Asian Market Gems: JW (Cayman) Therapeutics And Two Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets experience shifts with consumer inflation heating up and solid corporate earnings in the U.S., investors are keeping a close eye on how these trends might influence Asian markets. In this context, penny stocks—though an older term—remain a relevant investment area for those interested in smaller or newer companies that may offer untapped potential. This article will explore several penny stocks that demonstrate financial strength, offering insights into their potential for long-term growth.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.10 | SGD42.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.40 | HK$883.33M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.12 | HK$3.66B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.31 | HK$1.92B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.45 | SGD182.38M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.15 | HK$1.92B | ✅ 4 ⚠️ 1 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.645 | SGD614.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.40 | SGD9.45B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.95 | THB1.4B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.24 | SGD48.53M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 975 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

JW (Cayman) Therapeutics (SEHK:2126)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: JW (Cayman) Therapeutics Co. Ltd is a clinical stage cell therapy company focused on the research, development, manufacture, and marketing of cellular immunotherapy products in China with a market cap of HK$1.45 billion.

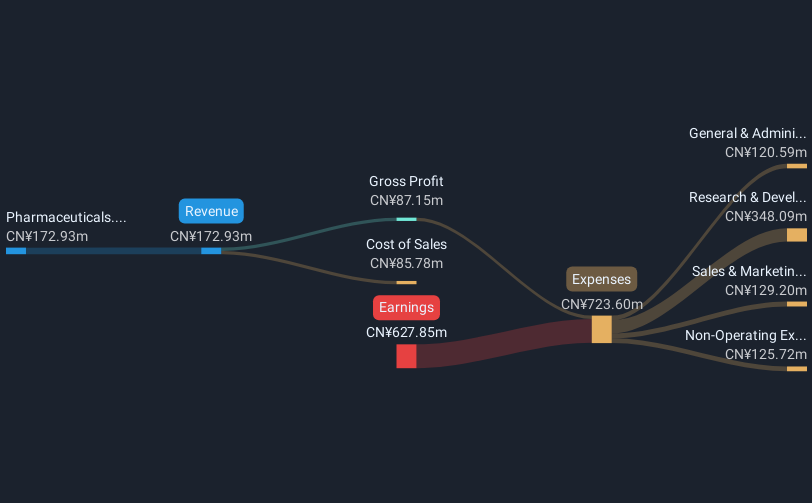

Operations: The company generates revenue from its Pharmaceuticals segment, amounting to CN¥158.22 million.

Market Cap: HK$1.45B

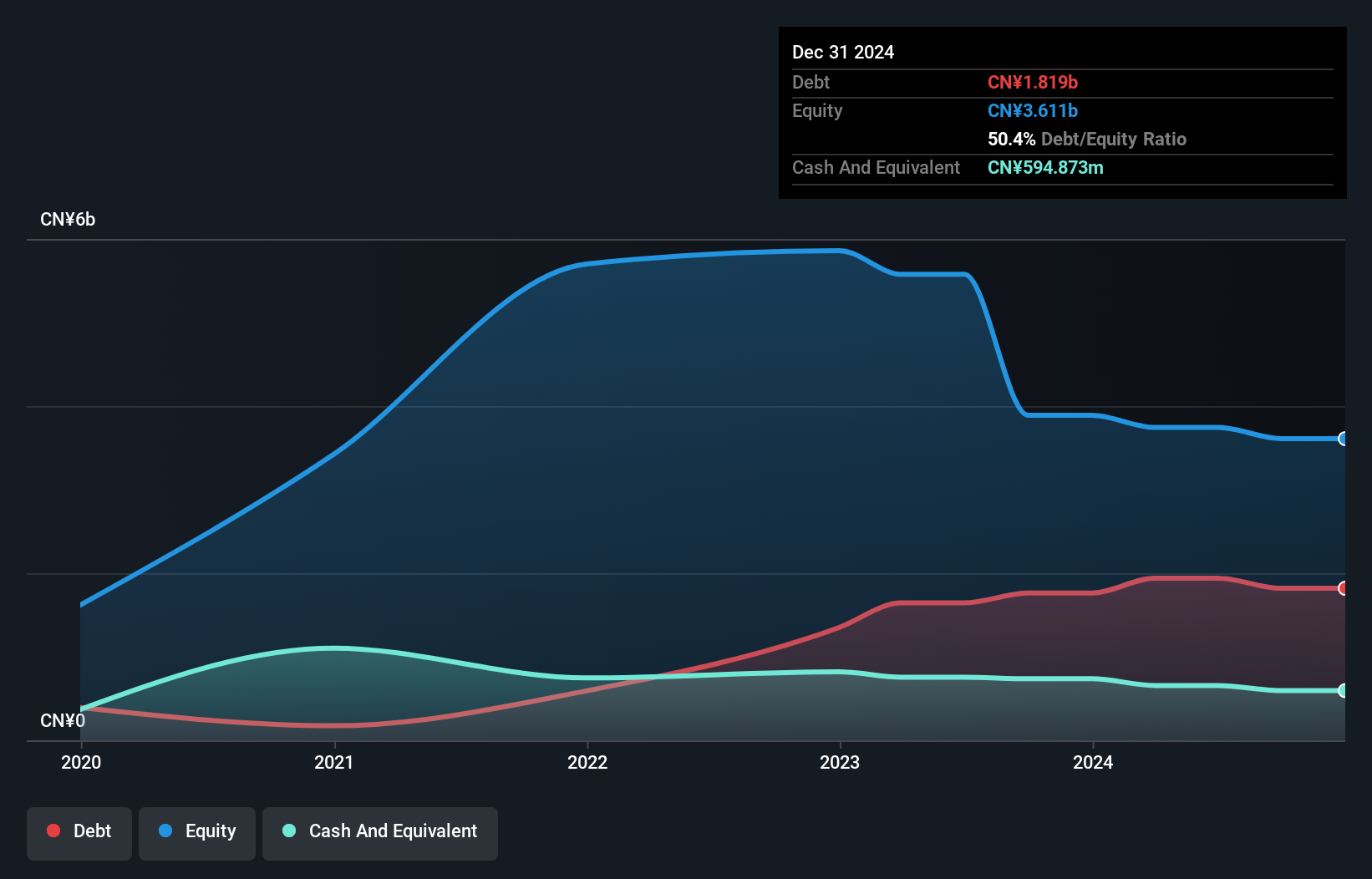

JW (Cayman) Therapeutics, with a market cap of HK$1.45 billion, is navigating the biotech landscape with its focus on cellular immunotherapy products. Despite being unprofitable and experiencing share price volatility, the company has promising developments such as the NMPA's acceptance of a supplemental Biological License Application for Carteyva® in treating relapsed large B-cell lymphoma. The company's financial health is supported by short-term assets exceeding liabilities and more cash than debt. Recent agreements, like the license agreement with Juno valued up to US$10 million, highlight strategic partnerships that could bolster future prospects amidst current challenges.

- Unlock comprehensive insights into our analysis of JW (Cayman) Therapeutics stock in this financial health report.

- Assess JW (Cayman) Therapeutics' future earnings estimates with our detailed growth reports.

AIM Vaccine (SEHK:6660)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AIM Vaccine Co., Ltd. is involved in the research, development, manufacture, and sale of human-use vaccines in China with a market cap of HK$4.93 billion.

Operations: The company generates revenue of CN¥1.29 billion from the sale of vaccines and research and development services.

Market Cap: HK$4.93B

AIM Vaccine Co., Ltd., with a market cap of HK$4.93 billion, is advancing in the vaccine sector despite current unprofitability and a negative return on equity. The company recently received dual clinical trial approvals for its mRNA herpes zoster vaccine from both the U.S. FDA and China's National Medical Products Administration, showcasing its robust mRNA technology platform. While earnings have declined over five years, revenue is forecast to grow significantly, supported by sufficient cash runway for more than three years. Recent executive changes aim to strengthen governance as AIM focuses on innovation and commercialization of its mRNA products.

- Click to explore a detailed breakdown of our findings in AIM Vaccine's financial health report.

- Evaluate AIM Vaccine's prospects by accessing our earnings growth report.

Marco Polo Marine (SGX:5LY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Marco Polo Marine Ltd. is an integrated marine logistics company operating in Singapore, Indonesia, Taiwan, Thailand, Malaysia, and internationally with a market cap of SGD206.45 million.

Operations: The company's revenue is primarily derived from Ship Chartering Services, which generated SGD71.03 million, and Ship Building and Repair Services, contributing SGD43.62 million.

Market Cap: SGD206.45M

Marco Polo Marine Ltd., with a market cap of SGD206.45 million, operates in marine logistics across Asia. Despite recent earnings showing a slight decrease in sales to SGD52.69 million for the half year ended March 2025, the company maintains profitability with net income at SGD10.64 million. Its financial stability is supported by short-term assets exceeding both short and long-term liabilities, and operating cash flow well covering its debt. While facing challenges like negative earnings growth over the past year, Marco Polo Marine trades at good value relative to peers and has not meaningfully diluted shareholders recently.

- Click here to discover the nuances of Marco Polo Marine with our detailed analytical financial health report.

- Gain insights into Marco Polo Marine's future direction by reviewing our growth report.

Make It Happen

- Navigate through the entire inventory of 975 Asian Penny Stocks here.

- Curious About Other Options? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2126

JW (Cayman) Therapeutics

A clinical stage cell therapy company, engages in the research and development, manufacture, and marketing of cellular immunotherapy products in the People’s Republic of China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives