- United Kingdom

- /

- Basic Materials

- /

- LSE:IBST

3 UK Stocks That May Be Trading At An Estimated Discount Of Up To 42.6%

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index closing lower amid weak trade data from China, highlighting concerns about global economic recovery. In such an environment, identifying stocks that may be trading at an estimated discount can offer potential opportunities for investors seeking value amidst broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £5.894 | £11.72 | 49.7% |

| Victrex (LSE:VCT) | £7.82 | £15.58 | 49.8% |

| Just Group (LSE:JUST) | £1.476 | £2.95 | 50% |

| Informa (LSE:INF) | £7.972 | £14.49 | 45% |

| Huddled Group (AIM:HUD) | £0.033 | £0.06 | 44.8% |

| Gooch & Housego (AIM:GHH) | £5.46 | £10.92 | 50% |

| GlobalData (AIM:DATA) | £1.72 | £3.09 | 44.3% |

| Entain (LSE:ENT) | £7.414 | £13.57 | 45.4% |

| Duke Capital (AIM:DUKE) | £0.30 | £0.54 | 44.2% |

| Deliveroo (LSE:ROO) | £1.757 | £3.12 | 43.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Hollywood Bowl Group (LSE:BOWL)

Overview: Hollywood Bowl Group plc operates ten-pin bowling and mini-golf centers in the United Kingdom and internationally, with a market cap of £439.86 million.

Operations: The company generates revenue from its ten-pin bowling and mini-golf centers, amounting to £240.46 million in the recreational activities segment.

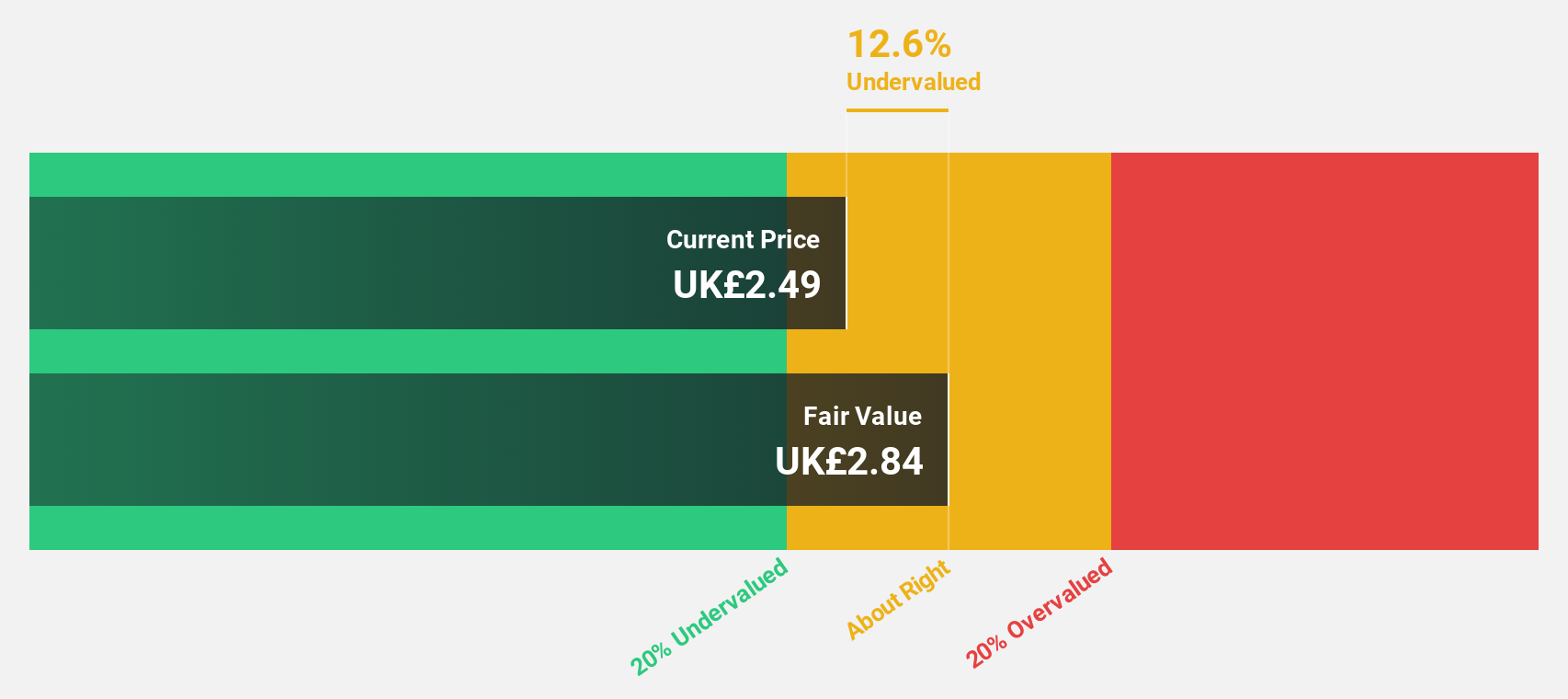

Estimated Discount To Fair Value: 10.2%

Hollywood Bowl Group is trading at a good value, 10.2% below its fair value estimate of £2.9, with analysts expecting a 51.4% price increase. Despite an unstable dividend track record, the company shows promise with earnings forecasted to grow faster than the UK market at 14.5%. Recent half-year results revealed revenue growth to £129.25 million from £119.19 million, although net income slightly decreased to £20.63 million from £21.95 million last year.

- Upon reviewing our latest growth report, Hollywood Bowl Group's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Hollywood Bowl Group.

Coats Group (LSE:COA)

Overview: Coats Group plc, with a market cap of £1.22 billion, operates globally in thread manufacturing and produces structural components for apparel and footwear as well as performance materials.

Operations: The company generates revenue from three primary segments: Apparel ($769.80 million), Footwear ($403.50 million), and Performance Materials ($327.60 million).

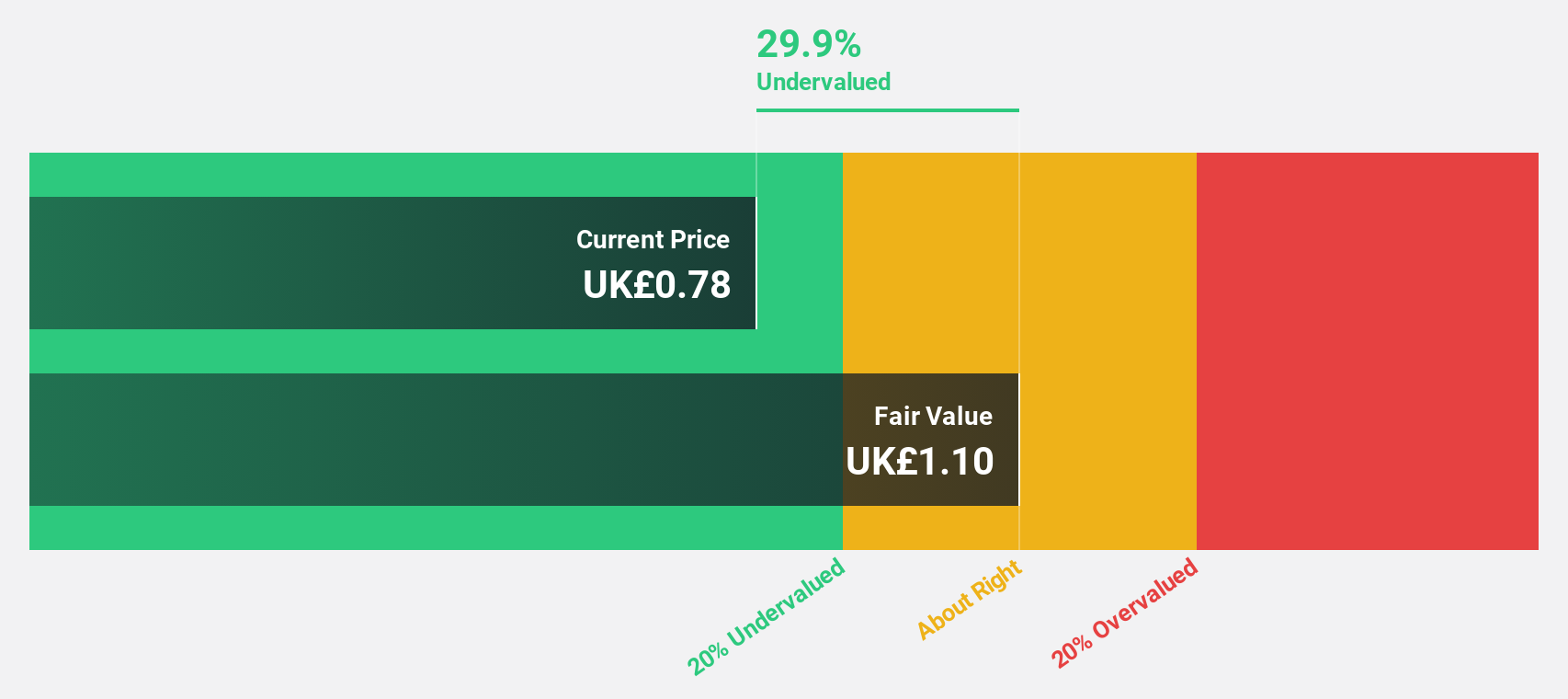

Estimated Discount To Fair Value: 29.5%

Coats Group is trading at a significant discount, 29.5% below its estimated fair value of £1.09, with earnings expected to grow significantly faster than the UK market at 21.2%. Recent strategic decisions, including exiting non-core operations in the Americas Yarns business, are poised to enhance EBIT margins and generate modest cash inflows. Despite high-quality earnings impacted by one-off items and debt concerns relative to operating cash flow, analysts foresee a 53.5% price increase potential.

- Insights from our recent growth report point to a promising forecast for Coats Group's business outlook.

- Navigate through the intricacies of Coats Group with our comprehensive financial health report here.

Ibstock (LSE:IBST)

Overview: Ibstock plc manufactures and sells clay and concrete building products for the residential construction sector in the United Kingdom, with a market cap of £743.53 million.

Operations: The company generates revenue from its clay segment, amounting to £248.76 million, and its concrete segment, contributing £117.44 million.

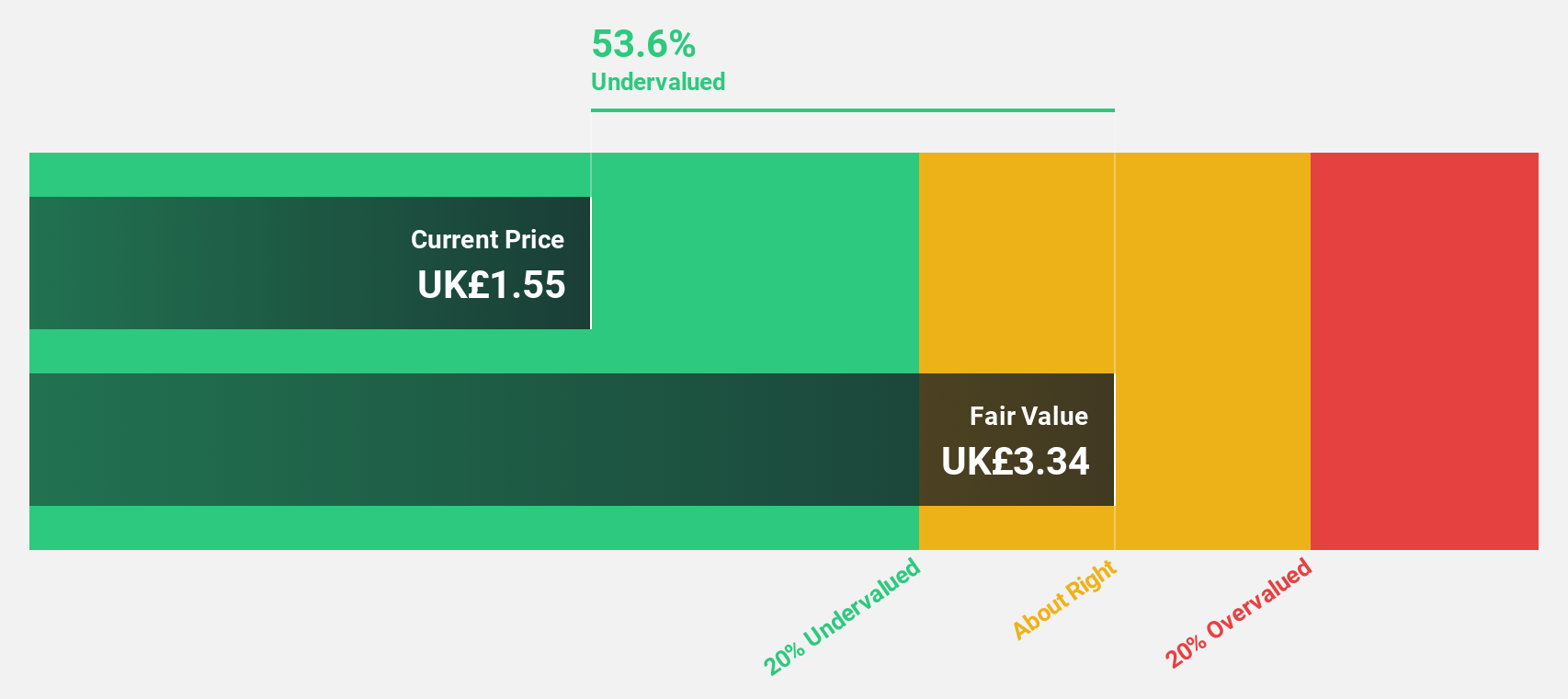

Estimated Discount To Fair Value: 42.6%

Ibstock is trading 42.6% below its estimated fair value of £3.28, with earnings anticipated to grow significantly at 31.7% annually, outpacing the UK market. Despite a low forecasted return on equity (13.8%) and recent executive changes including a new Chair and CFO departure, the company remains undervalued based on discounted cash flow analysis. Revenue growth is expected at 9% per year, surpassing the broader market's pace but not reaching high-growth thresholds.

- The analysis detailed in our Ibstock growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Ibstock.

Seize The Opportunity

- Explore the 50 names from our Undervalued UK Stocks Based On Cash Flows screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IBST

Ibstock

Manufactures and sells clay and concrete building products and solutions to customers in the residential construction sector in the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives