- India

- /

- Metals and Mining

- /

- NSEI:MMFL

A Quick Analysis On M M Forgings' (NSE:MMFL) CEO Salary

Vidyashankar Krishnan is the CEO of M M Forgings Limited (NSE:MMFL), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for M M Forgings.

View our latest analysis for M M Forgings

Comparing M M Forgings Limited's CEO Compensation With the industry

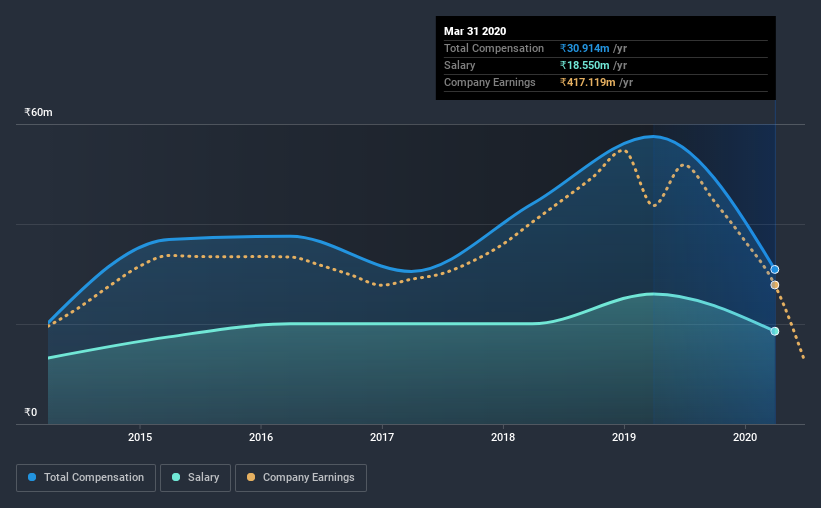

Our data indicates that M M Forgings Limited has a market capitalization of ₹8.4b, and total annual CEO compensation was reported as ₹31m for the year to March 2020. That's a notable decrease of 46% on last year. Notably, the salary which is ₹18.6m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under ₹15b, the reported median total CEO compensation was ₹6.2m. Hence, we can conclude that Vidyashankar Krishnan is remunerated higher than the industry median. Moreover, Vidyashankar Krishnan also holds ₹1.0b worth of M M Forgings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

On an industry level, around 94% of total compensation represents salary and 6.1% is other remuneration. M M Forgings sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

M M Forgings Limited's Growth

Over the last three years, M M Forgings Limited has shrunk its earnings per share by 26% per year. In the last year, its revenue is down 33%.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has M M Forgings Limited Been A Good Investment?

Given the total shareholder loss of 17% over three years, many shareholders in M M Forgings Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

As previously discussed, Vidyashankar is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. This doesn't look good against shareholder returns, which have been negative for the past three years. To make matters worse, EPS growth has also been negative during this period. Considering such poor performance, we think shareholders might be concerned if the CEO's compensation were to grow.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 4 warning signs for M M Forgings you should be aware of, and 1 of them can't be ignored.

Important note: M M Forgings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading M M Forgings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:MMFL

M M Forgings

Manufactures and sells steel forgings in India.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

EU#1 - From German Startup to EU’s Biggest Company

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Amazon - A Fundamental and Historical Valuation

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion