- Singapore

- /

- Food and Staples Retail

- /

- SGX:OV8

Asian Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

Recent developments in global trade policies and easing inflation have been key influences on market sentiment, with Asian markets closely watching these trends. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Halcyon Technology (SET:HTECH) | THB2.64 | THB792M | ✅ 2 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.445 | SGD180.35M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.176 | SGD35.06M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.21 | SGD8.7B | ✅ 5 ⚠️ 0 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.13 | SGD858.72M | ✅ 3 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.90 | HK$3.28B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.39 | HK$50.26B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.15 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.20 | HK$2B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.04 | HK$1.7B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,161 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Yeebo (International Holdings) (SEHK:259)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yeebo (International Holdings) Limited is an investment holding company involved in the manufacture and sale of liquid crystal display (LCD) and liquid crystal display module (LCM) products, with a market cap of approximately HK$1.85 billion.

Operations: The company's revenue is primarily generated from its Displays and Other Services segment, amounting to HK$949.16 million.

Market Cap: HK$1.85B

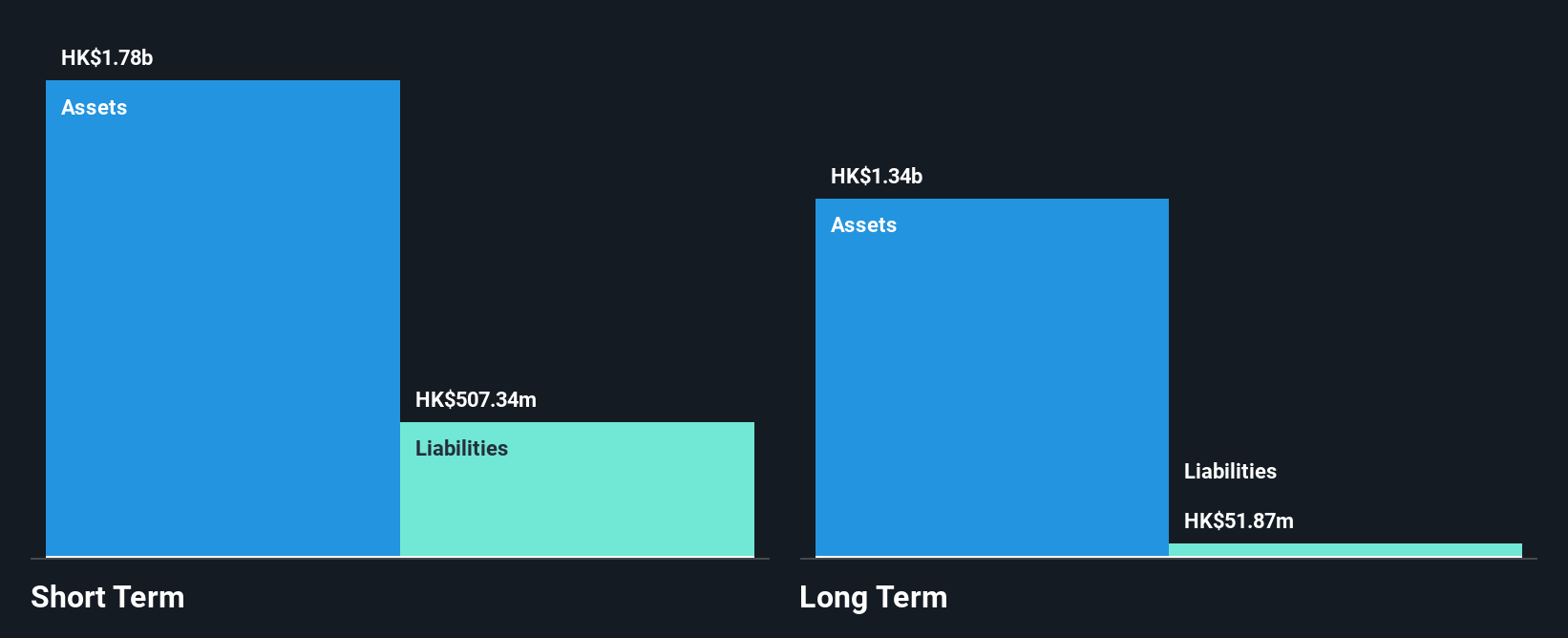

Yeebo (International Holdings) Limited, with a market cap of HK$1.85 billion, primarily generates revenue from its Displays and Other Services segment, totaling HK$949.16 million. The company has high-quality past earnings and more cash than total debt, indicating financial stability. Short-term assets significantly exceed both short- and long-term liabilities, offering liquidity assurance. However, recent negative earnings growth and reduced profit margins present challenges despite stable weekly volatility. A special shareholders meeting on May 12 will address the proposed acquisition of a target company's entire issued share capital under a Share Transfer Agreement dated March 20, 2025.

- Click here to discover the nuances of Yeebo (International Holdings) with our detailed analytical financial health report.

- Gain insights into Yeebo (International Holdings)'s past trends and performance with our report on the company's historical track record.

Sheng Siong Group (SGX:OV8)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore, with a market cap of SGD2.77 billion.

Operations: The company generates its revenue of SGD1.46 billion from supermarket operations selling consumer goods.

Market Cap: SGD2.77B

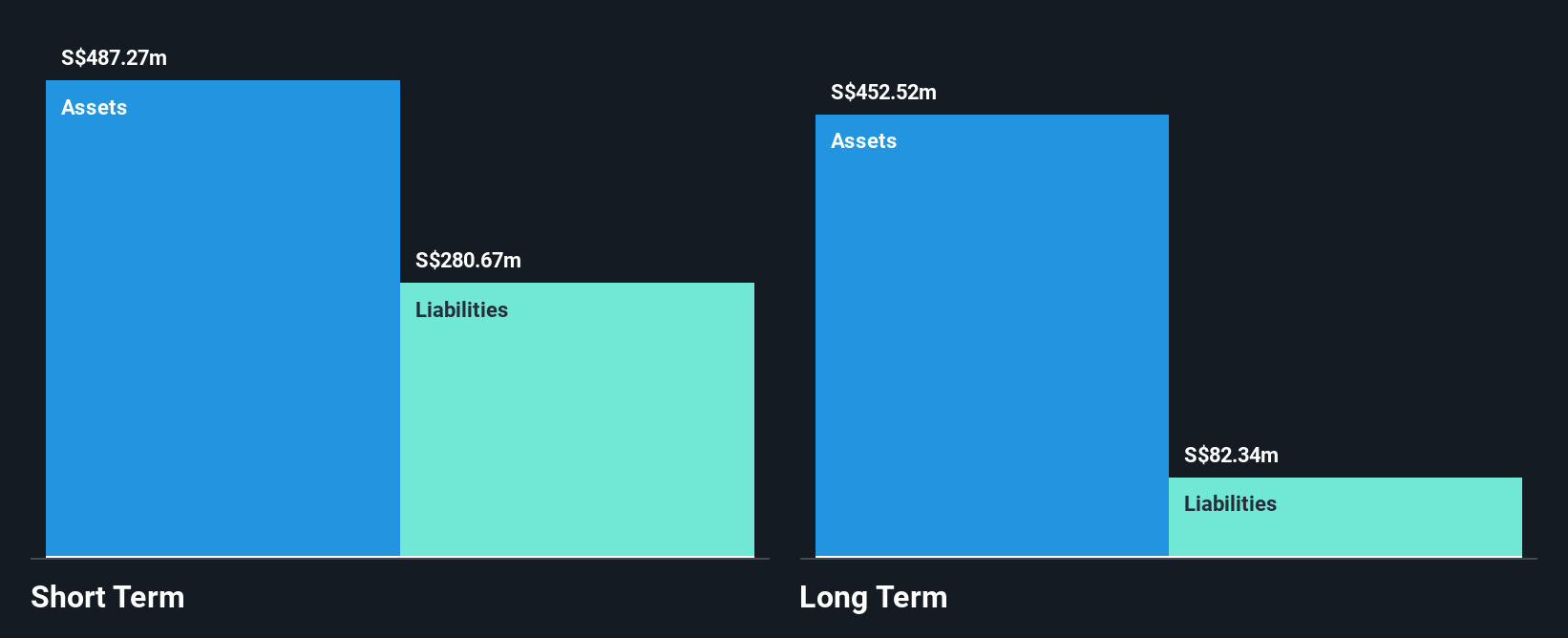

Sheng Siong Group Ltd, with a market cap of SGD2.77 billion, is financially robust with no debt and strong liquidity as short-term assets significantly surpass liabilities. Despite earnings growth of 3.5% annually over five years, recent growth was modest at 2.2%, underperforming the industry average. The company continues to expand its retail footprint, securing six new locations and awaiting additional tenders, aligning with its long-term strategy. Recent earnings showed increased sales of SGD402.97 million for Q1 2025 compared to the previous year, alongside a stable dividend policy confirmed at their AGM in April 2025.

- Jump into the full analysis health report here for a deeper understanding of Sheng Siong Group.

- Gain insights into Sheng Siong Group's future direction by reviewing our growth report.

Guizhou Xinbang Pharmaceutical (SZSE:002390)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guizhou Xinbang Pharmaceutical Co., Ltd. engages in the research, development, manufacturing, and sale of Chinese herbal medicines and other pharmaceutical products both domestically and internationally, with a market cap of CN¥6.86 billion.

Operations: Guizhou Xinbang Pharmaceutical Co., Ltd. does not report specific revenue segments, but it operates in the Chinese herbal medicines and pharmaceutical products industry across domestic and international markets.

Market Cap: CN¥6.86B

Guizhou Xinbang Pharmaceutical, with a market cap of CN¥6.86 billion, faces challenges in earnings growth, having seen a significant decline over the past year. Despite this, the company maintains financial stability with cash surpassing total debt and strong coverage of interest payments by EBIT. Short-term assets significantly exceed liabilities, providing liquidity strength. However, profit margins have decreased from 4.6% to 1.4%, and dividends are not well covered by earnings at 1.66%. The management team is seasoned with an average tenure of 10 years, though the board lacks experience with only a 1.7-year average tenure.

- Take a closer look at Guizhou Xinbang Pharmaceutical's potential here in our financial health report.

- Examine Guizhou Xinbang Pharmaceutical's past performance report to understand how it has performed in prior years.

Key Takeaways

- Embark on your investment journey to our 1,161 Asian Penny Stocks selection here.

- Want To Explore Some Alternatives? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:OV8

Sheng Siong Group

An investment holding company, operates a chain of supermarket retail stores in Singapore.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives