- United States

- /

- Insurance

- /

- NYSE:AON

Aon (NYSE:AON) Enhances Leadership Team With Strategic Industry Appointments

Reviewed by Simply Wall St

Aon (NYSE:AON) recently appointed David Carlson as its global industrial and manufacturing leader, a move that underscores the company's focus on enhancing industry-specific insights and expertise. Despite these significant leadership changes, Aon's stock price remained relatively flat over the past week with a slight 1% decline. This contrasts with broader market trends, as the S&P 500 and Nasdaq experienced gains. Aon's appointment of Carlson, along with other leadership shifts, may have supported its industry-specific focus, but did not have a considerable impact on the stock's performance within the context of a rising market.

The appointment of David Carlson as Aon's global industrial and manufacturing leader signals an enhanced focus on industry-specific expertise, which could align with the company’s broader strategy of driving operational efficiency through risk analyzers and expansion in business services. While the immediate impact on Aon's stock price was minimal, with a 1% decline over the past week, investors may see potential long-term benefits in revenue and earnings growth as the company positions itself for greater client demand in risk solutions.

Aon's total shareholder return over the past five years, including dividends, stands at 92.99%. This substantial performance provides context to the more recent one-year period where Aon's return of 13.9% outperformed the broader US market, and its return of 17.3% during the same period surpassed the US Insurance industry. This historical performance suggests that Aon has consistently delivered value over varied periods despite market fluctuations.

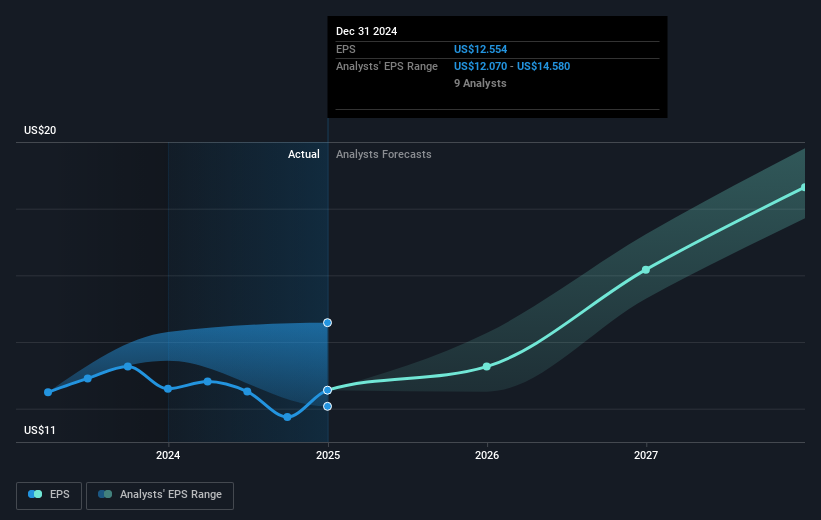

With current revenue at $16.36 billion and earnings at $2.55 billion, the leadership changes could potentially strengthen Aon's ability to meet the analyst forecast of $3.9 billion in earnings by 2028. However, challenges such as macroeconomic volatility and industry-specific risks could impede these projections. The consensus price target of $396.07 reflects a 9.8% premium over the current share price of $357.93, indicating that analysts see room for upside if Aon can successfully enhance its operational efficiencies and expand its market reach.

Understand Aon's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AON

Aon

A professional services firm, provides a range of risk and human capital solutions worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives