- China

- /

- Electronic Equipment and Components

- /

- SZSE:002897

Asian Stocks Possibly Trading Below Their Intrinsic Value Estimates In August 2025

Reviewed by Simply Wall St

In August 2025, Asian markets are experiencing a notable upswing, with China's stock indices advancing on renewed trade optimism and Japan's reaching record highs amid robust economic growth. Amid this positive momentum, identifying stocks that may be trading below their intrinsic value becomes crucial for investors seeking opportunities in an evolving market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥159.60 | CN¥311.36 | 48.7% |

| Unimicron Technology (TWSE:3037) | NT$139.00 | NT$276.19 | 49.7% |

| Tibet Tianlu (SHSE:600326) | CN¥16.59 | CN¥32.85 | 49.5% |

| Sunjin Beauty ScienceLtd (KOSDAQ:A086710) | ₩10620.00 | ₩21002.53 | 49.4% |

| Matsuya R&DLtd (TSE:7317) | ¥714.00 | ¥1426.13 | 49.9% |

| LigaChem Biosciences (KOSDAQ:A141080) | ₩146800.00 | ₩287080.35 | 48.9% |

| Kolmar Korea (KOSE:A161890) | ₩79000.00 | ₩154152.04 | 48.8% |

| Kioxia Holdings (TSE:285A) | ¥2473.00 | ¥4905.46 | 49.6% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.80 | NZ$1.60 | 49.9% |

| Dive (TSE:151A) | ¥930.00 | ¥1841.73 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

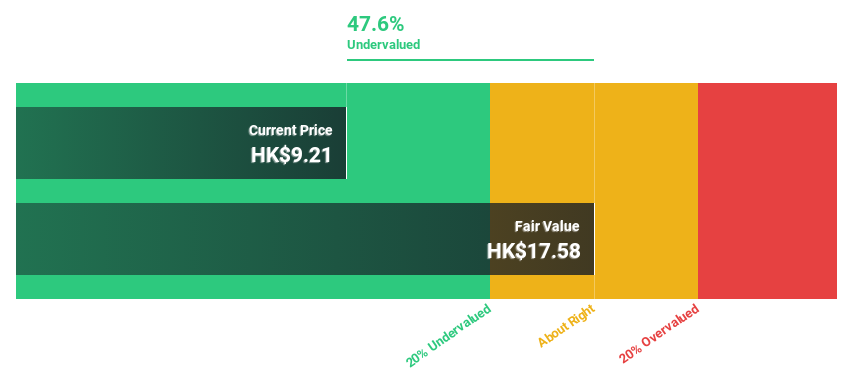

Consun Pharmaceutical Group (SEHK:1681)

Overview: Consun Pharmaceutical Group Limited focuses on the research, development, manufacturing, and sale of Chinese medicines and medical contrast medium products in China, with a market cap of HK$12.33 billion.

Operations: The company's revenue is primarily derived from the Consun Pharmaceutical Segment, contributing CN¥2.53 billion, and the Yulin Pharmaceutical Segment, which adds CN¥442.84 million.

Estimated Discount To Fair Value: 46.7%

Consun Pharmaceutical Group is trading at HK$14.88, significantly below its estimated fair value of HK$27.94, indicating potential undervaluation based on cash flows. Recent earnings results show improved performance with sales reaching CNY 1.57 billion and net income at CNY 498.3 million for the first half of 2025, supporting its growth trajectory. The company announced a dividend increase to HKD 0.33 per share, reflecting strong cash flow management despite an unstable dividend history.

- Our expertly prepared growth report on Consun Pharmaceutical Group implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Consun Pharmaceutical Group.

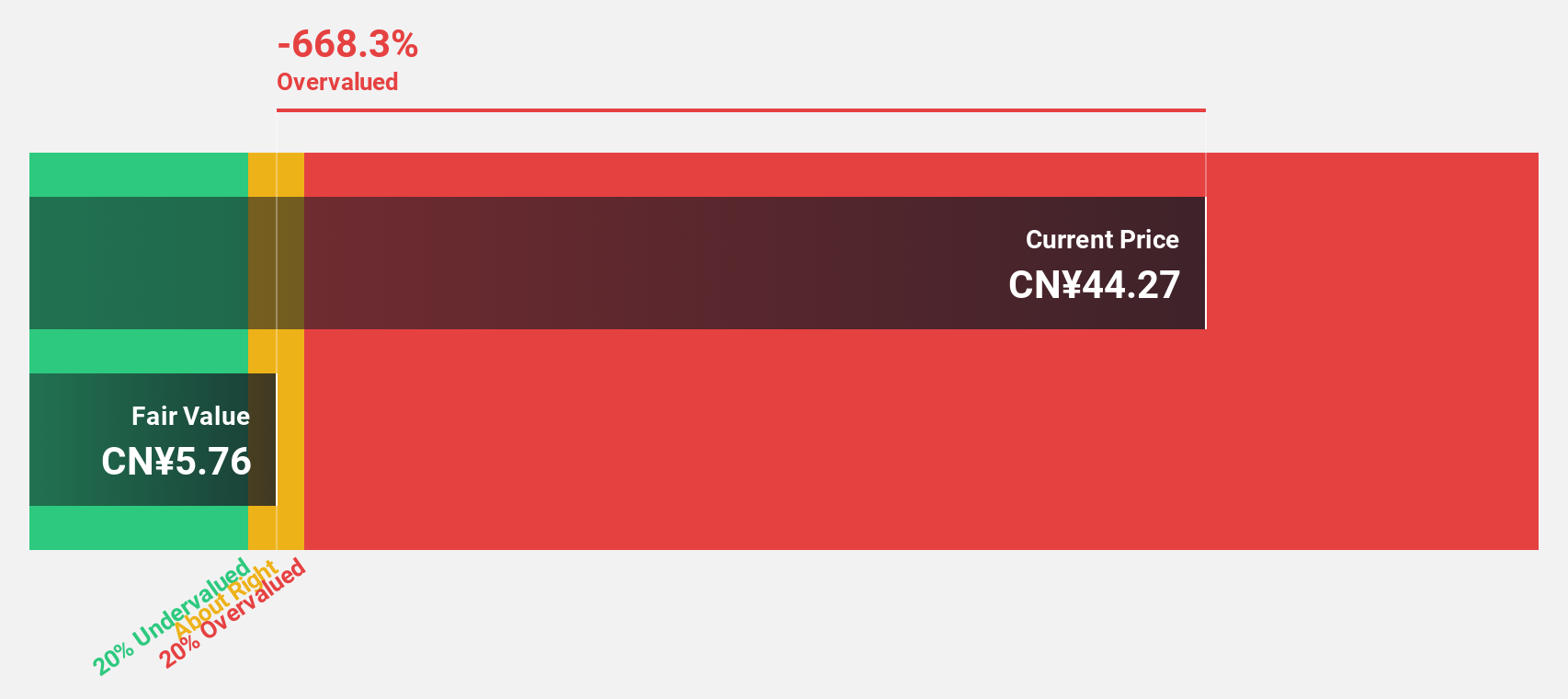

Wenzhou Yihua Connector (SZSE:002897)

Overview: Wenzhou Yihua Connector Co., Ltd. focuses on the research, development, manufacture, and sale of communication connectors and components in China with a market cap of CN¥8.79 billion.

Operations: The company's revenue primarily comes from its operations in the research, development, manufacture, and sale of communication connectors and components within China.

Estimated Discount To Fair Value: 41%

Wenzhou Yihua Connector, trading at CN¥45.28, is currently 41% below its estimated fair value of CN¥76.73, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from 3.4% to 1.7%, earnings are forecasted to grow significantly at 43.37% annually, outpacing the Chinese market's growth rate of 24.1%. Recent changes include a decrease in registered capital and amendments to the company's articles of association following shareholder meetings in June 2025.

- Upon reviewing our latest growth report, Wenzhou Yihua Connector's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Wenzhou Yihua Connector with our detailed financial health report.

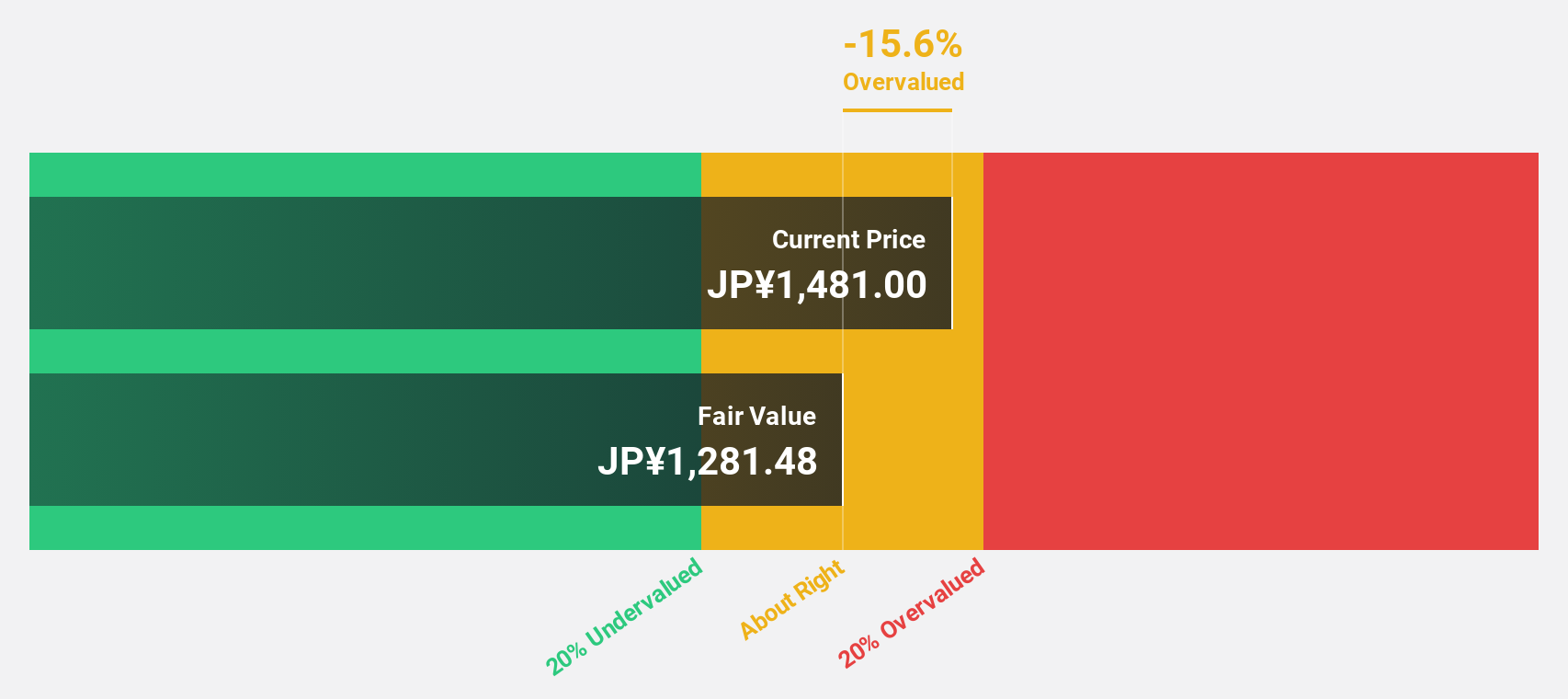

Round One (TSE:4680)

Overview: Round One Corporation operates indoor leisure complex facilities and has a market cap of ¥419.32 billion.

Operations: Revenue segments for the company include amusement facilities at ¥79.65 billion, bowling operations at ¥19.34 billion, and karaoke services at ¥10.57 billion.

Estimated Discount To Fair Value: 10.6%

Round One, trading at ¥1599, is undervalued compared to its fair value estimate of ¥1789.19. Its earnings are projected to grow annually by 13.4%, surpassing the Japanese market's 8.1% growth rate, though revenue growth lags behind the 20% benchmark at 8.8%. Recent sales data showed a modest increase in Japan and the USA, while plans for IPOs of subsidiaries could impact future cash flows positively or negatively depending on execution and market conditions.

- The analysis detailed in our Round One growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Round One stock in this financial health report.

Where To Now?

- Unlock our comprehensive list of 263 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wenzhou Yihua Connector might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002897

Wenzhou Yihua Connector

Engages in the research, development, manufacture, and sale of communication connector and its components in China.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives