- United States

- /

- Healthcare Services

- /

- NasdaqGS:WGS

3 Stocks Including FinWise Bancorp Estimated To Be Priced Below Intrinsic Value

Reviewed by Simply Wall St

As the United States stock market experiences a period of gains with major indices like the Nasdaq, S&P 500, and Dow Jones Industrial Average posting solid weekly and monthly increases, investors are keenly observing opportunities that may be priced below their intrinsic value. In such an environment, identifying stocks that appear undervalued can be crucial for those looking to capitalize on potential market inefficiencies and enhance portfolio performance.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TowneBank (TOWN) | $32.51 | $64.47 | 49.6% |

| Similarweb (SMWB) | $8.55 | $16.92 | 49.5% |

| Owens Corning (OC) | $127.31 | $254.03 | 49.9% |

| Old National Bancorp (ONB) | $20.43 | $40.82 | 49.9% |

| NeuroPace (NPCE) | $9.94 | $19.59 | 49.3% |

| Huntington Bancshares (HBAN) | $15.44 | $30.88 | 50% |

| Eagle Bancorp (EGBN) | $16.75 | $33.24 | 49.6% |

| DexCom (DXCM) | $58.22 | $113.90 | 48.9% |

| Compass (COMP) | $7.71 | $15.15 | 49.1% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $19.43 | $38.00 | 48.9% |

Let's dive into some prime choices out of the screener.

FinWise Bancorp (FINW)

Overview: FinWise Bancorp is the bank holding company for FinWise Bank, offering a range of banking products and services to individual and corporate clients in Utah, with a market cap of $260.43 million.

Operations: The company's revenue is primarily generated from its banking segment, amounting to $80.20 million.

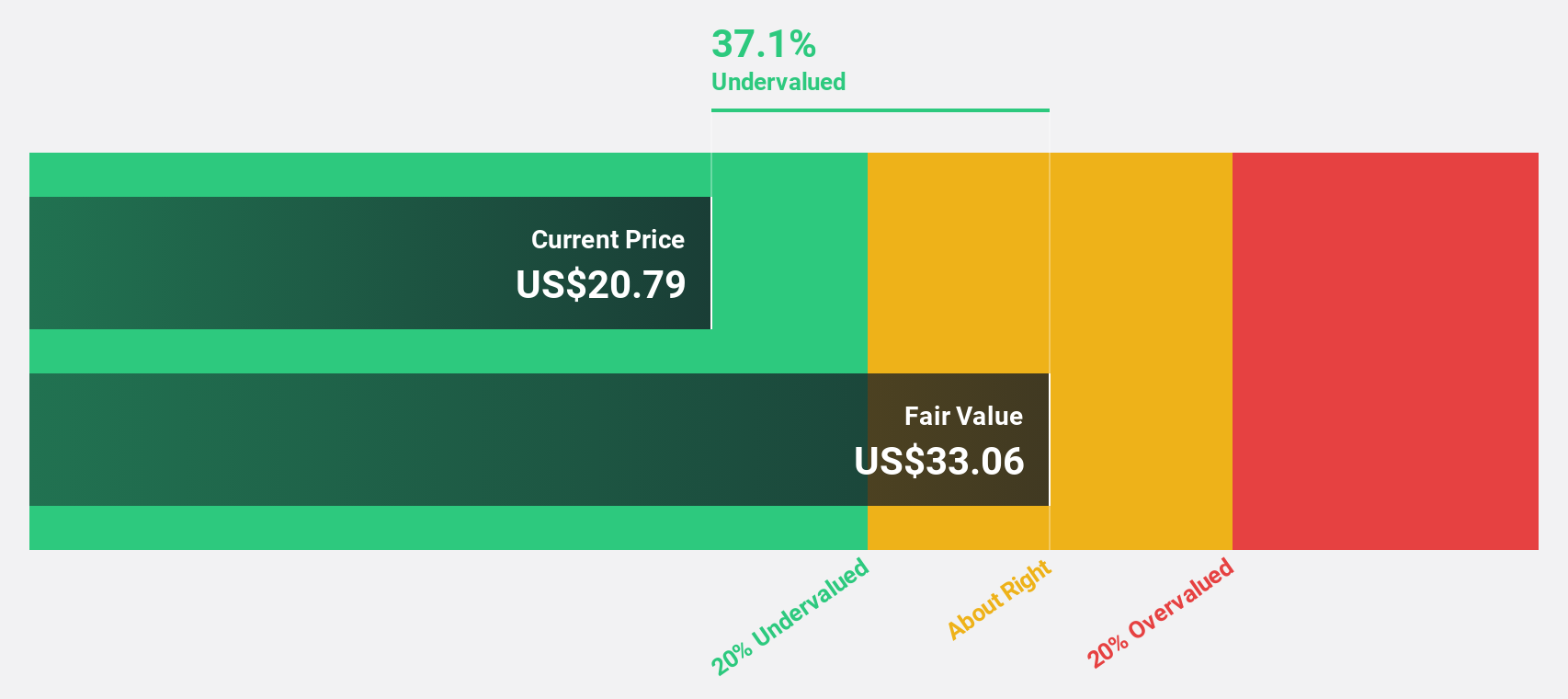

Estimated Discount To Fair Value: 39.6%

FinWise Bancorp appears undervalued, trading at US$19.19 against a fair value estimate of US$31.79, with earnings and revenue forecasted to grow significantly above market averages. Recent Q3 results show increased net income and interest income, though the company faces challenges with high non-performing loans and low allowance coverage. Strategic agreements with Tallied Technologies and DreamFi Inc. aim to diversify revenue streams through new credit card programs and financial services offerings, potentially enhancing future cash flows.

- Our earnings growth report unveils the potential for significant increases in FinWise Bancorp's future results.

- Click to explore a detailed breakdown of our findings in FinWise Bancorp's balance sheet health report.

Camden National (CAC)

Overview: Camden National Corporation is the bank holding company for Camden National Bank, offering a range of commercial and consumer banking products and services to various customer segments in the United States, with a market cap of $645.58 million.

Operations: The company generates revenue of $215.17 million from its banking products and services for a diverse clientele, including consumer, institutional, municipal, non-profit, and commercial customers in the U.S.

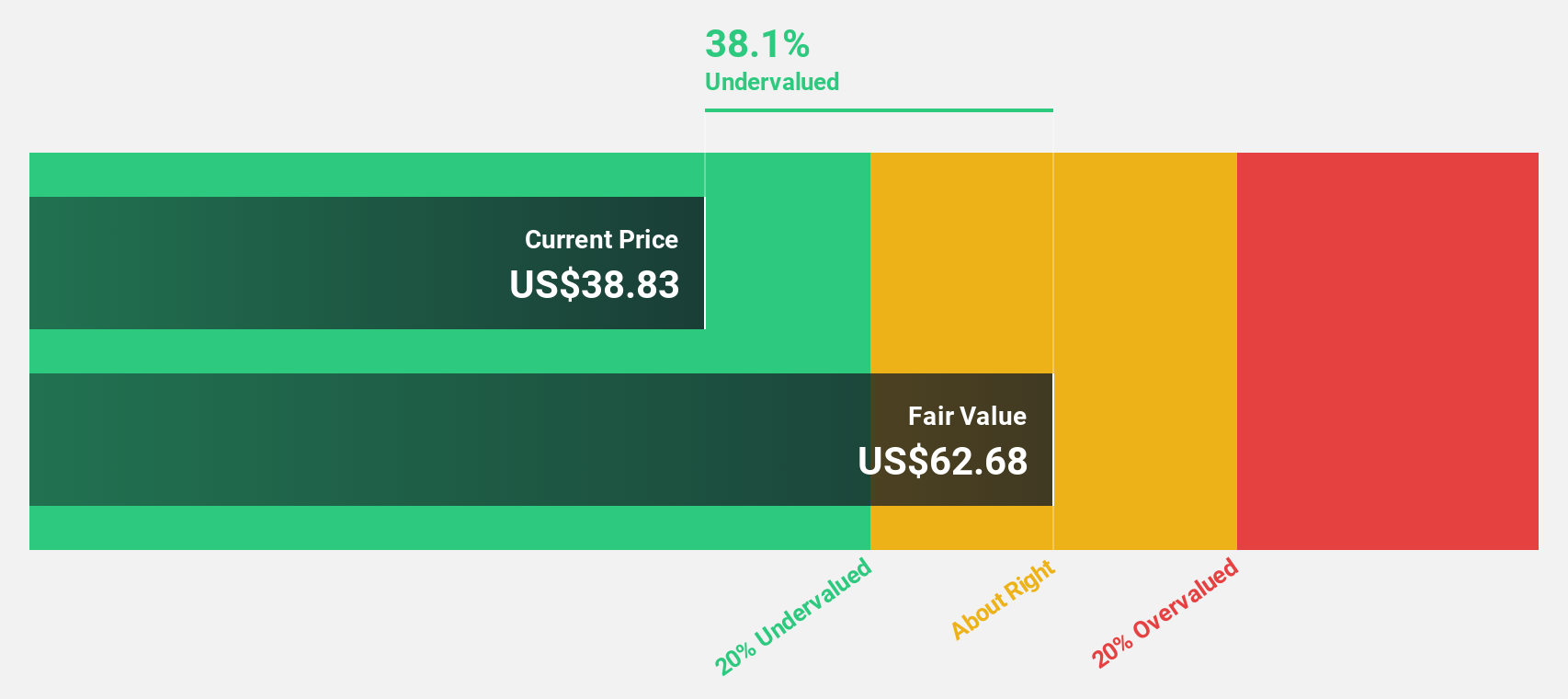

Estimated Discount To Fair Value: 39.9%

Camden National is trading at US$38.15, significantly below its estimated fair value of US$63.52, indicating potential undervaluation based on cash flows. Earnings are expected to grow 25.72% annually, outpacing the broader U.S. market growth forecast of 16.1%. Recent Q3 results highlight strong performance with net income rising to US$21.19 million from US$13.07 million year-over-year, though shareholder dilution remains a concern amidst reliable dividend payouts yielding 4.4%.

- Our expertly prepared growth report on Camden National implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Camden National.

GeneDx Holdings (WGS)

Overview: GeneDx Holdings Corp. is a genomics company that provides genetic testing services, with a market cap of approximately $3.96 billion.

Operations: The company's revenue is primarily derived from its Gene Dx segment, which generated $398.88 million.

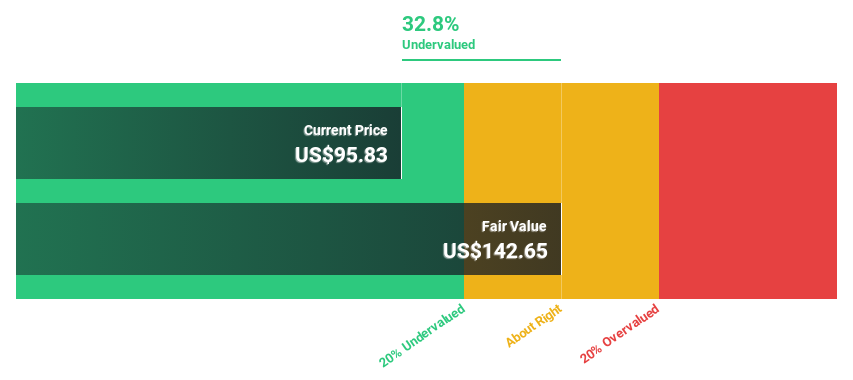

Estimated Discount To Fair Value: 44.6%

GeneDx Holdings is trading at US$136.91, well below its estimated fair value of US$247.23, suggesting it may be undervalued based on cash flows. The company became profitable this year and forecasts a significant 50% annual earnings growth over the next three years, surpassing the U.S. market's average growth rate. Despite recent insider selling, GeneDx raised its revenue guidance for 2025 and continues to expand its genomic testing capabilities with FDA Breakthrough Device Designation for innovative diagnostic technologies.

- According our earnings growth report, there's an indication that GeneDx Holdings might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of GeneDx Holdings.

Next Steps

- Delve into our full catalog of 170 Undervalued US Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WGS

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives