As global markets continue to navigate a landscape marked by record highs in major U.S. stock indexes and resilient job growth, investors are keenly observing the performance of smaller-cap stocks, which have recently outpaced their larger counterparts. Penny stocks, though often overlooked due to their vintage terminology, remain relevant as they represent opportunities for growth at accessible price points. When backed by strong financials and solid fundamentals, these smaller or newer companies can offer a compelling blend of value and potential for long-term success.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.29 | A$105.2M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.29 | HK$788.69M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.435 | £47.07M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.24 | SGD8.82B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.53 | SEK2.42B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ✅ 5 ⚠️ 0 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.65 | £131.26M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.845 | £11.63M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,836 stocks from our Global Penny Stocks screener.

We'll examine a selection from our screener results.

AIRA Capital (SET:AIRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AIRA Capital Public Company Limited, operating in Thailand, focuses on investment and financial advisory services and has a market cap of THB7.96 billion.

Operations: AIRA Capital's revenue is derived from several segments, including Factoring (THB128 million), Property Development (THB280 million), Advisory and Investment Banking (THB14 million), Securities and Investment Business (THB320 million), and Rental and Service Business excluding Property Development (THB63 million).

Market Cap: THB7.96B

AIRA Capital, with a market cap of THB7.96 billion, operates across diverse segments including securities and investment business (THB320 million) and property development (THB280 million). Despite its seasoned management team and robust short-term asset position, AIRA faces challenges such as high debt levels with a net debt to equity ratio of 84.5% and consistent unprofitability over the past five years. The company's stock has experienced significant volatility recently, making it a risky option for investors seeking stability in penny stocks. However, AIRA's cash runway exceeds three years, providing some financial resilience amidst these challenges.

- Navigate through the intricacies of AIRA Capital with our comprehensive balance sheet health report here.

- Explore historical data to track AIRA Capital's performance over time in our past results report.

Bros Eastern.Ltd (SHSE:601339)

Simply Wall St Financial Health Rating: ★★★★★☆

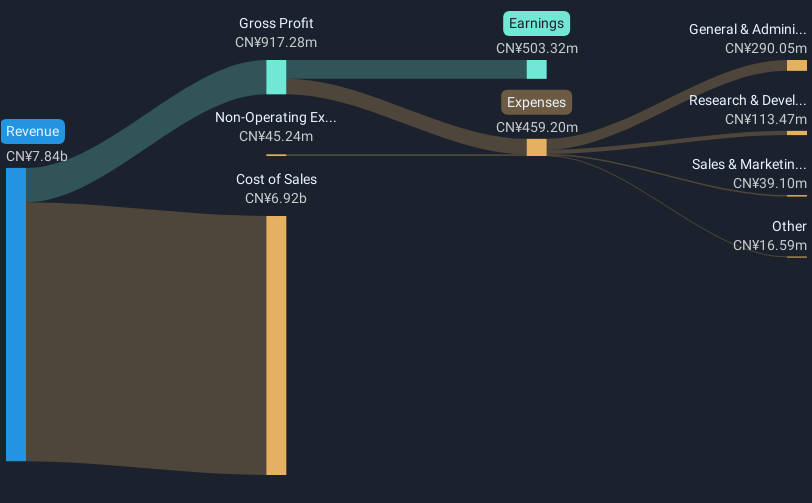

Overview: Bros Eastern Ltd (ticker: SHSE:601339) is involved in the research, development, production, and sale of dyed mélange and color-spun yarns, with a market cap of CN¥7.81 billion.

Operations: Bros Eastern Ltd does not report any specific revenue segments.

Market Cap: CN¥7.81B

Bros Eastern Ltd, with a market cap of CN¥7.81 billion, demonstrates financial stability through its seasoned management and board, alongside a satisfactory net debt to equity ratio of 25%. Despite recent earnings growth falling below its five-year average, the company has shown resilience by improving its debt position over time. Bros Eastern's earnings have grown modestly against industry declines, although profit margins have slightly decreased from last year. The stock trades at a favorable price-to-earnings ratio compared to the broader Chinese market but faces challenges with an unstable dividend track record and limited operating cash flow coverage for debt obligations.

- Click here to discover the nuances of Bros Eastern.Ltd with our detailed analytical financial health report.

- Examine Bros Eastern.Ltd's earnings growth report to understand how analysts expect it to perform.

CnlightLtd (SZSE:002076)

Simply Wall St Financial Health Rating: ★★★★★★

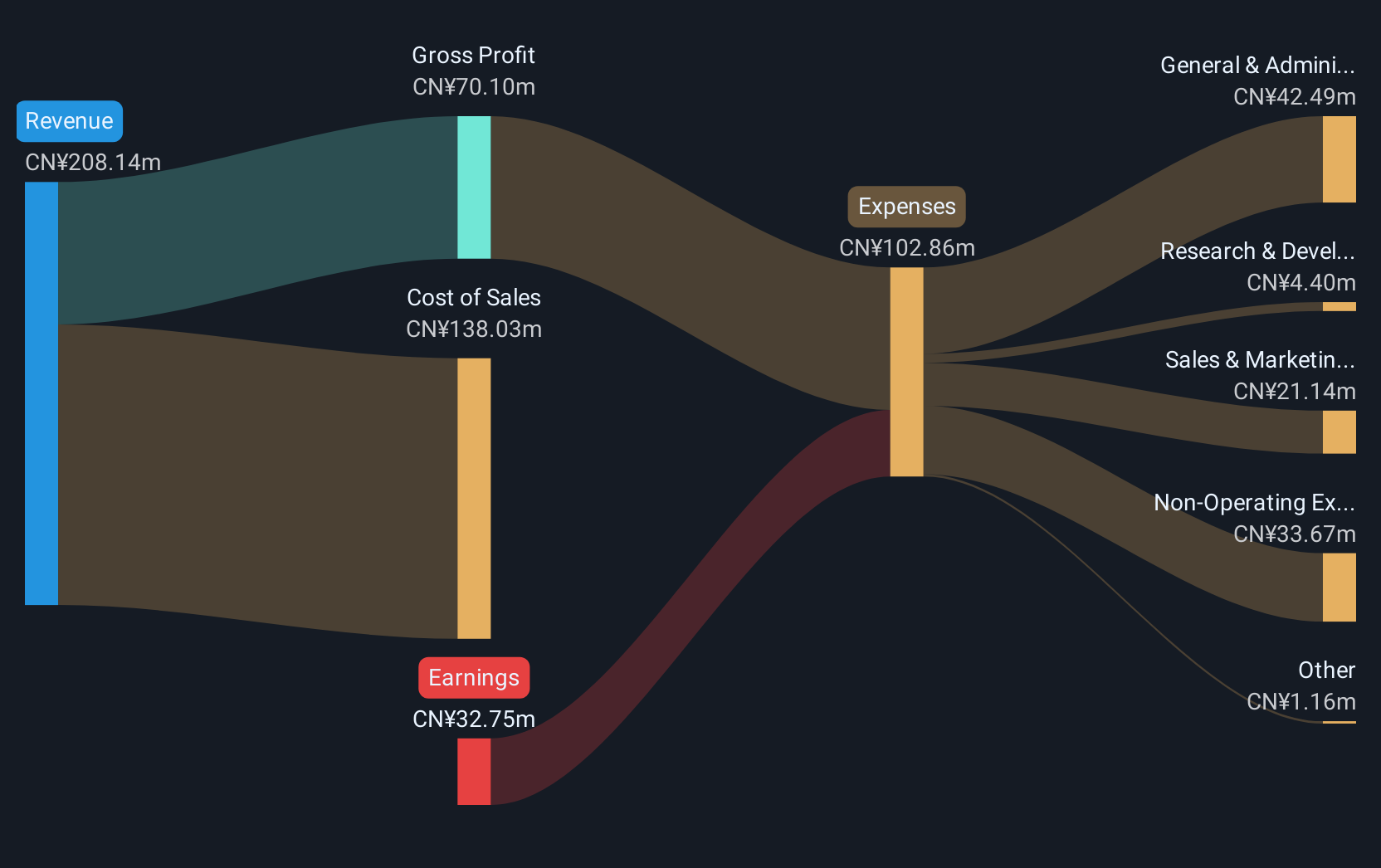

Overview: Cnlight Co., Ltd is a company that manufactures and sells lighting products in China, with a market cap of CN¥2.24 billion.

Operations: No specific revenue segments have been reported for Cnlight Co., Ltd.

Market Cap: CN¥2.24B

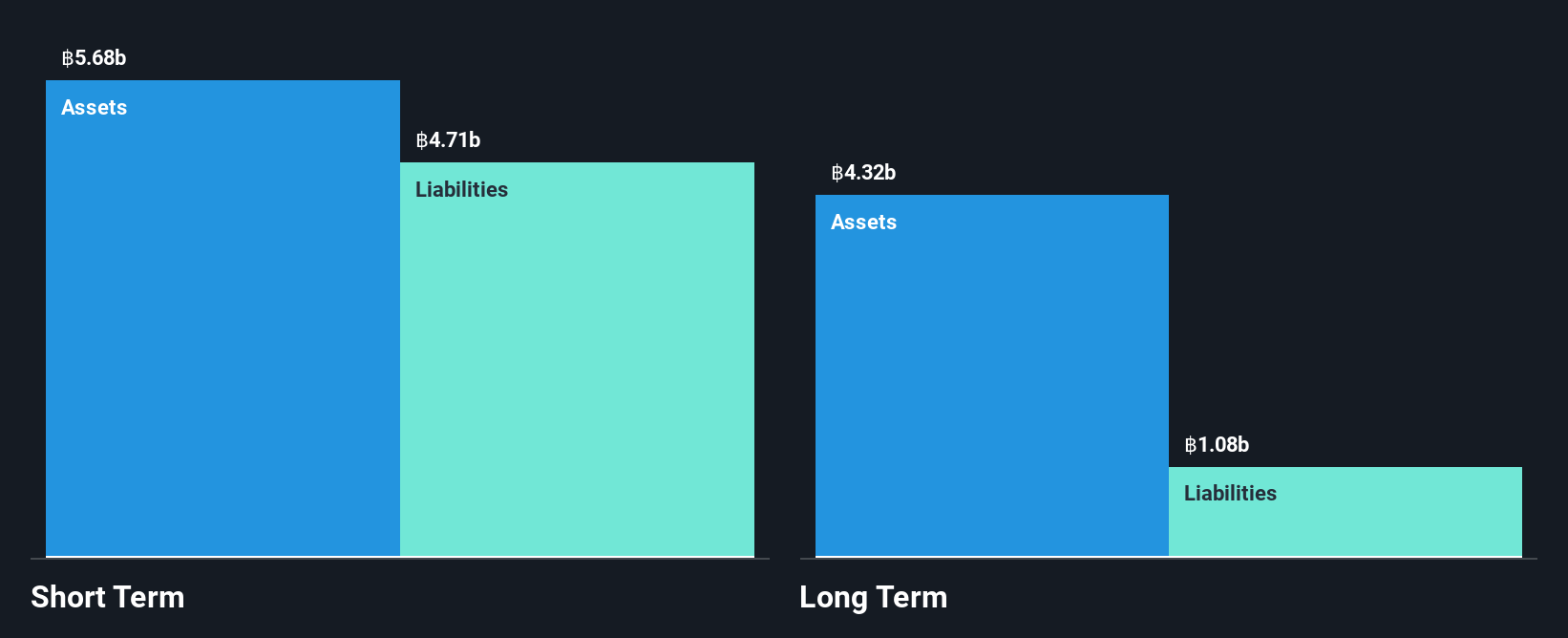

Cnlight Co., Ltd, with a market cap of CN¥2.24 billion, faces challenges as it remains unprofitable despite reducing losses by 55.1% annually over the past five years. The company’s short-term assets cover both its short-term and long-term liabilities, indicating some financial stability. However, its negative return on equity and high share price volatility present risks for investors. Recent earnings reports show an increase in sales to CN¥46.66 million but a net loss of CN¥1.21 million for Q1 2025 compared to a profit last year, highlighting ongoing profitability issues amid strategic changes proposed at recent shareholder meetings.

- Click here and access our complete financial health analysis report to understand the dynamics of CnlightLtd.

- Gain insights into CnlightLtd's past trends and performance with our report on the company's historical track record.

Next Steps

- Dive into all 3,836 of the Global Penny Stocks we have identified here.

- Seeking Other Investments? We've found 16 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bros Eastern.Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601339

Bros Eastern.Ltd

Engages in the research and development, production, and sale of dyed mélange and color-spun yarns.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives