Stock Analysis

Docebo (TSE:DCBO) Is Looking To Continue Growing Its Returns On Capital

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, we've noticed some promising trends at Docebo (TSE:DCBO) so let's look a bit deeper.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Docebo is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.081 = US$4.7m ÷ (US$158m - US$101m) (Based on the trailing twelve months to December 2023).

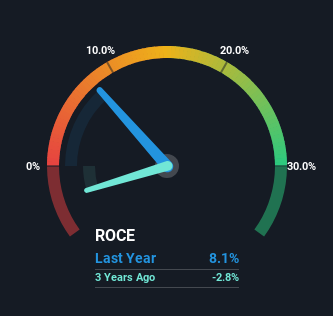

Thus, Docebo has an ROCE of 8.1%. In absolute terms, that's a low return but it's around the Software industry average of 9.6%.

Check out our latest analysis for Docebo

Above you can see how the current ROCE for Docebo compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for Docebo .

The Trend Of ROCE

Docebo has recently broken into profitability so their prior investments seem to be paying off. The company was generating losses four years ago, but now it's earning 8.1% which is a sight for sore eyes. Not only that, but the company is utilizing 63% more capital than before, but that's to be expected from a company trying to break into profitability. We like this trend, because it tells us the company has profitable reinvestment opportunities available to it, and if it continues going forward that can lead to a multi-bagger performance.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. Effectively this means that suppliers or short-term creditors are now funding 64% of the business, which is more than it was four years ago. And with current liabilities at those levels, that's pretty high.

The Bottom Line

Overall, Docebo gets a big tick from us thanks in most part to the fact that it is now profitable and is reinvesting in its business. Considering the stock has delivered 9.4% to its stockholders over the last three years, it may be fair to think that investors aren't fully aware of the promising trends yet. So exploring more about this stock could uncover a good opportunity, if the valuation and other metrics stack up.

One more thing, we've spotted 2 warning signs facing Docebo that you might find interesting.

While Docebo isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're helping make it simple.

Find out whether Docebo is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:DCBO

Docebo

Docebo Inc. operates as a learning management software company that provides artificial intelligence (AI)-powered learning platform in North America and internationally.

Flawless balance sheet with high growth potential.