- United States

- /

- Transportation

- /

- NasdaqGS:GRAB

3 Stocks Including Grab Holdings That Might Be Trading Below Estimated Value

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it has shown a 9.8% increase over the past year with earnings projected to grow by 15% annually. In such a climate, identifying stocks that might be trading below their estimated value can offer potential opportunities for investors looking to capitalize on future growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $23.99 | $47.92 | 49.9% |

| Shoals Technologies Group (SHLS) | $5.26 | $10.39 | 49.4% |

| Roku (ROKU) | $80.63 | $160.58 | 49.8% |

| Riverview Bancorp (RVSB) | $5.33 | $10.47 | 49.1% |

| Mid Penn Bancorp (MPB) | $26.41 | $52.26 | 49.5% |

| MetroCity Bankshares (MCBS) | $26.84 | $52.85 | 49.2% |

| Lincoln Educational Services (LINC) | $22.56 | $44.39 | 49.2% |

| German American Bancorp (GABC) | $36.86 | $72.97 | 49.5% |

| First Reliance Bancshares (FSRL) | $9.07 | $17.83 | 49.1% |

| Arrow Financial (AROW) | $24.88 | $49.74 | 50% |

We'll examine a selection from our screener results.

Grab Holdings (GRAB)

Overview: Grab Holdings Limited operates as a superapp provider in Southeast Asia, offering services across Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam with a market capitalization of approximately $19.42 billion.

Operations: The company's revenue is primarily derived from its Mobility segment at $1.08 billion, Deliveries at $1.56 billion, and Financial Services at $273 million.

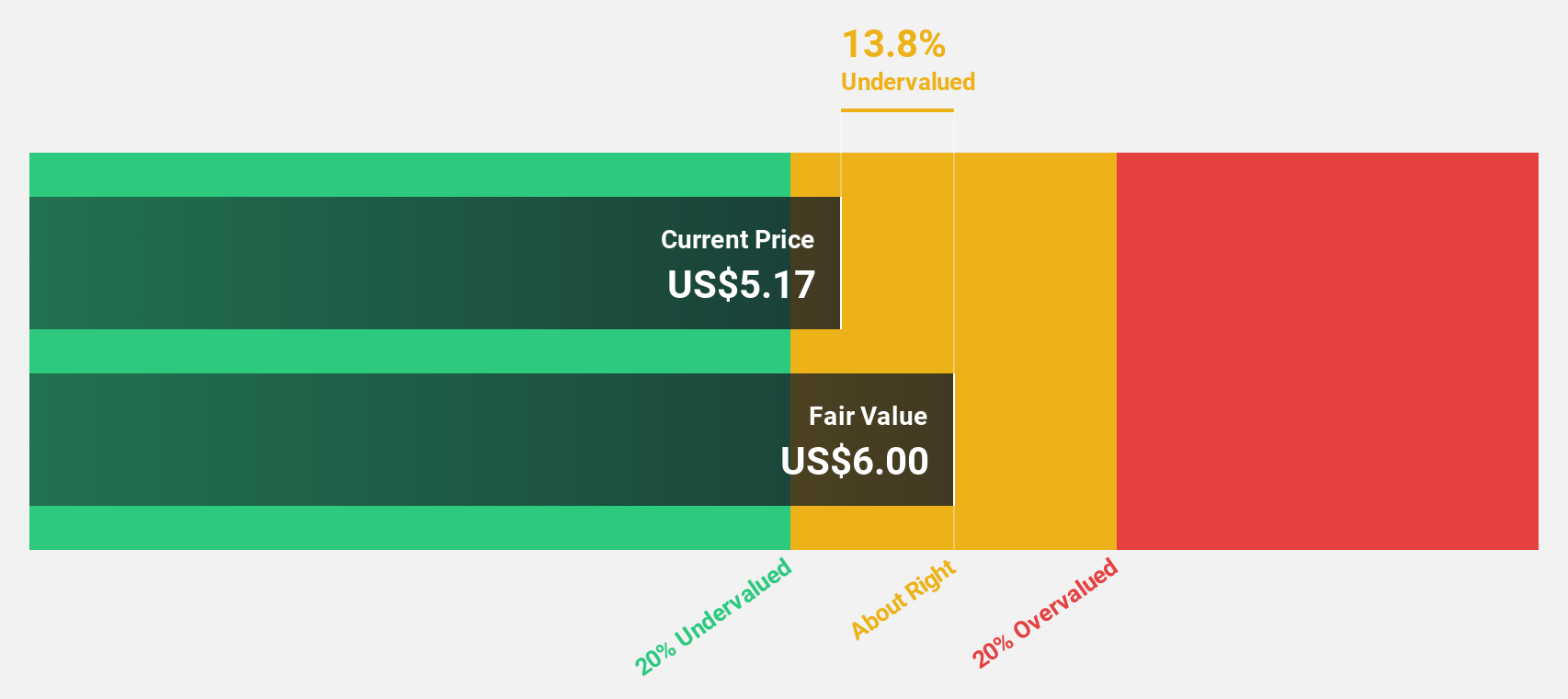

Estimated Discount To Fair Value: 19.8%

Grab Holdings is trading at US$4.80, about 19.8% below its estimated fair value of US$5.99, indicating potential undervaluation based on cash flows. Recent earnings show a shift to profitability with net income of US$10 million for Q1 2025, compared to a loss previously. Despite slower revenue growth forecasts at 14.2% annually, earnings are expected to grow significantly by over 40% per year, outpacing the broader US market's growth expectations.

- Upon reviewing our latest growth report, Grab Holdings' projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Grab Holdings' balance sheet health report.

Jabil (JBL)

Overview: Jabil Inc. offers manufacturing services and solutions globally, with a market cap of $19.41 billion.

Operations: Jabil's revenue segments include Electronics Manufacturing Services at $20.62 billion and Diversified Manufacturing Services at $13.48 billion.

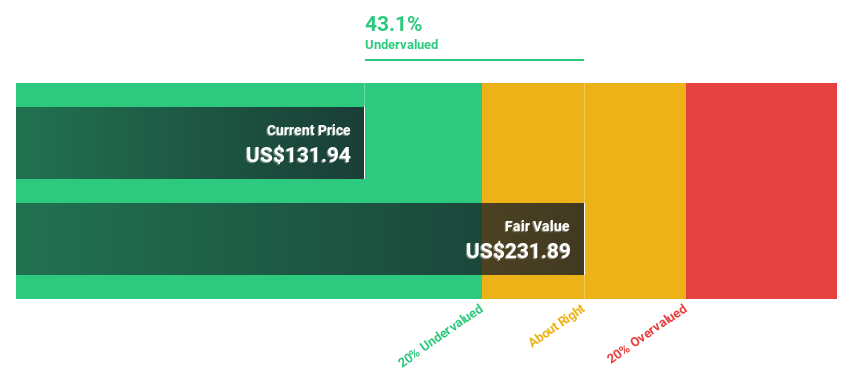

Estimated Discount To Fair Value: 11.7%

Jabil is trading at US$196.89, approximately 11.7% below its estimated fair value of US$222.93, suggesting it might be undervalued based on cash flows. Despite a drop in profit margins from 4.6% to 2%, earnings are forecast to grow significantly at nearly 25% annually, surpassing the broader market's growth rate of 14.5%. Recent earnings show an increase in quarterly net income to US$222 million from US$129 million year-on-year, highlighting strong financial performance amidst high debt levels.

- The analysis detailed in our Jabil growth report hints at robust future financial performance.

- Click here to discover the nuances of Jabil with our detailed financial health report.

Sea (SE)

Overview: Sea Limited operates as a consumer internet company through its subsidiaries, offering services in Southeast Asia, Latin America, the rest of Asia, and internationally with a market cap of $93.65 billion.

Operations: The company's revenue segments consist of E-Commerce at $13.19 billion, Digital Entertainment at $1.95 billion, and Digital Financial Services at $2.66 billion, along with Other Services contributing $131.44 million.

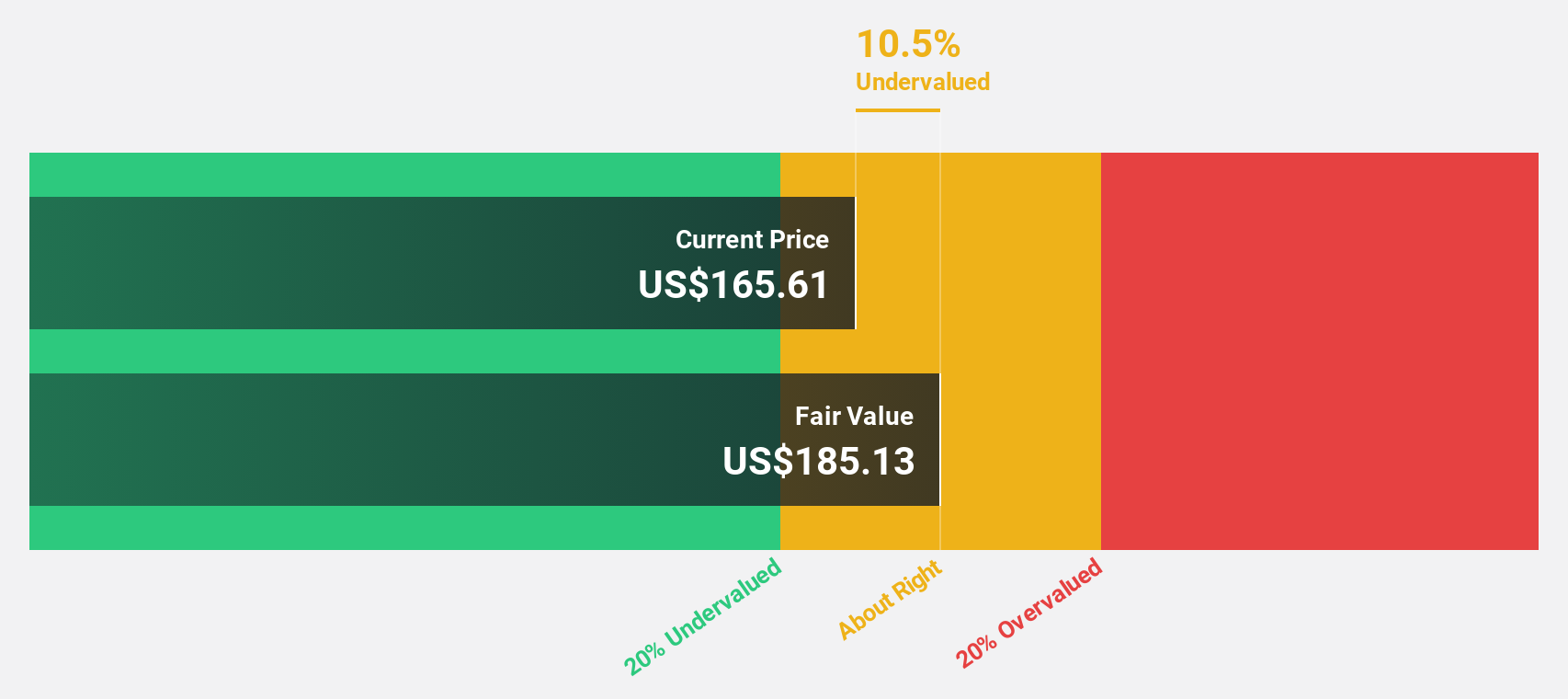

Estimated Discount To Fair Value: 15.1%

Sea is trading at US$157.27, approximately 15.1% below its estimated fair value of US$185.2, indicating potential undervaluation based on cash flows. Recent earnings show a substantial improvement with net income rising to US$403.05 million from a net loss of US$23.66 million year-on-year, reflecting robust financial performance. With forecasted earnings growth of 30.18% annually, Sea's growth outlook surpasses the broader market's projected rate of 14.5%, despite revenue growing slower than 20% per year.

- Our growth report here indicates Sea may be poised for an improving outlook.

- Get an in-depth perspective on Sea's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 171 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GRAB

Grab Holdings

Engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives