- Taiwan

- /

- Tech Hardware

- /

- TWSE:2376

Asian Companies Possibly Trading Below Intrinsic Value Estimates In July 2025

Reviewed by Simply Wall St

As global markets experience a surge, with indices like the S&P 500 and Nasdaq Composite reaching record highs, Asian markets are also showing signs of optimism amid easing trade tensions between the U.S. and China. In this environment, identifying stocks that may be trading below their intrinsic value can offer opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Strike CompanyLimited (TSE:6196) | ¥3705.00 | ¥7290.78 | 49.2% |

| Polaris Holdings (TSE:3010) | ¥211.00 | ¥416.25 | 49.3% |

| MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.89 | HK$1.76 | 49.6% |

| Medley (TSE:4480) | ¥3180.00 | ¥6250.17 | 49.1% |

| Livero (TSE:9245) | ¥1717.00 | ¥3380.20 | 49.2% |

| Kanto Denka Kogyo (TSE:4047) | ¥841.00 | ¥1679.50 | 49.9% |

| GCH Technology (SHSE:688625) | CN¥30.58 | CN¥60.27 | 49.3% |

| cottaLTD (TSE:3359) | ¥439.00 | ¥860.97 | 49% |

| China Kings Resources GroupLtd (SHSE:603505) | CN¥21.72 | CN¥42.59 | 49% |

| Bloks Group (SEHK:325) | HK$141.20 | HK$279.47 | 49.5% |

Here's a peek at a few of the choices from the screener.

Bloks Group (SEHK:325)

Overview: Bloks Group Limited focuses on the design, development, and sales of toy products in Mainland China, with a market capitalization of approximately HK$35.19 billion.

Operations: The company's revenue segment is primarily derived from the design, development, and sales of toy products in Mainland China, amounting to approximately CN¥2.24 billion.

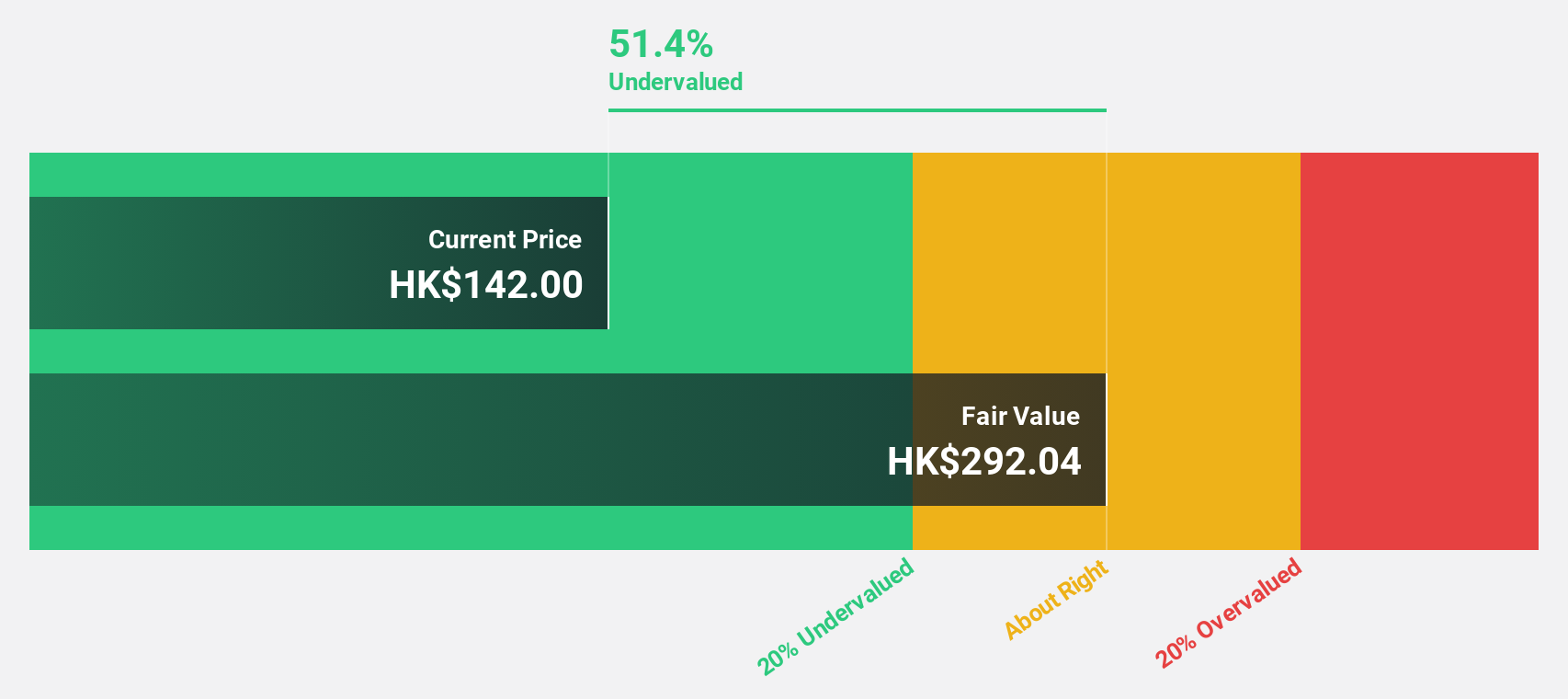

Estimated Discount To Fair Value: 49.5%

Bloks Group, recently added to the S&P Global BMI Index, is trading at HK$141.2, significantly below its estimated fair value of HK$279.47. Despite negative shareholders' equity and high share price volatility, Bloks Group's revenue is expected to grow at 36.2% annually—outpacing the Hong Kong market—and become profitable within three years with a forecasted Return on Equity of 52.3%. Revenue surged by 155.6% last year, highlighting robust growth potential despite current challenges.

- The growth report we've compiled suggests that Bloks Group's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Bloks Group.

Zhejiang Yinlun MachineryLtd (SZSE:002126)

Overview: Zhejiang Yinlun Machinery Co., Ltd. specializes in the R&D, manufacturing, and sale of thermal management and exhaust gas post-treatment products, with a market cap of CN¥20.12 billion.

Operations: The company generates revenue from its expertise in developing, producing, and selling thermal management and exhaust gas post-treatment solutions.

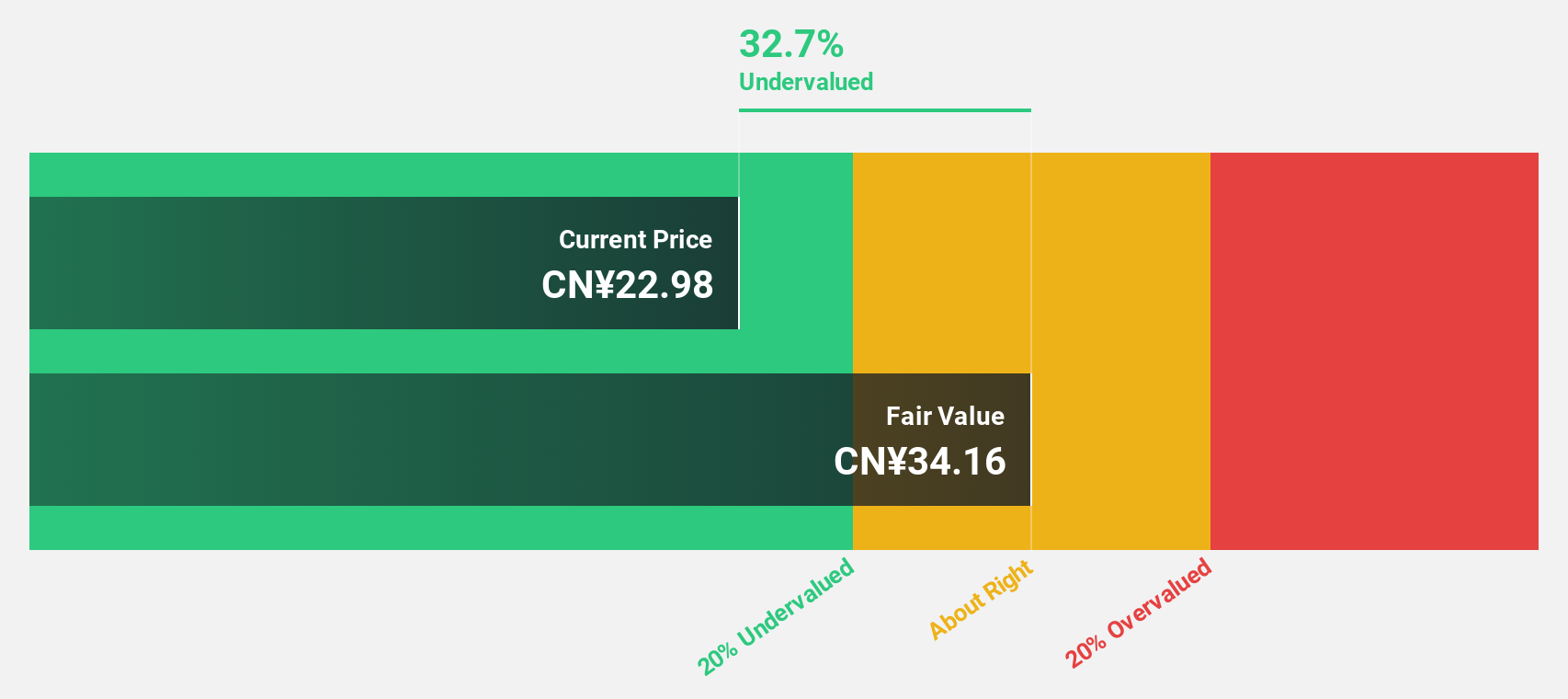

Estimated Discount To Fair Value: 24.8%

Zhejiang Yinlun Machinery Ltd. is trading at CNY 24.28, well below its estimated fair value of CNY 32.28, presenting a potential undervaluation based on cash flows. The company reported first-quarter sales of CNY 3.42 billion and net income of CNY 212.36 million, reflecting steady growth from the previous year. Additionally, Zhejiang Yinlun has announced a share repurchase program worth up to CNY 100 million and increased dividends, underscoring strong cash flow management despite modest Return on Equity forecasts at 16.2%.

- Our earnings growth report unveils the potential for significant increases in Zhejiang Yinlun MachineryLtd's future results.

- Delve into the full analysis health report here for a deeper understanding of Zhejiang Yinlun MachineryLtd.

Giga-Byte Technology (TWSE:2376)

Overview: Giga-Byte Technology Co., Ltd. and its subsidiaries engage in the manufacturing, processing, and trading of computer peripherals and components across Taiwan, Europe, the United States, Canada, China, and other international markets with a market cap of approximately NT$189.58 billion.

Operations: The company's revenue primarily comes from its Brand Business Division, which generates NT$274.76 billion.

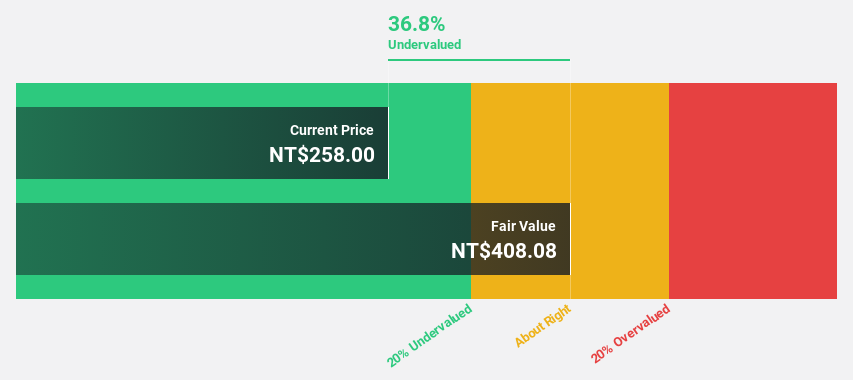

Estimated Discount To Fair Value: 48.3%

Giga-Byte Technology Co., Ltd. is trading at NT$283, significantly below its estimated fair value of NT$547.54, highlighting potential undervaluation based on cash flows. The company's first-quarter sales reached TWD 65.75 billion with net income of TWD 3.12 billion, showing robust growth from the previous year. Despite a dividend yield of 2.37% not fully covered by free cash flows, earnings are forecast to grow faster than the Taiwan market average at 16.9% annually.

- Our growth report here indicates Giga-Byte Technology may be poised for an improving outlook.

- Click here to discover the nuances of Giga-Byte Technology with our detailed financial health report.

Turning Ideas Into Actions

- Dive into all 286 of the Undervalued Asian Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2376

Giga-Byte Technology

Manufactures, processes, and trades in computer peripherals and component parts in Taiwan, Europe, the United States, Canada, China, and internationally.

Very undervalued with solid track record.

Market Insights

Community Narratives