- Hong Kong

- /

- Specialty Stores

- /

- SEHK:178

Asian Penny Stocks With Market Caps Under US$2B To Consider

Reviewed by Simply Wall St

As the global markets continue to navigate economic fluctuations, Asia's stock exchanges are capturing attention with their diverse opportunities. Penny stocks, a term often associated with smaller or newer companies, remain relevant by offering potential growth at lower price points. When these stocks are supported by robust financial health and solid fundamentals, they can present compelling investment opportunities in the evolving market landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.41 | HK$889.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.17 | HK$3.75B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.44 | HK$2.03B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.46 | SGD186.43M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.16 | HK$1.94B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.58 | THB2.75B | ✅ 3 ⚠️ 3 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.655 | SGD624.47M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.45 | SGD9.64B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.94 | THB1.38B | ✅ 2 ⚠️ 2 View Analysis > |

| ITE (Holdings) (SEHK:8092) | HK$0.029 | HK$26.84M | ✅ 2 ⚠️ 5 View Analysis > |

Click here to see the full list of 975 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Sa Sa International Holdings (SEHK:178)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sa Sa International Holdings Limited is an investment holding company that operates in the retail and wholesale of cosmetic products across Hong Kong, Macau, Mainland China, Southeast Asia, and internationally with a market cap of approximately HK$2.05 billion.

Operations: The company's revenue is primarily generated from Hong Kong & Macau at HK$2.99 billion, followed by Mainland China at HK$520.44 million and Southeast Asia at HK$419.59 million.

Market Cap: HK$2.05B

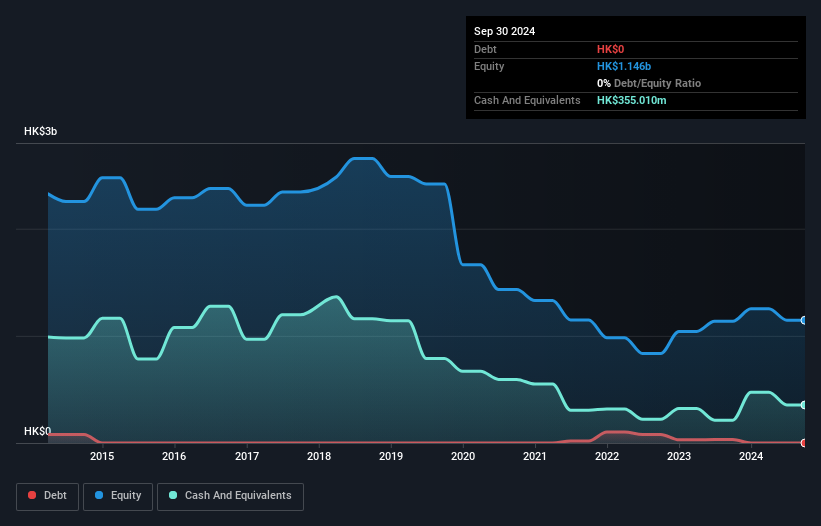

Sa Sa International Holdings, with a market cap of approximately HK$2.05 billion, has seen significant shifts in its business strategy amidst challenging conditions. Despite a decline in annual net income from HK$218.88 million to HK$76.97 million, the company is focusing on enhancing its online presence in Mainland China and adopting an asset-light model to reduce costs and improve efficiency. Recent initiatives include a share repurchase program worth up to HK$20 million aimed at boosting investor confidence and shareholder returns. The company's seasoned management team and stable weekly volatility further add resilience amidst fluctuating profit margins and sales figures.

- Unlock comprehensive insights into our analysis of Sa Sa International Holdings stock in this financial health report.

- Explore Sa Sa International Holdings' analyst forecasts in our growth report.

Guangxi Oriental Intelligent Manufacturing Technology (SZSE:002175)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangxi Oriental Intelligent Manufacturing Technology Co., Ltd. operates in the intelligent manufacturing sector and has a market cap of approximately CN¥5.90 billion.

Operations: Guangxi Oriental Intelligent Manufacturing Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥5.9B

Guangxi Oriental Intelligent Manufacturing Technology, with a market cap of CN¥5.90 billion, demonstrates financial resilience despite recent challenges in earnings growth. The company's short-term assets significantly exceed both its short and long-term liabilities, indicating strong liquidity. Although it reported a decline in net income from CN¥43.94 million to CN¥16.61 million over the past year, its debt levels have substantially decreased from 149.2% to 14.9% over five years, supported by cash holdings exceeding total debt and well-covered interest payments through profits. However, profit margins have contracted from 16.1% to 4.6%, reflecting operational pressures amidst industry dynamics.

- Navigate through the intricacies of Guangxi Oriental Intelligent Manufacturing Technology with our comprehensive balance sheet health report here.

- Assess Guangxi Oriental Intelligent Manufacturing Technology's previous results with our detailed historical performance reports.

Aotecar New Energy Technology (SZSE:002239)

Simply Wall St Financial Health Rating: ★★★★★☆

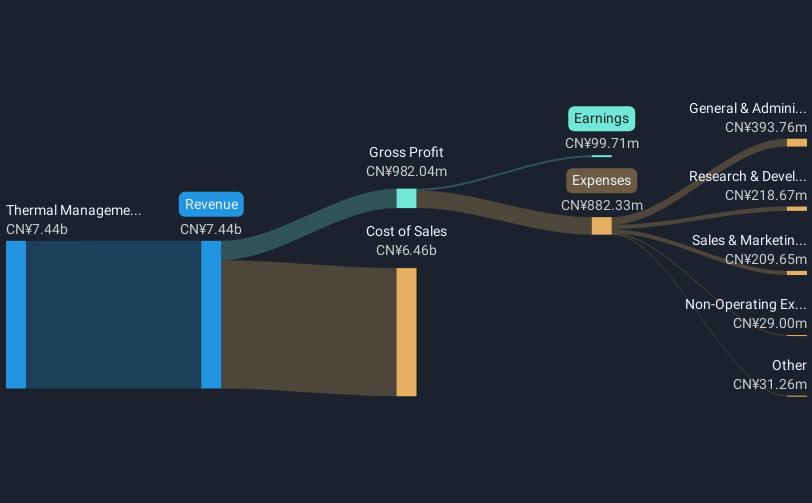

Overview: Aotecar New Energy Technology Co., Ltd. focuses on the research, design, manufacture, and sale of automotive AC compressors and HVAC systems, with a market cap of CN¥8.07 billion.

Operations: The company's revenue is primarily derived from its Thermal Management Components Manufacturing segment, generating CN¥8.41 billion.

Market Cap: CN¥8.07B

Aotecar New Energy Technology, with a market cap of CN¥8.07 billion, shows promising financial stability despite recent dividend reductions. The company reported first-quarter revenue of CN¥1.91 billion and net income of CN¥46.69 million, reflecting a year-on-year increase in profits and improved net profit margins from 1.1% to 1.3%. Its short-term assets exceed both short and long-term liabilities, indicating robust liquidity management. Despite an increased debt-to-equity ratio over five years, the company's debt remains well-covered by operating cash flow, supporting its capacity to manage financial obligations efficiently amidst industry growth challenges.

- Click here to discover the nuances of Aotecar New Energy Technology with our detailed analytical financial health report.

- Examine Aotecar New Energy Technology's past performance report to understand how it has performed in prior years.

Key Takeaways

- Investigate our full lineup of 975 Asian Penny Stocks right here.

- Contemplating Other Strategies? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:178

Sa Sa International Holdings

An investment holding company, engages in the retail and wholesale of cosmetic products in Hong Kong, Macau, Mainland China, Southeast Asia, and internationally.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives