- United States

- /

- Specialty Stores

- /

- NasdaqGS:EVGO

Allogene Therapeutics And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

In the last week, the market has stayed flat, but it is up 11% over the past year with earnings expected to grow by 15% per annum in the coming years. For investors seeking opportunities beyond large-cap stocks, penny stocks can offer a unique blend of potential value and growth, especially when these smaller or newer companies are backed by strong financials. Despite their somewhat outdated name, penny stocks remain an intriguing investment area for those looking to uncover promising candidates that might not yet be on everyone's radar.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.41 | $509.94M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.01 | $169.86M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.24 | $228.14M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $100.41M | ✅ 3 ⚠️ 1 View Analysis > |

| Safe Bulkers (SB) | $4.11 | $420.49M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.84765 | $6.16M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.88 | $109.38M | ✅ 3 ⚠️ 2 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.84 | $44.48M | ✅ 2 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.296 | $28.06M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 421 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Allogene Therapeutics (ALLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Allogene Therapeutics, Inc. is a clinical-stage immuno-oncology company focused on developing and commercializing genetically engineered allogeneic T cell therapies for cancer and autoimmune diseases, with a market cap of approximately $280 million.

Operations: Currently, there are no reported revenue segments for this clinical-stage immuno-oncology company.

Market Cap: $279.98M

Allogene Therapeutics, Inc., a clinical-stage immuno-oncology company, is pre-revenue with no significant revenue streams. The company focuses on developing allogeneic CAR T cell therapies and recently presented promising Phase 1 TRAVERSE study data for ALLO-316 in renal cell carcinoma at the ASCO Annual Meeting. Despite being debt-free and having sufficient cash runway for nearly two years, Allogene remains unprofitable with increasing losses over the past five years. Its stock exhibits high volatility and trades significantly below estimated fair value. Regulatory designations like RMAT and Fast Track for ALLO-316 highlight its potential in unmet medical needs.

- Navigate through the intricacies of Allogene Therapeutics with our comprehensive balance sheet health report here.

- Examine Allogene Therapeutics' earnings growth report to understand how analysts expect it to perform.

EVgo (EVGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EVgo, Inc. owns and operates a direct current fast charging network for electric vehicles in the United States, with a market cap of approximately $1.06 billion.

Operations: The company's revenue is derived entirely from its operations in the United States, totaling $276.95 million.

Market Cap: $1.06B

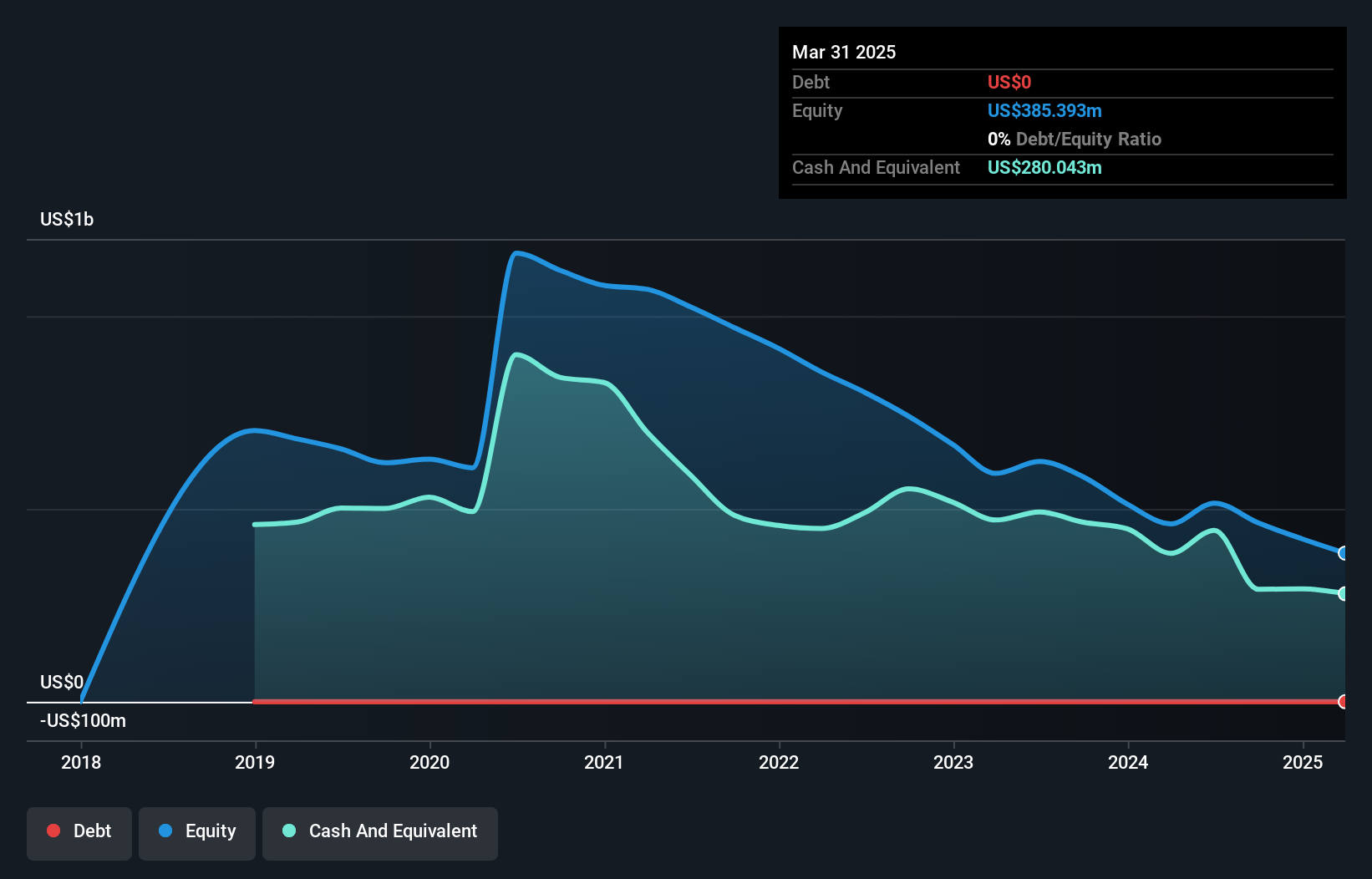

EVgo, Inc. is navigating the penny stock landscape with a focus on expanding its fast-charging network for electric vehicles across the U.S., backed by a market cap of US$1.06 billion and revenue of US$276.95 million. Despite being unprofitable with increasing losses over five years, EVgo's short-term assets exceed its liabilities, and it maintains more cash than debt, indicating financial resilience. Recent inclusion in the S&P Retail Select Industry Index and strategic executive appointments aim to boost growth prospects as revenue is forecasted to grow 23.36% annually; however, significant insider selling raises caution about future confidence levels.

- Click to explore a detailed breakdown of our findings in EVgo's financial health report.

- Learn about EVgo's future growth trajectory here.

Hyliion Holdings (HYLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hyliion Holdings Corp. designs and develops power generators for stationary and mobile applications, with a market cap of approximately $0.26 billion.

Operations: Hyliion Holdings Corp. does not currently report any revenue segments.

Market Cap: $255.84M

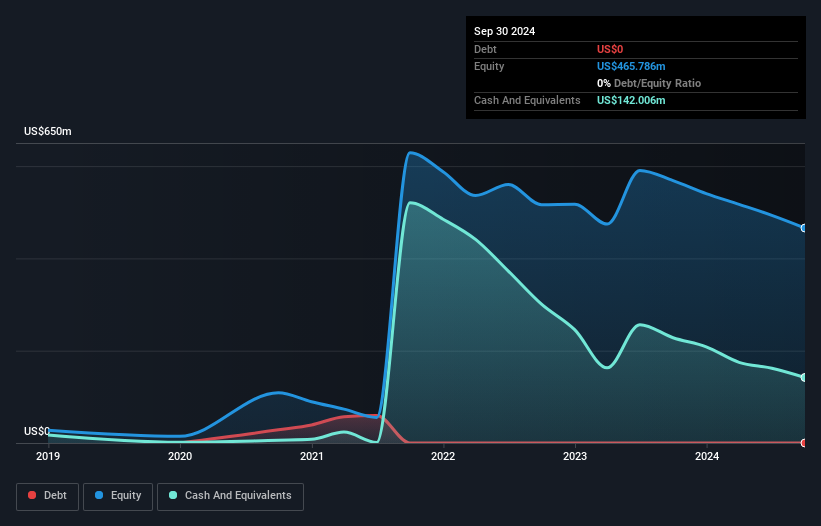

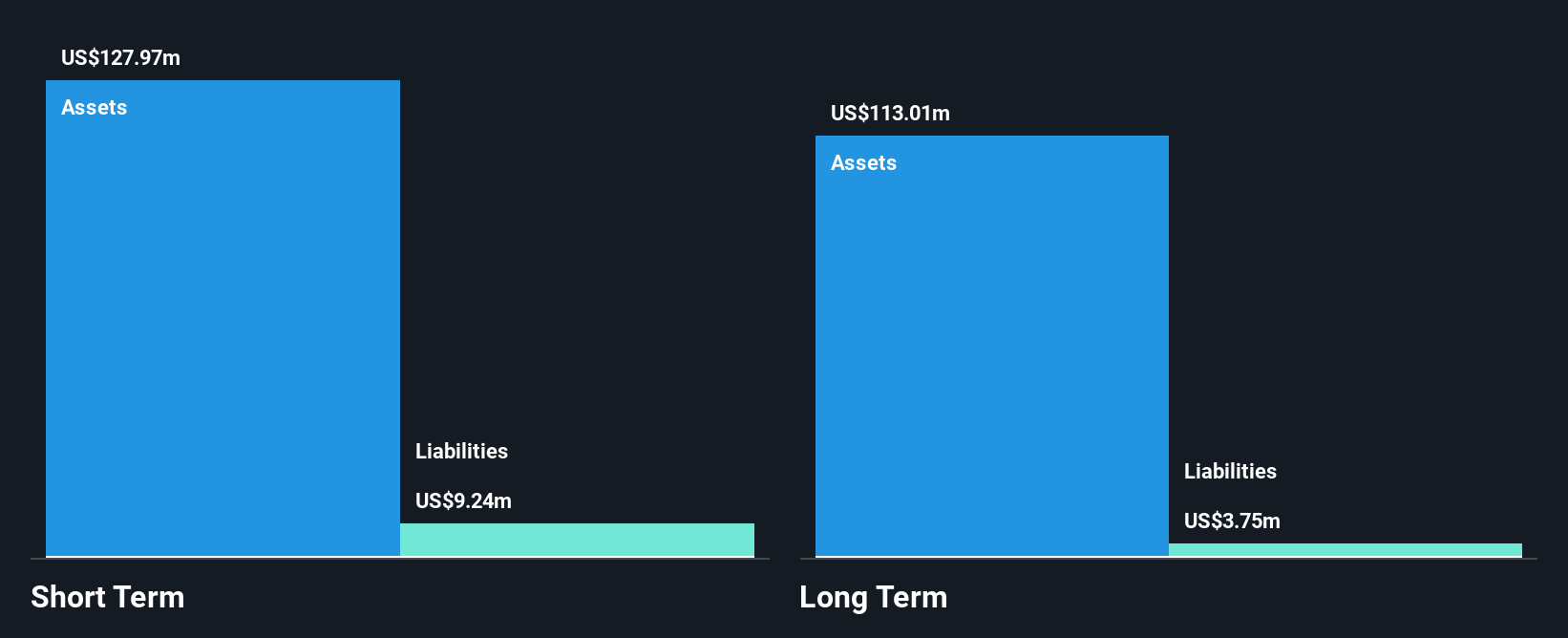

Hyliion Holdings, with a market cap of US$0.26 billion, remains a pre-revenue company in the penny stock arena, focusing on innovative power solutions like the KARNO Power Module. Despite its unprofitability and increasing losses over five years, Hyliion's short-term assets significantly exceed its liabilities by US$128 million to US$9.2 million, and it is debt-free. Recent strategic moves include a non-binding LOI with MMR Power Solutions for future deployments and a potential $1 billion opportunity with Alkhorayef Industries in Saudi Arabia. These developments highlight Hyliion's efforts to establish market presence while navigating financial challenges typical of early-stage companies.

- Take a closer look at Hyliion Holdings' potential here in our financial health report.

- Understand Hyliion Holdings' earnings outlook by examining our growth report.

Summing It All Up

- Unlock more gems! Our US Penny Stocks screener has unearthed 418 more companies for you to explore.Click here to unveil our expertly curated list of 421 US Penny Stocks.

- Looking For Alternative Opportunities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EVgo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVGO

EVgo

Owns and operates a direct current fast charging network for electric vehicles in the United States.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives