- China

- /

- Real Estate

- /

- SHSE:600067

Asian Market Highlights: Top Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by steady interest rates and mixed economic data, investors are increasingly turning their attention to the opportunities within Asia. Penny stocks, often representing smaller or newer companies, continue to capture interest due to their potential for surprising value. Despite the vintage feel of the term, these stocks can offer significant returns when backed by solid financial foundations; in this article, we explore three such penny stocks that exemplify balance sheet strength and growth potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.103 | SGD43.77M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.27 | HK$801.31M | ✅ 4 ⚠️ 1 View Analysis > |

| KPa-BM Holdings (SEHK:2663) | HK$0.335 | HK$186.57M | ✅ 2 ⚠️ 4 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.415 | SGD168.19M | ✅ 4 ⚠️ 3 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.15 | HK$1.92B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.19 | SGD8.62B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.174 | SGD34.66M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.09 | SGD847.74M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.72 | HK$54.07B | ✅ 3 ⚠️ 1 View Analysis > |

| United Energy Group (SEHK:467) | HK$0.50 | HK$12.92B | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 1,020 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ruifeng Power Group (SEHK:2025)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ruifeng Power Group Company Limited is an investment holding company involved in the design, development, manufacture, and sale of cylinder blocks and heads in China, with a market cap of HK$3.30 billion.

Operations: The company's revenue is primarily derived from Cylinder Blocks at CN¥716.83 million, followed by Cylinder Heads at CN¥213.16 million, and Ancillary Cylinder Block Components and Others contributing CN¥26.86 million.

Market Cap: HK$3.3B

Ruifeng Power Group has demonstrated robust revenue growth, with sales reaching CN¥956.85 million, primarily from cylinder blocks and heads. Despite a challenging five-year period where earnings declined by 19.4% annually, recent performance shows a significant turnaround with a 71.5% earnings increase over the past year, outpacing the auto components industry average. The company's financial health is supported by satisfactory debt levels and strong short-term asset coverage of liabilities. However, its return on equity remains low at 1.9%. Recent dividend increases may appeal to investors seeking income from penny stocks in Asia's market landscape.

- Take a closer look at Ruifeng Power Group's potential here in our financial health report.

- Learn about Ruifeng Power Group's historical performance here.

First Shanghai Investments (SEHK:227)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: First Shanghai Investments Limited is an investment holding company involved in financial services, direct investments, and property and hotel development across Hong Kong, the People’s Republic of China, and France with a market cap of HK$777.69 million.

Operations: The company's revenue is primarily derived from Financial Services (HK$168.57 million), Property Investment and Hotel (HK$151.38 million), and Property Development (HK$67.62 million).

Market Cap: HK$777.69M

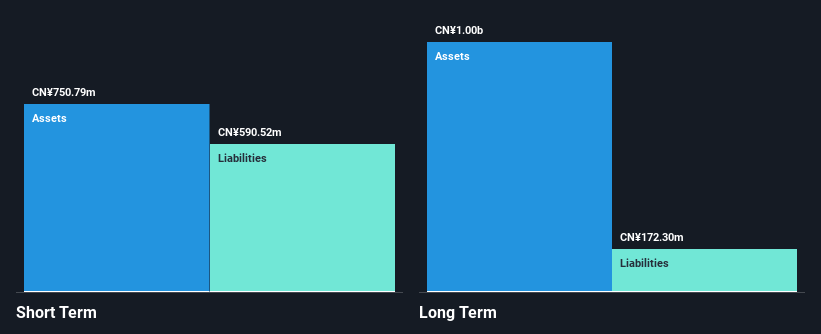

First Shanghai Investments has shown a positive shift by becoming profitable this year, reporting a net income of HK$77.97 million for 2024, compared to a loss the previous year. The company benefits from strong short-term assets (HK$3.8 billion) that cover both its short and long-term liabilities comfortably. Despite this financial stability, the company's operating cash flow remains negative, indicating challenges in debt coverage through operations. Its Return on Equity is low at 3.1%, and recent earnings were significantly impacted by one-off gains of HK$61 million, suggesting caution when evaluating profitability sustainability in the penny stock sector.

- Click to explore a detailed breakdown of our findings in First Shanghai Investments' financial health report.

- Assess First Shanghai Investments' previous results with our detailed historical performance reports.

Citychamp Dartong Advanced Materials (SHSE:600067)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Citychamp Dartong Advanced Materials Co., Ltd. operates in the advanced materials sector and has a market cap of approximately CN¥3.97 billion.

Operations: Citychamp Dartong Advanced Materials Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥3.97B

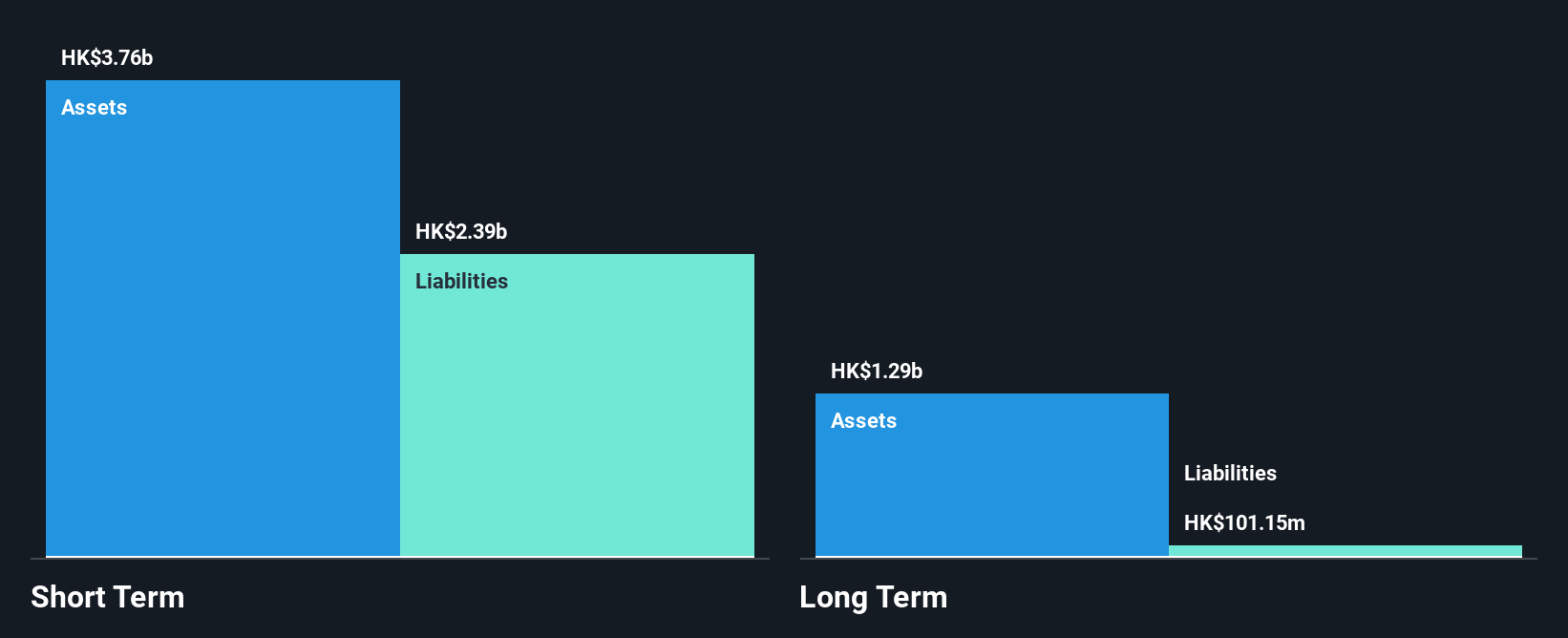

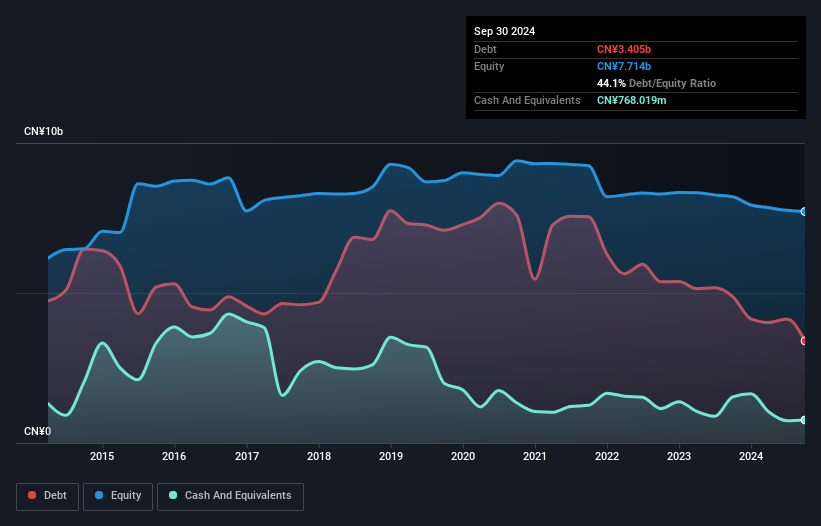

Citychamp Dartong Advanced Materials has demonstrated a recent improvement in financial performance, with Q1 2025 revenue reaching CN¥2.53 billion, up from CN¥2.41 billion the previous year, and net income increasing to CN¥34.8 million. Despite being unprofitable over five years with growing losses, its debt management is robust; short-term assets of CN¥12.7 billion exceed both short-term and long-term liabilities significantly. The company's seasoned management team averages 7.3 years of tenure, contributing positively to stability amidst volatility in the penny stock market segment where it trades at a discount to estimated fair value by 42%.

- Jump into the full analysis health report here for a deeper understanding of Citychamp Dartong Advanced Materials.

- Gain insights into Citychamp Dartong Advanced Materials' past trends and performance with our report on the company's historical track record.

Where To Now?

- Gain an insight into the universe of 1,020 Asian Penny Stocks by clicking here.

- Ready For A Different Approach? Uncover 18 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600067

Citychamp Dartong Advanced Materials

Citychamp Dartong Advanced Materials Co., Ltd.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives