- United States

- /

- Healthcare Services

- /

- NasdaqGM:CSTL

Castle Biosciences, Inc.'s (NASDAQ:CSTL) P/S Is On The Mark

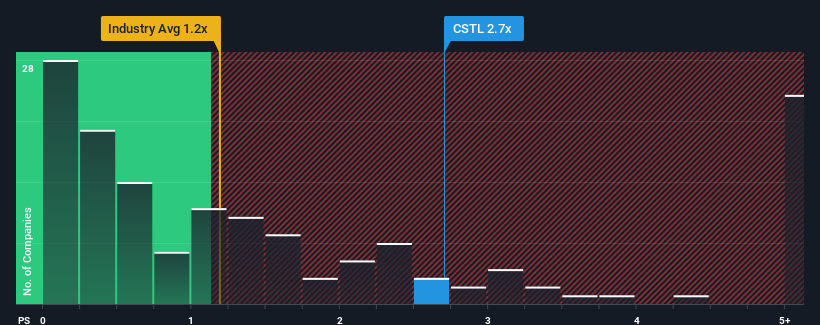

When close to half the companies in the Healthcare industry in the United States have price-to-sales ratios (or "P/S") below 1.2x, you may consider Castle Biosciences, Inc. (NASDAQ:CSTL) as a stock to potentially avoid with its 2.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Castle Biosciences

What Does Castle Biosciences' P/S Mean For Shareholders?

Castle Biosciences certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Castle Biosciences' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Castle Biosciences would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 60%. The strong recent performance means it was also able to grow revenue by 251% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 9.7% per annum during the coming three years according to the nine analysts following the company. With the industry only predicted to deliver 7.6% per year, the company is positioned for a stronger revenue result.

With this information, we can see why Castle Biosciences is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Castle Biosciences' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Castle Biosciences' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 3 warning signs for Castle Biosciences you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CSTL

Castle Biosciences

A molecular diagnostics company, provides test solutions for the diagnosis and treatment of dermatologic cancers, Barrett’s esophagus (BE), uveal melanoma, and mental health conditions.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives