Are Costamp Group's (BIT:MOLD) Statutory Earnings A Good Guide To Its Underlying Profitability?

As a general rule, we think profitable companies are less risky than companies that lose money. That said, the current statutory profit is not always a good guide to a company's underlying profitability. In this article, we'll look at how useful this year's statutory profit is, when analysing Costamp Group (BIT:MOLD).

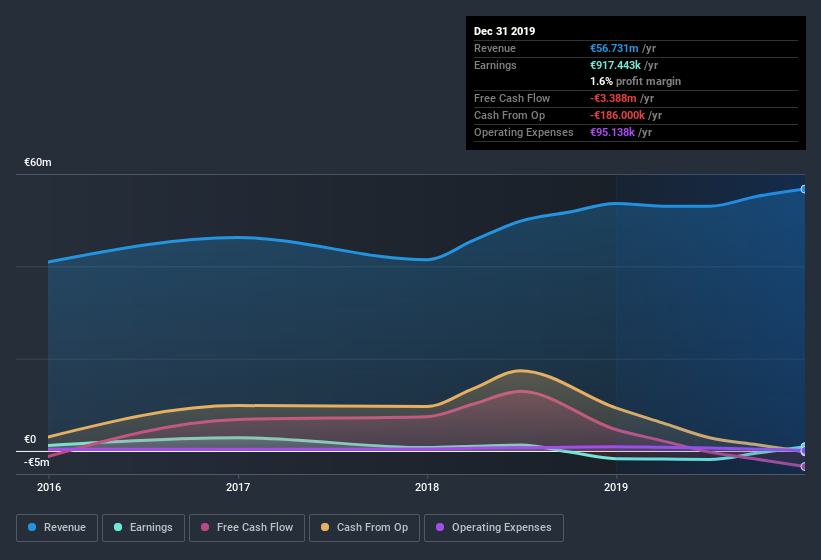

It's good to see that over the last twelve months Costamp Group made a profit of €917.4k on revenue of €56.7m.

View our latest analysis for Costamp Group

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. This article will focus on the impact unusual items have had on Costamp Group's statutory earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Costamp Group's profit received a boost of €228k in unusual items, over the last year. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. If Costamp Group doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Costamp Group's Profit Performance

We'd posit that Costamp Group's statutory earnings aren't a clean read on ongoing productivity, due to the large unusual item. Because of this, we think that it may be that Costamp Group's statutory profits are better than its underlying earnings power. The good news is that it earned a profit in the last twelve months, despite its previous loss. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. If you'd like to know more about Costamp Group as a business, it's important to be aware of any risks it's facing. For instance, we've identified 4 warning signs for Costamp Group (1 doesn't sit too well with us) you should be familiar with.

This note has only looked at a single factor that sheds light on the nature of Costamp Group's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Costamp Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BIT:MOLD

Costamp Group

Costamp Group S.p.A. manufactures and sells casting dies for automotive and industrial applications.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives