- United States

- /

- Software

- /

- NasdaqGS:API

3 Penny Stocks To Watch With Market Caps Over $60M

Reviewed by Simply Wall St

The U.S. stock market has experienced a mixed performance recently, with major indices like the S&P 500 and Nasdaq slipping after reaching record highs, while the Dow Jones Industrial Average saw a modest uptick. Amid such fluctuations, investors often seek opportunities in less conventional areas of the market. Penny stocks, despite their somewhat outdated moniker, represent an intriguing investment avenue by offering potential growth at lower price points when backed by strong financials and fundamentals. In this article, we explore three penny stocks that stand out as promising candidates for those interested in uncovering hidden value within smaller companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.33 | $481.01M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8688 | $146.11M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.18 | $222.03M | ✅ 3 ⚠️ 0 View Analysis > |

| Talkspace (TALK) | $2.77 | $463.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $95.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Safe Bulkers (SB) | $3.69 | $377.52M | ✅ 3 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Flexible Solutions International (FSI) | $4.95 | $62.61M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8399 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $3.53 | $469.75M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 437 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

BigCommerce Holdings (BIGC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BigCommerce Holdings, Inc. provides a software-as-a-service ecommerce platform for brands and retailers across various regions globally, with a market cap of approximately $398.89 million.

Operations: The company's revenue is primarily derived from its Internet Information Providers segment, totaling $334.94 million.

Market Cap: $398.89M

BigCommerce Holdings, with a market cap of US$398.89 million, offers an ecommerce platform that is gaining traction in AI-driven search optimization through partnerships like Feedonomics. Despite being unprofitable and having a negative return on equity of -55.13%, the company has improved its financial position over five years by achieving positive shareholder equity and maintaining sufficient cash runway for over three years due to stable free cash flow. Recent earnings showed a narrowed net loss of US$0.353 million for Q1 2025, while revenue guidance remains optimistic at up to US$351.1 million for the year.

- Unlock comprehensive insights into our analysis of BigCommerce Holdings stock in this financial health report.

- Gain insights into BigCommerce Holdings' outlook and expected performance with our report on the company's earnings estimates.

Agora (API)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Agora, Inc. operates a real-time engagement platform-as-a-service across the United States, the People’s Republic of China, and internationally, with a market cap of approximately $353.47 million.

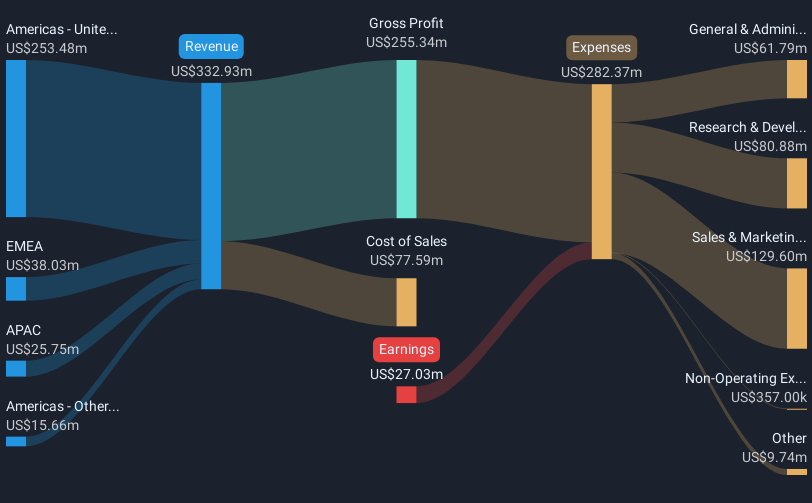

Operations: The company generates revenue from its Internet Telephone segment, amounting to $133.50 million.

Market Cap: $353.47M

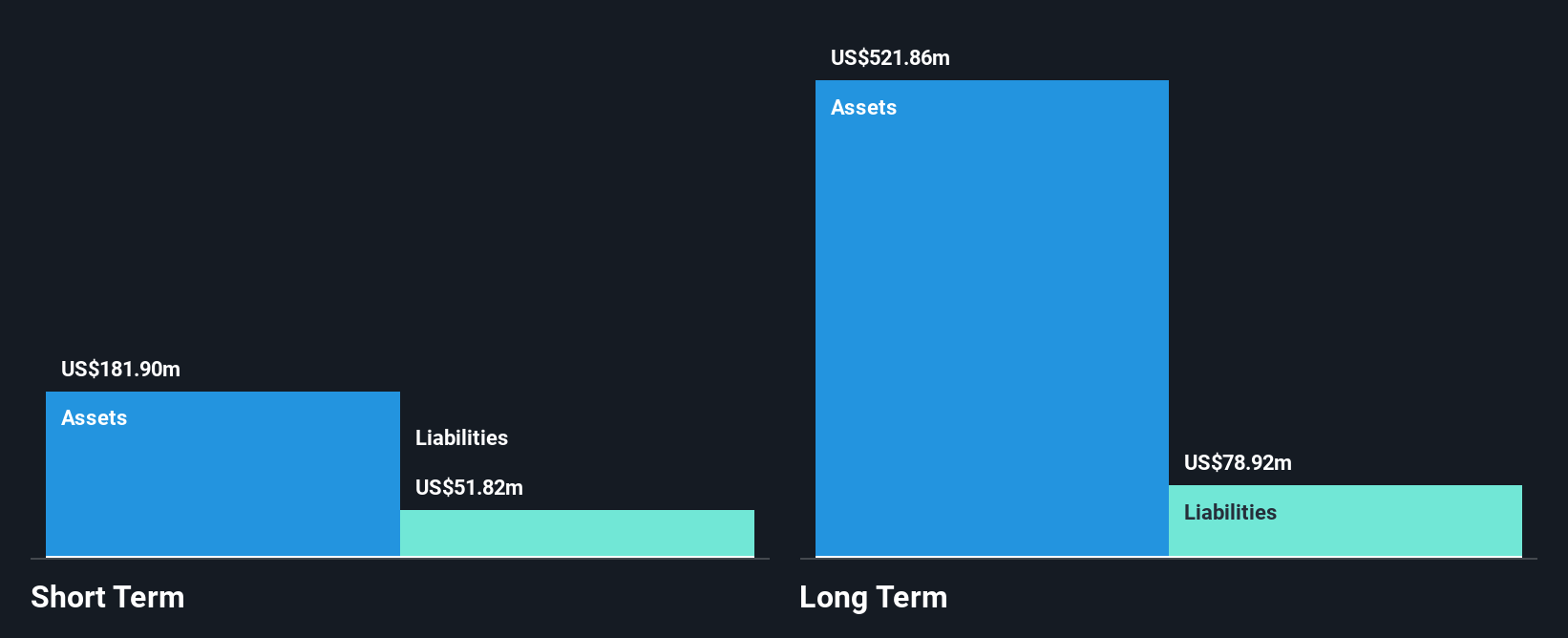

Agora, Inc., with a market cap of US$353.47 million, is navigating its financial landscape by maintaining a solid cash position that exceeds both short and long-term liabilities. The company recently reported Q1 2025 revenues of US$33.27 million, showing slight growth from the previous year, and achieved net income of US$0.407 million compared to a significant loss earlier. Despite being unprofitable overall, Agora has reduced losses over five years and forecasts robust earnings growth at 146.44% annually. Share repurchases have been substantial, completing over 41% under its buyback program since February 2022.

- Navigate through the intricacies of Agora with our comprehensive balance sheet health report here.

- Understand Agora's earnings outlook by examining our growth report.

Inuvo (INUV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Inuvo, Inc. is an advertising technology and services company that develops and commercializes large language generative artificial intelligence to discover and target digital audiences in the United States, with a market cap of $63.62 million.

Operations: The company generates revenue primarily from its Software & Programming segment, which amounted to $93.48 million.

Market Cap: $63.62M

Inuvo, Inc., with a market cap of US$63.62 million, operates in the advertising technology sector and is currently unprofitable. The company reported Q1 2025 revenue of US$26.71 million, an increase from the previous year, though it still posted a net loss of US$1.26 million. Inuvo's short-term assets surpass its long-term liabilities but fall short of covering all short-term liabilities. Despite being debt-free and having a stable cash runway for over three years, its stock remains highly volatile and recently underwent a reverse stock split to improve marketability amid ongoing efforts to achieve profitability alongside forecasted revenue growth.

- Dive into the specifics of Inuvo here with our thorough balance sheet health report.

- Assess Inuvo's future earnings estimates with our detailed growth reports.

Make It Happen

- Gain an insight into the universe of 437 US Penny Stocks by clicking here.

- Looking For Alternative Opportunities? Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:API

Agora

Through its subsidiaries, engages in the operation of a real-time engagement platform-as-a-service in the United States, the People’s Republic of China, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives