- Canada

- /

- Metals and Mining

- /

- TSXV:AGD

Antioquia Gold (CVE:AGD) Shareholders Booked A 100% Gain In The Last Five Years

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, long term Antioquia Gold Inc. (CVE:AGD) shareholders have enjoyed a 100% share price rise over the last half decade, well in excess of the market return of around 9.0% (not including dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 20%.

Check out our latest analysis for Antioquia Gold

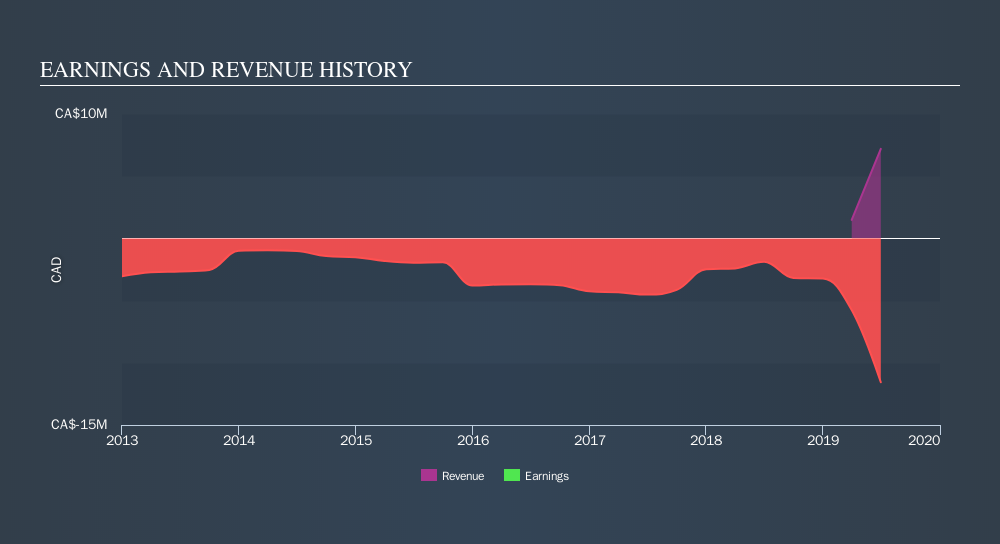

Antioquia Gold isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

The image below shows how revenue has tracked over time.

If you are thinking of buying or selling Antioquia Gold stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Antioquia Gold shareholders have received a total shareholder return of 20% over one year. That gain is better than the annual TSR over five years, which is 15%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. You could get a better understanding of Antioquia Gold's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSXV:AGD

Antioquia Gold

Engages in the exploration, evaluation, and mining of gold resource properties in Colombia.

Slightly overvalued with weak fundamentals.

Market Insights

Community Narratives