- United States

- /

- IT

- /

- NYSE:ACN

Accenture (NYSE:ACN) Expands AI Initiatives Through NVIDIA Partnership And Reserv Investment

Reviewed by Simply Wall St

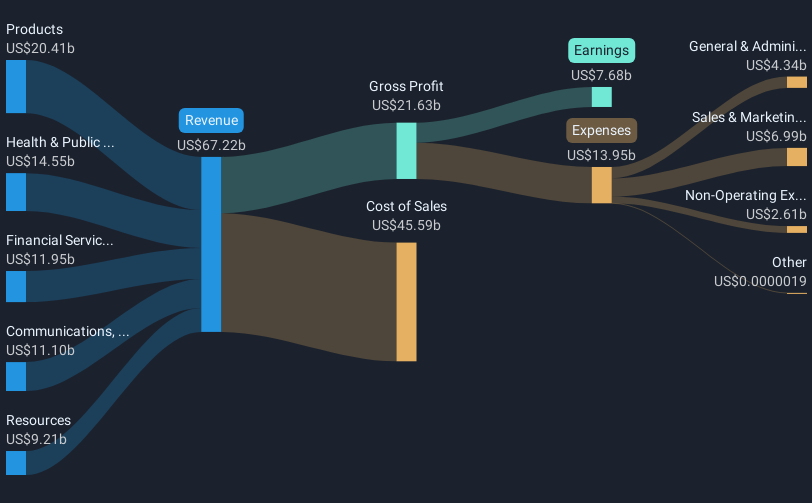

Accenture (NYSE:ACN) recently made headlines with its expanded partnership with NVIDIA Inception and an investment in the insurance company Reserv, which aim to foster AI-driven innovation and enhance claims processing capabilities, respectively. Over the past month, Accenture's stock price moved up by 2.5%, aligning with the broader market trends. While the market has experienced a 13% increase over the last year, Accenture's recent initiatives in AI and digital transformation might have added weight to its performance, aligning with anticipated earnings growth of 14% annually. The launch of an AI Silicon Valley hub and collaborations with major tech firms could further bolster its forward trajectory.

Buy, Hold or Sell Accenture? View our complete analysis and fair value estimate and you decide.

The recent expansion of Accenture's partnership with NVIDIA Inception and investment in Reserv highlights the company's focus on AI-driven innovation, potentially driving future growth. Over five years, Accenture's total shareholder return was 62.55%, reflecting robust performance in a dynamic landscape. In the short term, Accenture underperformed the US IT industry, which returned 37.6%, but these strategic initiatives may position it well for future gains.

Accenture's AI Silicon Valley hub and partnerships may bolster revenue and earnings forecasts, especially with analysts predicting revenue growth of 6.7% annually. The company's share price increased by 2.5% recently, but it remains below the consensus price target of approximately US$355. This suggests potential room for appreciation if revenue and earnings forecasts align with expectations. As Accenture enhances its cloud and security offerings, the influence of these developments may support stronger earnings growth despite current market pressures.

Evaluate Accenture's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in North America, Europe, the Middle East, Africa, and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives