- Singapore

- /

- Healthcare Services

- /

- SGX:BSL

Asian Penny Stocks With Market Caps Under US$500M To Watch

Reviewed by Simply Wall St

Asian markets have shown resilience with positive developments such as the easing of trade tensions between the U.S. and China, contributing to a more optimistic outlook. Penny stocks, while an older term, still represent an intriguing investment area for those interested in smaller or newer companies that can offer unique value propositions. By focusing on financial strength and growth potential, investors may find promising opportunities among these lesser-known stocks in Asia's diverse market landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.101 | SGD42.92M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.29 | HK$813.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.04 | HK$3.53B | ✅ 5 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.27 | HK$1.89B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.05 | HK$1.75B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.22 | SGD8.74B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.184 | SGD36.66M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.10 | SGD850.49M | ✅ 4 ⚠️ 1 View Analysis > |

| United Energy Group (SEHK:467) | HK$0.52 | HK$13.44B | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 1,005 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Tian Tu Capital (SEHK:1973)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tian Tu Capital Co., Ltd. is a private equity and venture capital firm that invests in small and medium-sized companies across various stages, with a market cap of HK$2.49 billion.

Operations: The company's revenue segment includes Asset Management, which reported -CN¥662.24 million.

Market Cap: HK$2.49B

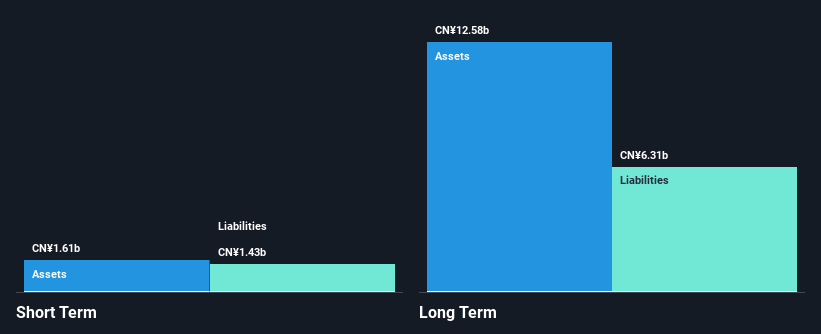

Tian Tu Capital faces challenges typical of penny stocks, with a market cap of HK$2.49 billion and limited revenue under US$1 million, indicating it is pre-revenue. The company reported a significant net loss of CN¥891.49 million for the year ending December 2024, highlighting ongoing financial struggles. Despite these setbacks, Tian Tu has more cash than debt and its short-term assets cover its liabilities, suggesting some financial resilience. Recent board changes may influence strategic direction as the firm navigates its unprofitable status and negative return on equity (-13.82%).

- Click to explore a detailed breakdown of our findings in Tian Tu Capital's financial health report.

- Assess Tian Tu Capital's previous results with our detailed historical performance reports.

Autostreets Development (SEHK:2443)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Autostreets Development Limited is an investment holding company that offers used vehicle transaction services in China, with a market capitalization of HK$3.48 billion.

Operations: The company generates CN¥408.59 million from its transportation and related services segment.

Market Cap: HK$3.48B

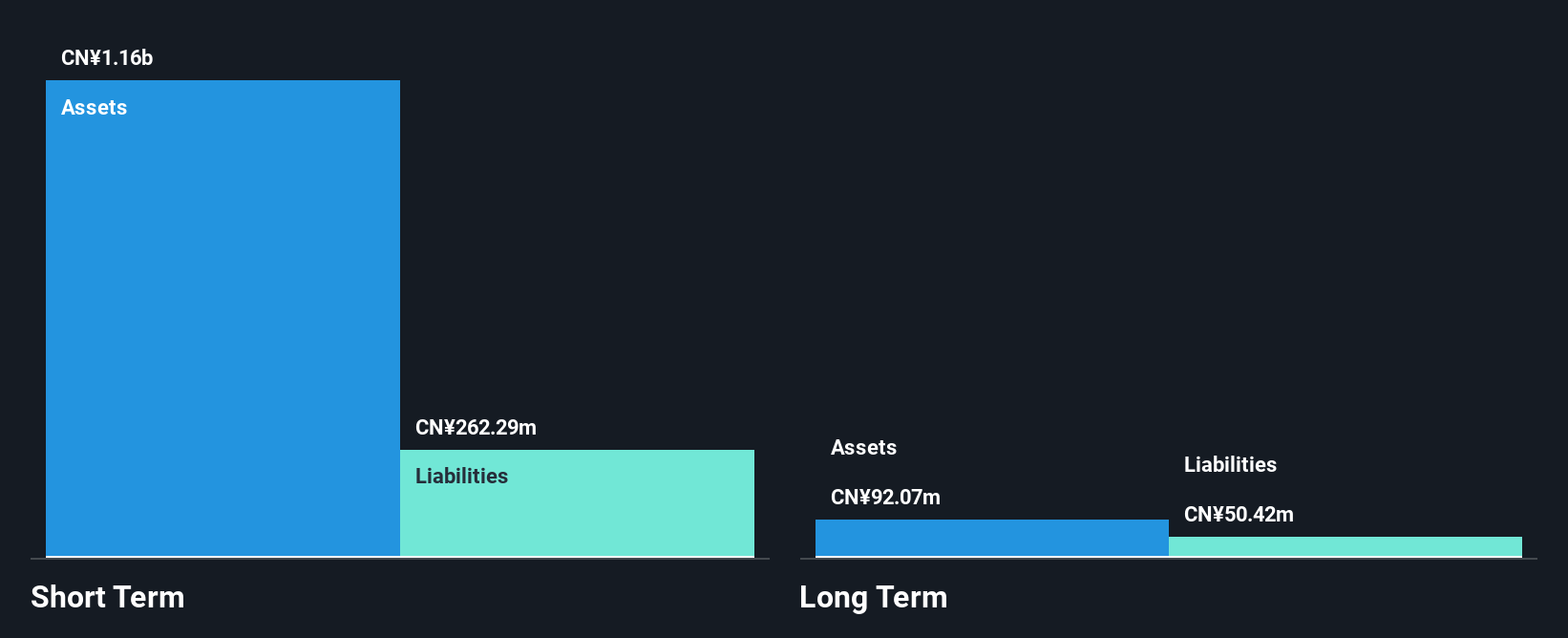

Autostreets Development Limited, with a market cap of HK$3.48 billion, is navigating the challenges of penny stocks in Asia by leveraging its CN¥408.59 million revenue from transportation services despite a net loss of CN¥123 million for 2024. The company benefits from having more cash than debt and sufficient short-term assets to cover liabilities, indicating financial stability amidst unprofitability. Recent leadership changes include the appointment of Mr. Zhao Hongliang as an executive director and CEO, potentially impacting strategic direction as Autostreets seeks to improve its negative return on equity and address declining revenues.

- Click here to discover the nuances of Autostreets Development with our detailed analytical financial health report.

- Examine Autostreets Development's past performance report to understand how it has performed in prior years.

Raffles Medical Group (SGX:BSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Raffles Medical Group Ltd offers integrated private healthcare services across Singapore, Greater China, Vietnam, Cambodia, and Japan with a market cap of SGD1.84 billion.

Operations: The company's revenue is primarily derived from Hospital Services (SGD345.65 million), Healthcare Services (SGD295.05 million), and Insurance Services (SGD177.99 million).

Market Cap: SGD1.84B

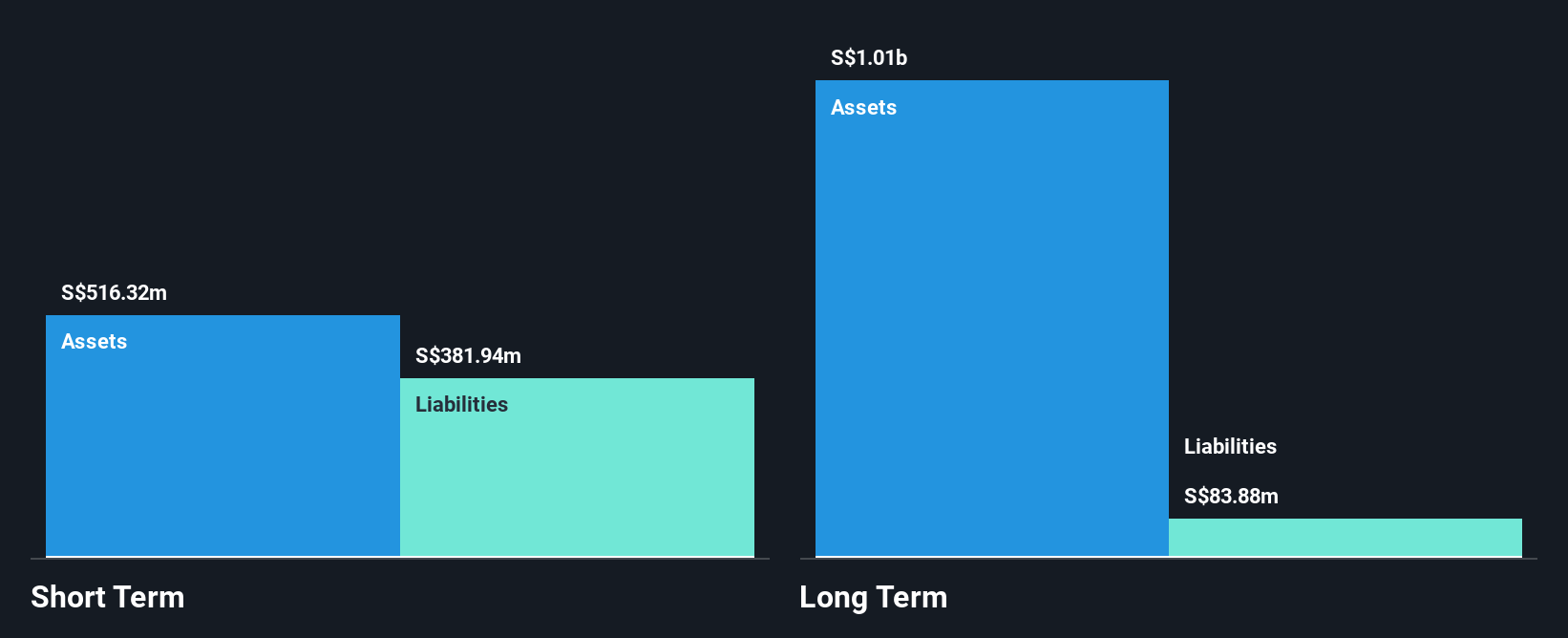

Raffles Medical Group, with a market cap of SGD1.84 billion, is enhancing its position in Asia's healthcare sector through strategic alliances, such as the recent partnership with Chongqing's First Affiliated Hospital. This collaboration aims to integrate international expertise and local strengths to improve medical services in Chongqing. Despite a stable debt-to-equity ratio and sufficient assets to cover liabilities, Raffles faces challenges like declining profit margins from 12.7% to 8.3% over the past year and negative earnings growth of -31%. However, forecasted earnings growth of 9.58% per year suggests potential recovery opportunities ahead.

- Unlock comprehensive insights into our analysis of Raffles Medical Group stock in this financial health report.

- Examine Raffles Medical Group's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Unlock our comprehensive list of 1,005 Asian Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BSL

Raffles Medical Group

Provides integrated private healthcare services primarily in Singapore, Greater China, Vietnam, Cambodia, and Japan.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives