- United States

- /

- Insurance

- /

- NYSE:THG

Announcing: Hanover Insurance Group (NYSE:THG) Stock Increased An Energizing 125% In The Last Five Years

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. For example, the The Hanover Insurance Group, Inc. (NYSE:THG) share price has soared 125% in the last half decade. Most would be very happy with that.

See our latest analysis for Hanover Insurance Group

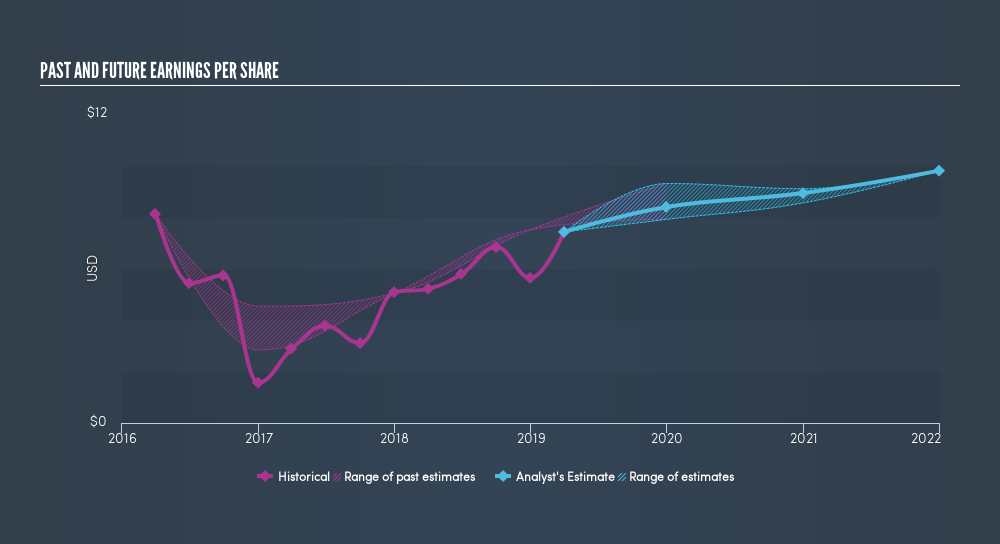

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Hanover Insurance Group managed to grow its earnings per share at 6.9% a year. This EPS growth is slower than the share price growth of 18% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

We know that Hanover Insurance Group has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Hanover Insurance Group will grow revenue in the future.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Hanover Insurance Group's TSR for the last 5 years was 161%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Hanover Insurance Group has rewarded shareholders with a total shareholder return of 9.5% in the last twelve months. That's including the dividend. However, the TSR over five years, coming in at 21% per year, is even more impressive. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Before spending more time on Hanover Insurance Group it might be wise to click here to see if insiders have been buying or selling shares.

Of course Hanover Insurance Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:THG

Hanover Insurance Group

Through its subsidiaries, provides various property and casualty insurance products and services in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives