- United Kingdom

- /

- Oil and Gas

- /

- LSE:PHAR

3 UK Penny Stocks With Market Caps Under £200M To Consider

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China that highlighted ongoing challenges in the global economy. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain an intriguing area for potential value. By focusing on those with robust financials and clear growth prospects, these stocks can offer opportunities for both stability and upside potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.025 | £452.99M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.65 | £375.66M | ✅ 5 ⚠️ 3 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.82 | £1.13B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.42 | £426.14M | ✅ 2 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.89 | £298.52M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.04 | £165.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.33 | £72.9M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 405 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Michelmersh Brick Holdings (AIM:MBH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Michelmersh Brick Holdings plc, along with its subsidiaries, manufactures and sells bricks and brick prefabricated products in the United Kingdom and Europe, with a market cap of £108.28 million.

Operations: The company generates revenue of £70.11 million from its Building Products segment.

Market Cap: £108.28M

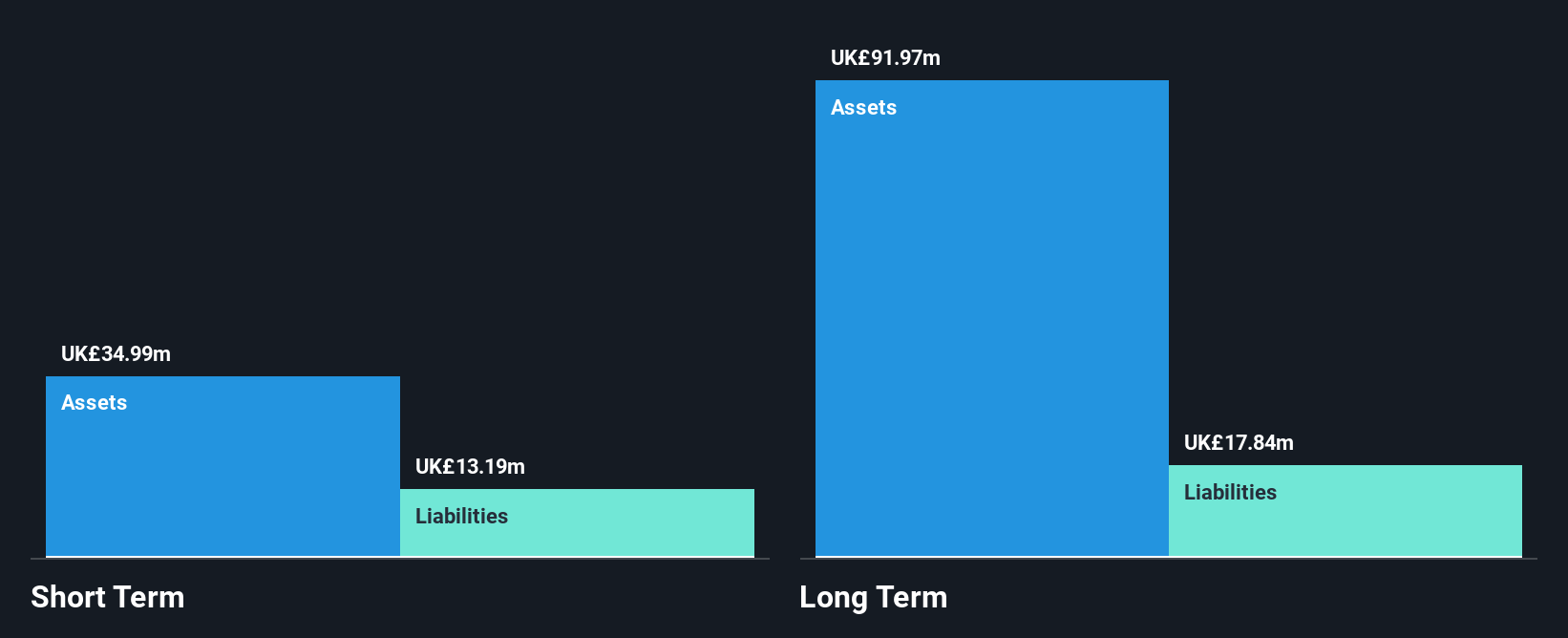

Michelmersh Brick Holdings plc, with a market cap of £108.28 million, has demonstrated financial stability by maintaining a debt-free balance sheet and covering its short-term liabilities with assets of £35.0 million against £13.2 million in liabilities. Despite a recent decline in earnings growth and profit margins from 12.5% to 8.7%, the company is projected to grow earnings by 16.57% annually according to analyst forecasts. Recent strategic moves include a share buyback program worth up to £2 million and consistent dividend payments, signaling efforts to enhance shareholder value amidst fluctuating sales figures (£70.11 million down from £77.34 million).

- Unlock comprehensive insights into our analysis of Michelmersh Brick Holdings stock in this financial health report.

- Learn about Michelmersh Brick Holdings' future growth trajectory here.

Somero Enterprises (AIM:SOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Somero Enterprises, Inc. designs, assembles, remanufactures, sells, and distributes concrete leveling, contouring, and placing equipment with a market cap of £139.47 million.

Operations: The company's revenue primarily comes from its Construction Machinery & Equipment segment, which generated $109.15 million.

Market Cap: £139.47M

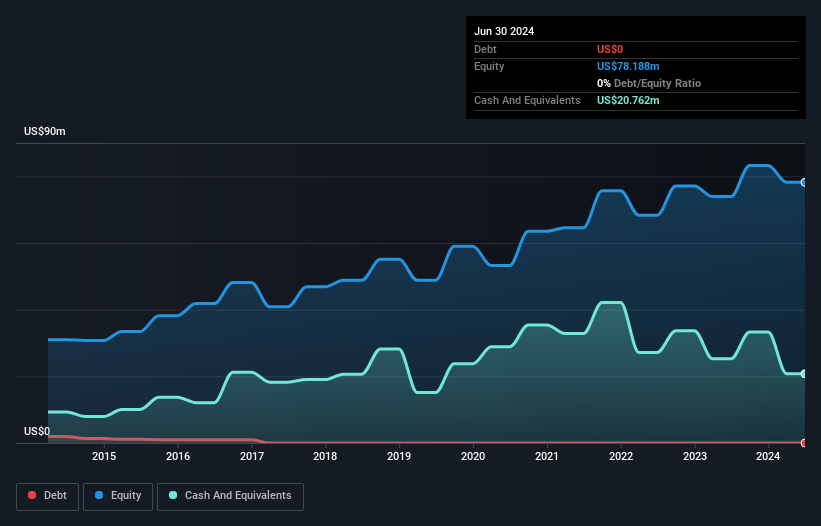

Somero Enterprises, with a market cap of £139.47 million, operates debt-free and maintains strong financial health by covering short-term liabilities with assets of US$61.4 million against US$11.5 million in liabilities. Despite recent challenges such as a decline in net income from US$27.98 million to US$18.6 million and reduced revenue guidance for 2025 to approximately US$105 million, the company continues to distribute dividends, albeit at lower levels than previous years. Recent leadership changes include the appointment of Timothy Averkamp as CEO and Robert Scheuer as Non-Executive Chairman, bringing significant industry experience to drive strategic growth initiatives forward.

- Take a closer look at Somero Enterprises' potential here in our financial health report.

- Gain insights into Somero Enterprises' past trends and performance with our report on the company's historical track record.

Pharos Energy (LSE:PHAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pharos Energy plc is an independent energy company engaged in the exploration, development, and production of oil and gas properties in Vietnam and Egypt with a market cap of £83.19 million.

Operations: Pharos Energy generates its revenue primarily from its operations in SE Asia, contributing $115.4 million, and Egypt, which adds $20.7 million.

Market Cap: £83.19M

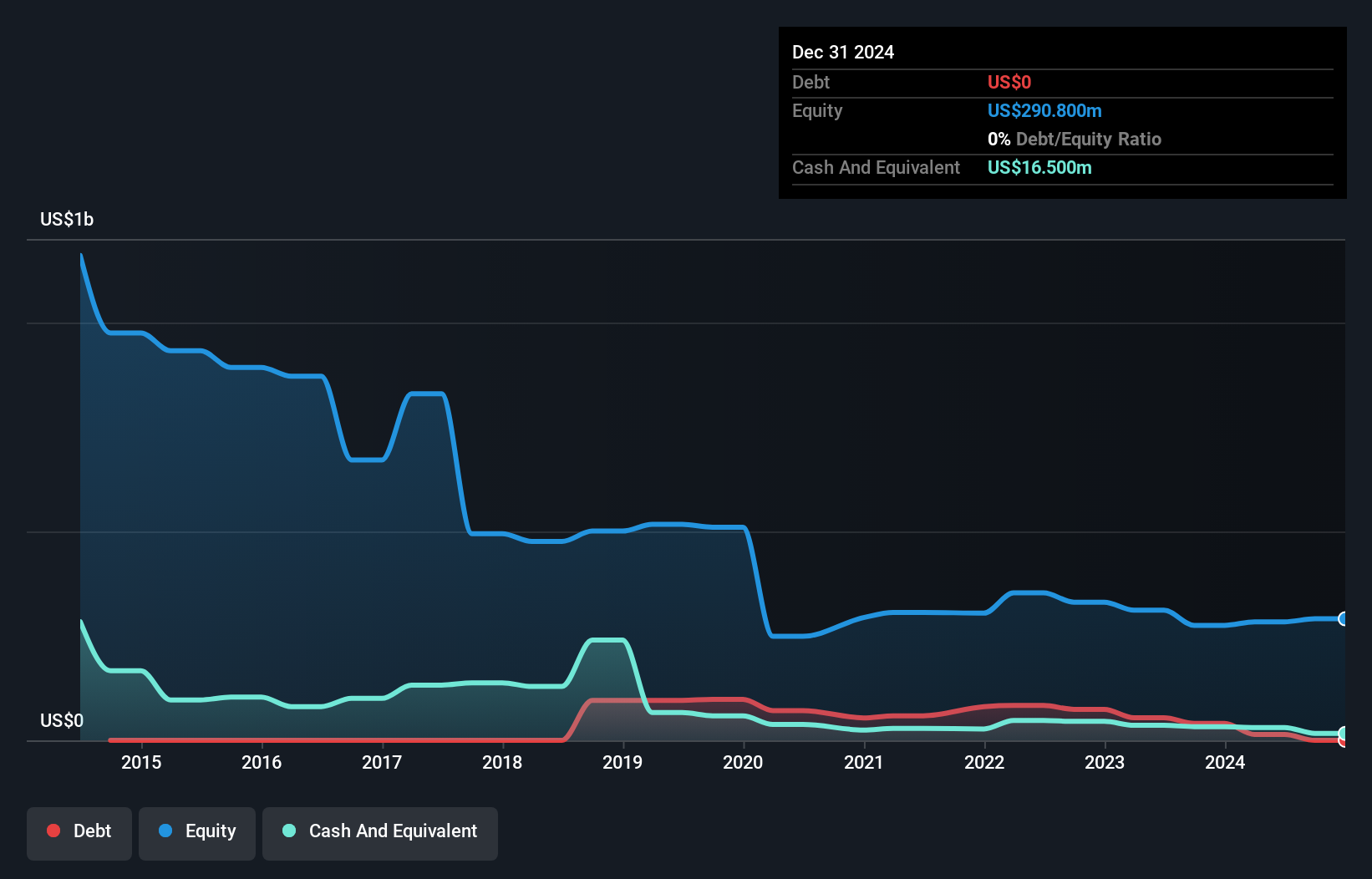

Pharos Energy, with a market cap of £83.19 million, operates without debt and has recently become profitable, reporting net income of US$23.6 million in 2024 compared to a loss the previous year. Despite its earnings volatility and high share price fluctuations, the company declared a final dividend of 0.847 pence per share for 2025, indicating commitment to shareholder returns amid an unstable dividend history. While short-term assets cover liabilities comfortably at US$74 million against US$17.7 million in obligations, long-term liabilities remain uncovered by current assets at US$118.8 million, posing potential financial pressure moving forward.

- Get an in-depth perspective on Pharos Energy's performance by reading our balance sheet health report here.

- Examine Pharos Energy's earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Click through to start exploring the rest of the 402 UK Penny Stocks now.

- Want To Explore Some Alternatives? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PHAR

Pharos Energy

An independent energy company, explores, develops, and produce oil and gas properties in Vietnam and Egypt.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives