Stock Analysis

- United States

- /

- Software

- /

- NasdaqGS:BL

Investor Optimism Abounds BlackLine, Inc. (NASDAQ:BL) But Growth Is Lacking

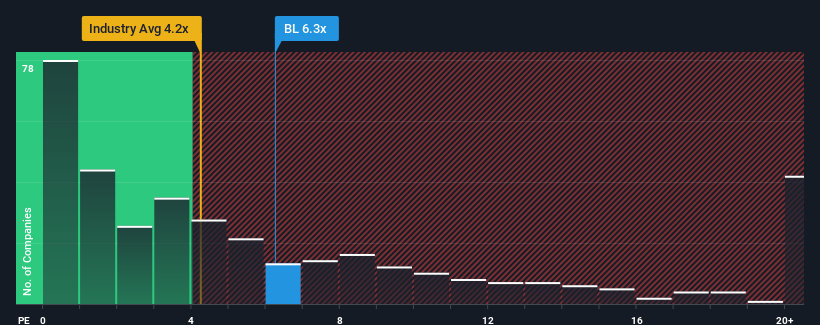

You may think that with a price-to-sales (or "P/S") ratio of 6.3x BlackLine, Inc. (NASDAQ:BL) is a stock to potentially avoid, seeing as almost half of all the Software companies in the United States have P/S ratios under 4.2x and even P/S lower than 1.6x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for BlackLine

What Does BlackLine's P/S Mean For Shareholders?

Recent times haven't been great for BlackLine as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think BlackLine's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, BlackLine would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. Pleasingly, revenue has also lifted 68% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 10% each year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 15% each year growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that BlackLine's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From BlackLine's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It comes as a surprise to see BlackLine trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about these 3 warning signs we've spotted with BlackLine (including 1 which is potentially serious).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether BlackLine is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NasdaqGS:BL

BlackLine

BlackLine, Inc. provides cloud-based solutions to automate and streamline accounting and finance operations worldwide.

Moderate growth potential with questionable track record.