- United States

- /

- Oil and Gas

- /

- NYSE:GPRK

3 Reliable Dividend Stocks Offering Up To 7.3% Yield

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed landscape with the Dow faltering and tech stocks like those in the Nasdaq seeing gains from cloud computing deals, investors are keenly observing shifts in economic indicators such as private-sector payroll data amidst government shutdowns. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive choice for those seeking reliable returns despite market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Shore Bancshares (SHBI) | 3.06% | ★★★★★☆ |

| Provident Financial Services (PFS) | 5.21% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.69% | ★★★★★★ |

| PCB Bancorp (PCB) | 3.66% | ★★★★★☆ |

| Heritage Commerce (HTBK) | 4.91% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.92% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.21% | ★★★★★★ |

| Ennis (EBF) | 5.89% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.35% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.88% | ★★★★★★ |

Click here to see the full list of 133 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Timberland Bancorp (TSBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Timberland Bancorp, Inc. is the bank holding company for Timberland Bank, offering a range of community banking services in Washington, with a market cap of $253.41 million.

Operations: Timberland Bancorp, Inc. generates revenue primarily through its community banking services, amounting to $81.62 million.

Dividend Yield: 3.5%

Timberland Bancorp's recent earnings report shows solid financial performance, with net income rising to US$29.16 million for the full year, supporting its dividend growth. The company increased its quarterly dividend by 8% to US$0.28 per share, reflecting a stable and growing payout history over the past decade. With a low payout ratio of 27.7%, dividends are well covered by earnings, though the yield of 3.45% is below top-tier levels in the U.S market.

- Get an in-depth perspective on Timberland Bancorp's performance by reading our dividend report here.

- According our valuation report, there's an indication that Timberland Bancorp's share price might be on the cheaper side.

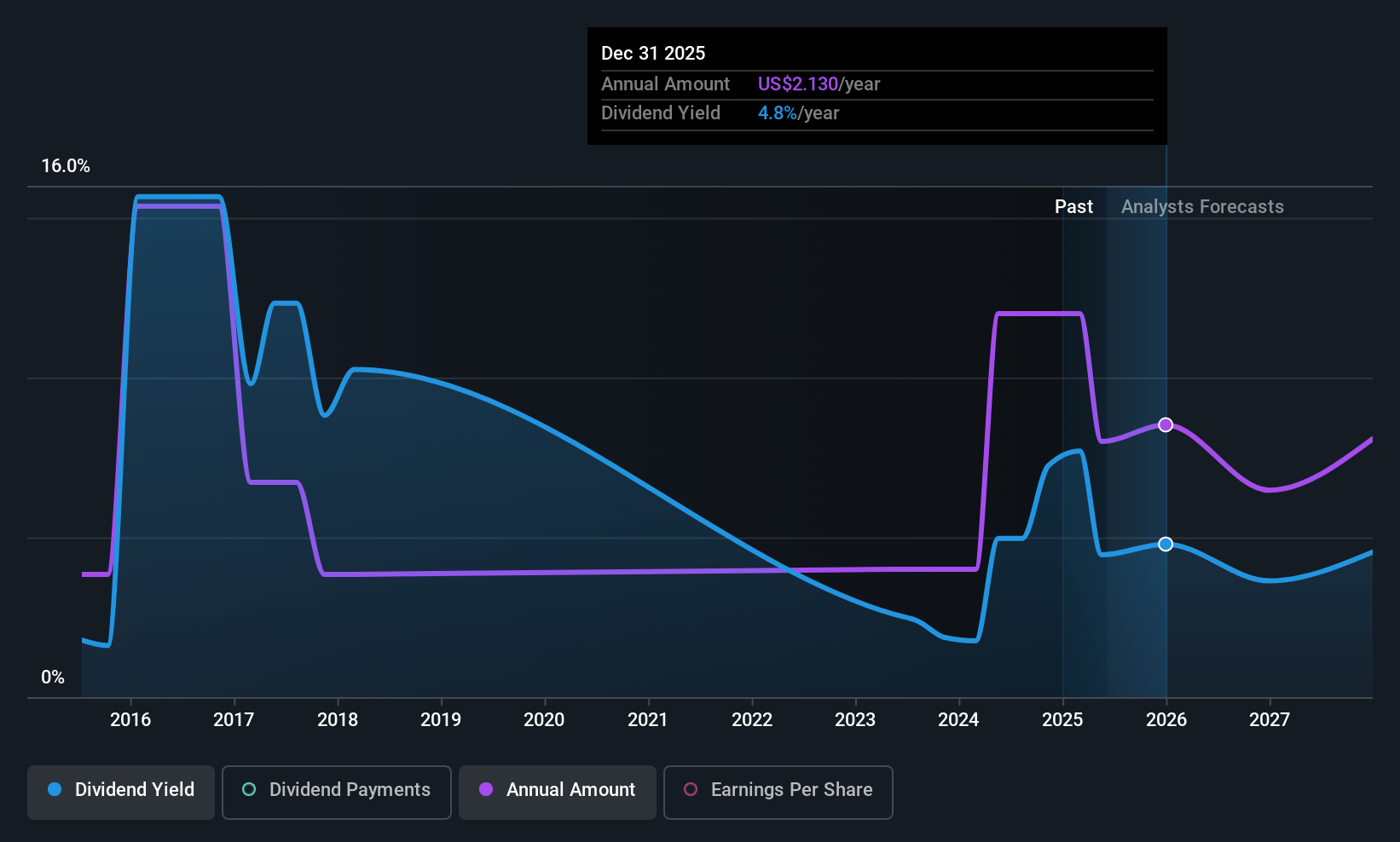

GeoPark (GPRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GeoPark Limited is an oil and natural gas exploration and production company active in several Latin American countries, with a market cap of $417.18 million.

Operations: GeoPark Limited generates revenue primarily through its oil and gas exploration and production segment, amounting to $560.35 million.

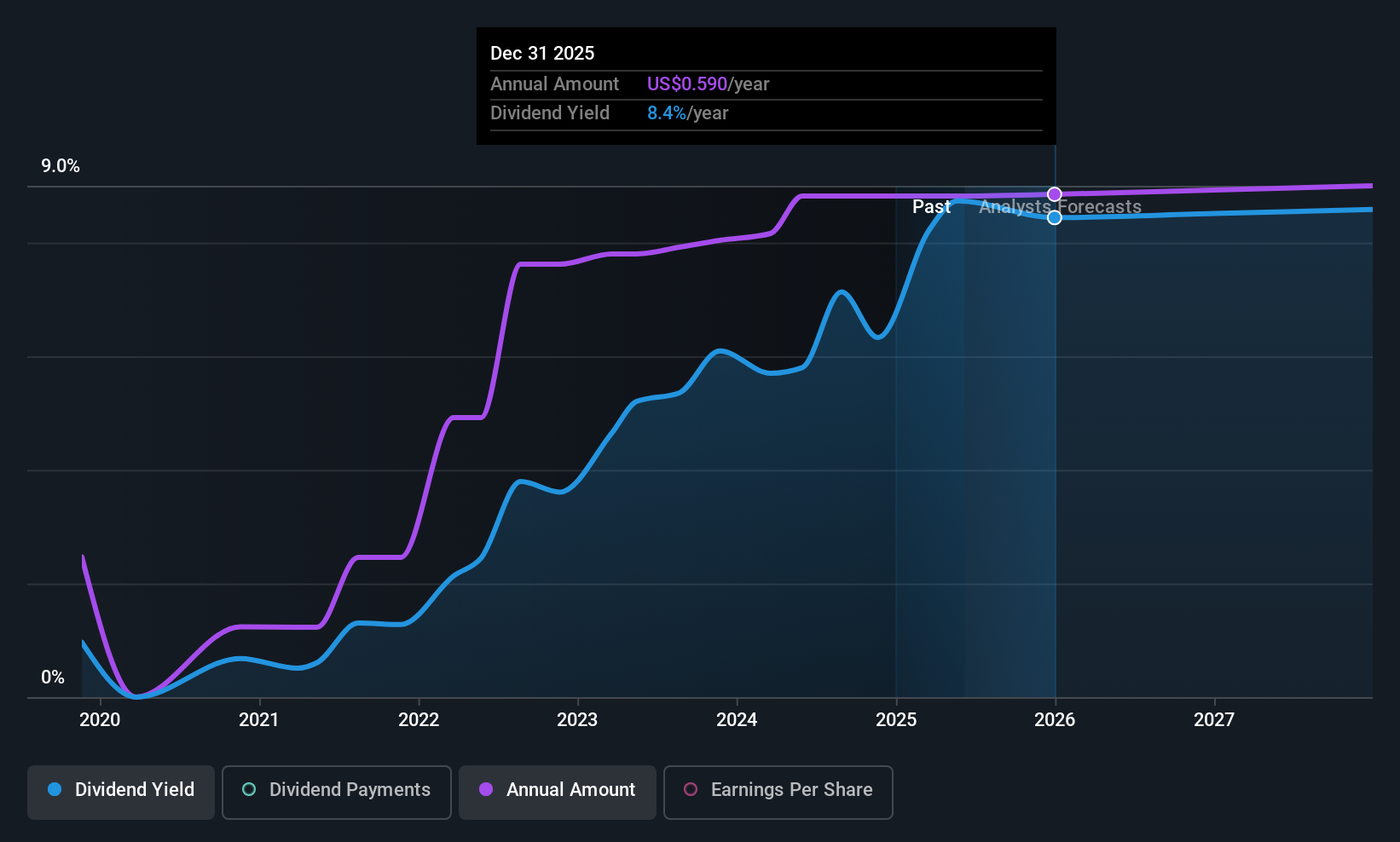

Dividend Yield: 7.4%

GeoPark's dividend yield of 7.38% ranks it among the top 25% of U.S. dividend payers, yet its volatile and short six-year dividend history raises sustainability concerns. Despite a reasonable payout ratio of 72.1%, financial challenges include declining production and earnings, with recent quarterly sales falling to US$119.79 million from US$190.2 million a year ago, impacting profit margins significantly. Recent M&A activities and strategic expansions in Argentina signal potential for future growth but add complexity to its financial outlook.

- Click to explore a detailed breakdown of our findings in GeoPark's dividend report.

- The valuation report we've compiled suggests that GeoPark's current price could be inflated.

Teekay Tankers (TNK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teekay Tankers Ltd. offers marine transportation services to the oil industry both in Bermuda and globally, with a market cap of $2.11 billion.

Operations: Teekay Tankers Ltd. generates its revenue primarily from its Tankers segment, amounting to $824.14 million, and its Marine Services and Other segment, contributing $127.74 million.

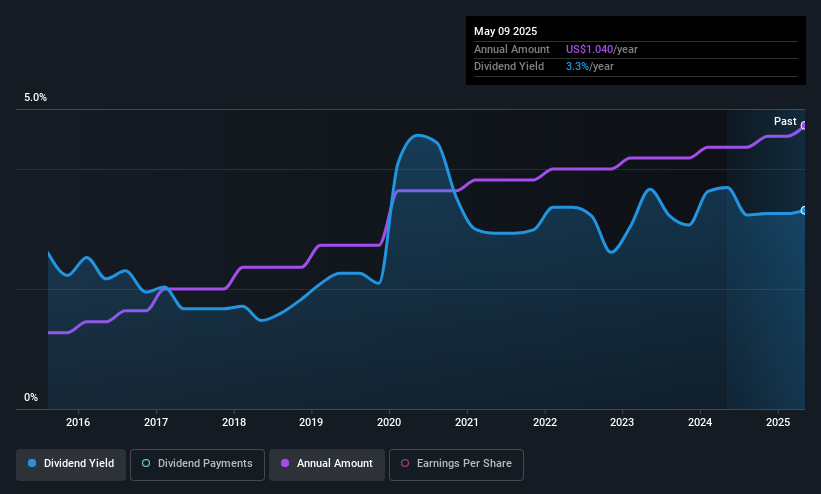

Dividend Yield: 3.3%

Teekay Tankers' dividend yield of 3.3% is below the top U.S. payers, with a history marked by volatility and unreliability over the past decade. Despite this, dividends are well-covered by earnings (payout ratio: 33.1%) and cash flows (cash payout ratio: 76.6%). Recent Q3 results show net income growth to US$92.08 million despite revenue declines, suggesting operational resilience amidst financial challenges and a declared quarterly dividend of US$0.25 per share reflects ongoing shareholder returns commitment.

- Navigate through the intricacies of Teekay Tankers with our comprehensive dividend report here.

- Our expertly prepared valuation report Teekay Tankers implies its share price may be lower than expected.

Next Steps

- Reveal the 133 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPRK

GeoPark

Operates as an oil and natural gas exploration and production company in Chile, Colombia, Brazil, Argentina, Ecuador, and other Latin American countries.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives