- United States

- /

- Pharma

- /

- NasdaqGM:PAHC

3 Stocks Estimated To Be Trading Below Fair Value In November 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a pullback with major indices like the Dow Jones, Nasdaq, and S&P 500 showing declines, investors are increasingly cautious amid mixed earnings reports and fluctuating tech shares. In such an environment, identifying stocks that are trading below their fair value can offer potential opportunities for those looking to invest in assets that may be undervalued by the market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TowneBank (TOWN) | $32.58 | $64.47 | 49.5% |

| Similarweb (SMWB) | $8.76 | $16.96 | 48.4% |

| Old National Bancorp (ONB) | $20.49 | $40.82 | 49.8% |

| NeuroPace (NPCE) | $9.40 | $19.57 | 52% |

| MoneyHero (MNY) | $1.30 | $2.55 | 49.1% |

| Eagle Bancorp (EGBN) | $16.81 | $33.24 | 49.4% |

| Crocs (CROX) | $81.16 | $158.03 | 48.6% |

| Compass (COMP) | $7.78 | $15.15 | 48.7% |

| CareTrust REIT (CTRE) | $35.31 | $70.12 | 49.6% |

| AbbVie (ABBV) | $211.96 | $421.58 | 49.7% |

We'll examine a selection from our screener results.

RMR Group (RMR)

Overview: The RMR Group Inc., through its subsidiary The RMR Group LLC, offers asset management services in the United States and has a market cap of approximately $493.02 million.

Operations: Revenue segments for RMR Group include Real Estate & Property Managers, contributing $194.99 million.

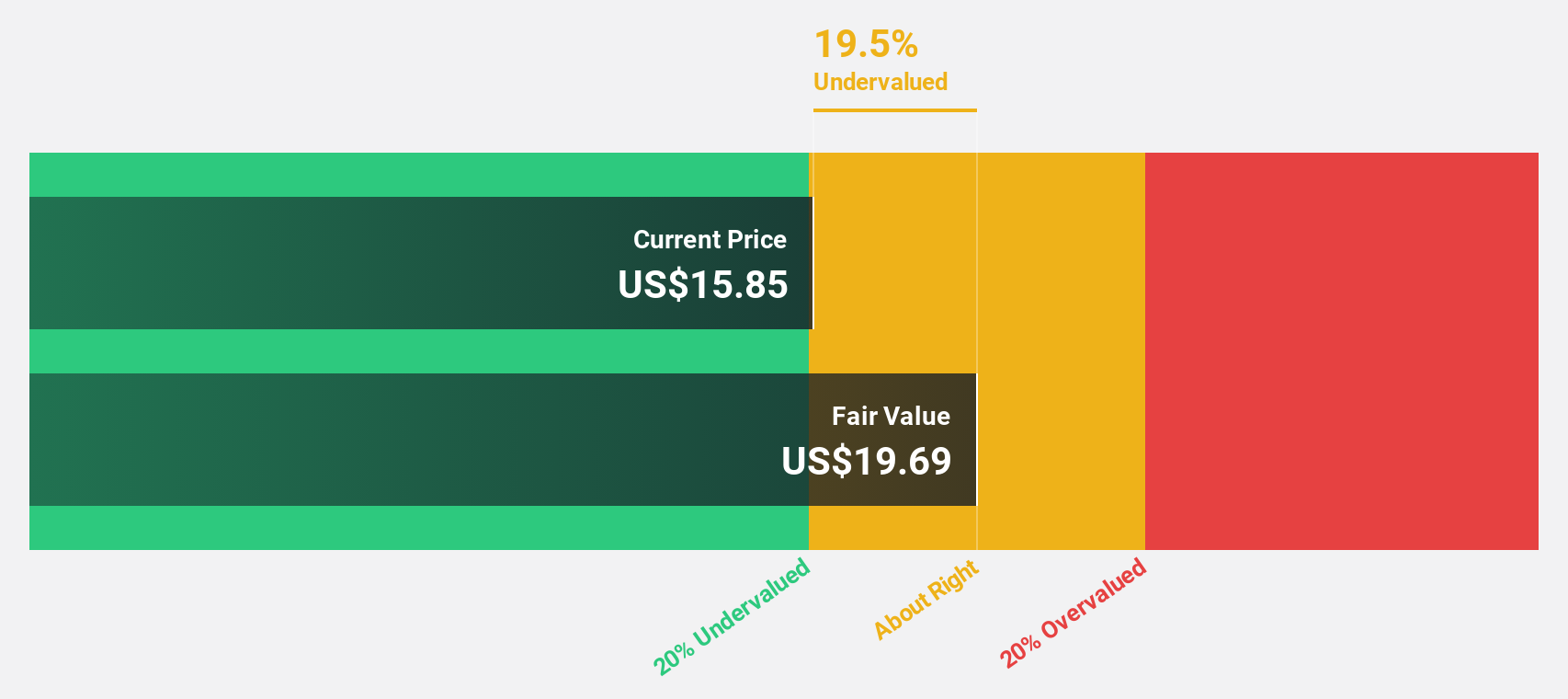

Estimated Discount To Fair Value: 20.2%

RMR Group, trading at US$15.5, is undervalued based on discounted cash flow analysis with a fair value estimate of US$19.43. Despite this, its 11.61% dividend isn't well covered by earnings or free cash flows, posing sustainability concerns. Revenue growth is robust at 71.5% annually, outpacing the market significantly; however, profit growth forecasts remain moderate at 17.83%. Recent executive changes may influence strategic direction and financial management effectiveness moving forward.

- Our expertly prepared growth report on RMR Group implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on RMR Group's balance sheet by reading our health report here.

Phibro Animal Health (PAHC)

Overview: Phibro Animal Health Corporation is an animal health and mineral nutrition company with operations across the United States, Latin America, Canada, Europe, the Middle East, Africa, and the Asia Pacific; it has a market cap of approximately $1.70 billion.

Operations: The company's revenue segments include Animal Health at $962.80 million, Mineral Nutrition at $253.24 million, and Performance Products at $80.18 million.

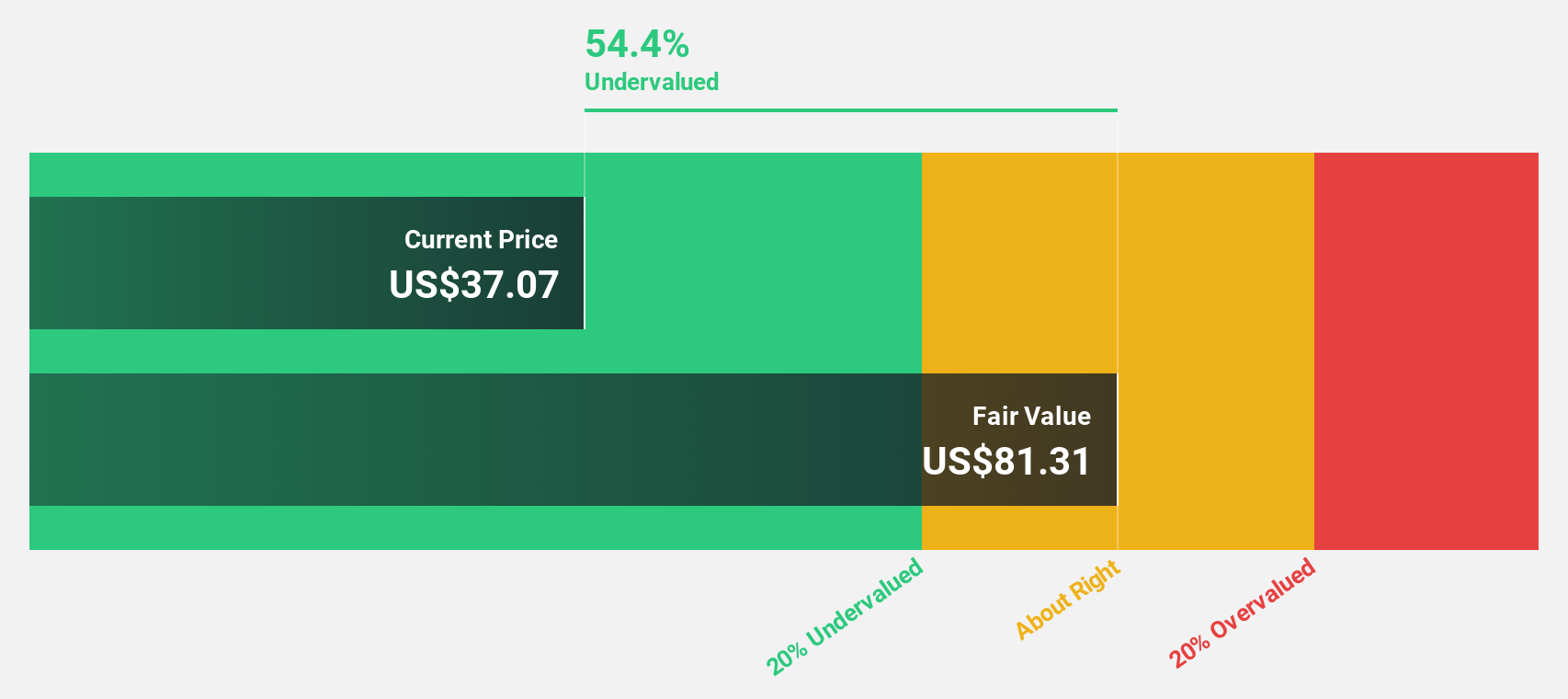

Estimated Discount To Fair Value: 45.8%

Phibro Animal Health, trading at US$42.06, is undervalued with a fair value estimate of US$77.67 based on discounted cash flow analysis. Although earnings are forecast to grow significantly at 26.6% annually, revenue growth lags behind the market at 5.6%. Recent product launches in veterinary dental care could bolster future cash flows despite current challenges like debt coverage issues by operating cash flow and large one-off items impacting financial results.

- In light of our recent growth report, it seems possible that Phibro Animal Health's financial performance will exceed current levels.

- Navigate through the intricacies of Phibro Animal Health with our comprehensive financial health report here.

PROS Holdings (PRO)

Overview: PROS Holdings, Inc. offers software solutions to enhance selling and shopping processes in the digital economy across various regions globally, with a market cap of approximately $1.11 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $351.68 million.

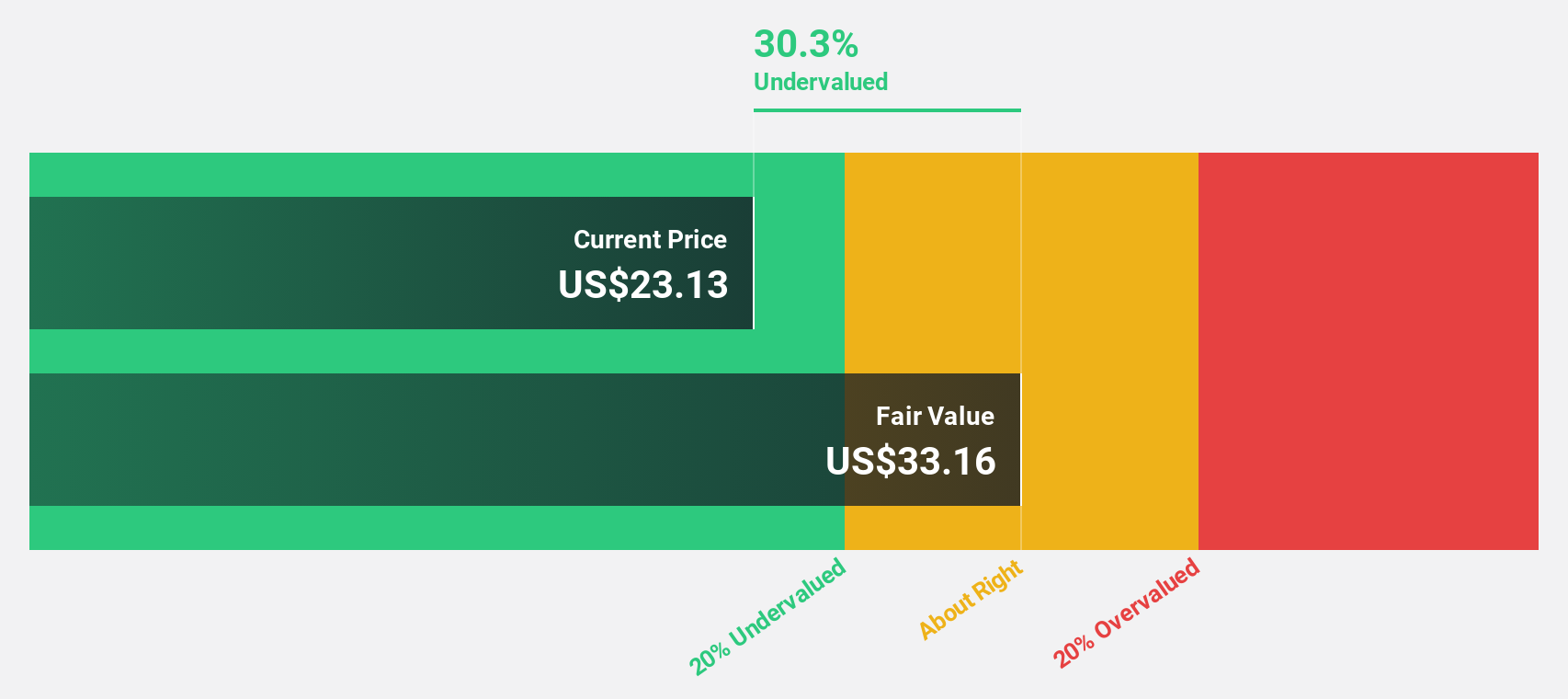

Estimated Discount To Fair Value: 28.6%

PROS Holdings is trading at US$23.05, significantly below its fair value estimate of US$32.27, indicating it is undervalued based on discounted cash flow analysis. Despite recent net losses, earnings are forecast to grow substantially over the next three years. The company has introduced AI-powered pricing solutions available on SAP Store, potentially enhancing future cash flows as B2B digital commerce expands. An acquisition by Thoma Bravo for $1.3 billion could influence future valuation dynamics.

- Our comprehensive growth report raises the possibility that PROS Holdings is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of PROS Holdings stock in this financial health report.

Turning Ideas Into Actions

- Explore the 170 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PAHC

Phibro Animal Health

Operates as an animal health and mineral nutrition company in the United States, Latin America and Canada, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives