Asian Penny Stocks Spotlight: HighTide Therapeutics And 2 Other Noteworthy Picks

Reviewed by Simply Wall St

As global markets continue to navigate a dynamic landscape, Asia's financial scene remains a focal point for investors seeking opportunities beyond traditional avenues. Penny stocks, despite their somewhat outdated terminology, still capture the interest of those looking to invest in smaller or newer companies with potential for growth. In this article, we spotlight several Asian penny stocks that exhibit strong financial health and could offer compelling opportunities for investors seeking stability and long-term potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.102 | SGD43.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.37 | HK$864.4M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.22 | HK$1.85B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.13 | HK$1.89B | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.21 | SGD8.7B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.92 | THB1.35B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.225 | SGD45.5M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.25 | SGD891.64M | ✅ 3 ⚠️ 1 View Analysis > |

| United Energy Group (SEHK:467) | HK$0.52 | HK$13.44B | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 987 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

HighTide Therapeutics (SEHK:2511)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: HighTide Therapeutics, Inc. is a clinical-stage biopharmaceutical company developing therapies for chronic metabolic and liver diseases in Mainland China, with a market cap of HK$1.70 billion.

Operations: HighTide Therapeutics, Inc. does not report any specific revenue segments.

Market Cap: HK$1.7B

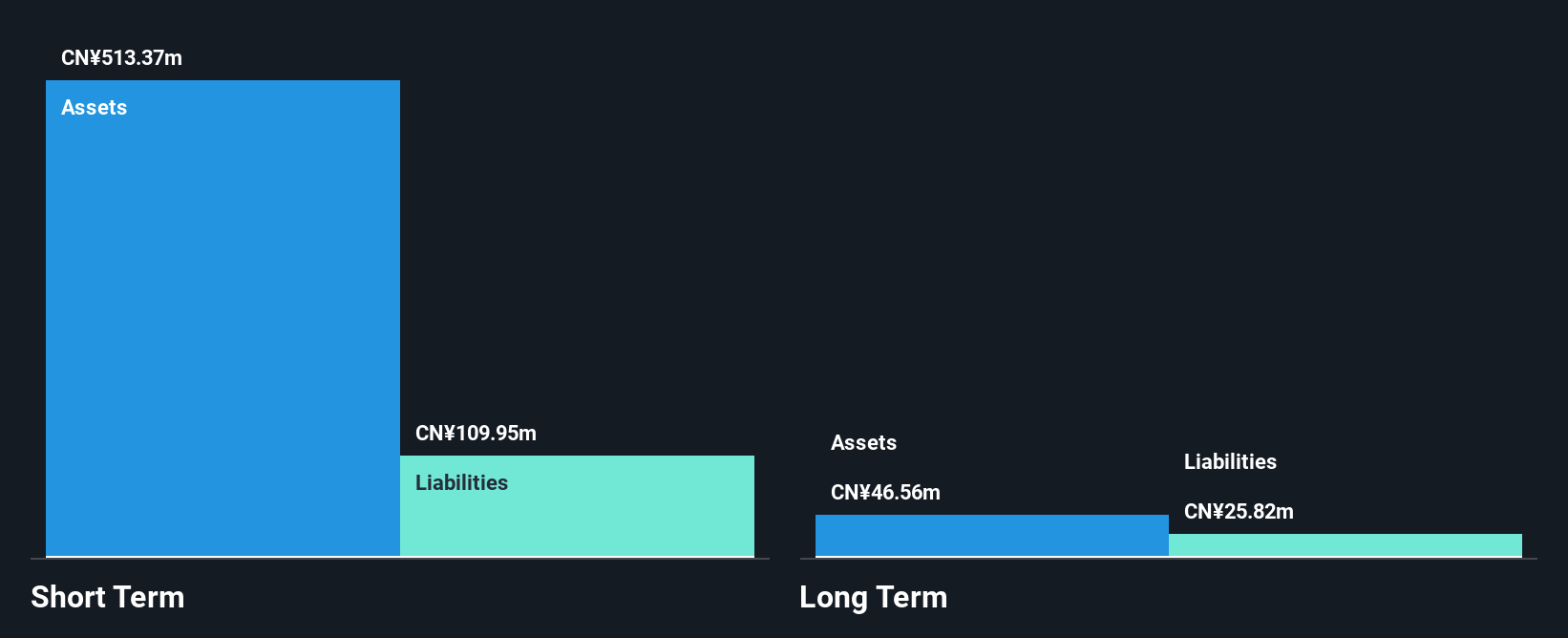

HighTide Therapeutics is a pre-revenue biopharmaceutical company with a market cap of HK$1.70 billion, focusing on chronic metabolic and liver diseases. Recent Phase 3 trials for HTD1801 showed promising results in treating type 2 diabetes mellitus, supporting plans to submit a new drug application in China. Despite having more cash than debt and sufficient short-term assets to cover liabilities, the company's share price remains highly volatile. The board's relative inexperience may be a concern, although the management team is seasoned. HighTide recently raised HK$124.99 million through an equity offering to support its development activities.

- Take a closer look at HighTide Therapeutics' potential here in our financial health report.

- Assess HighTide Therapeutics' previous results with our detailed historical performance reports.

Dongguan Rural Commercial Bank (SEHK:9889)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Rural Commercial Bank Co., Ltd. offers a range of banking products and services in China and has a market cap of HK$25.49 billion.

Operations: Currently, there are no specific revenue segments reported for this company.

Market Cap: HK$25.49B

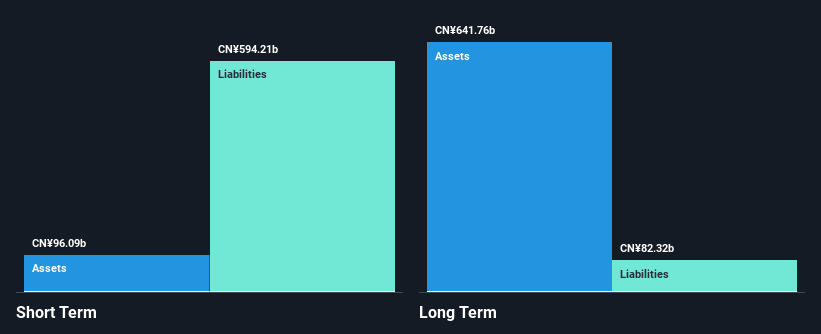

Dongguan Rural Commercial Bank, with a market cap of HK$25.49 billion, offers a mixed picture for investors interested in penny stocks. Recent earnings showed a decline in net income to CNY 1,633.18 million from the previous year, reflecting negative earnings growth of 15.5%. The bank's net profit margin decreased slightly to 51.3%, though it maintains high-quality earnings and an appropriate level of bad loans at 1.8%. Despite trading significantly below estimated fair value and having stable weekly volatility at 4%, the bank's return on equity remains low at 7.3%. The board is experienced with an average tenure of 5.6 years.

- Click here to discover the nuances of Dongguan Rural Commercial Bank with our detailed analytical financial health report.

- Gain insights into Dongguan Rural Commercial Bank's historical outcomes by reviewing our past performance report.

Greattown Holdings (SHSE:600094)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Greattown Holdings Ltd. operates in the real estate development sector in China, with a market capitalization of approximately CN¥7.22 billion.

Operations: The company's revenue is primarily derived from its operations in China, totaling CN¥4.50 billion.

Market Cap: CN¥7.22B

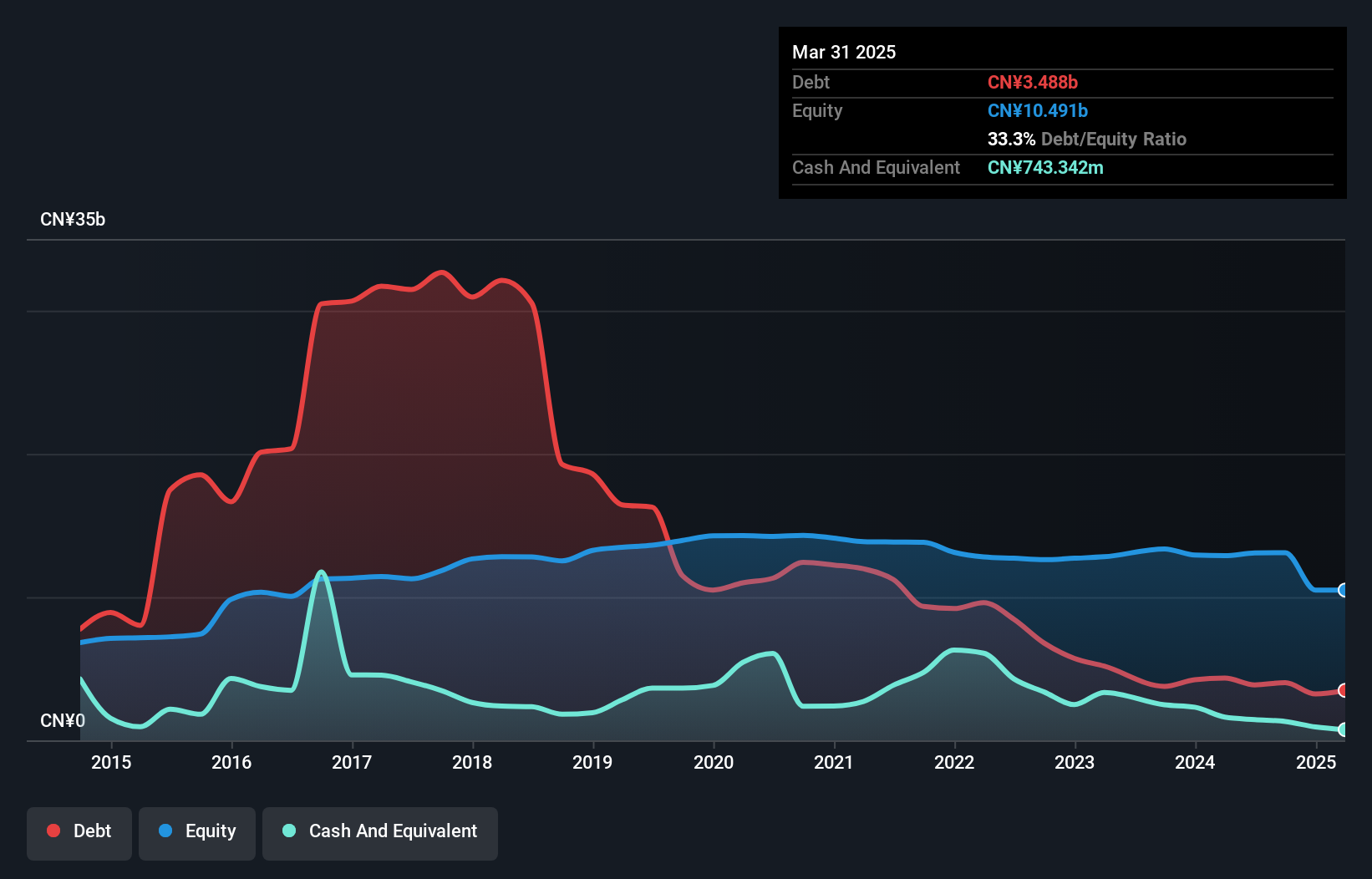

Greattown Holdings Ltd., with a market cap of CN¥7.22 billion, presents a mixed outlook for penny stock investors in the real estate sector. The company reported first-quarter sales of CN¥674 million, marking significant improvement from the previous year, and achieved a net income of CN¥3.87 million after prior losses. Despite reducing its debt to equity ratio to 33.3% over five years, Greattown remains unprofitable with negative return on equity and insufficient cash flow coverage for debt. While short-term assets exceed liabilities significantly, earnings have declined annually by 52.8%, challenging its growth prospects amidst stable weekly volatility at 5%.

- Jump into the full analysis health report here for a deeper understanding of Greattown Holdings.

- Review our historical performance report to gain insights into Greattown Holdings' track record.

Summing It All Up

- Take a closer look at our Asian Penny Stocks list of 987 companies by clicking here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HighTide Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2511

HighTide Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development of therapies to treat patients with chronic metabolic and liver diseases in Mainland China.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives