As global markets navigate the complexities of new tariffs and mixed economic data, investors are increasingly looking towards Asia for opportunities, with Chinese markets showing resilience amidst hopes for further stimulus. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those seeking to balance growth with consistent returns in their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.10% | ★★★★★★ |

| NCD (TSE:4783) | 4.37% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.33% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.38% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.34% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.24% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.31% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.06% | ★★★★★★ |

| Daicel (TSE:4202) | 4.81% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.05% | ★★★★★★ |

Click here to see the full list of 1199 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

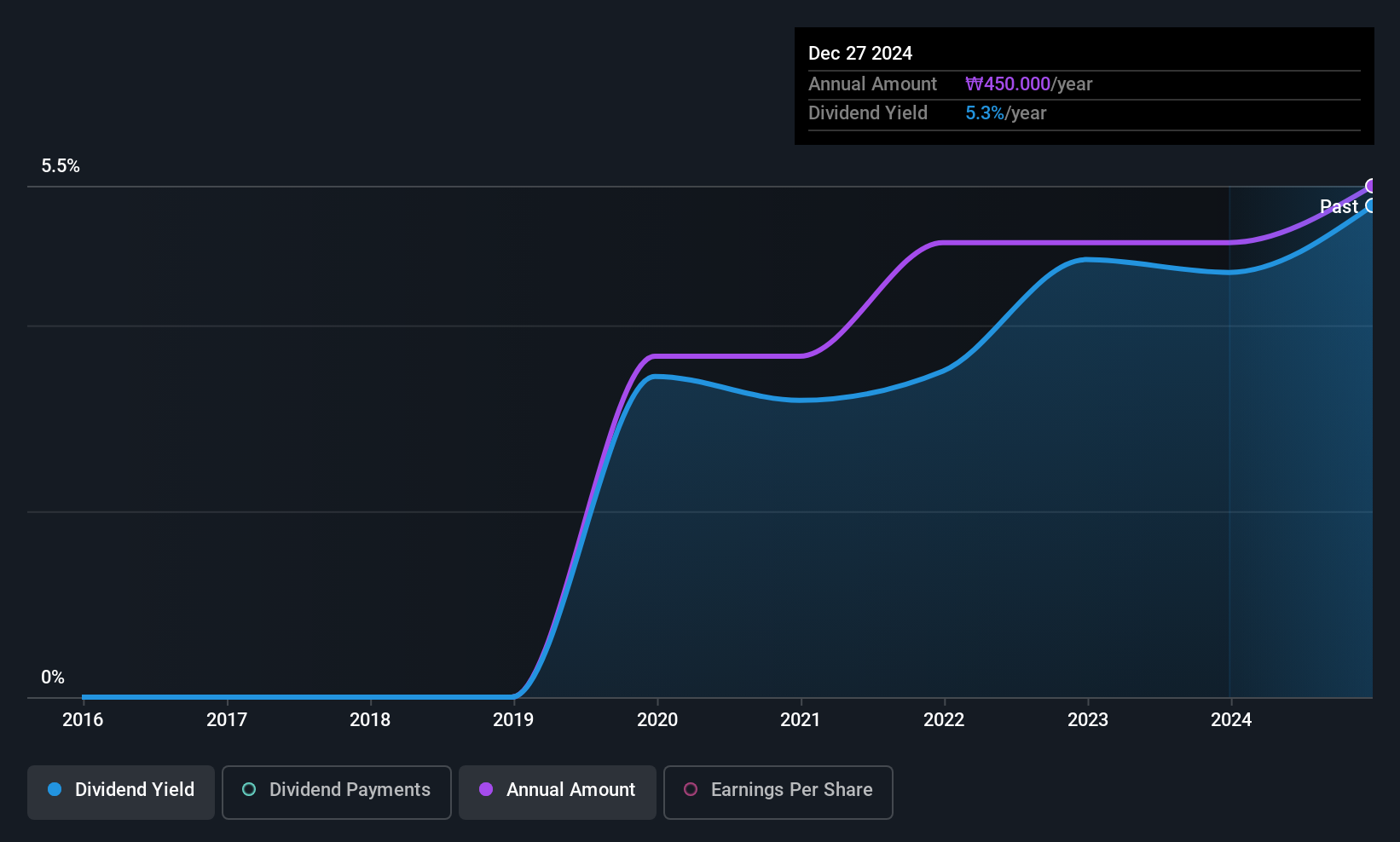

Motonic (KOSE:A009680)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Motonic Corporation manufactures and sells automotive components worldwide, with a market cap of ₩245.26 billion.

Operations: Motonic Corporation generates revenue of ₩289.92 billion from its automobile parts manufacturing segment.

Dividend Yield: 5.3%

Motonic's dividend payments are well-supported by earnings and cash flows, with a payout ratio of 40.1% and a cash payout ratio of 54.1%. Although the company has only paid dividends for six years, these payments have shown reliability and growth with minimal volatility. The dividend yield stands at 5.29%, placing it in the top quartile of Korean market payers. Additionally, Motonic trades at a significant discount to its estimated fair value, enhancing its appeal as an investment option in Asia's dividend landscape.

- Get an in-depth perspective on Motonic's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Motonic shares in the market.

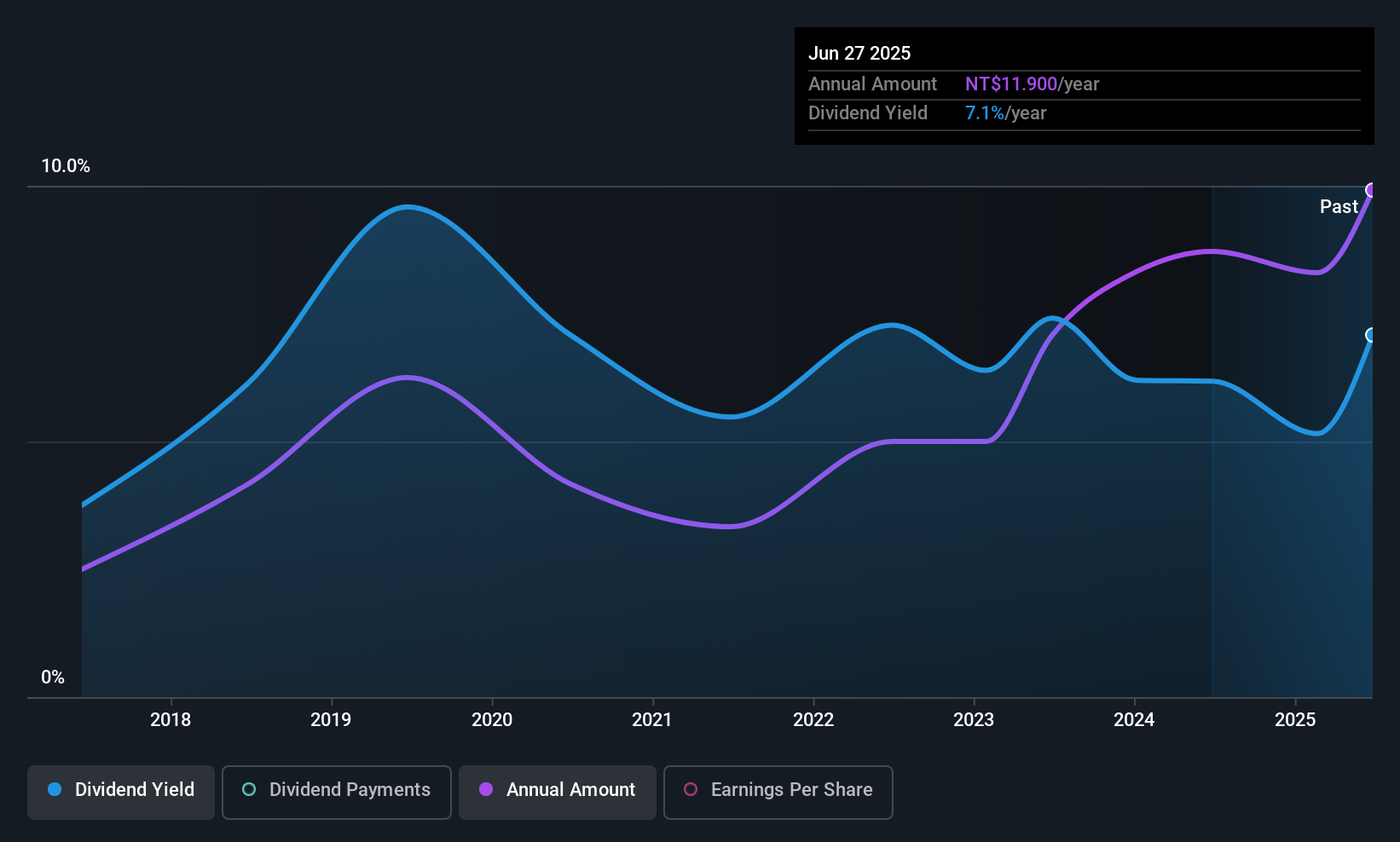

Nova Technology (TPEX:6613)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nova Technology Corporation offers services to semiconductor, photonics, solar energy, biotech, pharmaceutical, and chemical industrial manufacturers across Taiwan, China, and globally with a market cap of NT$13.81 billion.

Operations: Nova Technology Corporation generates revenue from its operations in China, contributing NT$6.70 billion, and Taiwan, contributing NT$4.16 billion.

Dividend Yield: 6.7%

Nova Technology's dividend yield of 6.7% ranks in the top quartile of Taiwan's market, supported by a payout ratio of 71.1% and a cash payout ratio of 62.6%. However, its dividends have been volatile over the past eight years, with periods of significant drops, despite being covered by earnings and cash flows. Recent board changes may influence future policy stability. Earnings for Q1 2025 showed slight declines compared to last year, impacting dividend reliability perceptions.

- Click here to discover the nuances of Nova Technology with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Nova Technology is priced lower than what may be justified by its financials.

Taishin Financial Holding (TWSE:2887)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taishin Financial Holding Co., Ltd. operates in Taiwan and internationally, offering a range of financial products and services through its subsidiaries, with a market cap of NT$237.46 billion.

Operations: Taishin Financial Holding Co., Ltd. generates revenue primarily from its Taishin Bank Personal Finance Business Headquarters (NT$30.28 billion), Corporate Financial Business Headquarters (NT$14.95 billion), Taishin Securities Merger (NT$5.43 billion), and Financial Market Business Headquarters (NT$6.24 billion), along with contributions from Taishin Life (NT$2.85 billion).

Dividend Yield: 4.9%

Taishin Financial Holding's dividend yield, while lower than the top quartile in Taiwan, is supported by a reasonable payout ratio of 65.6%, indicating coverage by earnings. However, its dividend history shows volatility over the past decade. Recent amendments to company bylaws and discussions on earnings distribution suggest potential shifts in dividend policy. Q1 2025 results showed net income of TWD 4.73 billion, slightly down from TWD 5.01 billion last year, affecting perceptions of dividend stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Taishin Financial Holding.

- According our valuation report, there's an indication that Taishin Financial Holding's share price might be on the cheaper side.

Where To Now?

- Get an in-depth perspective on all 1199 Top Asian Dividend Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taishin Financial Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2887

Taishin Financial Holding

Provides various financial products and services in Taiwan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives