- Romania

- /

- Oil and Gas

- /

- BVB:SNG

3 European Stocks That May Be Undervalued In July 2025

Reviewed by Simply Wall St

As of July 2025, the European stock market is experiencing mixed performance, with the pan-European STOXX Europe 600 Index remaining roughly flat amid ongoing U.S. and European trade talks. Despite this uncertainty, certain stocks might be undervalued due to favorable industrial output growth in the eurozone and a widening trade surplus. Identifying potentially undervalued stocks involves assessing companies that may benefit from these economic conditions while being mindful of their financial health and market position.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Surgical Science Sweden (OM:SUS) | SEK147.60 | SEK294.40 | 49.9% |

| StrongPoint (OB:STRO) | NOK11.50 | NOK22.62 | 49.2% |

| QPR Software Oyj (HLSE:QPR1V) | €0.808 | €1.60 | 49.6% |

| Medhelp Care Aktiebolag (OM:MEDHLP) | SEK4.98 | SEK9.94 | 49.9% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.50 | €6.89 | 49.2% |

| Honkarakenne Oyj (HLSE:HONBS) | €2.72 | €5.39 | 49.5% |

| Green Oleo (BIT:GRN) | €0.80 | €1.58 | 49.4% |

| Atea (OB:ATEA) | NOK143.00 | NOK284.70 | 49.8% |

| Almirall (BME:ALM) | €10.70 | €21.21 | 49.5% |

| adidas (XTRA:ADS) | €205.80 | €408.66 | 49.6% |

We'll examine a selection from our screener results.

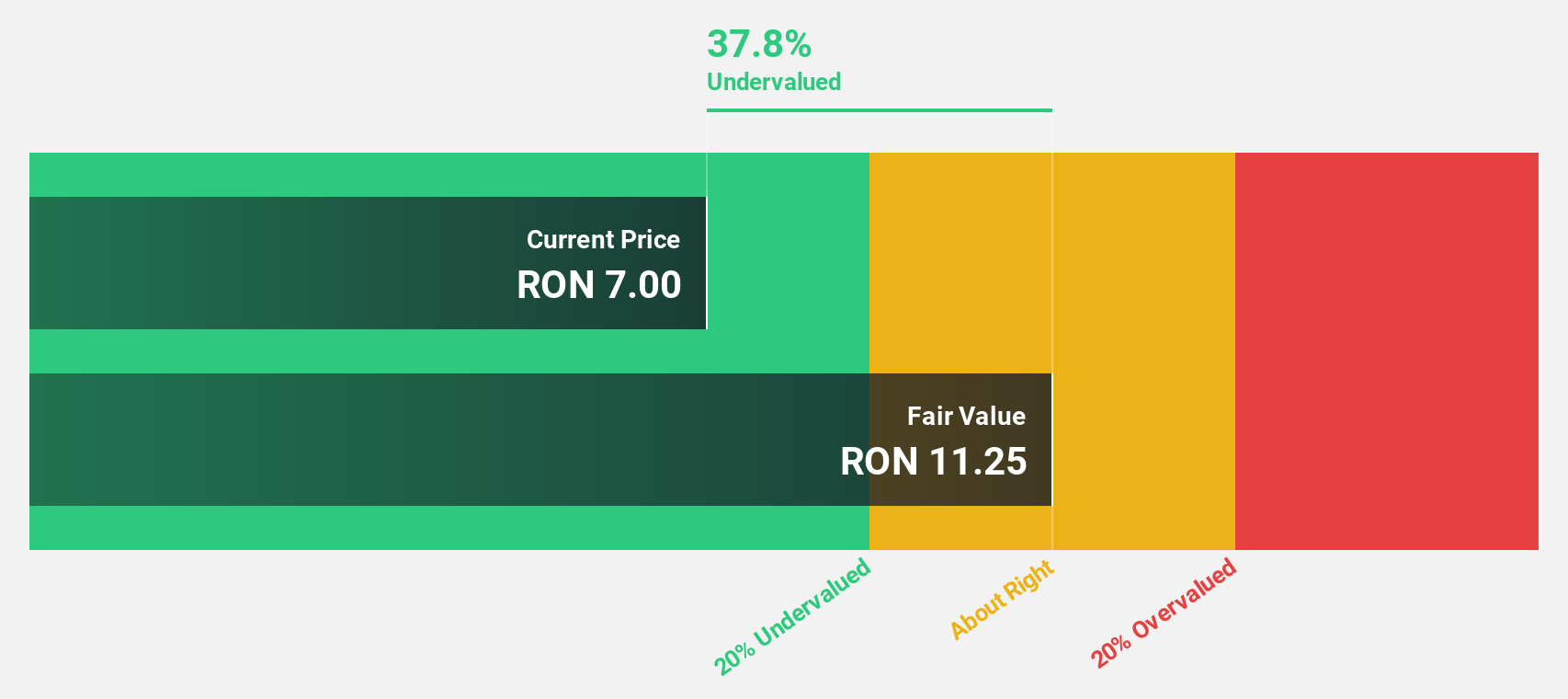

SNGN Romgaz (BVB:SNG)

Overview: SNGN Romgaz SA is a Romanian company involved in the exploration, production, and supply of natural gas, with a market cap of RON29.22 billion.

Operations: The company's revenue segments include RON7.54 billion from upstream activities, RON586.95 million from storage, and RON557.14 million from electricity operations.

Estimated Discount To Fair Value: 42.6%

SNGN Romgaz appears undervalued based on discounted cash flow analysis, trading at RON 7.58 compared to a fair value estimate of RON 13.2, a significant discount over 20%. Despite recent delistings from OTC equity markets, the company's earnings and revenue are forecasted to grow faster than the Romanian market at rates of 11.6% and 10.8% per year respectively, indicating robust cash flow potential amidst high-quality earnings and strong relative value against peers.

- Insights from our recent growth report point to a promising forecast for SNGN Romgaz's business outlook.

- Unlock comprehensive insights into our analysis of SNGN Romgaz stock in this financial health report.

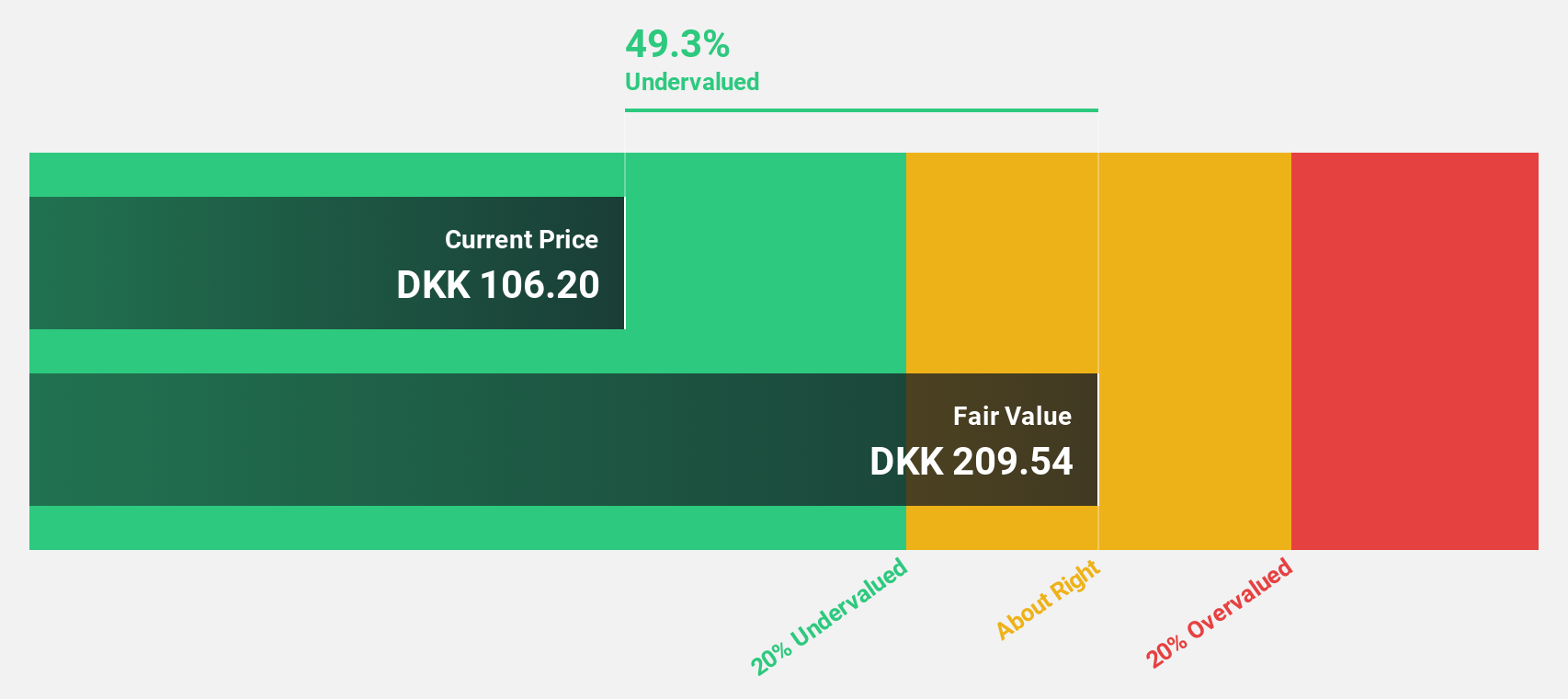

Vestas Wind Systems (CPSE:VWS)

Overview: Vestas Wind Systems A/S designs, manufactures, installs, and services wind turbines across the United States, Denmark, and internationally with a market cap of DKK120.38 billion.

Operations: The company generates revenue through its Service segment, amounting to €3.72 billion, and its Power Solutions segment, which brings in €14.37 billion.

Estimated Discount To Fair Value: 23.9%

Vestas Wind Systems, trading at DKK 120.55, is undervalued by over 20% based on discounted cash flow analysis with a fair value estimate of DKK 158.5. The company's earnings are projected to grow significantly at 21.1% annually, surpassing the Danish market's growth rate and highlighting strong cash flow prospects. Recent orders in Germany and the USA bolster its revenue outlook despite high share price volatility over the past three months.

- According our earnings growth report, there's an indication that Vestas Wind Systems might be ready to expand.

- Dive into the specifics of Vestas Wind Systems here with our thorough financial health report.

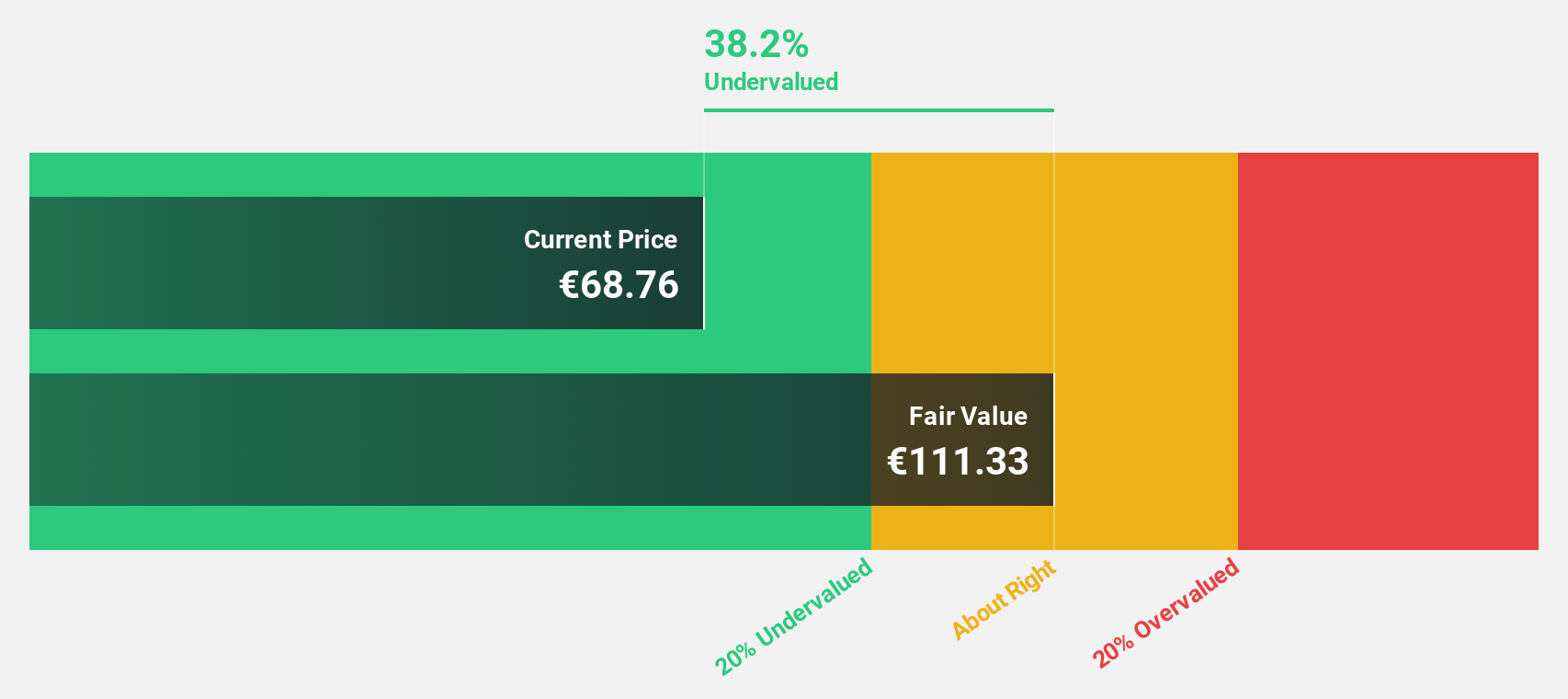

Eurofins Scientific (ENXTPA:ERF)

Overview: Eurofins Scientific SE, with a market cap of €10.99 billion, offers a range of analytical testing and laboratory services globally through its subsidiaries.

Operations: Eurofins Scientific SE generates revenue of €6.95 billion from its analytical testing services worldwide.

Estimated Discount To Fair Value: 46.4%

Eurofins Scientific, trading at €61.36, is significantly undervalued with a fair value estimate of €114.56 based on discounted cash flow analysis. The company's earnings are expected to grow substantially at 20.2% annually, outpacing the French market's growth rate. Recent strategic financial moves include a successful €500 million Schuldschein loan issuance and a share buyback program aimed at enhancing shareholder value and strengthening its balance sheet despite high debt levels.

- Our earnings growth report unveils the potential for significant increases in Eurofins Scientific's future results.

- Click to explore a detailed breakdown of our findings in Eurofins Scientific's balance sheet health report.

Summing It All Up

- Navigate through the entire inventory of 174 Undervalued European Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:SNG

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives