- Canada

- /

- Consumer Finance

- /

- TSX:MOGO

3 TSX Penny Stocks With Market Caps Under CA$700M

Reviewed by Simply Wall St

As the Canadian market navigates ongoing trade negotiations and economic fluctuations, investors are increasingly exploring diverse opportunities beyond traditional sectors. Penny stocks, though a somewhat outdated term, continue to represent smaller or newer companies that can offer unique investment prospects. By focusing on those with strong financials and potential for growth, investors may uncover promising opportunities in this often-overlooked segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.59 | CA$60.69M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.69 | CA$612.77M | ✅ 3 ⚠️ 4 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$1.95 | CA$98.55M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.78 | CA$498.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.97 | CA$19.62M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.15 | CA$156.33M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$176.45M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$5.65M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 449 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Mogo (TSX:MOGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mogo Inc. is a financial technology company operating in Canada, Europe, and internationally with a market cap of CA$42.25 million.

Operations: The company generates revenue from its Financial Services - Consumer segment, amounting to CA$41.50 million.

Market Cap: CA$42.25M

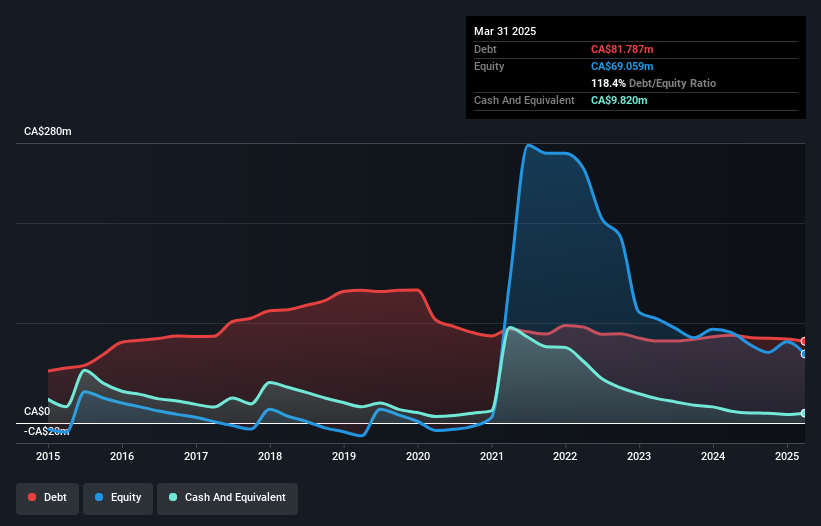

Mogo Inc., with a market cap of CA$42.25 million, has faced challenges typical of penny stocks, including high volatility and unprofitability. Despite a negative return on equity and increased losses over five years, Mogo maintains a substantial cash runway exceeding three years due to positive free cash flow. Its seasoned management team averages 13.9 years in tenure, providing stability amidst financial hurdles. Recent earnings reports show declining revenue and increased net losses compared to the previous year; however, the company expects its subscription and services revenue to grow at a mid-to-high single-digit rate this fiscal year.

- Jump into the full analysis health report here for a deeper understanding of Mogo.

- Gain insights into Mogo's outlook and expected performance with our report on the company's earnings estimates.

PetroTal (TSX:TAL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PetroTal Corp. is involved in the exploration, appraisal, and development of oil and natural gas in Peru, South America, with a market cap of CA$612.77 million.

Operations: The company's revenue is primarily derived from its oil and gas exploration and production activities, generating $340.62 million.

Market Cap: CA$612.77M

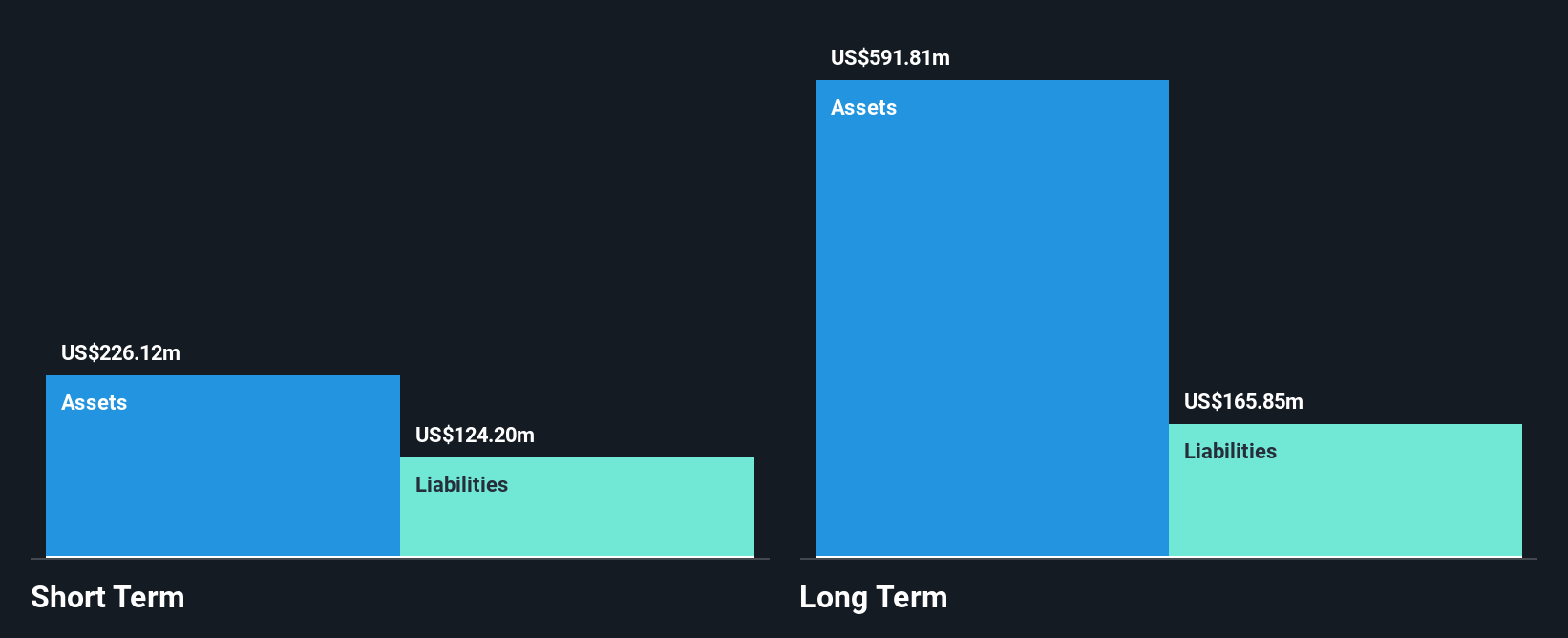

PetroTal Corp., with a market cap of CA$612.77 million, demonstrates some strengths and challenges typical of penny stocks. The company has a solid asset base, with short-term assets exceeding both its short- and long-term liabilities, while its debt is well covered by operating cash flow. Despite trading below estimated fair value, PetroTal faces declining earnings forecasts and reduced profit margins compared to last year. Recent initiatives include a share repurchase program aimed at enhancing shareholder returns and securing a $65 million loan for infrastructure investments in Peru's Bretana oil field, underscoring ongoing strategic development efforts amidst volatile oil prices.

- Get an in-depth perspective on PetroTal's performance by reading our balance sheet health report here.

- Gain insights into PetroTal's future direction by reviewing our growth report.

Orogen Royalties (TSXV:OGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orogen Royalties Inc. is a mineral exploration company active in Canada, the United States, Mexico, Argentina, Kenya, and Colombia with a market cap of CA$385.75 million.

Operations: The company generates revenue from its mineral exploration activities, amounting to CA$8.52 million.

Market Cap: CA$385.75M

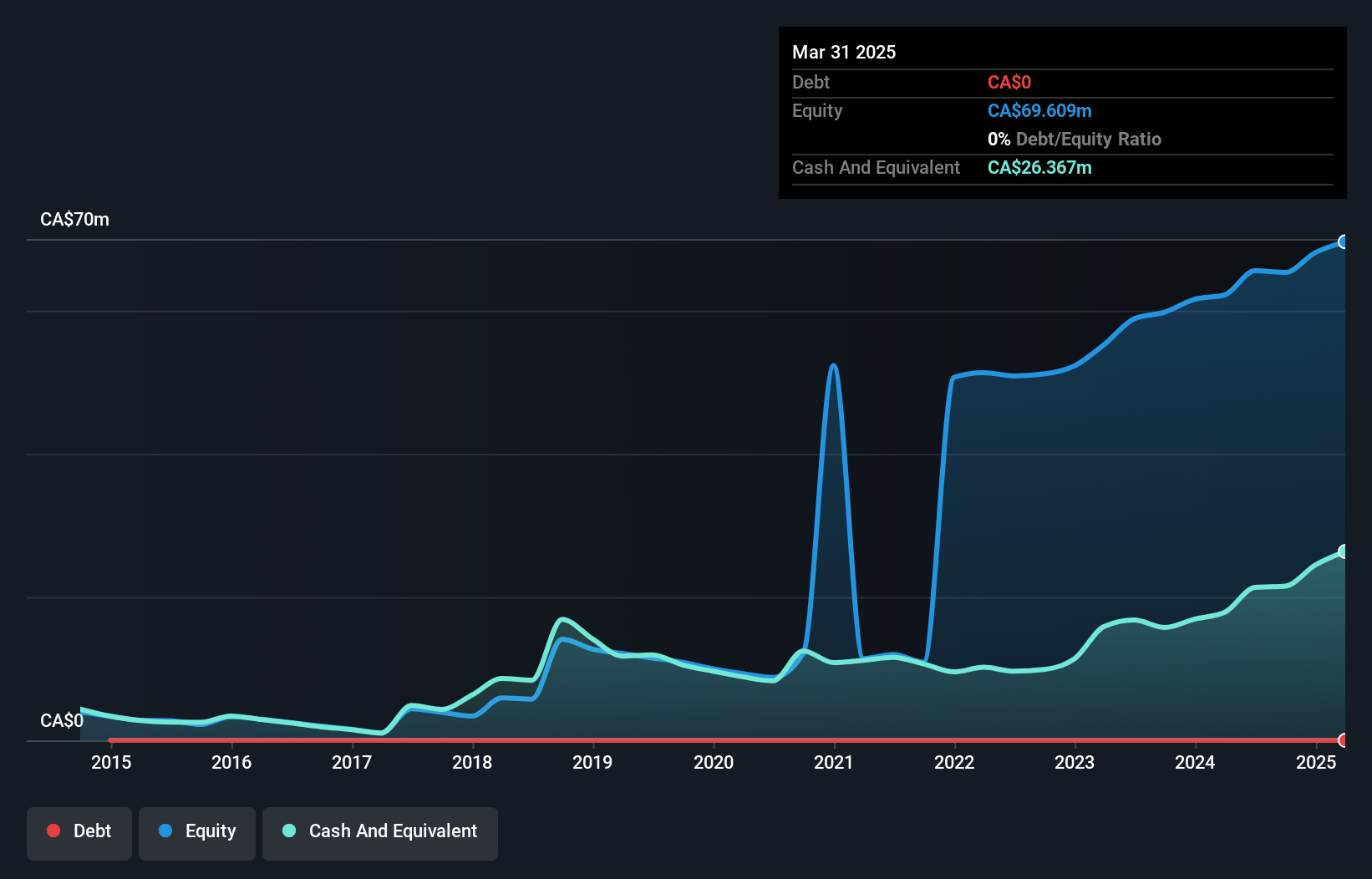

Orogen Royalties Inc., with a market cap of CA$385.75 million, exemplifies the complexities of penny stocks, showing both potential and challenges. The company is debt-free and has experienced significant earnings growth over the past five years, though recent profit margins have declined slightly. Orogen's short-term assets comfortably cover its liabilities, indicating financial stability. Despite lower returns on equity compared to industry standards, its management team and board are seasoned with substantial tenure. A major development is Triple Flag Precious Metals Corp.'s acquisition agreement valued at approximately CA$330 million, highlighting strategic shifts in Orogen's operational landscape.

- Take a closer look at Orogen Royalties' potential here in our financial health report.

- Understand Orogen Royalties' earnings outlook by examining our growth report.

Summing It All Up

- Discover the full array of 449 TSX Penny Stocks right here.

- Interested In Other Possibilities? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MOGO

Mogo

Operates as a financial technology company in Canada, Europe, and internationally.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives