- South Korea

- /

- Media

- /

- KOSE:A030000

Asian Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As geopolitical tensions and trade discussions continue to influence global markets, Asian economies are navigating these challenges with varied impacts on their stock indices. Amidst this backdrop, dividend stocks in Asia present a compelling opportunity for investors seeking stability and income, as they often provide regular payouts even in fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.56% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.36% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.33% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.41% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.32% | ★★★★★★ |

| Daicel (TSE:4202) | 5.03% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.47% | ★★★★★★ |

Click here to see the full list of 1238 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

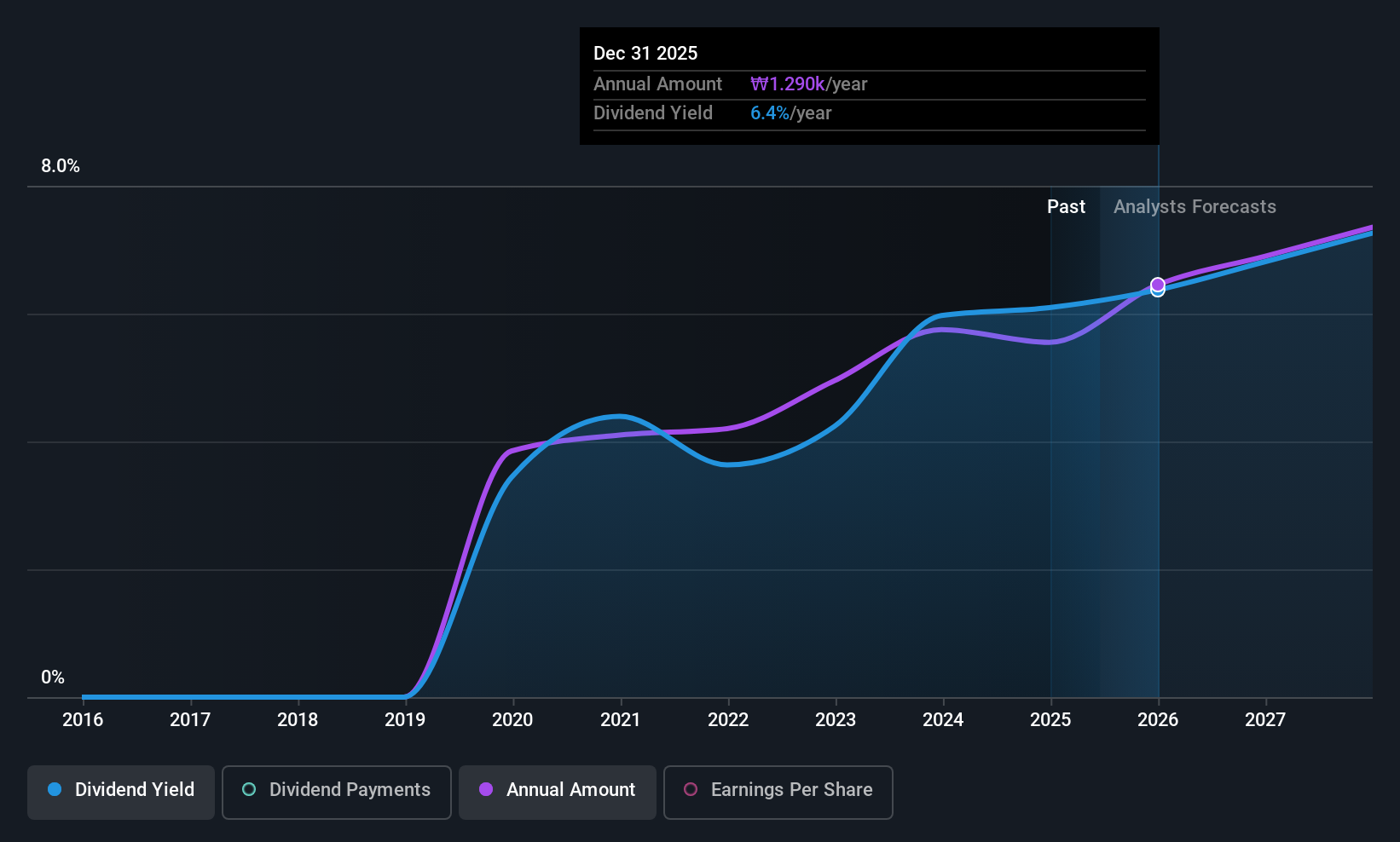

Cheil Worldwide (KOSE:A030000)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cheil Worldwide Inc. offers a range of marketing solutions globally and has a market cap of ₩2.06 trillion.

Operations: Cheil Worldwide Inc.'s revenue primarily comes from its advertising segment, which generated ₩4.37 billion.

Dividend Yield: 6.1%

Cheil Worldwide offers a compelling dividend profile, trading at 54.5% below its estimated fair value and providing a dividend yield in the top 25% of the KR market. Although dividends have been stable and growing for six years, they are well-covered by earnings (64.5%) and cash flows (58.6%). Earnings have grown at 6.2% annually over five years, with forecasts suggesting further growth of 10.87% per year, supporting future dividend sustainability.

- Click here to discover the nuances of Cheil Worldwide with our detailed analytical dividend report.

- The analysis detailed in our Cheil Worldwide valuation report hints at an deflated share price compared to its estimated value.

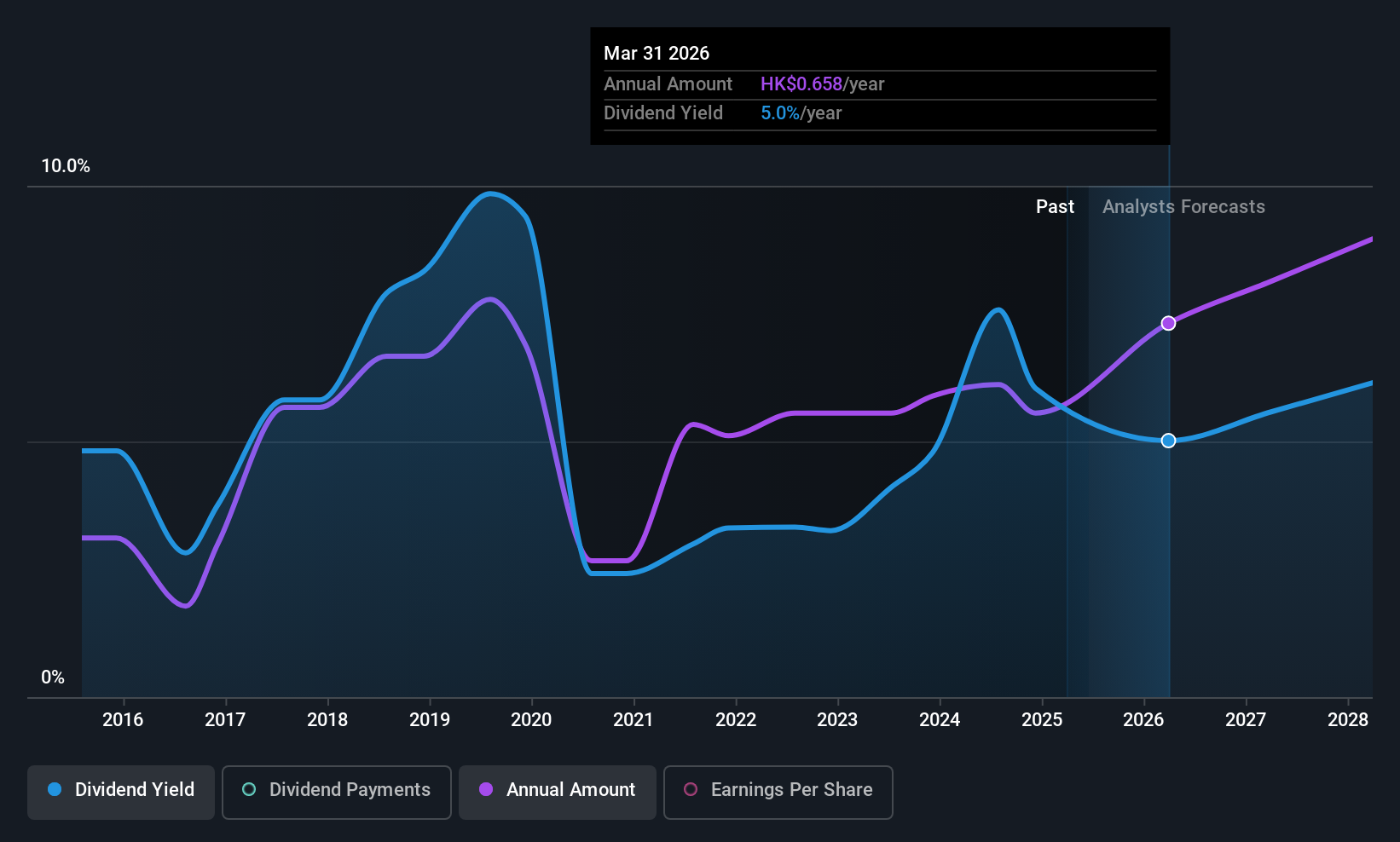

Chow Tai Fook Jewellery Group (SEHK:1929)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chow Tai Fook Jewellery Group Limited is an investment holding company that manufactures and sells jewelry products in Mainland China, Hong Kong, Macau, and internationally with a market cap of HK$137.03 billion.

Operations: Chow Tai Fook Jewellery Group's revenue is primarily derived from Mainland China, contributing HK$74.58 billion, and from Hong Kong, Macau, and other markets with HK$15.98 billion.

Dividend Yield: 3.8%

Chow Tai Fook Jewellery Group's dividend outlook is mixed. The company recently approved a final dividend of HK$0.32 per share, with dividends covered by earnings (payout ratio: 87.8%) and cash flows (cash payout ratio: 53.7%). However, its dividend history is volatile over the past decade, and the yield of 3.79% is below Hong Kong's top quartile payers. Despite high debt levels, it trades at a discount to estimated fair value, offering potential for value investors seeking dividends in Asia.

- Get an in-depth perspective on Chow Tai Fook Jewellery Group's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Chow Tai Fook Jewellery Group shares in the market.

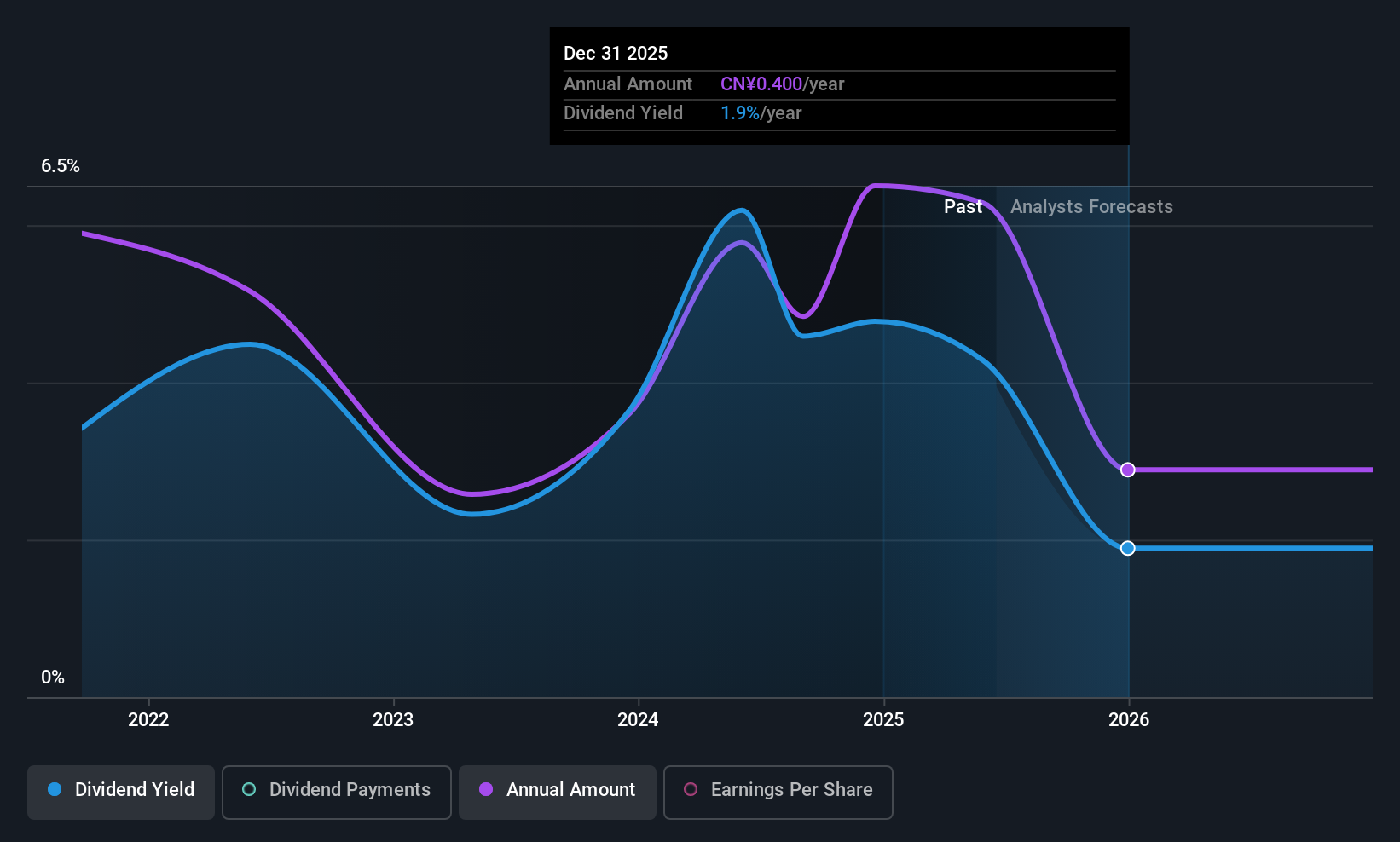

Tianjin Yiyi Hygiene ProductsLtd (SZSE:001206)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tianjin Yiyi Hygiene Products Co., Ltd specializes in the R&D, design, production, and sale of disposable pet and personal hygiene care products both in China and internationally, with a market cap of CN¥4.21 billion.

Operations: Tianjin Yiyi Hygiene Products Co., Ltd generates revenue through its diverse portfolio of disposable pet and personal hygiene care products, catering to both domestic and international markets.

Dividend Yield: 3.8%

Tianjin Yiyi Hygiene Products shows both strengths and weaknesses for dividend investors. Its dividend yield of 3.78% is among the top 25% in China, supported by a payout ratio of 70.2% and cash flow coverage at 69.4%. However, its four-year history of volatile dividends is a concern. Despite recent earnings growth to CNY 54.09 million in Q1 2025, the company approved a reduced final cash dividend for 2024, reflecting ongoing volatility challenges.

- Navigate through the intricacies of Tianjin Yiyi Hygiene ProductsLtd with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Tianjin Yiyi Hygiene ProductsLtd's share price might be too pessimistic.

Seize The Opportunity

- Get an in-depth perspective on all 1238 Top Asian Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A030000

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives