120.40 | HK$236.17 | 49% |

| Astroscale Holdings (TSE:186A) | ¥679.00 | ¥1347.77 | 49.6% |

| ALUX (KOSDAQ:A475580) | ₩11560.00 | ₩22701.67 | 49.1% |

Here we highlight a subset of our preferred stocks from the screener.

Wee Hur Holdings (SGX:E3B)

Overview: Wee Hur Holdings Ltd., with a market cap of SGD519.37 million, is an investment holding company involved in general building and civil engineering construction in Singapore and Australia.

Operations: The company's revenue is primarily derived from its building construction segment (SGD123.74 million), workers dormitory operations (SGD84.69 million), property development in Singapore (SGD47.45 million), fund management activities (SGD5.54 million), corporate functions (SGD3.56 million), PBSA operations (SGD2.09 million), and property development in Australia (SGD0.94 million).

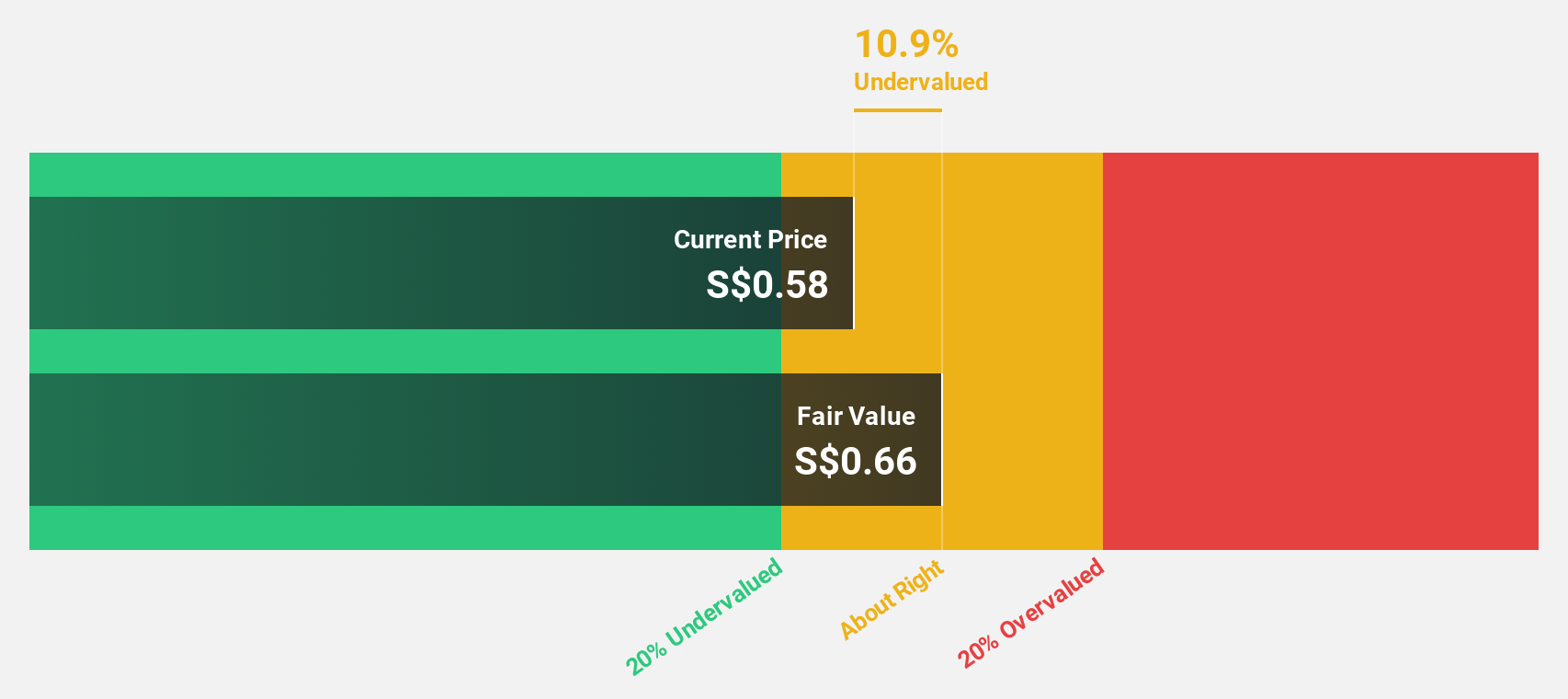

Estimated Discount To Fair Value: 13.5%

Wee Hur Holdings is trading at S$0.57, below its estimated fair value of S$0.65, indicating it may be undervalued based on cash flows. Despite significant insider selling recently, earnings are expected to grow 24.2% annually over the next three years, outpacing the Singapore market's 7.2%. However, profit margins have decreased from last year due to large one-off items impacting financial results. The company has also filed a shelf registration for S$500 million in notes.

- Our expertly prepared growth report on Wee Hur Holdings implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Wee Hur Holdings with our comprehensive financial health report here.

Ficont Industry (Beijing) (SHSE:605305)

Overview: Ficont Industry (Beijing) Co., Ltd. operates in the wind energy, construction, and safety protection equipment sectors both in China and internationally, with a market cap of CN¥6.54 billion.

Operations: The company's revenue from construction machinery and equipment is CN¥1.37 billion.

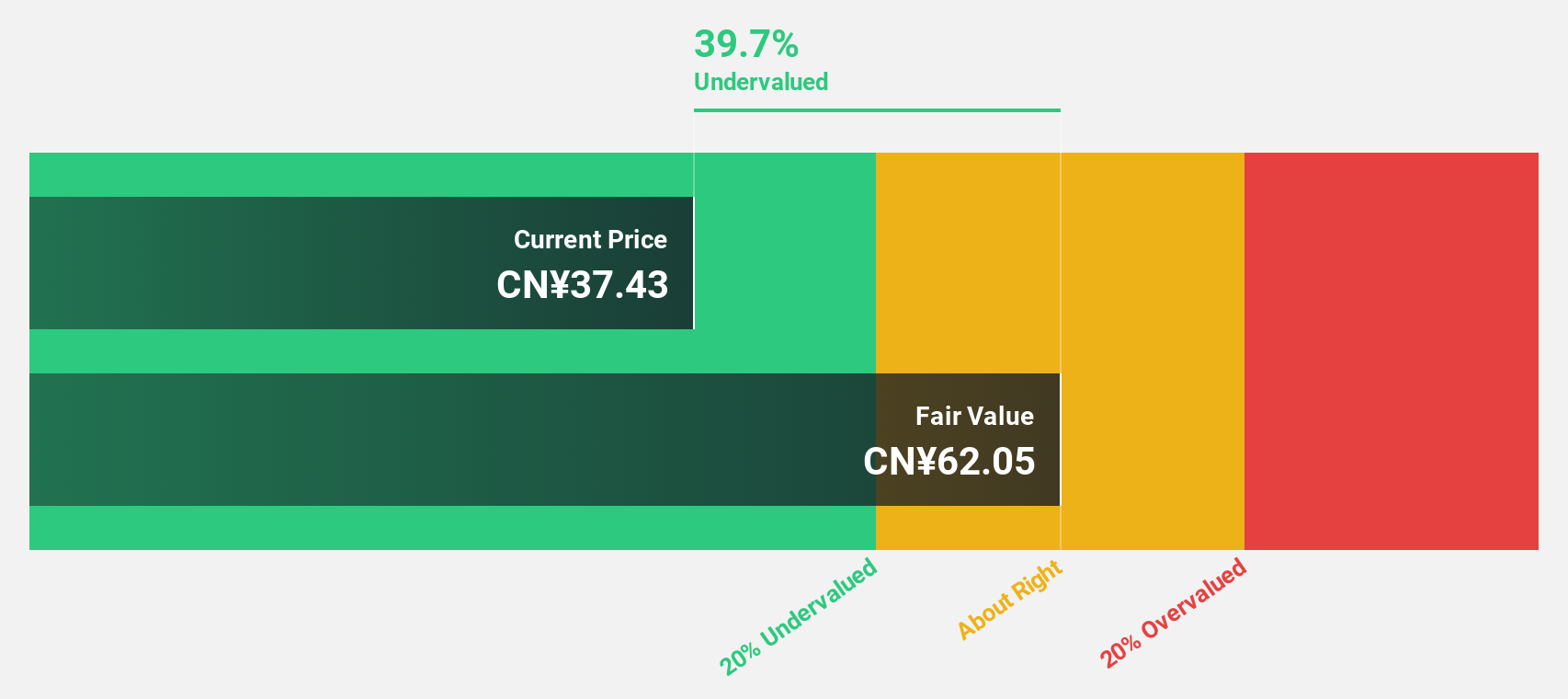

Estimated Discount To Fair Value: 44.6%

Ficont Industry (Beijing) is trading at CN¥30.78, below its estimated fair value of CN¥55.59, suggesting undervaluation based on cash flows. The company reported strong growth with Q1 2025 net income rising to CNY 98.54 million from CNY 58.38 million a year ago, and revenue forecasted to grow at 21.5% annually, outpacing the Chinese market's growth rate of 12.4%. However, the dividend track record remains unstable despite recent increases.

- In light of our recent growth report, it seems possible that Ficont Industry (Beijing)'s financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Ficont Industry (Beijing) stock in this financial health report.

Shenzhen Envicool Technology (SZSE:002837)

Overview: Shenzhen Envicool Technology Co., Ltd. specializes in producing and selling temperature control and energy-saving solutions in China, with a market cap of CN¥30.84 billion.

Operations: The company's revenue primarily comes from its precision temperature control energy-saving equipment segment, which generated CN¥4.78 billion.

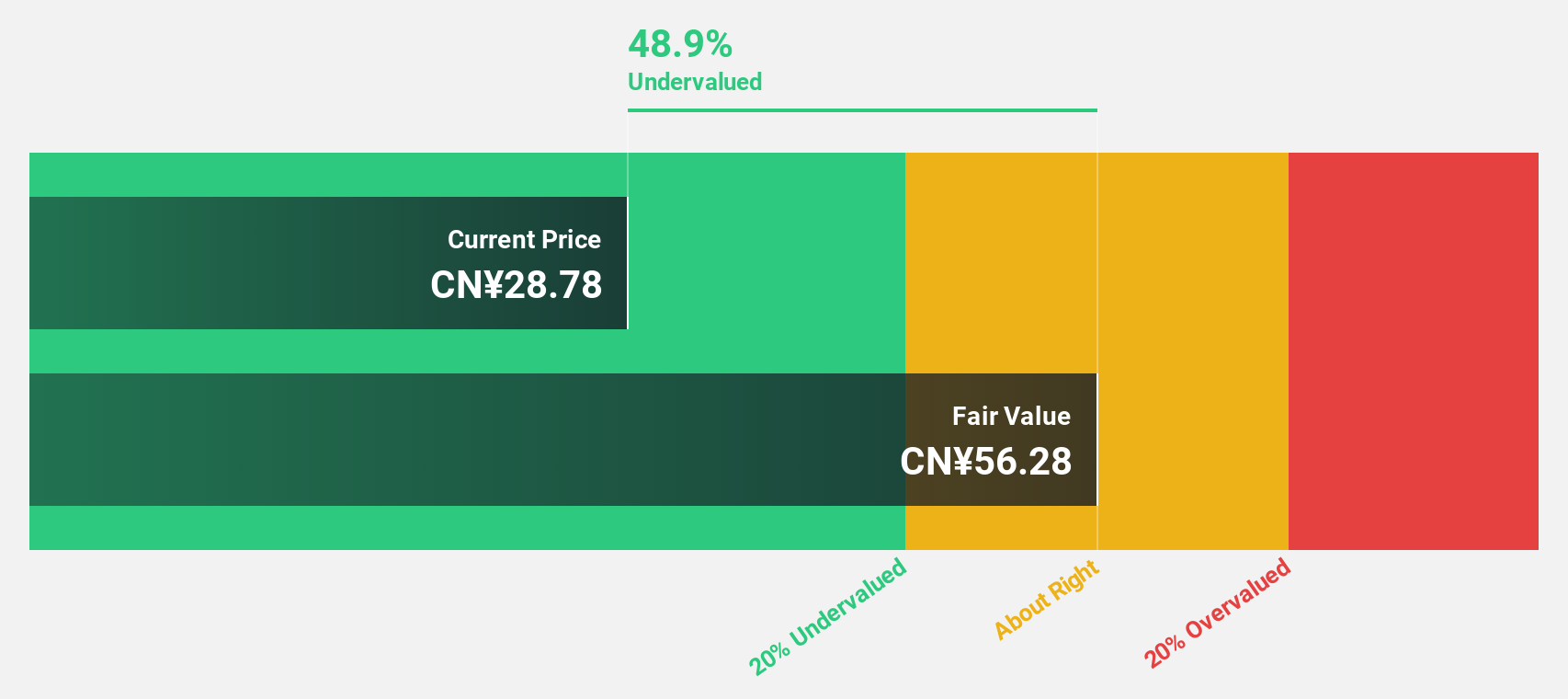

Estimated Discount To Fair Value: 49%

Shenzhen Envicool Technology, trading at CN¥31.84, is valued below its fair value estimate of CN¥62.45, indicating potential undervaluation based on cash flows. Recent strategic alliances for data center projects in ASEAN and a headquarters expansion highlight growth ambitions. Earnings are expected to grow significantly by 27.7% annually, surpassing the market average of 23.4%. Despite high non-cash earnings quality and volatility in share price, revenue growth prospects remain robust at 25.1% per year.

- Our earnings growth report unveils the potential for significant increases in Shenzhen Envicool Technology's future results.

- Click to explore a detailed breakdown of our findings in Shenzhen Envicool Technology's balance sheet health report.

Key Takeaways

- Take a closer look at our Undervalued Asian Stocks Based On Cash Flows list of 264 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605305

Ficont Industry (Beijing)

Provides wind energy, construction, and safety protection equipment in China and internationally.

Undervalued with solid track record.

Market Insights

Community Narratives