- United Kingdom

- /

- Capital Markets

- /

- AIM:PEEL

3 UK Penny Stocks With Market Caps Over £10M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market fluctuations, penny stocks remain an intriguing investment area for those seeking potential growth opportunities in smaller or newer companies. While the term "penny stock" may seem outdated, it still signifies a sector where investors can find value and growth when these companies are backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.21 | £300.14M | ✅ 5 ⚠️ 0 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.99 | £448.68M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.47 | £361.12M | ✅ 5 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.912 | £1.19B | ✅ 4 ⚠️ 2 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.766 | £64.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.385 | £41.66M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.38 | £422.29M | ✅ 2 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.085 | £173.09M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.32 | £72.42M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 407 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ANGLE (AIM:AGL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ANGLE plc is a medical diagnostic company focused on developing cancer diagnostics products across the United Kingdom, Europe, North America, and internationally, with a market cap of £24.92 million.

Operations: The company's revenue is primarily generated from its Parsortix segment, amounting to £2.86 million.

Market Cap: £24.92M

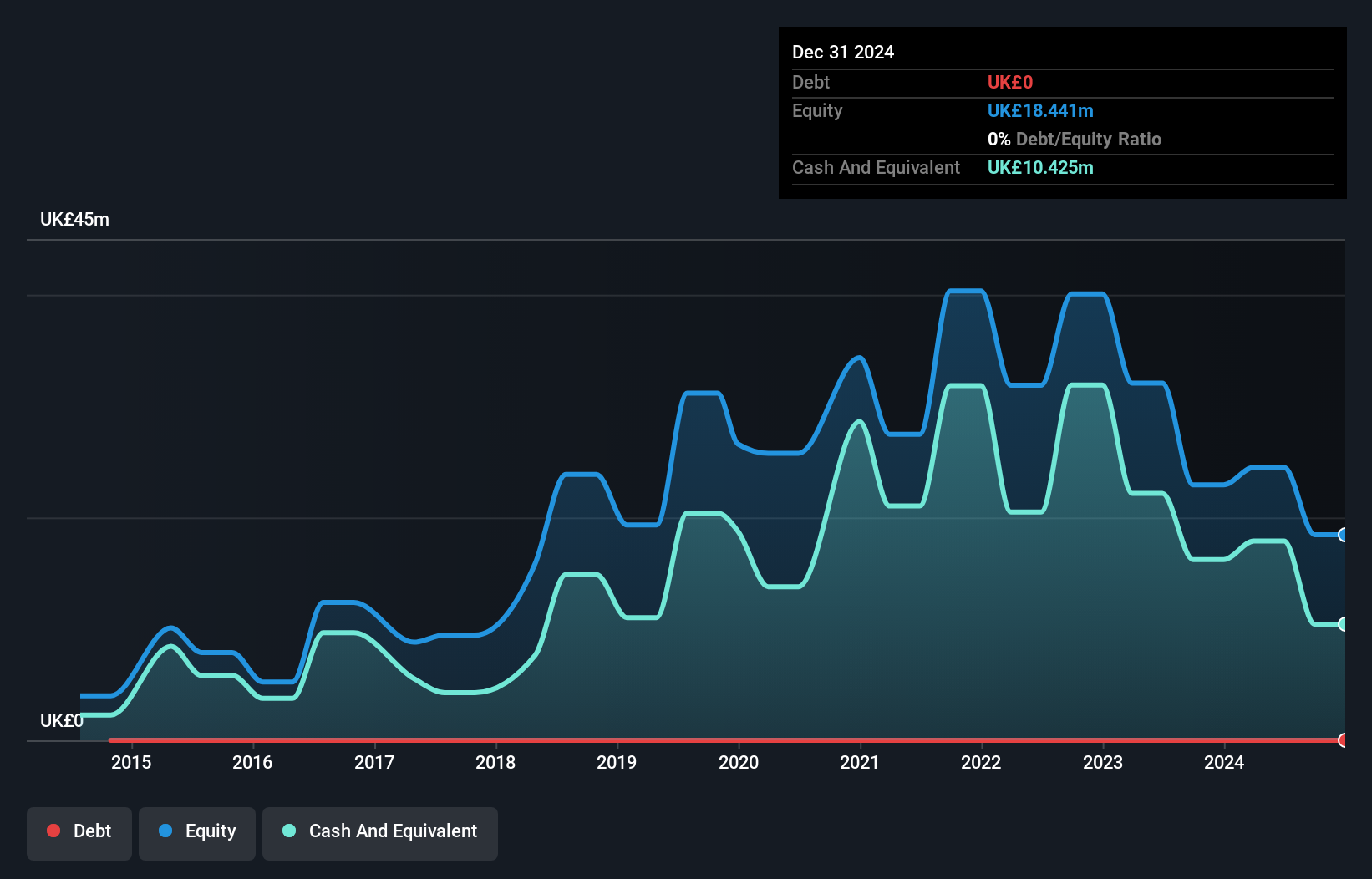

ANGLE plc, with a market cap of £24.92 million, operates in the medical diagnostics space but remains unprofitable and has less than a year of cash runway. Despite generating £2.86 million in revenue from its Parsortix segment, the company faces significant challenges as highlighted by its auditor's going concern doubts. Recent board changes add to uncertainties, although the presentation of promising new data on their HER2-CTC assay offers potential growth prospects. The stock exhibits high volatility and lacks meaningful revenue streams while maintaining a debt-free position with short-term assets covering both short and long-term liabilities.

- Navigate through the intricacies of ANGLE with our comprehensive balance sheet health report here.

- Examine ANGLE's earnings growth report to understand how analysts expect it to perform.

Catalyst Media Group (AIM:CMX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Catalyst Media Group plc provides business administrative services globally and has a market cap of £12.62 million.

Operations: The company's revenue segment includes Business Administrative Services generating £0.03 million.

Market Cap: £12.62M

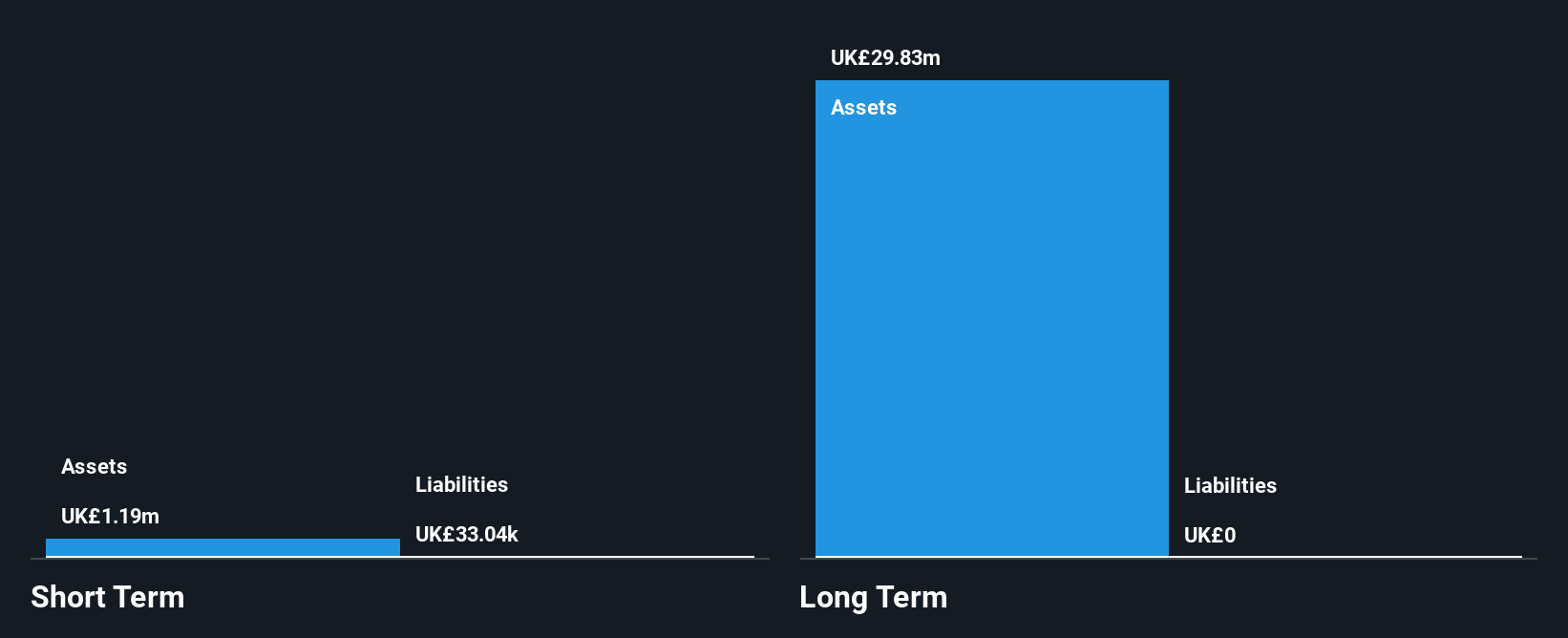

Catalyst Media Group plc, with a market cap of £12.62 million, remains pre-revenue with only £25K in sales and is currently unprofitable. The company has no debt and its short-term assets of £1.2 million comfortably cover liabilities of £33K. Despite reducing losses by 19% annually over the past five years, it reported a net loss of £0.41 million for the recent half year ended December 2024. The stock shows high volatility, increasing from 7% to 13% weekly over the past year, while trading at a significant discount to its estimated fair value without meaningful shareholder dilution recently.

- Click to explore a detailed breakdown of our findings in Catalyst Media Group's financial health report.

- Review our historical performance report to gain insights into Catalyst Media Group's track record.

Peel Hunt (AIM:PEEL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Peel Hunt Limited operates as an integrated investment banking firm in the United Kingdom, with a market capitalization of £108.07 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: £108.07M

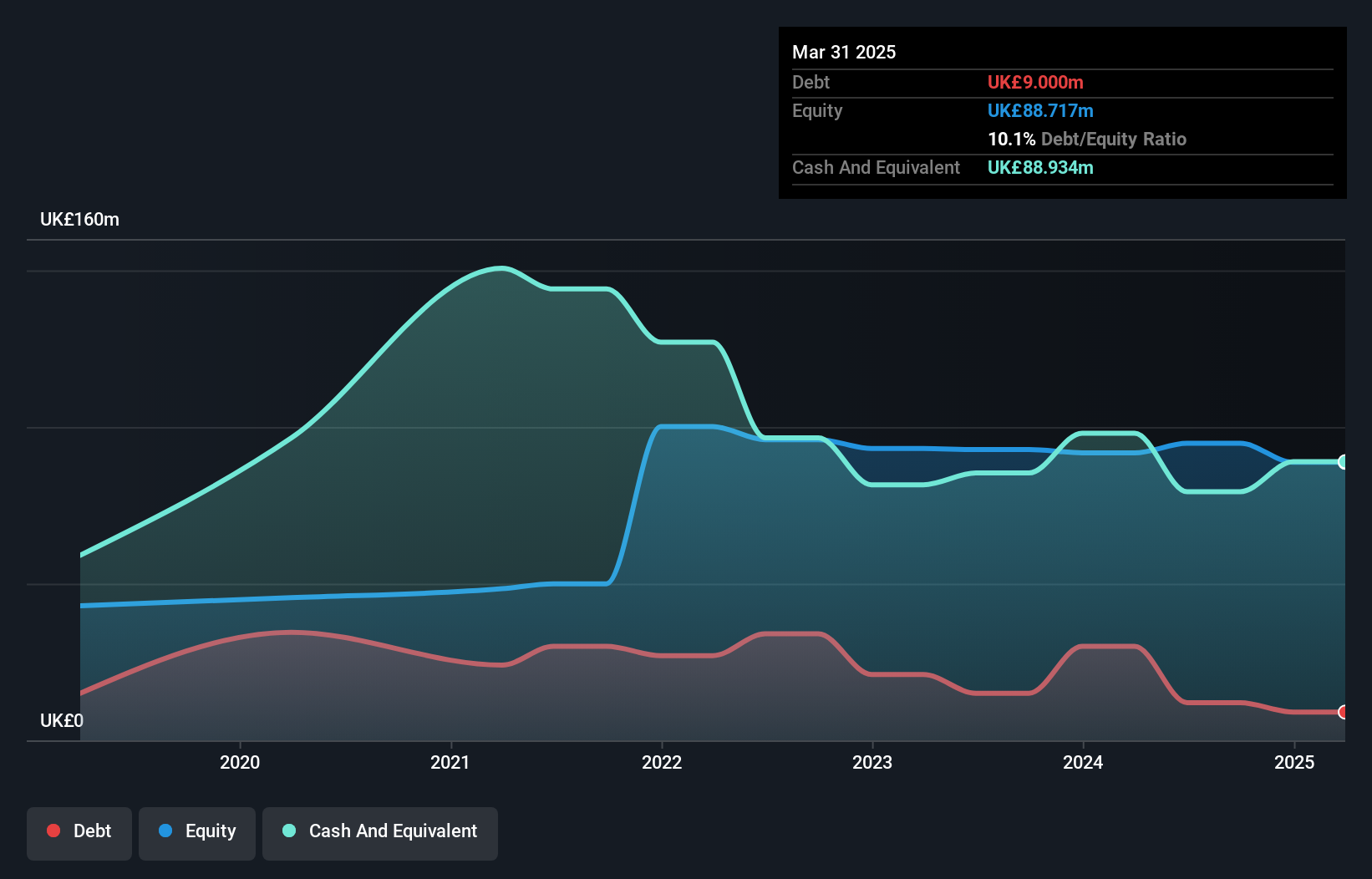

Peel Hunt Limited, with a market capitalization of £108.07 million, is navigating its financial challenges as it remains unprofitable with a recent net loss of £2.73 million for the year ended March 2025. Despite this, the company maintains strong liquidity with short-term assets (£553.3M) exceeding both short-term (£457.2M) and long-term liabilities (£23.6M), while having more cash than total debt and no significant shareholder dilution over the past year. Recent executive changes include appointing Billy Neve as Group Finance Director and Michael Lee as Chief Operating Officer to support strategic transitions within the firm.

- Dive into the specifics of Peel Hunt here with our thorough balance sheet health report.

- Assess Peel Hunt's future earnings estimates with our detailed growth reports.

Key Takeaways

- Embark on your investment journey to our 407 UK Penny Stocks selection here.

- Contemplating Other Strategies? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PEEL

Peel Hunt

Engages in the integrated investment banking business in the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives