- Sweden

- /

- Life Sciences

- /

- OM:ALIF B

3 European Stocks Estimated To Be Trading At Discounts Up To 39.4%

Reviewed by Simply Wall St

As European markets experience a modest uptick, buoyed by easing inflation and ongoing trade negotiations with the U.S., investors are keenly observing potential opportunities amid economic fluctuations. In this context, identifying undervalued stocks can be particularly appealing as they may offer significant upside potential when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK47.90 | SEK95.24 | 49.7% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €53.90 | €104.47 | 48.4% |

| Airbus (ENXTPA:AIR) | €166.44 | €327.43 | 49.2% |

| CTT Systems (OM:CTT) | SEK206.00 | SEK406.89 | 49.4% |

| Absolent Air Care Group (OM:ABSO) | SEK211.00 | SEK417.53 | 49.5% |

| Etteplan Oyj (HLSE:ETTE) | €10.50 | €20.42 | 48.6% |

| Clemondo Group (OM:CLEM) | SEK10.70 | SEK21.25 | 49.6% |

| dormakaba Holding (SWX:DOKA) | CHF718.00 | CHF1403.62 | 48.8% |

| doValue (BIT:DOV) | €2.254 | €4.46 | 49.4% |

| VIGO Photonics (WSE:VGO) | PLN530.00 | PLN1027.65 | 48.4% |

Let's uncover some gems from our specialized screener.

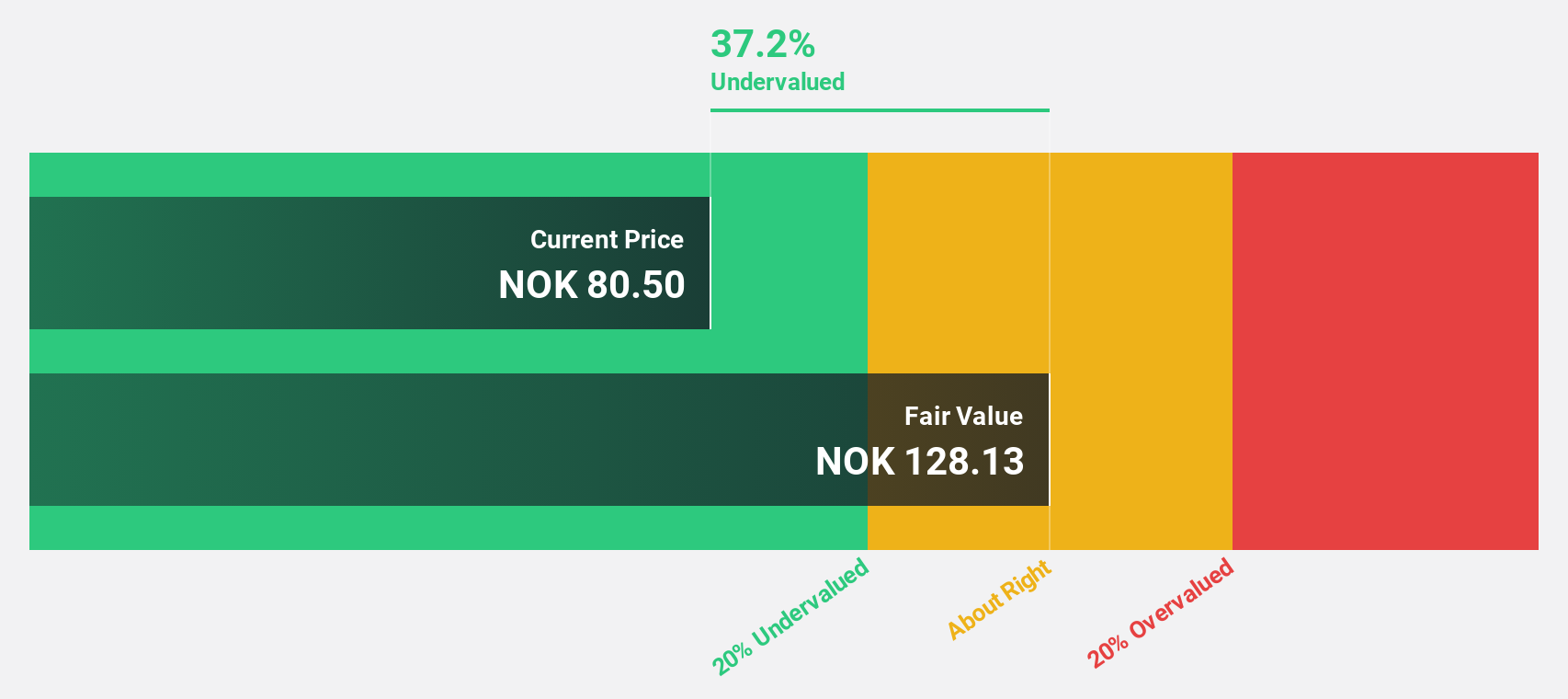

Europris (OB:EPR)

Overview: Europris ASA is a discount variety retailer operating in Norway with a market cap of NOK13.39 billion.

Operations: The company generates revenue primarily from its retail - variety stores segment, amounting to NOK13.66 billion.

Estimated Discount To Fair Value: 36.4%

Europris is trading at NOK 81.8, significantly below its estimated fair value of NOK 128.64, suggesting it may be undervalued based on cash flows. Despite a recent net loss of NOK 80.26 million for Q1 2025, earnings are forecast to grow over 21% annually, surpassing the Norwegian market's growth rate. The company continues expanding its physical store network and owns Swedish retailer ÖoB, enhancing its growth potential in discount retailing across Scandinavia.

- Our growth report here indicates Europris may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Europris.

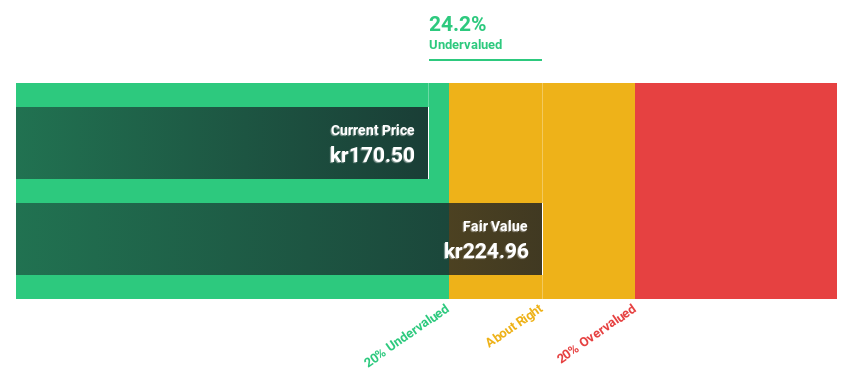

AddLife (OM:ALIF B)

Overview: AddLife AB (publ) and its subsidiaries supply equipment, consumables, and reagents mainly to the healthcare sector, research institutions, colleges, universities, as well as the food and pharmaceutical industries; it has a market cap of approximately SEK22.69 billion.

Operations: AddLife's revenue is generated from its Labtech segment, which accounts for SEK3.92 billion, and its Medtech segment, contributing SEK6.50 billion.

Estimated Discount To Fair Value: 18.2%

AddLife AB, trading at SEK 186.2, is undervalued relative to its estimated fair value of SEK 227.72. The company's earnings grew by nearly 300% over the past year and are forecasted to increase significantly at an annual rate of approximately 28.9%, outpacing the Swedish market's growth rate. However, interest payments are not well covered by earnings, and the return on equity is projected to remain low in three years at around 10%.

- Our expertly prepared growth report on AddLife implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in AddLife's balance sheet health report.

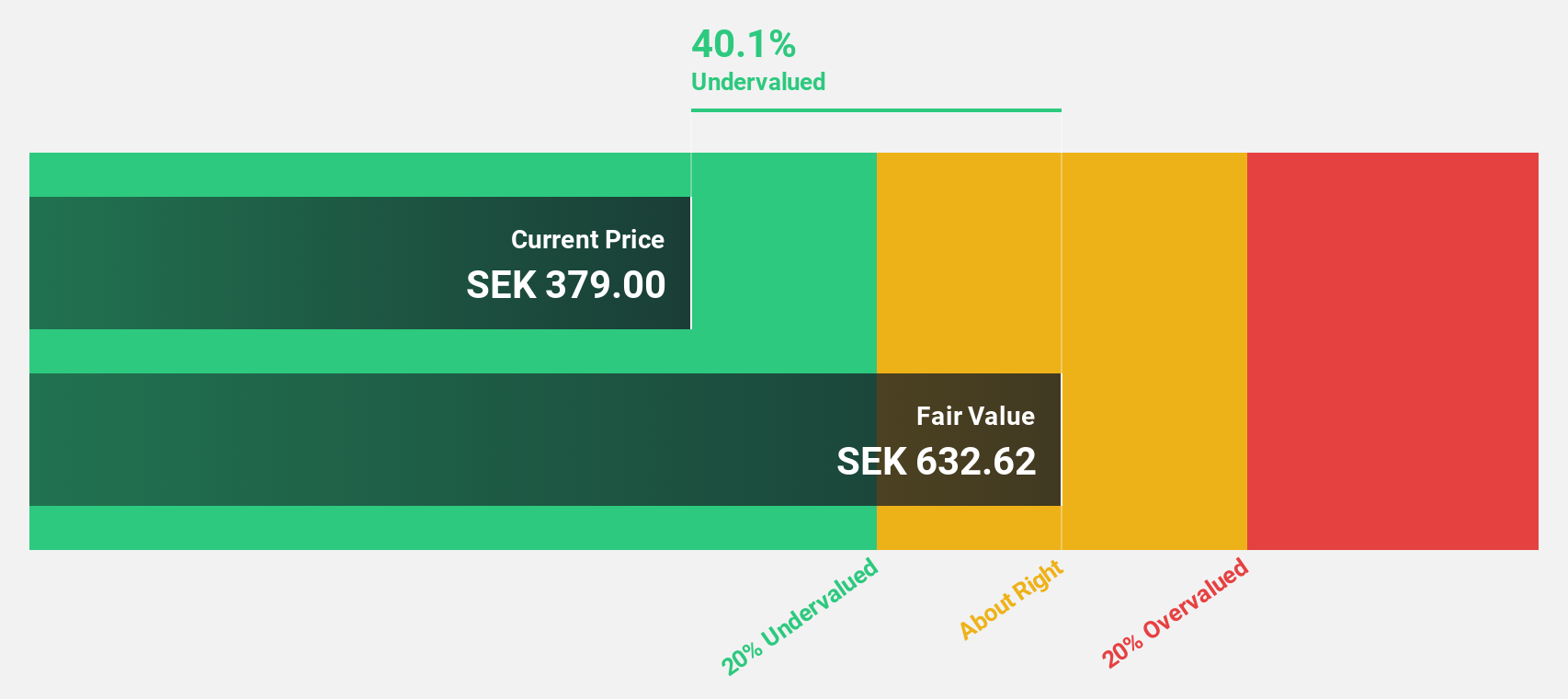

TF Bank (OM:TFBANK)

Overview: TF Bank AB (publ) is a digital bank that offers consumer banking services and e-commerce solutions via its proprietary IT platform in Sweden, with a market cap of SEK8.26 billion.

Operations: The company's revenue segments include Credit Cards at SEK677.50 million, Consumer Lending at SEK611.92 million, and Ecommerce Solutions (excluding Credit Cards) at SEK393.80 million.

Estimated Discount To Fair Value: 39.4%

TF Bank, trading at SEK 383.5, is significantly undervalued compared to its estimated fair value of SEK 632.52. Earnings grew by 59.6% last year and are forecasted to increase annually by 19.6%, surpassing the Swedish market's growth rate of 15.9%. Revenue is expected to grow at a robust pace of 31.4% per year, although the bank faces challenges with high bad loans at 2.8% and recent insider selling activity.

- In light of our recent growth report, it seems possible that TF Bank's financial performance will exceed current levels.

- Take a closer look at TF Bank's balance sheet health here in our report.

Summing It All Up

- Discover the full array of 182 Undervalued European Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ALIF B

AddLife

Provides equipment, consumables, and reagents primarily to healthcare sector, research, colleges, and universities, as well as the food and pharmaceutical industries.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives