- Israel

- /

- Specialty Stores

- /

- TASE:CAST

3 Middle Eastern Dividend Stocks Yielding Up To 4.9%

Reviewed by Simply Wall St

In the current Middle Eastern market landscape, geopolitical tensions and uncertainty around U.S. Federal Reserve rate cuts have led to a cautious approach among investors, with most Gulf bourses experiencing declines. Despite these challenges, dividend stocks remain an attractive option for income-focused investors seeking stability and potential returns in uncertain times, as they can provide consistent payouts even when broader market conditions are volatile.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.11% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.56% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.30% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.03% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.10% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.78% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.76% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.13% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.99% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.07% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our Top Middle Eastern Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Al Rajhi Banking and Investment (SASE:1120)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Rajhi Banking and Investment Corporation, along with its subsidiaries, offers banking and investment services both within the Kingdom of Saudi Arabia and internationally, with a market cap of SAR381.20 billion.

Operations: Al Rajhi Banking and Investment Corporation's revenue primarily comes from its Retail Segment at SAR18.04 billion, followed by the Corporate Segment at SAR7.47 billion, the Treasury Segment at SAR6.41 billion, and Investment Services and Brokerage Segments at SAR1.71 billion.

Dividend Yield: 3.1%

Al Rajhi Banking and Investment's recent earnings report shows strong growth, with net income rising to SAR 6.15 billion in the second quarter. Despite a low dividend yield of 3.06% compared to top-tier payers, its dividends are well-covered by earnings, evidenced by a payout ratio of 27.2%. However, its dividend track record is unstable and has been volatile over the past decade, though there has been some increase in payments during this period.

- Navigate through the intricacies of Al Rajhi Banking and Investment with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Al Rajhi Banking and Investment is trading beyond its estimated value.

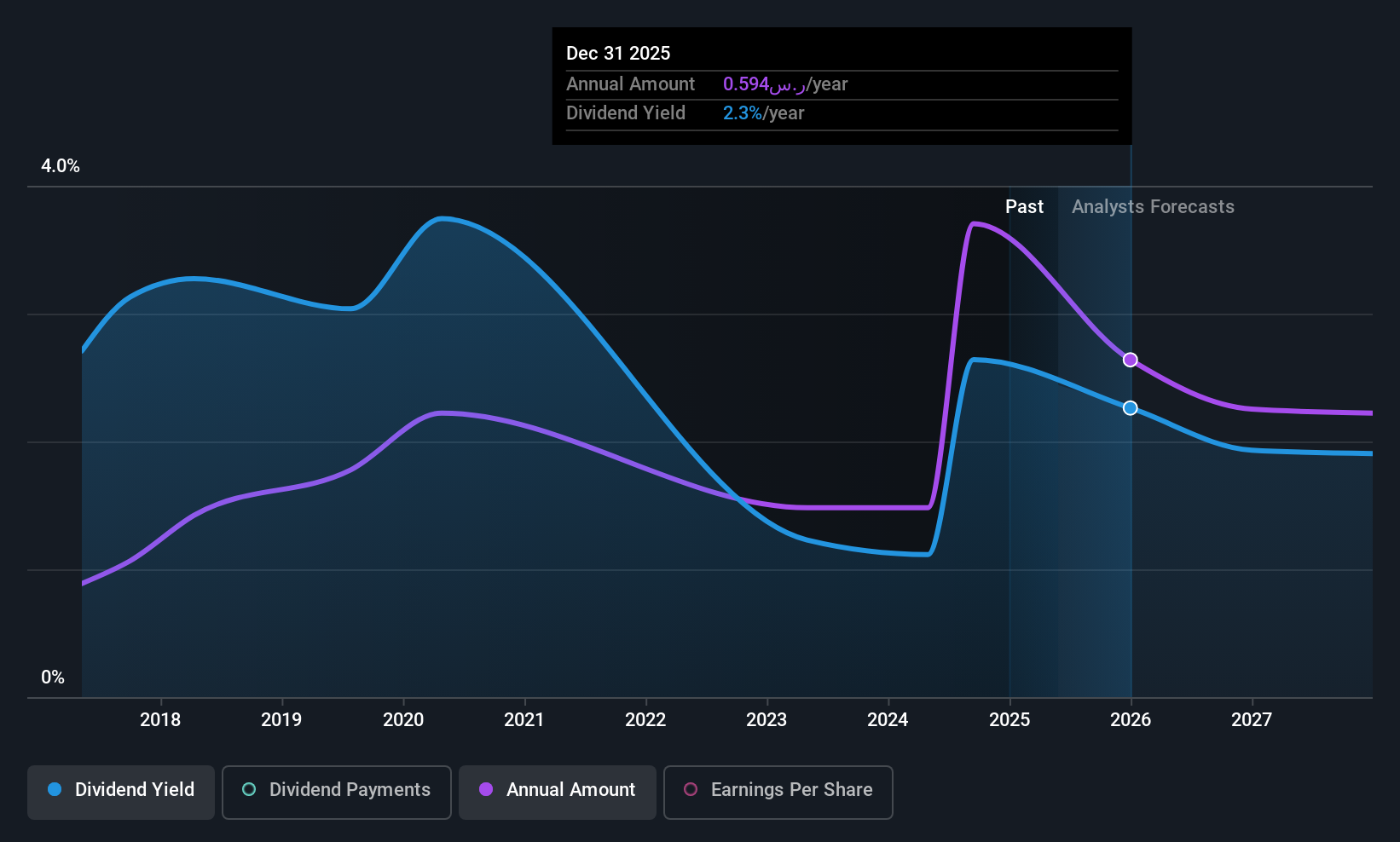

Bank Albilad (SASE:1140)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank Albilad, with a market cap of SAR38.76 billion, operates in the Kingdom of Saudi Arabia offering a range of banking products and services through its subsidiaries.

Operations: Bank Albilad generates revenue from four main segments: Retail Banking (SAR2.10 billion), Treasury Sector (SAR1.26 billion), Corporate Banking (SAR2.03 billion), and Investment and Brokerage Services Sector (SAR443.01 million).

Dividend Yield: 3.2%

Bank Albilad's recent earnings report highlights a net income increase to SAR 765.77 million in Q2, with dividends set at 0.45 SAR per share for the first half of 2025. Despite an unstable dividend track record, payments have grown over the past decade and are currently covered by a low payout ratio of 42.7%. The dividend yield is modest at 3.22%, below top-tier payers in Saudi Arabia, but strategic digital banking investments may bolster future performance.

- Click here and access our complete dividend analysis report to understand the dynamics of Bank Albilad.

- Upon reviewing our latest valuation report, Bank Albilad's share price might be too optimistic.

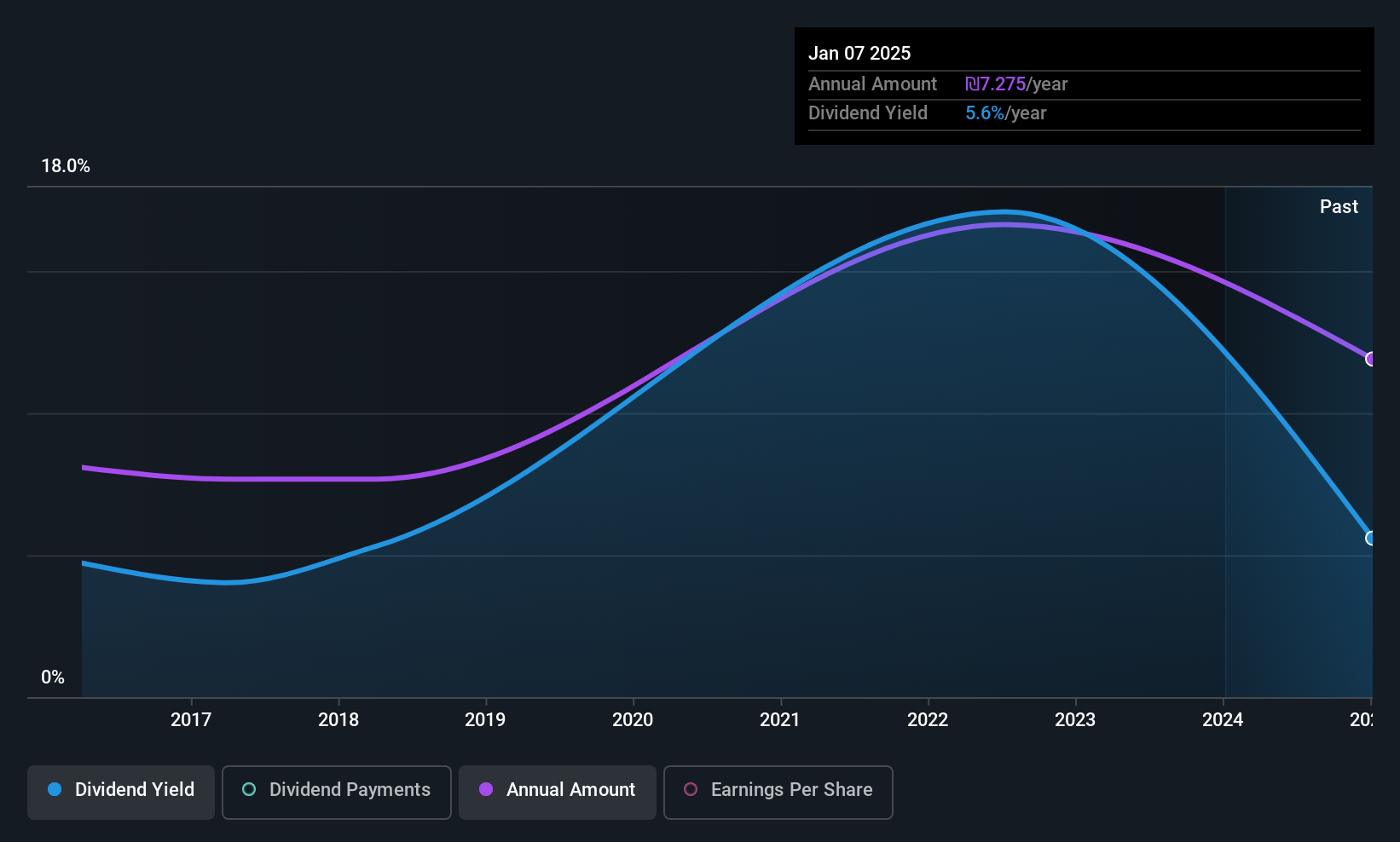

Castro Model (TASE:CAST)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Castro Model Ltd. operates in Israel, focusing on the retail sale of fashion products, home fashion, accessories, and cosmetics with a market cap of ₪1.22 billion.

Operations: Castro Model Ltd.'s revenue is primarily derived from its apparel fashions segment at ₪1.47 billion, followed by fashion accessories in Israel at ₪551.33 million, and care and cosmetics at ₪81.42 million.

Dividend Yield: 4.9%

Castro Model's dividend payments have been volatile over the past decade, though they have shown growth. Despite a low payout ratio of 44.2% and cash payout ratio of 50%, indicating coverage by earnings and cash flows, their dividend yield of 4.93% lags behind top-tier Israeli payers. Recent earnings show increased sales to ILS 470.57 million but a net income drop to ILS 1.42 million, suggesting potential pressure on future dividends amidst fluctuating performance metrics.

- Delve into the full analysis dividend report here for a deeper understanding of Castro Model.

- Insights from our recent valuation report point to the potential overvaluation of Castro Model shares in the market.

Summing It All Up

- Unlock our comprehensive list of 72 Top Middle Eastern Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:CAST

Castro Model

Engages in the retail sale of fashion products, home fashion, fashion accessories and cosmetics and care products in Israel.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives