- South Korea

- /

- Media

- /

- KOSE:A214320

Asian Dividend Stocks Worth Considering

Reviewed by Simply Wall St

In recent weeks, Asian markets have experienced mixed performance amid global geopolitical tensions and trade-related uncertainties. Despite these challenges, investors continue to seek opportunities in dividend stocks, which can offer a steady income stream and potential for long-term growth. When considering dividend stocks in Asia, it's important to focus on companies with strong fundamentals and the ability to sustain payouts even during volatile market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.55% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.40% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.19% | ★★★★★★ |

| NCD (TSE:4783) | 4.15% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.29% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.38% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.08% | ★★★★★★ |

| Daicel (TSE:4202) | 5.02% | ★★★★★★ |

Click here to see the full list of 1253 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

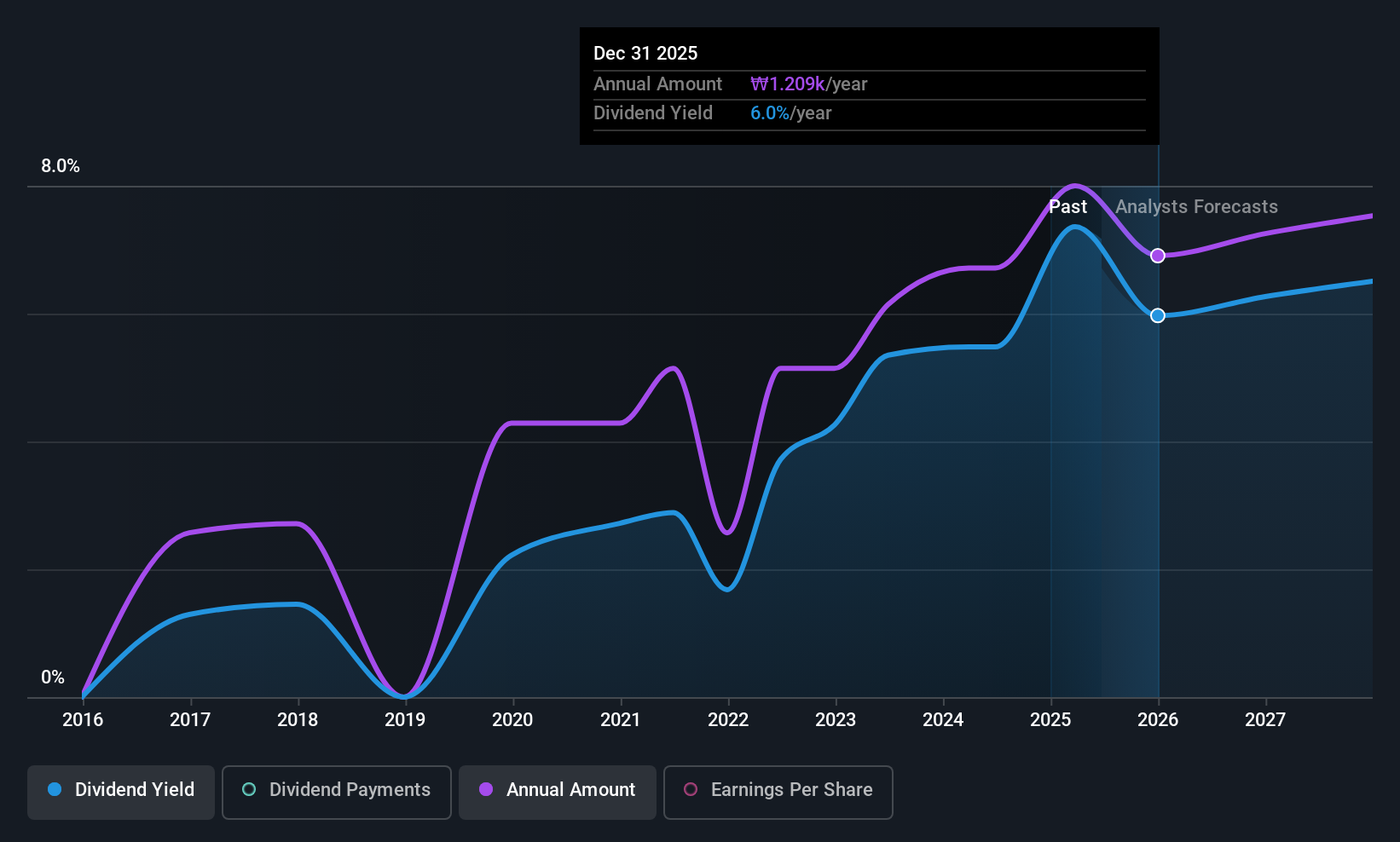

Innocean Worldwide (KOSE:A214320)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Innocean Worldwide Inc. is a global provider of marketing and communications services operating across various regions, with a market cap of ₩806 billion.

Operations: Innocean Worldwide Inc. generates revenue primarily from its Advertising Agency segment, amounting to ₩2.14 billion.

Dividend Yield: 5.8%

Innocean Worldwide offers a compelling dividend profile with a yield of 5.83%, placing it in the top 25% of dividend payers in the South Korean market. The dividends are well covered by earnings and cash flows, boasting payout ratios of 54.3% and 32.2%, respectively. Despite this, its less than decade-long history of volatile dividend payments raises concerns about reliability, although it trades at good value compared to peers and industry standards.

- Navigate through the intricacies of Innocean Worldwide with our comprehensive dividend report here.

- The analysis detailed in our Innocean Worldwide valuation report hints at an deflated share price compared to its estimated value.

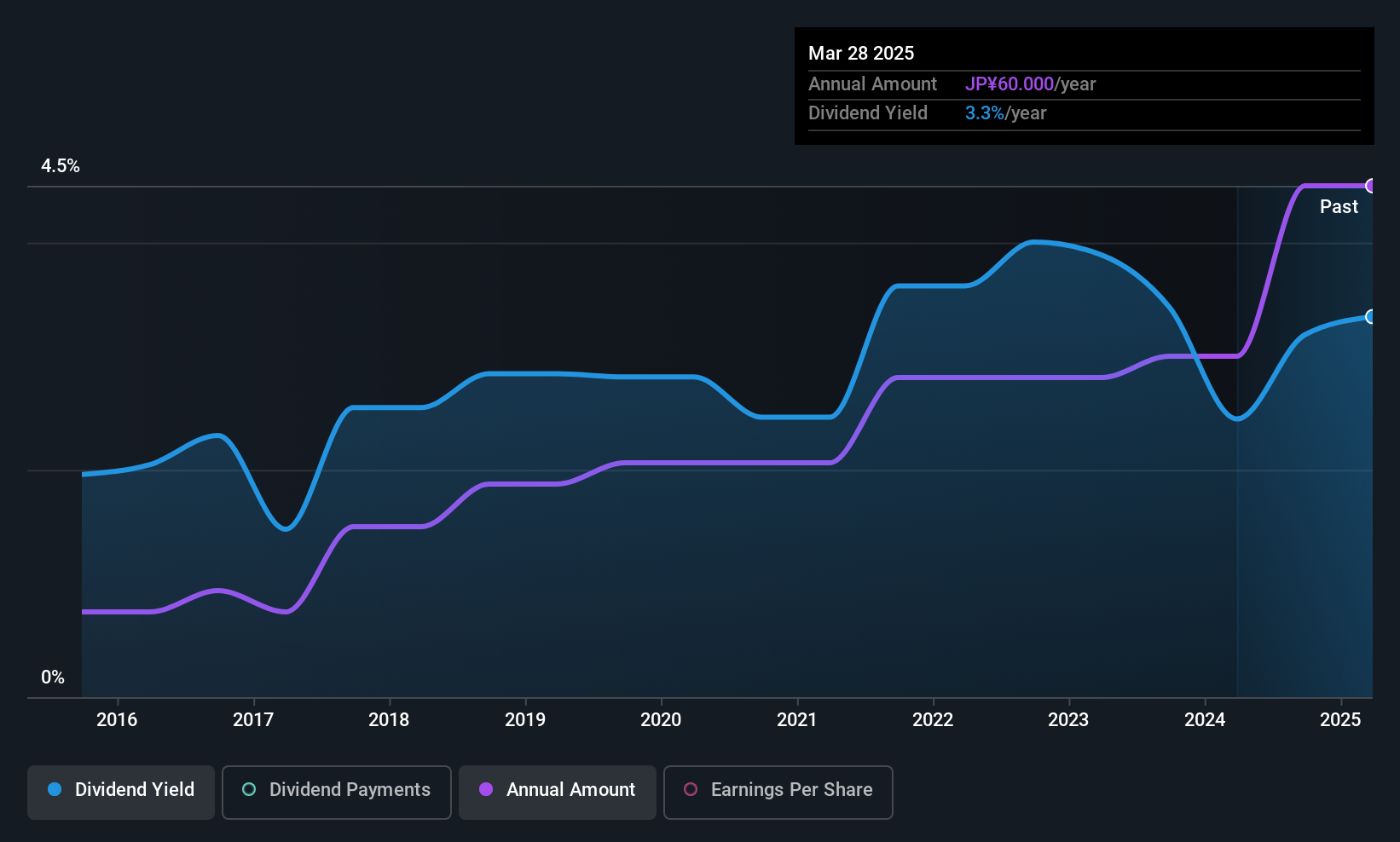

Shin Nippon Air Technologies (TSE:1952)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shin Nippon Air Technologies Co., Ltd. operates in the engineering sector, offering systems for air, water, heat control, and other facilities related to air conditioning, electrical, and sanitary services both in Japan and internationally; it has a market cap of ¥104.82 billion.

Operations: Shin Nippon Air Technologies Co., Ltd.'s revenue primarily comes from its Equipment Construction segment, which generated ¥137.68 billion.

Dividend Yield: 3.5%

Shin Nippon Air Technologies exhibits a mixed dividend profile, with dividends well covered by earnings and cash flows—payout ratios are 37.8% and 26.6%, respectively. However, its dividend yield of 3.46% is below the top tier in Japan, and its history shows volatility with recent decreases from JPY 50 to JPY 40 per share expected for the fiscal year ending March 2026. Despite these issues, the stock trades at a significant discount to estimated fair value.

- Click here to discover the nuances of Shin Nippon Air Technologies with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Shin Nippon Air Technologies' share price might be too pessimistic.

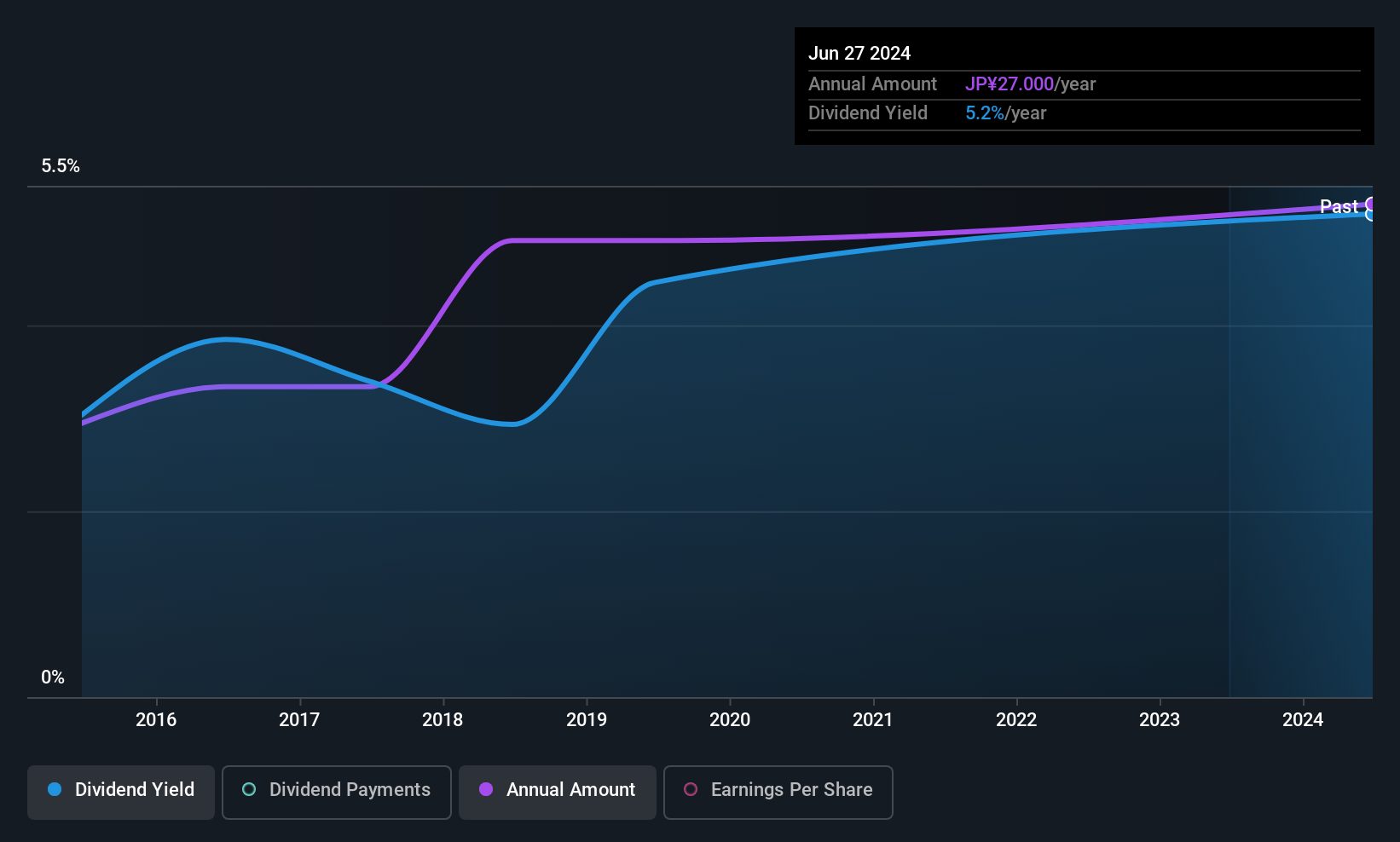

Global (TSE:3271)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Global Ltd., with a market cap of ¥28.53 billion, operates in Japan through its subsidiaries, focusing on the development of condominiums, apartment complexes, earning properties, commercial facilities, hotels, and other properties.

Operations: Global Ltd.'s revenue segments include the Income Property Business at ¥22.07 billion, Condominium Business (Excluding Hotel Business) at ¥9.72 billion, Sales Agency Business at ¥724.08 million, Building Management Business at ¥524.82 million, and Hotel business at ¥498.01 million.

Dividend Yield: 3.8%

Global's dividend profile is supported by strong coverage, with a cash payout ratio of 16.2% and an earnings payout ratio of 35.9%, suggesting sustainability despite past volatility in payments. While its dividend yield of 3.77% is below the top quartile in Japan, the stock trades at a significant discount to its estimated fair value, offering potential for capital appreciation alongside dividends. However, debt coverage by operating cash flow remains a concern for financial stability.

- Dive into the specifics of Global here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Global is priced higher than what may be justified by its financials.

Key Takeaways

- Click this link to deep-dive into the 1253 companies within our Top Asian Dividend Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A214320

Innocean Worldwide

Provides marketing and communications services in the Americas, Europe, Asia, Oceania, the Middle East, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives