- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (AMZN) Partners With Apex Systems For AI Solutions In AWS Marketplace

Reviewed by Simply Wall St

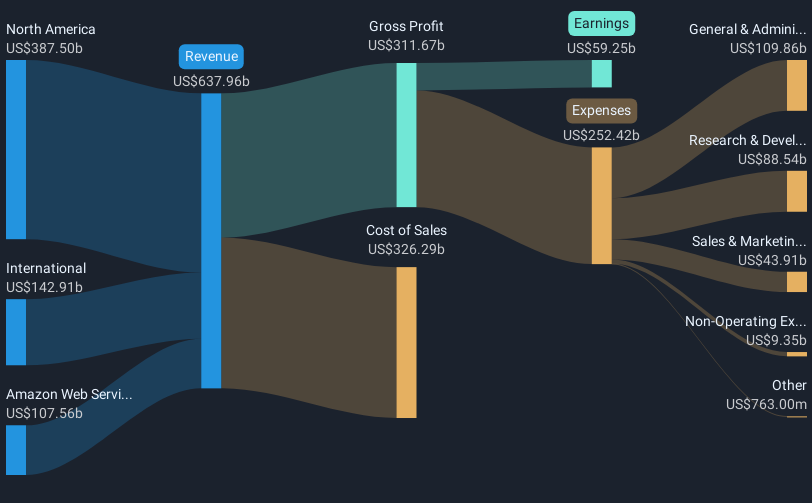

Amazon.com (AMZN) experienced a 22% price increase over the last quarter, a reflection of its robust Q1 earnings reporting a significant rise in revenue and net income. The successful launch of Apex Systems' customer service AI on the AWS Marketplace highlights Amazon's innovative edge, while strategic business expansions such as the expansion of delivery services and AWS infrastructure in Chile have reinforced its market position. Despite minor legal challenges and executive changes, these advancements complemented the overall market uptrend of 18% over the past year, aligning Amazon's performance with broader market dynamics.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

The recent advancements in Amazon's offerings, highlighted by the launch of Apex Systems' AI service on AWS and expansion efforts in Chile, align well with the company's narrative of enhancing operational efficiency and broadening market reach. These initiatives could further bolster Amazon's fulfillment network and digital services, potentially impacting revenue and earnings positively. The AI advancements, particularly within AWS, may contribute significantly to future revenue growth as companies increasingly adopt cloud-based solutions. Despite the initial costs and potential competition challenges, these strategic moves are expected to support sustainable growth in revenue and margins.

Amazon's longer-term total shareholder return of 88.72% over the past three years underscores the company's ability to deliver substantial value to investors, reflecting effective execution of its strategies. This return contrasts with the firm's recent alignment with a broader market uptrend of 18% over the past year. The recent 22% share price surge indicates positive short-term sentiment, yet the current price of US$228.29 remains below the consensus analyst price target of approximately US$250.77. This suggests potential for further upside, contingent on the realization of forecasted growth in revenue and earnings to US$104.8 billion by 2028. Investors should consider these variables when evaluating Amazon's market positioning and future growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives