- United States

- /

- Residential REITs

- /

- NYSE:EQR

Are Equity Residential's (NYSE:EQR) Mixed Financials Driving The Negative Sentiment?

With its stock down 26% over the past three months, it is easy to disregard Equity Residential (NYSE:EQR). It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Stock prices are usually driven by a company’s financial performance over the long term, and therefore we decided to pay more attention to the company's financial performance. Specifically, we decided to study Equity Residential's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Equity Residential

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Equity Residential is:

9.2% = US$1.0b ÷ US$11b (Based on the trailing twelve months to December 2019).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.09 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learnt that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Equity Residential's Earnings Growth And 9.2% ROE

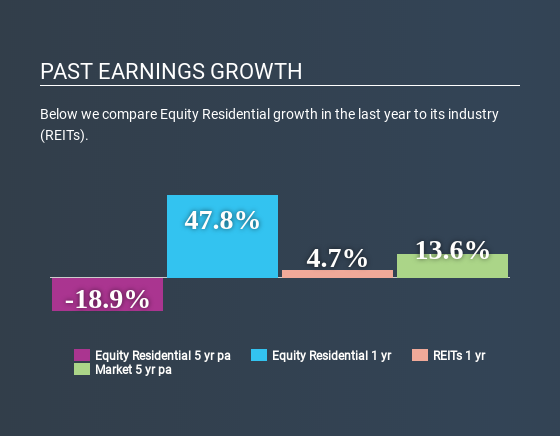

At first glance, Equity Residential's ROE doesn't look very promising. However, the fact that the company's ROE is higher than the average industry ROE of 5.8%, is definitely interesting. However, Equity Residential's five year net income decline rate was 19%. Bear in mind, the company does have a slightly low ROE. It is just that the industry ROE is lower. So that could be one of the factors that are causing earnings growth to shrink.

So, as a next step, we compared Equity Residential's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 15% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Is EQR fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Equity Residential Making Efficient Use Of Its Profits?

Equity Residential seems to be paying out most of its income as dividends judging by its three-year median payout ratio of 63% (meaning, the company retains only 37% of profits). However, this is typical for REITs as they are often required by law to distribute most of their earnings. Accordingly, this likely explains why its earnings have been shrinking.

Additionally, Equity Residential has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 0.2% over the next three years. Despite the lower expected payout ratio, the company's ROE is not expected to change by much.

Conclusion

In total, we're a bit ambivalent about Equity Residential's performance. On the one hand, the company does have a decent rate of return, however, its earnings growth number is quite disappointing and as discussed earlier, the low retained earnings is hampering the growth. Further, on studying current analyst estimates, we found that the company's earnings growth is expected to be pretty much the same. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:EQR

Equity Residential

Equity Residential is committed to creating communities where people thrive.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives