Philippe Brassac became the CEO of Crédit Agricole S.A. (EPA:ACA) in 2015, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Crédit Agricole

Comparing Crédit Agricole S.A.'s CEO Compensation With the industry

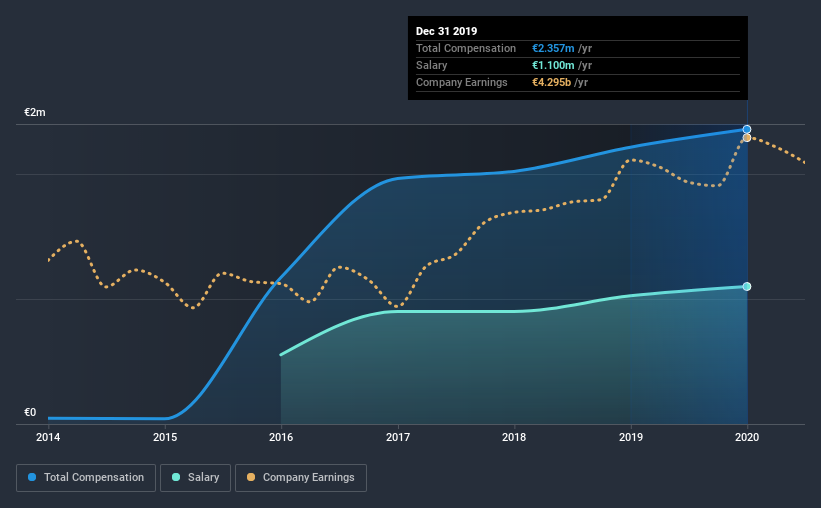

At the time of writing, our data shows that Crédit Agricole S.A. has a market capitalization of €24b, and reported total annual CEO compensation of €2.4m for the year to December 2019. That's just a smallish increase of 6.4% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at €1.1m.

In comparison with other companies in the industry with market capitalizations over €6.8b , the reported median total CEO compensation was €2.1m. So it looks like Crédit Agricole compensates Philippe Brassac in line with the median for the industry.

Talking in terms of the industry, salary represented approximately 66% of total compensation out of all the companies we analyzed, while other remuneration made up 34% of the pie. In Crédit Agricole's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Crédit Agricole S.A.'s Growth Numbers

Over the past three years, Crédit Agricole S.A. has seen its earnings per share (EPS) grow by 15% per year. It saw its revenue drop 2.3% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Crédit Agricole S.A. Been A Good Investment?

Given the total shareholder loss of 37% over three years, many shareholders in Crédit Agricole S.A. are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As previously discussed, Philippe is compensated close to the median for companies of its size, and which belong to the same industry. At the same time, the company has logged negative shareholder returns over the last three years. However, earnings growth is positive over the same time frame. Considering positive earnings growth, we'd say compensation is fair, but shareholders may be wary of a bump in pay before the company logs positive returns.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for Crédit Agricole that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Crédit Agricole or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:ACA

Crédit Agricole

Provides retail and corporate banking, insurance, and investment banking products and services in France, Italy, rest of the European Union, rest of Europe, North America, Central and South America, Africa, the Middle East, the Asia Pacific, and Japan.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Sezzle's Profits to Soar with 27% Margin Boost

Beacon Trade and Vertical Integration leading Growth. However, economic headwinds and store rollouts could continue to fuel OpEx

High-Tech Precision Play

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Looks interesting, I am jumping into the finances now. Your 15% margin seems high for a conservative model, can't just ignore the years they need to invest. You didnt seem to mention that they had to dilute the sharebase by issuing ~40mil shares. raising ~8 mil. should be enough if mouse does OK. If not they will need to raise more to suvive. Losing 20m a year, 14m after there 6m cutbacks. Am I reading it right that they have no debt. have they any history of raising debt? First look it is too dependant on the mouse and GoT games. they do well stock will 2-3x, poorly and it will drop. I am not sure I agree with your work for hire backstop. Unlikely meta horizons will continue with the same size contract going forward. say 10% margins and 15x multiple on 30m. that is 45m, which with the new sharecount is 10c. It is a backstop but maybe not that strong. Mouse fails and devs could start jumping ship and outside contracts could dry up. Hmm on top of all that AI could be disrupting the work for hire model. I think I have mostly talked myself out of it. Although Mouse looks good and does seem like the type of game that could go viral on twitch for a few months. If it does you will likly get a great return 5x plus. crap maybe I am talking myself back in.